Markets Brief: Inflation May Be Cooling, but High Prices Hurt Demand

Chinese ADR-listed stocks get a big boost; Nordstrom, Advance Auto Parts slide on outlook.

It was a volatile week for the broader market, which ended trading on Friday with its biggest one-day loss since mid-June. The decline came following comments from Federal Reserve Chairman Jerome Powell that the central bank must stay on its course to continue raising interest rates until inflation comes down.

Ten of 11 industry sectors declined for the week, with technology and communication stocks down the most. Only energy stocks gained on rising oil prices.

Chinese ADR-listed stocks dominated the best-performers list on news that the U.S. and China reached a deal on auditing procedures. Meanwhile, disappointing earnings results and reports of weakening consumer demand from companies hammered shares of various retailers and software firms.

Inflation worries cooled somewhat on the latest Personal Consumption Expenditure Index data, the Fed’s preferred measure of inflation. July showed a 0.1 decrease in prices for a year-over-year change of 6.3%, down from 6.8% in June. The PCE data follows what the July Consumer Price Index report showed earlier this month.

The latest jobs data is scheduled to be released on September 2, with the August employment report. Employment has remained strong despite concerns of economic uncertainty from both investors and companies. July brought in a surprise increase of 528,000 jobs, the largest since February.

Economists are predicting an increase of 290,000 jobs in August, according to FactSet. Unemployment is expected to remain unchanged at 3.5%.

Events scheduled for the coming week include:

- Tuesday: Best Buy BBY, HP HPQ, and CrowdStrike Holdings CRWD report earnings.

- Wednesday: Okta OKTA and MongoDB MDB report earnings.

- Thursday: Broadcom AVGO reports earnings.

- Friday: August employment report.

For the trading week ended Aug. 26:

- The Morningstar US Market Index fell 3.87%.

- The best-performing sector was energy, up 4.15%; all other sectors declined for the week.

- The worst-performing sectors were technology, down 5.23%, and communication services, down 4.52%.

- Yields on the U.S. 10-year Treasury rose to 3.04% from 2.98%.

- WTI crude-oil prices rose 2.52% to $93.06 per barrel.

- Of the 861 U.S.-listed companies covered by Morningstar, 146, or 17%, were up, and 715, 83%, declined.

What Stocks Are Up?

