Economic Growth May Be Slowing, but It Has Yet to Contract

And we’re still bullish on long-term U.S. GDP growth.

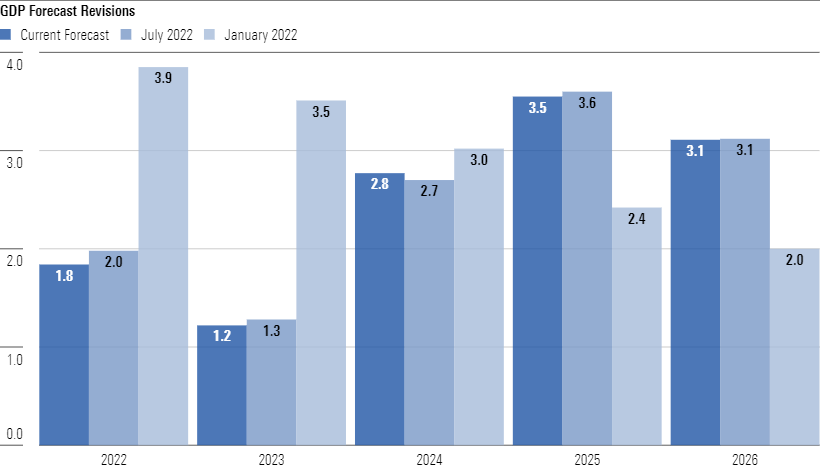

Despite mixed economic signals, we’re largely maintaining the gross domestic product forecasts from our July outlook, with only minor adjustments.

We estimate a GDP growth rate of 1.8% for 2022, 1.2% for 2023, and much higher rates for 2024 through 2026.

- source: Morningstar Analysts

Although the GDP drop from the first half of the year led some to believe we were in an economic recession, we think this is very unlikely. The GDP drop was driven by the noisiest components of spending, and other data points suggest growth—though this growth is undoubtedly slowing.

That said, we think the risk of a recession will be most concentrated in 2023, when full-year growth hits a trough. We do think GDP growth will bounce back starting in 2024 as the Federal Reserve pivots to easing, and that resolution of supply constraint issues will facilitate an acceleration in growth without inflation becoming a concern again.

Our short-term GDP forecast is relatively in line with the consensus of economic forecasters. The longer-term forecasts, however, begin to diverge, as ours are far more optimistic than consensus. Altogether, we expect a cumulative 250 basis points in more real GDP growth through 2026 than the consensus does.

In our view, the consensus remains overly pessimistic on the recovery in the labor supply and has generally overreacted to near-term headwinds. We expect a growth rebound in 2024 as the effects of supply shocks fade, with the Fed providing support by backpedaling on monetary tightening as needed.

Drop in First-Half GDP Is Probably Just Statistical Noise

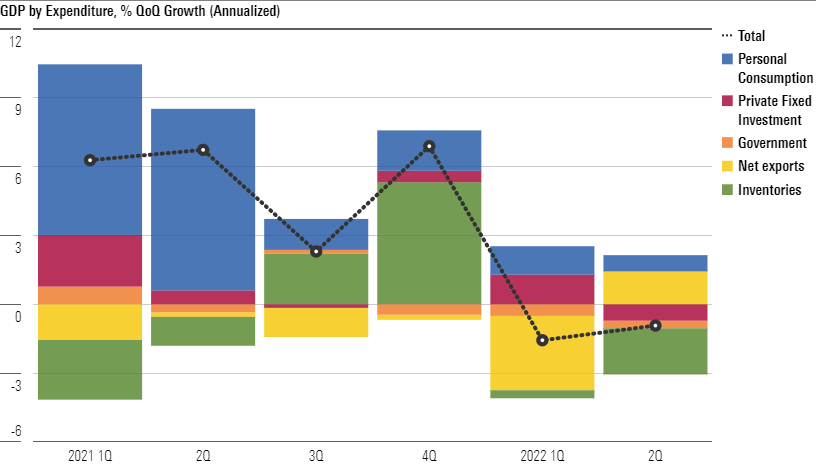

U.S. real GDP dropped 0.14% (0.6% annualized) in the second quarter of this year, following a 1.6% annualized drop in the first quarter.

As we’ve discussed previously, though this meets one common definition of a recession, we’re skeptical that output truly declined in the first half of 2022, given employment growth and other indicators.

The reported GDP decline was driven by the noisiest components of total spending (net exports and inventories), while final domestic demand (consumption plus investment) continued to increase. It’s also too early for the Fed's interest-rate hikes to be having a major effect on economic activity, given the usual lag.

- source: Morningstar Analysts

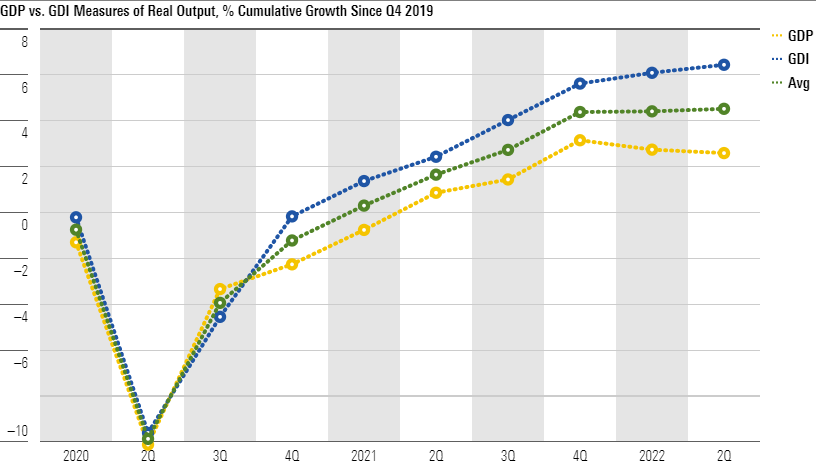

Finally, gross domestic income (which should be equivalent to GDP but is sourced from income data like profits and wages) showed an increase in the first half of 2022.

- source: Morningstar Analysts

U.S. Real GDP Remains Ahead of Its Prepandemic Mark

U.S. real GDP is still about 2.5% above fourth-quarter 2019 levels, although that leaves it lagging about 2% below the prepandemic trend (using the 2.3% growth rate averaged from 2016 to 2019). Although we’re doubtful that the economy is already contracting, growth has clearly slowed compared with earlier in the recovery.

Consumer goods spending has provided the biggest lift to GDP in the recovery, with net exports being the main drag. Real imports are up 16% since the start of the pandemic, as much of the surge in goods demand has leaked out of the country to instead support foreign manufacturers. This is part of why the ongoing recovery in services is important, as the domestic share of services content is much higher.

Bullish View on GDP Is Driven by Our Supply-Side View

Our longer-run GDP forecast is determined solely by our projections for the supply side of the economy, as we expect the Fed to calibrate aggregate demand so the economy is operating at full capacity.

GDP growth in the prepandemic years was fueled heavily by cyclical labor market expansion, during the long recovery from the Great Recession. So we can’t take it for granted that the prepandemic growth rate represents a good benchmark for long-term growth.

Our bullish view on GDP through 2026 compared with consensus is driven mostly by our expectations for labor supply. We expect labor force participation (adjusted for demographics) to soar past prepandemic rates as widespread job availability pulls in formerly discouraged workers. The consensus expects labor force participation to struggle to reach prepandemic rates.

We expect labor productivity growth to be roughly in line with consensus. The pandemic has already spurred a large boost to productivity, though more recently this has been obscured by short-term supply constraints. Productivity should be boosted as firms cope with tight labor markets by investing more in labor-saving capital and technology.

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)