Big-Box Retailing Stocks See Strength in Consumer Spending

How Walmart and Home Depot beat estimates.

They might be spending differently, but consumers are still spending.

Proof of that showed up in the second-quarter earnings results of the big-box retailers this week, though it was clear that some companies are executing better than others in an uneasy environment. In addition, the U.S. Census Bureau reported retail sales stayed steady in July, increasing less than 0.4%, excluding auto sales, slightly better than the expectation of no gains. Spending on gasoline declined as prices dropped, leaving more money for spending on building materials, garden equipment, personal-care products, and online purchases.

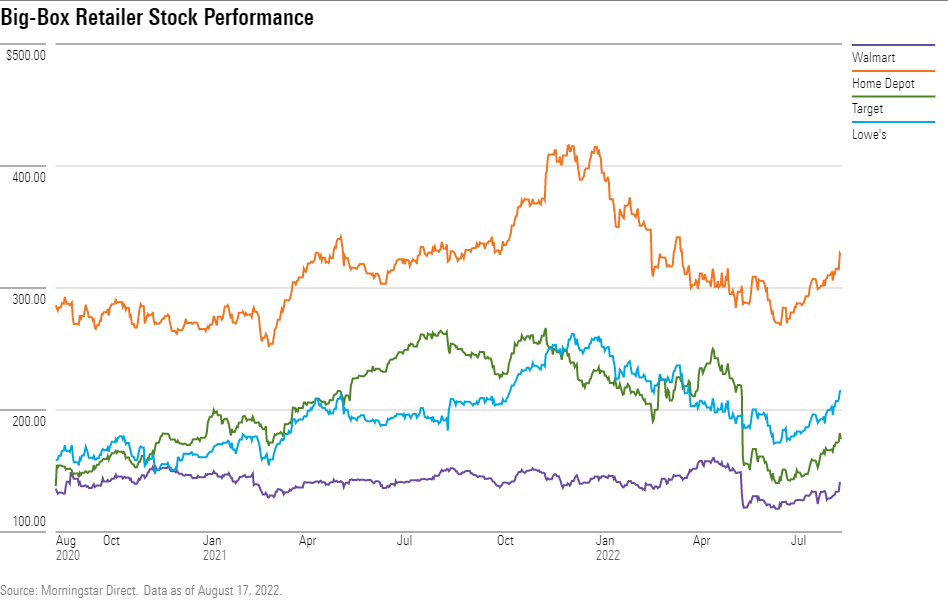

Retail giants Walmart WMT and Home Depot HD reported better-than-expected second-quarter sales and profits Tuesday, sending their stocks soaring and leading to gains in the broader stock market, including the Morningstar US Market Index.

“These reports somewhat help alleviate widespread imminent recession fears,” says James Paulsen, chief investment strategist at Leuthold Group. “Retail companies are facing stiffer opposition to price hikes, but so far, price inflation has not shut down consumer spending and that is allowing companies to manage through this challenging period.”

Walmart, Home Depot on Track to Meet or Beat Full-Year Outlooks

Adding to the good news, Walmart and Home Depot said they would meet or improve upon their full-year financial targets as they cut costs, weed inventories, raise prices, and continue to attract customers. Walmart's chief executive Doug McMillon told CNBC that its stores were attracting more households with annual incomes of $100,000 or higher. "People are really price-focused now, regardless of income level," McMillon said.

Target TGT increased second-quarter revenue by 3.5% to $26 billion, beating estimates, and said same-store sales grew 2.6%. Still, the company surprised investors with a 90% decline in earnings, even after lowering guidance on two separate occasions in May and June. The company blamed aggressive markdowns on excess merchandise for the plunge in earnings.

Target said “current trends support the company’s prior guidance for full-year revenue growth in the low- to mid-single-digit range and an operating margin rate in a range around 6%” in the second half of the year. That would compare with an operating margin rate of 1.2% in the second quarter.

Lowe's LOW posted better-than-expected net earnings of $3 billion and earnings per share of $4.67. Sales came in at $27.5 billion, below estimates and just shy of the $27.6 billion posted in the year-earlier period. Lowe’s now expects its operating margin to be at the top end of its 12.8% to 13% outlook range, and EPS for the full year to be at the top end of its $13.10 to $13.60 range. Sales are forecast to be in the bottom of its $97 billion to $99 billion range. Same-store sales are expected in the range of down 1% to up 1%.

Lowe’s chief executive Marvin Ellison summed the quarter up by saying the company continues to see “continued strong demand for our new and innovative products at higher price points.” He added the do-it-yourself customers “remain resilient, which reflects continued strong home improvement demand trends.”