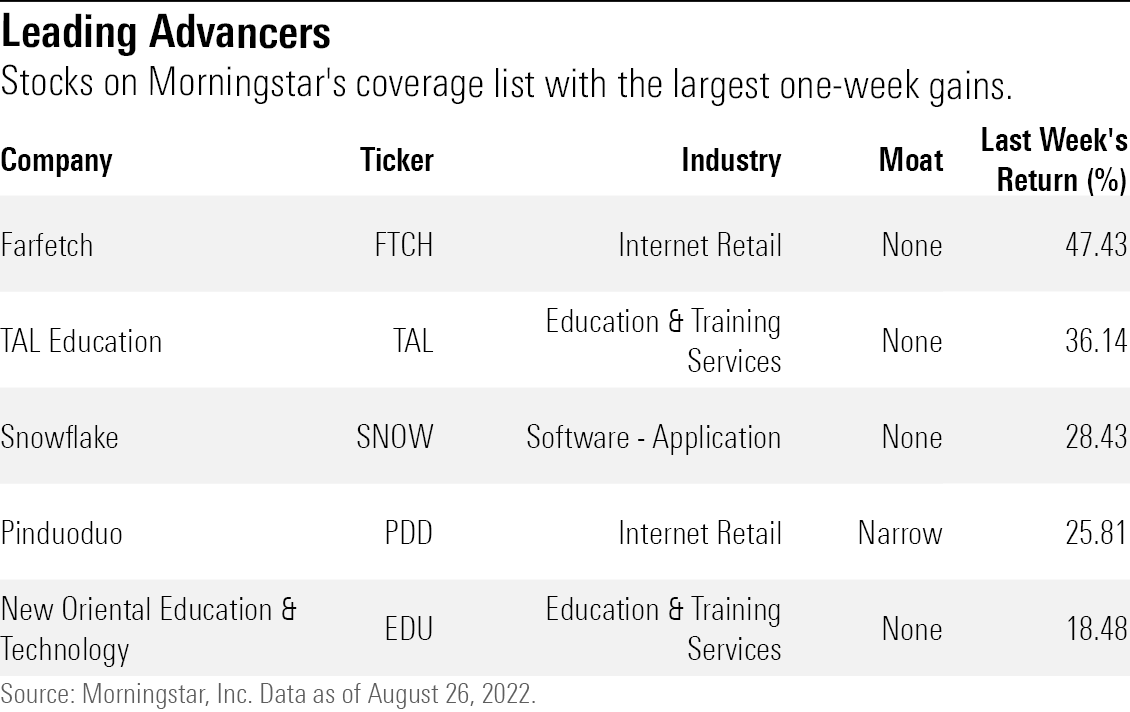

The best-performing stocks of the last week were Farfetch FTCH, TAL Education TAL, Snowflake SNOW, Pinduoduo PDD, and New Oriental Education & Technology EDU.

