Markets Brief: Stocks End Week Down; Employment Report Brings Some Good News

E-commerce firms Pinduoduo, Groupon impress. Shares of software companies Okta and MongoDB drop.

Stocks moved closer to their bear market low again after declining for a third week as continuing economic uncertainty dampens investor sentiment.

The Morningstar US Market Index fell 3.45% for the week and is now up just 7.4% from the bear market low on June 16.

Employment data came in slightly mixed, with 315,000 jobs being added to nonfarm payroll employment in August, above FactSet's estimate of 300,000. The unemployment rate rose to 3.7%, ahead of expectations that it would remain at 3.5%.

”The uptick in the unemployment rate came only because the increase in the labor force overshadowed the increase in employment," says Morningstar’s chief economist Preston Caldwell. This is a sign that more people are actively looking for work, or a higher labor supply, which Caldwell sees as healthy for the economy.

All sectors were down for the week, with basic materials and technology as the worst performers. E-commerce platforms such as Pinduoduo PDD gained the most for the week.

For the month of August, the Morningstar US Market Index fell 3.83%. The best-performing sector was energy, up 3.13%. The two worst-performing sectors were real estate, down 5.96%, and technology, off by 5.77%.

Next week provides a break from major economic reports, and markets will be closed Monday, Sept. 5, in observance of the Labor Day holiday. Earnings season is winding down, with a dwindling number of companies left to report their second-quarter results.

Events scheduled for the coming week include: Monday: Markets closed for Labor Day holiday. Wednesday: NIO NIO reports earnings. Thursday: Zscaler ZS and DocuSign DOCU report earnings. Friday: Kroger KR reports earnings.

For the trading week ended Sept. 2:

- The Morningstar US Market Index 3.45%.

- All sectors were down for the week. The worst performers were basic materials, down 5.61%, and technology, off 5.47%.

- Yields on the U.S. 10-year Treasury rose to 3.20% from 3.04%.

- WTI crude oil prices declined 6.65% to $86.87 per barrel.

- Of the 861 U.S.-listed companies covered by Morningstar, 85, or 10%, were up, and 776, or 90%, declined.

What Stocks Are Up?

