Construction-Related Stocks See Risks and Opportunities Amid Tightening Carbon Policies

As the planet warms, decarbonizing our buildings and infrastructure is coming into sharper focus.

Our built environment—the structures in which we reside, work, and play—contributes significantly to our enormous carbon footprint. If society hopes to realize its long-term goal of net-zero emissions, dramatic action needs to be taken.

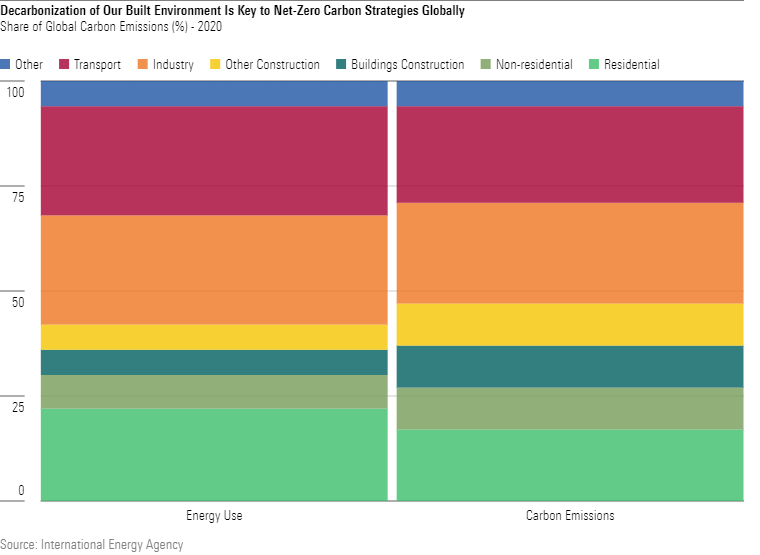

Minimizing carbon emissions from our buildings and infrastructure is a global challenge, but one the world must face to appropriately address climate change. This reality is patently obvious when considering that a sobering 37% of global energy-related carbon emissions emanate from the existing building stock and from the construction of new buildings. Consequently, decarbonizing buildings is a central component of the long-term net-zero strategies of major economies globally.

Certainly, effecting the vital decarbonization of our entire global building stock poses challenges from the standpoints of both policy and technology. It will also come at a distinct cost.

For example, existing buildings will require capital reinvestment, aimed largely at electrifying space heating and improving building air tightness. While this will happen gradually over the coming decades, the carbon emissions efficiency of newly constructed buildings is a near-term focus of policymakers globally. To this end, carbon emissions performance standards have been embedded into building codes and standards and are being progressively tightened globally.

The carbon footprint of a building is dominated by the energy it consumes over its useful life—referred to as its operational carbon emissions—but it is by no means the only source. The carbon emissions generated during the manufacture of a building’s materials, construction of the building itself, and any subsequent maintenance or renovation also contribute meaningfully to carbon emissions. Further, a building’s demolition and the removal and disposal of building material waste also contribute to lifecycle carbon emissions.

To date, these more “hidden” sources of a building’s carbon footprint—referred to as embodied carbon emissions—have garnered less policymaker attention than they ought to. However, this is a reality that we think is about to change. As building standards aimed at addressing operational and embodied carbon are progressively tightened over the coming decade, carbon policy-related risks and opportunities are emerging for the construction value chain.

Significant Progress Made on Operational Carbon, With More to Come

Operational carbon refers to the carbon emissions associated with the energy used to operate a building or piece of infrastructure over the course of its life.

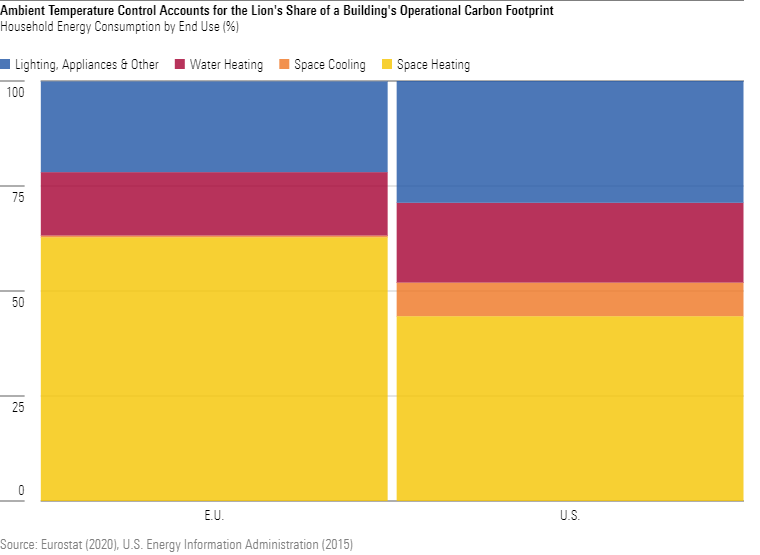

The control of a building’s ambient temperature via heating, cooling, and ventilation systems accounts for the majority of this operational carbon burden. Consequently, the electrification of heat sources—to get homes ready for the eventual transition to power generation from renewable sources—is key to improving the operational carbon credentials of newly constructed homes and buildings.

Still, more energy-efficient hot water supply, lighting, and appliances also contribute to improved operational carbon outcomes. Installation of on-site renewable power generation capacity—such as solar photovoltaic panels—helps to further narrow the gap to net-zero.

