A Better Way to Make Short-Term Bets

Success requires following a set of rules over a long period.

A version of this article previously appeared in the August 2022 issue of Morningstar ETFInvestor. Click here to download a complimentary copy.

Short-term investing is tough. Crystal balls are foggy, and they often fail to see the large-scale events that can dramatically shape the economy and financial markets. Few saw the rapid spread of a highly contagious virus in early 2020, or the market’s rapid decline and rebound that followed.

Such difficulties certainly haven’t stopped investors from trying. The potential for earning massive payoffs over a short period is a sticky trap. Four hundred years ago, the Dutch were speculating on tulip bulbs. More recently, cryptocurrencies and meme stocks were the shiny objects grabbing our attention and money.

That said, time-tested long-term strategies exist that take advantage of short-term bets. As with any great investment, the path to success requires a long holding period while weathering the ebbs and flows that result from these wagers.

YOLO

A buffet of exciting new assets was available to investors over the past few years, and many were willing to indulge. Stocks such as Tesla TSLA, Zoom Technologies ZTNO, and Peloton Interactive PTON hit all-time-highs, cryptocurrencies exploded in value, and U.S. thematic funds collectively raked in almost $84 billion over the 12 months between April 2020 and March 2021.

Much of the hype and popularity surrounding these investments centered around narratives about their transformative power. Supposedly, the underlying businesses and technologies were positioned to change the way we live and work, implying that their underlying value and associated prices would continue to rise.

That’s a tale as old as time in financial markets. New technologies can—and certainly have—changed our lives, but that doesn’t necessarily make their shares great investments, especially when the excitement surrounding them reaches a fever pitch. Euphoria seldom leads to reasonable prices. It’s more likely to create steep prices that are difficult to justify, which then rapidly fall when the excitement wears off. Trains, automobiles, and the internet were all transformative technologies in their time that went through similar cycles of irrational exuberance and cathartic decline.

But history’s lessons often do little to tame behavior in the moment. The emotional tug toward high-flying speculative investments is very real, especially when we see others using them to make life-changing money.