What a difference a quarter makes: Just three months ago, disappointing first-quarter results from Walmart and Target spooked investors and led to the market’s biggest one-day selloff in two years. Then, the companies—and investors—were caught off-guard by rapidly rising prices and changing consumer behaviors.

Inside Walmart’s Second-Quarter Results

This week Walmart reported an 8.4% jump in total revenue to $152.9 billion in its fiscal 2023 second quarter, and consolidated operating income of $6.9 billion, or earnings of $1.88 per share, topping analyst expectations on both fronts.

The world’s largest retailer said same-store sales grew 6.5% in the quarter compared with the year-earlier period. Analysts had been expecting 5.9% growth. It maintained its full-year forecast for same-store sales growth in its U.S. operations of about 4%, excluding fuel. It now sees adjusted EPS declining by 9% to 11%, an improvement from a decline of 11% to 13% it forecast just a few weeks ago.

Markdowns on excess inventory and low double-digit sales growth in groceries continue to erode profit margins. Customers of all income levels are increasingly trading down, the company said.

“Instead of deli meats at higher price points, customers are increasing purchases of hot dogs as well as canned tuna or chicken,” chief financial officer John David Rainey said, citing one example.

Rainey noted, too, that private-label products are more popular, especially in the food category where “the private brand growth rate doubled compared with Q1 levels.”

Walmart is making strides in destocking as softness in higher-end product categories persists.

“We've cleared most summer seasonal inventory, but we are still focused on reducing exposure to other areas such as electronics, home and sporting goods,” said Rainey. “We've also canceled billions of dollars in orders to help align inventory levels with expected demand. We estimate that only about 15% of our total inventory growth in Q2 is still above optimal levels.”

Its Sam’s Club unit, through which members purchase brand-name goods in bulk at wholesale prices, posted same-store sales growth of 9.5%, not including fuel. Membership income rose 8.9% as the total number of members reached an all-time high.

Morningstar equity analyst Zain Akbari was encouraged by management’s suggestion that the worst of the closeouts are likely past as it moves aggressively to clear surplus merchandise. And he noted the improving sales trends in the last weeks of July, with a solid start to the back-to-school season as fuel prices slid.

Still, at a recent price of $139.59 per share, Walmart trades above his fair value estimate of $138. “We still expect low-single-digit annual top-line growth and mid-single-digit operating margins over the long term and suggest prospective investors await a greater margin of safety,” said Akbari in a note on 3-star, wide-moat-rated Walmart.

Home Depot Has Its Best Quarter Ever

Home Depot, the world's largest home improvement retailer, reported the highest quarterly sales and earnings in the company's history.

Second-quarter sales increased 6.5% to $43.8 billion from the same period last year. Same-store sales rose 5.8% in the quarter, with comparable sales in the U.S. increasing 5.4%. Net earnings for the second quarter were $5.2 billion, or $5.05 per diluted share, compared with net earnings of $4.8 billion, or $4.53, in the same period of 2021, representing an 11.5% increase in diluted EPS.

Home Depot also reiterated its previous guidance for 2022:

- Total and comparable sales growth of about 3%.

- Operating margin of about 15.4%.

- Percent growth of diluted EPS growth in the mid-single digits.

While all of its merchandising categories posted positive comparisons year over year, demand was mixed. Sales in electrical, decor and storage, kitchen and bath, outdoor garden, tools, appliances, indoor garden, lumber, and flooring were positive but below the company average, Home Depot said.

Building materials, plumbing, millwork, paint, and hardware were all above average, driven by home improvement projects by professionals and do-it-yourselfers. Backlogs remain healthy and big-ticket transactions of over $1,000 were up 11.6% compared with the second quarter of last year, driven by demand for pipes and fittings, gypsum, and fasteners in its professional category.

Home Depot chief financial officer Richard McPhail noted that times remain precarious and unprecedented. But he voiced optimism about the strength of the consumer.

“We also see engaged and resilient homeowners who have strong balance sheets, consumers spending more time in their homes, and continued structural support for home improvement project demand,” said McPhail.

Morningstar senior equity analyst Jaime Katz noted that 2-star wide-moat Home Depot’s stock at a recent price of $325 per share trades at a 25% premium to her fair value estimate of $264. While the company’s second-quarter results exceeded expectations, she notes that, “despite these optimistic results, two-year comparable growth of 10.3% was a material decline from the above-20s rates observed in the past couple of quarters, implying that pent-up demand will continue to normalize.”

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TQKIUI6SDRCQFMUBSWCMD7OKPI.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)