Progress has been made on the operational carbon front over the past two decades, with U.S. and European building standards mandating incremental improvement in the energy efficiency of newly constructed homes and other buildings. For example, all newly constructed buildings in the European Union must be “nearly zero-emissions” from 2021 onward. The EU defines a nearly zero-emissions building as one with very high energy performance where the very low amount of energy required should be covered to a significant extent by energy from renewable sources.

Still, there is more work to be done to fully realize net-zero ambitions for newly constructed buildings. This is particularly the case in the United States where operational carbon requirements for newly built homes are determined on a state-by-state basis. California, Washington, and Vermont are leading the charge, having recently adopted residential energy codes for new builds that are estimated to be an approximate 10% away from net zero. However, progress in many other states has been more limited, meaning there’s still a lot of work to be done for much of the U.S. to minimize built-environment operational carbon.

Looking across the value chain, we think homebuilders are most exposed to rising operational-carbon standards. With these companies generally lacking pricing power, their profit margins are at risk as building standards progressively mandate improved operational-carbon outcomes over the coming decade, adding significant cost.

However, opportunities also exist for suppliers of building materials and systems that reduce a building’s operational carbon. For example, suppliers of innovative heating, ventilation, and air conditioning, or HVAC, equipment stand to benefit from increasing operational-carbon requirements over the coming decade as heat pumps and/or other electrified space heating become standard in newly constructed buildings. Further, the decarbonization of the entire building stock should drive a long-term tailwind for the industry as energy-efficiency retrofitting of the existing building stock takes place over coming decades.

Upside and Downside Risks Are Now Emerging as the Embodied Carbon Discussion Matures

To date, building standards have focused almost entirely on improving the operational carbon efficiency of buildings. However, operational carbon isn’t the full story when it comes to the built environment’s impact on our climate.

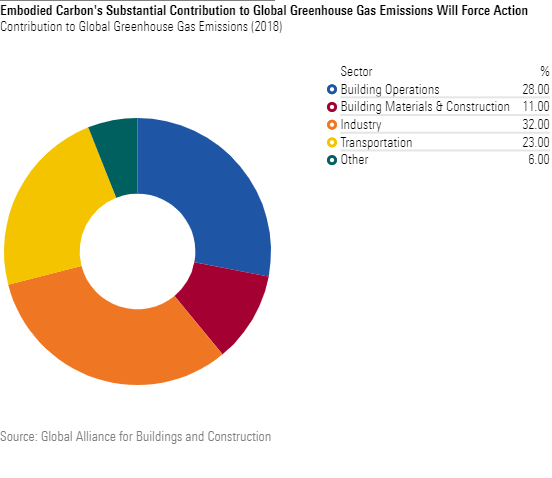

Embodied carbon emissions refer to carbon emissions generated during the manufacturing processes of building materials and systems, as well as those generated during construction, repair, refurbishment, and demolition.

Embodied carbon’s contribution to the lifecycle emissions of built assets accounts for a sizable 11% of total carbon emissions globally. The impetus to address embodied carbon is even starker when considering the increasing contribution of embodied carbon to total built-environment carbon emissions over coming decades as power generation transitions toward renewable sources (and therefore reduces the carbon footprint of a building’s ongoing operations). Embodied carbon is expected to contribute as much as 50% of the built environment’s carbon emissions over the 2019-2050 period, according to the World Green Building Council.

While building standards have been slow to act on embodied carbon, progress is now underway. In 2018, the Netherlands became the first jurisdiction to impose embodied-carbon performance standards on new builds. Various other embodied-carbon precedent actions and policies have been implemented in other parts of Europe, including France and Sweden. While the U.S. trails part of Europe on tackling embodied carbon, progress is also underway with the state of California, which has begun to mandate that embodied carbon be considered in commercial buildings.

We anticipate a coordinated global effort on embodied carbon in the long term, given its meaningful contribution to the built environment’s carbon footprint. Building design and building material selection are keys to minimizing the embodied carbon of a building. Consequently, as embodied-carbon standards ratchet up, building material winners and losers will likely emerge.

We think high-mass building materials—such as clay brick—will likely face a secular challenge from the need to reduce the embodied-carbon footprint of our building stock. Conversely, lightweight exterior wall alternatives such as timber, vinyl, and fiber cement boast more favorable embodied-carbon credentials and are likely to enjoy a structural growth opportunity.

Opportunities Abound for Investors Across the Construction Value Chain

As built-environment carbon standards evolve, we see two avenues open to astute investors. The first is to select attractively valued construction-related stocks operating in segments of the value chain that are subject to low lifecycle carbon-related risk or that are likely to benefit from lifecycle carbon policy tailwinds. These include HVAC suppliers, lightweight building materials manufacturers, and real estate service providers.

For instance, James Hardie Industries JHX, which has a Morningstar Economic Moat Rating of wide, is a lightweight building materials manufacturer that we think stands to benefit from rising embodied carbon standards. Concerns surrounding the health of the U.S. economy currently provide an opportunity for investors to gain exposure to the supplier at an attractive price, in our view.

The second way for investors to profit is to gain exposure to construction-related stocks that feature heightened carbon-policy risk, yet trade at a significant enough discount to fair value to provide sufficient margin of safety.

A prime example is that of U.S. homebuilder D.R. Horton DHI. While we think homebuilders are the most exposed to operational-carbon risk, D.R. Horton screens attractively. Trading with a Morningstar Rating of 4 stars, no-moat D.R. Horton’s current stock price more than accounts for the risk posed by rising operational-carbon build costs. Furthermore, we think D.R. Horton is best positioned among our U.S. homebuilder coverage owing to its strong position in entry-level homes, favorable geographic mix, balance sheet strength, and asset-light approach to land acquisition.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)