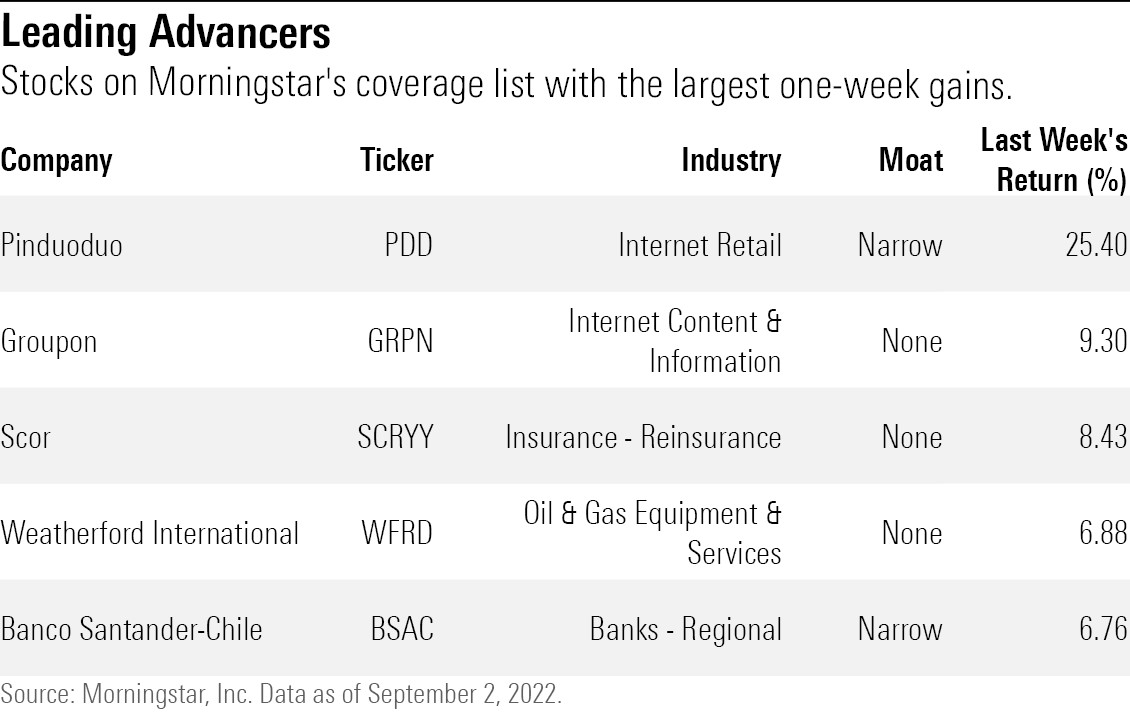

The best-performing companies in the last week were Pinduoduo, Groupon GRPN, Scor SCRYY, Weatherford International WFRD, and Banco Santander-Chile BSAC.