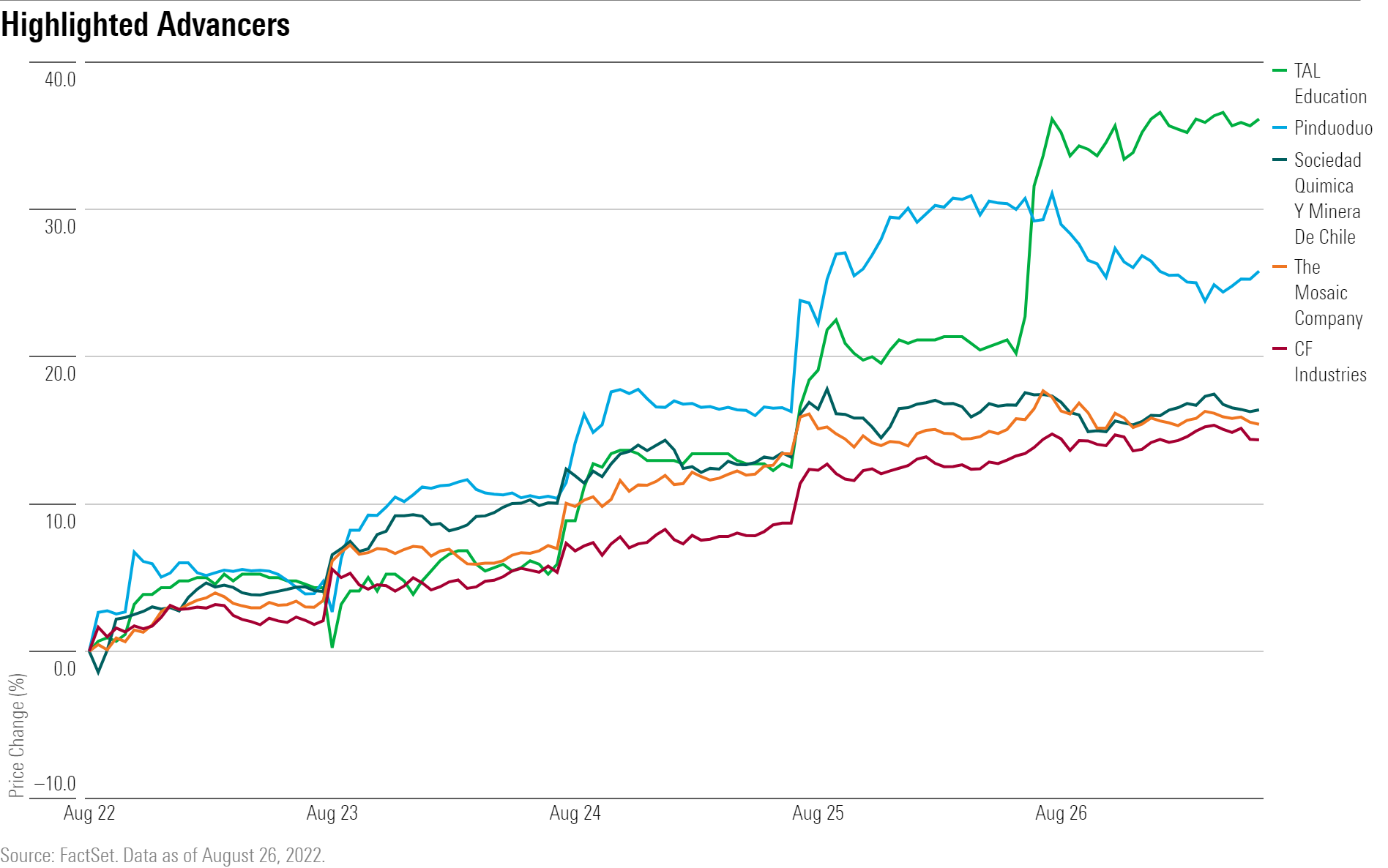

Chinese ADR-listed stocks were among the best performers following news that regulators in the U.S. and China had reached an agreement on auditing procedures. Investors had sold Chinese companies in the last year over concerns that shares would be delisted due to a standoff in allowing U.S. regulators to inspect China-based audits, The Wall Street Journal reported.

Following news of the deal shares of Tal Education, Pinduoduo, and New Oriental Education & Technology rallied.

Fertilizer producers The Mosaic Company MOS and CF Industries Holdings CF closed the week higher, as did lithium producers Sociedad Quimica Y Minera De Chile SQM and Livent LTHM.

What Stocks Are Down?

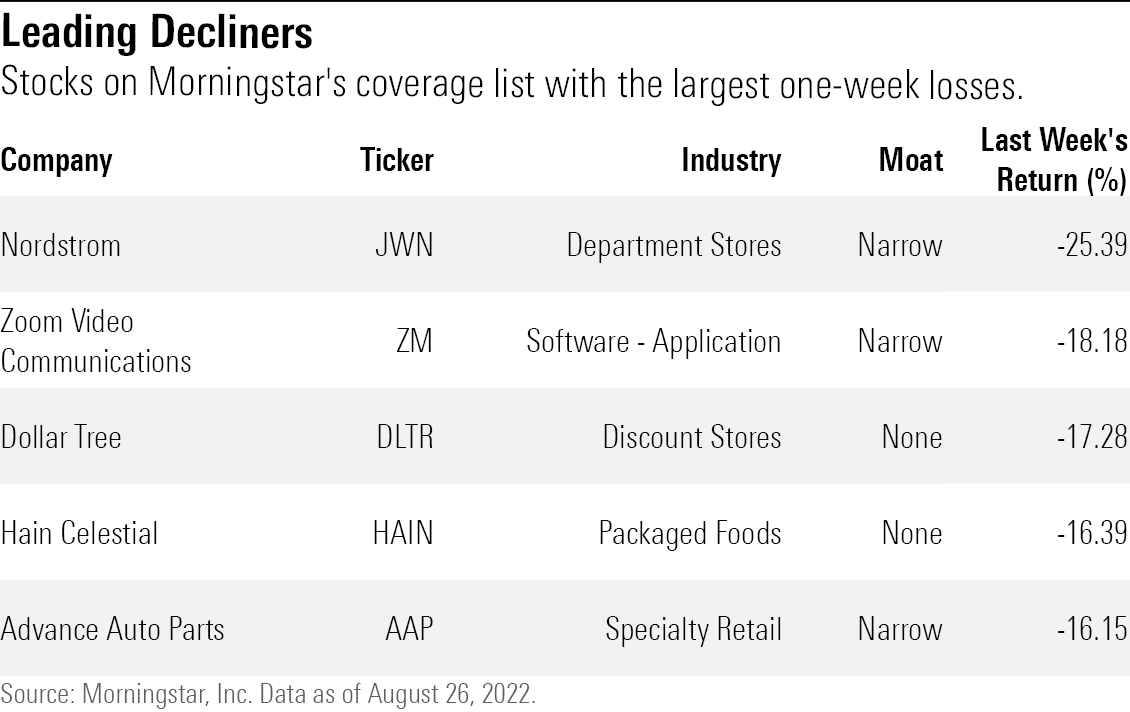

The worst-performing stocks for the week were Nordstrom JWN, Zoom Video Communications ZM, Dollar Tree DLTR, Hain Celestial HAIN, and Advance Auto Parts AAP.