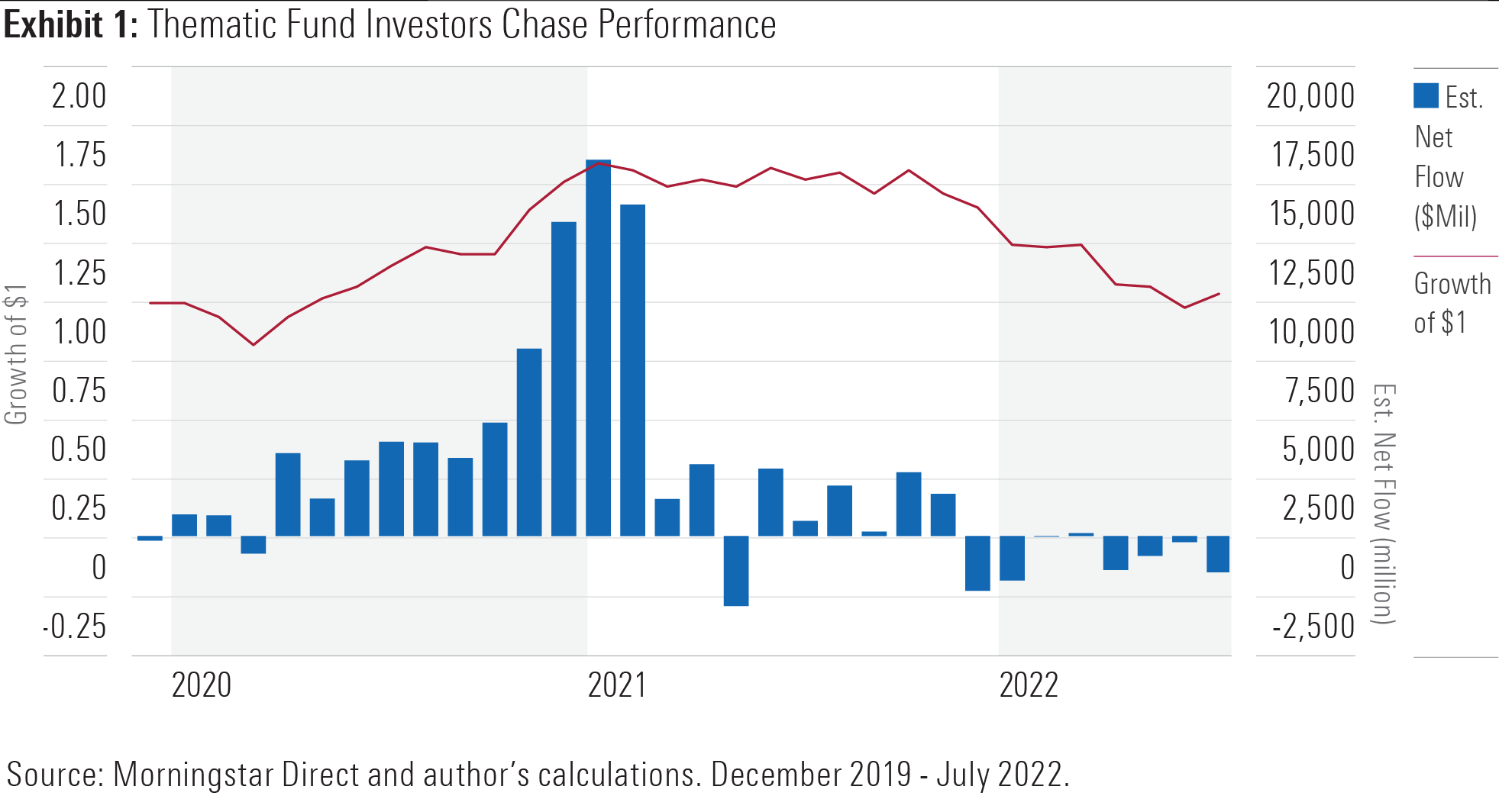

Timing is another big issue with short-term bets. An asset’s meteoric rise often fuels interest and attracts more money. Most new cash tends to enter near the top, leaving the majority of its investors exposed to the ensuing decline.

Flows into thematic funds over the past three years mirrored this pattern. Exhibit 1 shows that flows into thematic funds increased as the average return marched higher, only to cool off when performance turned south. Most of the new money entering thematic funds came in near the peak. The average investor missed out on much of their spectacular growth. The median thematic fund returned roughly 6.5 percentage points per year between January 2020 and July 2022, while the median internal rate of return—a proxy for a typical investor’s actual return—was about negative 0.8 percentage points annualized.

Performance-chasing is largely indefensible. Fortunate timing plays a big role in success, and more dollars tend to lose than win. But there is another side of performance-chasing that’s worth discussing.

Beyond Narratives

Buying stocks that have performed well recently, with the expectation that their outperformance will continue, is the basic premise behind momentum investing. Momentum strategies still bear some incremental risk, but that risk has been historically rewarded with market-beating performance over the long run.

The trick with momentum investing is harnessing the effect without giving in to the emotional whims that often accompany stocks with strong recent performance. To that end, it’s better to outsource the task to a low-cost momentum exchange-traded fund that adheres to a reasonable set of rules instead of relying on human discretion. Momentum ETFs such as iShares MSCI USA Momentum Factor ETF MTUM and its international sibling iShares MSCI International Momentum Factor ETF IMTM are better ways to capture the anomaly. Both earn Morningstar Analyst Ratings of Bronze.

Both ETFs use a repeatable process to build a long-term strategy around a series of short-term bets. MTUM and IMTM hold stocks with the strongest risk-adjusted price returns over the past seven and 13 months, and weight those stocks by a combination of their momentum and market cap. Sticking to a set of rules can be a big advantage. These ETFs mechanically buy and sell stocks to maintain exposure to recent winners regardless of the stories behind the stocks or their lines of business.

MTUM and IMTM have diversification on their side. Both pull their holdings from a wide opportunity set. They look beyond headline names and spread their bets across a range of the best-performing stocks without limiting themselves to a specific theme or industry. Sector and country tilts are common as these strategies need to place more weight on the best-performing segments to seize the momentum effect. They also systematically rebuild their portfolio at a high cadence to maintain a tight focus on the most recent outperformers.

Head Faked

But even the best momentum strategies aren’t immune to the perils of chasing performance. They perform best when the market is stable and stocks move in a consistent direction, providing reliable signals to latch on to. Past winners won’t necessarily outperform when volatility increases or the market quickly changes direction.

The momentum factor tends to be more dynamic than other factors like value or quality. Momentum can be thought of as a “free-range” factor, meaning it needs the freedom to move around to the top-performing segments of the market. Along those lines, most momentum strategies have few constraints because those limitations would ding their momentum factor exposure.

Outsize bets can help or hurt performance. For example, MTUM had a larger-than-average stake in real estate and utilities stocks at the end of 2019 that helped it weather the market’s drawdown over the first three months of 2020. It subsequently shifted its allocation toward technology and consumer stocks that led the market’s recovery, helping the ETF outperform the Russell 1000 Index by 8.7 percentage points in 2020.

But MTUM held on to some of those positions as it entered 2021. Volatility started to increase early in the year, and 2020’s top performers made an abrupt turn. MTUM subsequently trailed the market by 6.5 percentage points per year from January 2021 through July 2022.

High turnover is another calling card of momentum strategies, and it speaks to the perils in chasing past performance. Momentum strategies need to update their portfolios more frequently than other factors, and that often entails a lot of trading to unwind current holdings in favor of the new top performers. Annual turnover numbers can easily break 100%, so the costs of executing a momentum strategy should be relatively higher.

Like many factor ETFs, momentum ETFs like MTUM and IMTM require long holding periods to reap the rewards, and investors will likely have to endure some lumpy performance. They aren’t for everyone, but they’re one of the best ways to make short-term bets over the long term.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)