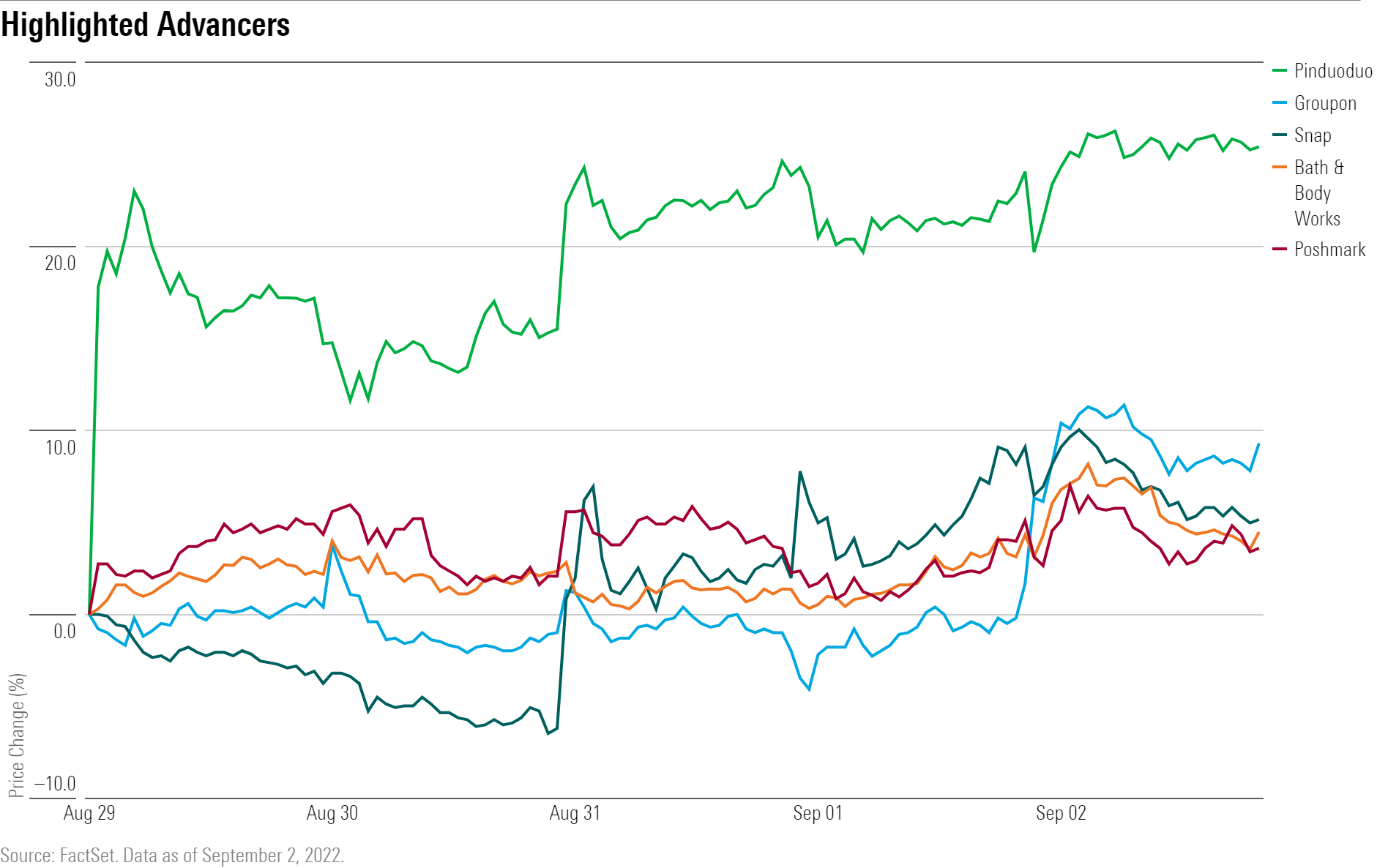

China-based e-commerce platform Pinduoduo rose after beating both revenue and earnings expectations. The company also launched another shopping site aimed toward U.S. consumers, CNBC reports. Shares of Groupon also closed the week higher.

Shares of Snap SNAP rose following news the company would cut its workforce by 20% as part of its efforts to reduce costs. Retailers Bath & Body Works BBWI, Poshmark POSH, and Ulta Beauty ULTA also finished the week higher.

What Stocks Are Down?

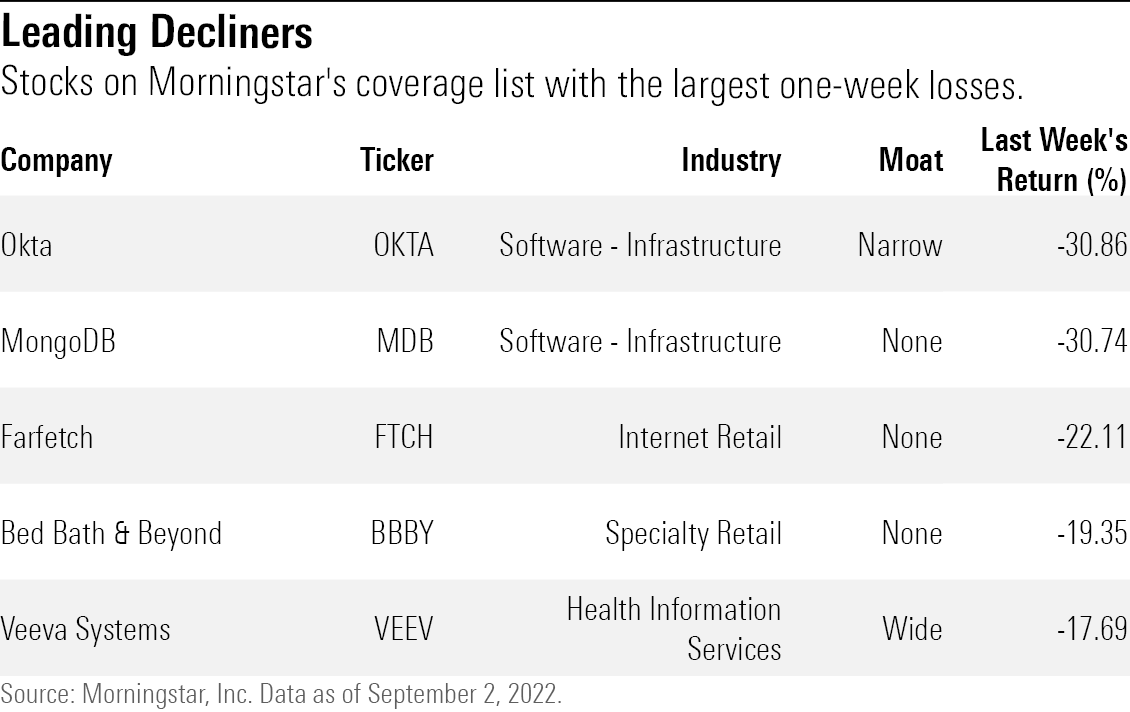

The worst-performing companies in the last week were Okta OKTA, MongoDB MDB, Farfetch FTCH, Bed Bath & Beyond BBBY, and Veeva Systems VEEV.