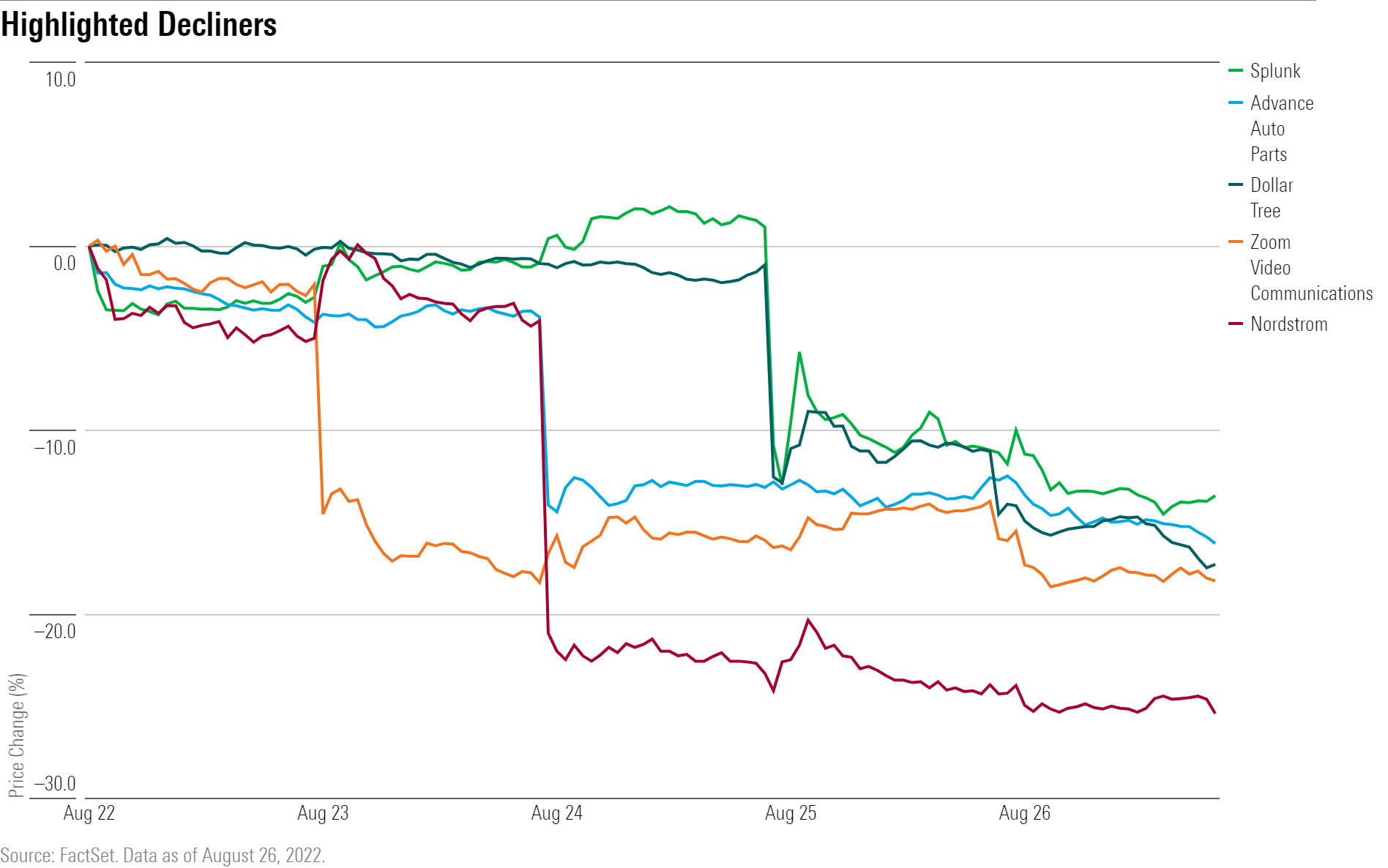

Disappointing earnings news was a common theme among the worst performers. Nordstrom was down the most among U.S.-listed stocks in Morningstar’s coverage universe after the clothing retailer reduced its guidance for the second half. The company also noted weakening sales in Nordstrom Rack, which targets lower-income consumers who are more susceptible to inflationary pressures.

Shares of tech firms Zoom Video Communications and Splunk SPLK also sank following disappointing earnings results. Dollar Tree and Advance Auto Parts declined after cutting their outlooks.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)