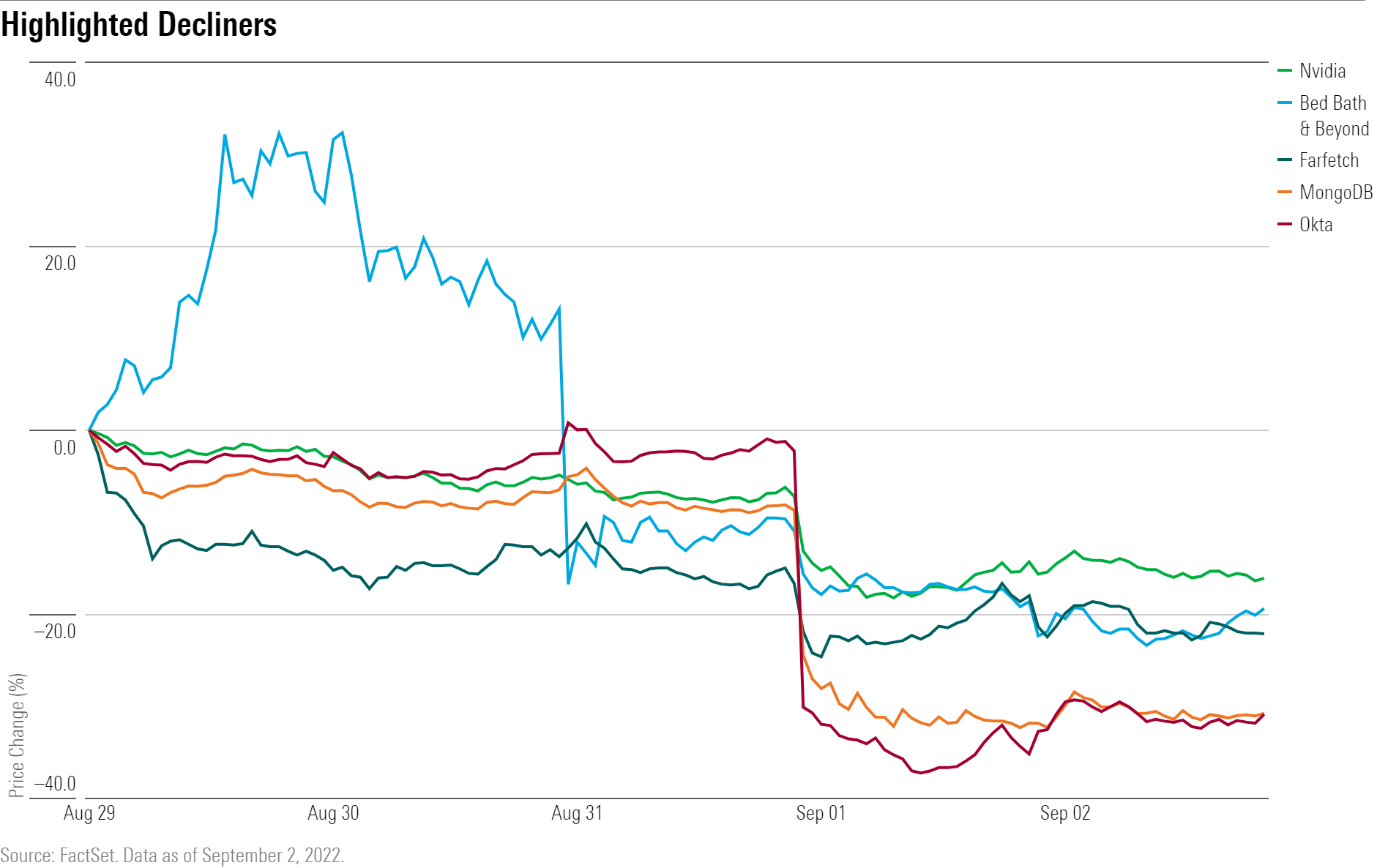

Shares of Okta fell following a reduced outlook for the second half of the year. MongoDB also closed lower following mixed guidance from management. The company expects higher revenue, but lower earnings per share. Healthcare software solutions provider Veeva Systems also slid after it lowered its revenue outlook for its 2023 fiscal year.

Nvidia NVDA fell on news that the U.S. government imposed a new license requirement for the sale of graphics cards to China.

Retailer Bed Bath & Beyond sank after the firm’s recent strategic update failed to impress investors and analysts. Farfetch also closed the week lower.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)