How Portfolio Rebalancing Has Helped Investors in 2022

It's not a panacea but has helped limit some losses.

With both stocks and bonds declining in tandem during the first half of the year, 2022 has been an unusually difficult market environment. However, investors who followed a disciplined rebalancing strategy would have sustained slightly less damage. While rebalancing doesn't always improve returns, this year's results illustrate why it's an important step for keeping risk in check.

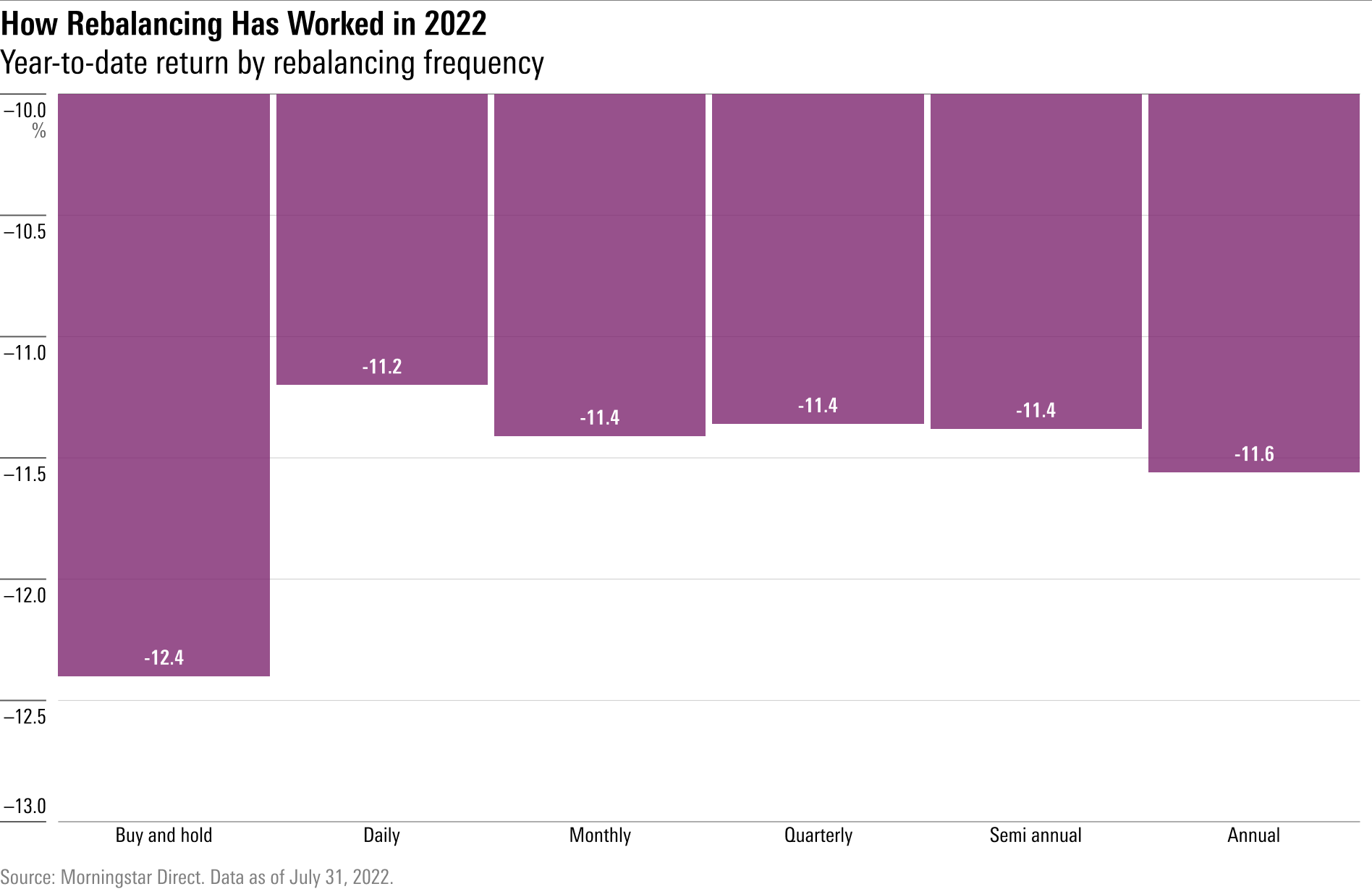

2022 Results

To test the impact of rebalancing, I set up six test portfolios with starting dates of Dec. 31, 2016, with each split between 60% stocks and 40% bonds. Each portfolio assumed a different rebalancing frequency, ranging from daily rebalancing to never, also known as buy and hold. As the graph below shows, investors who failed to rebalance would have suffered the deepest losses for the year-to-date period in 2022.

The reason for these results is straightforward: Thanks to generally strong equity market returns, the buy-and-hold portfolio would have had more and more equity exposure over time. By the end of 2021, the portfolio's stock position would have climbed to more than 74% of assets. That left it more exposed to the downdraft in the first six months of 2022.

The portfolios with other rebalancing frequencies lost about 1 percentage point less, on average. They all would have headed into the year with less equity exposure, but the portfolios with more-frequent rebalancing generally fared the best. Daily rebalancing, for example, kept losses in check but also helped investors maximize returns during periods when the market moved up, such as the month of July.

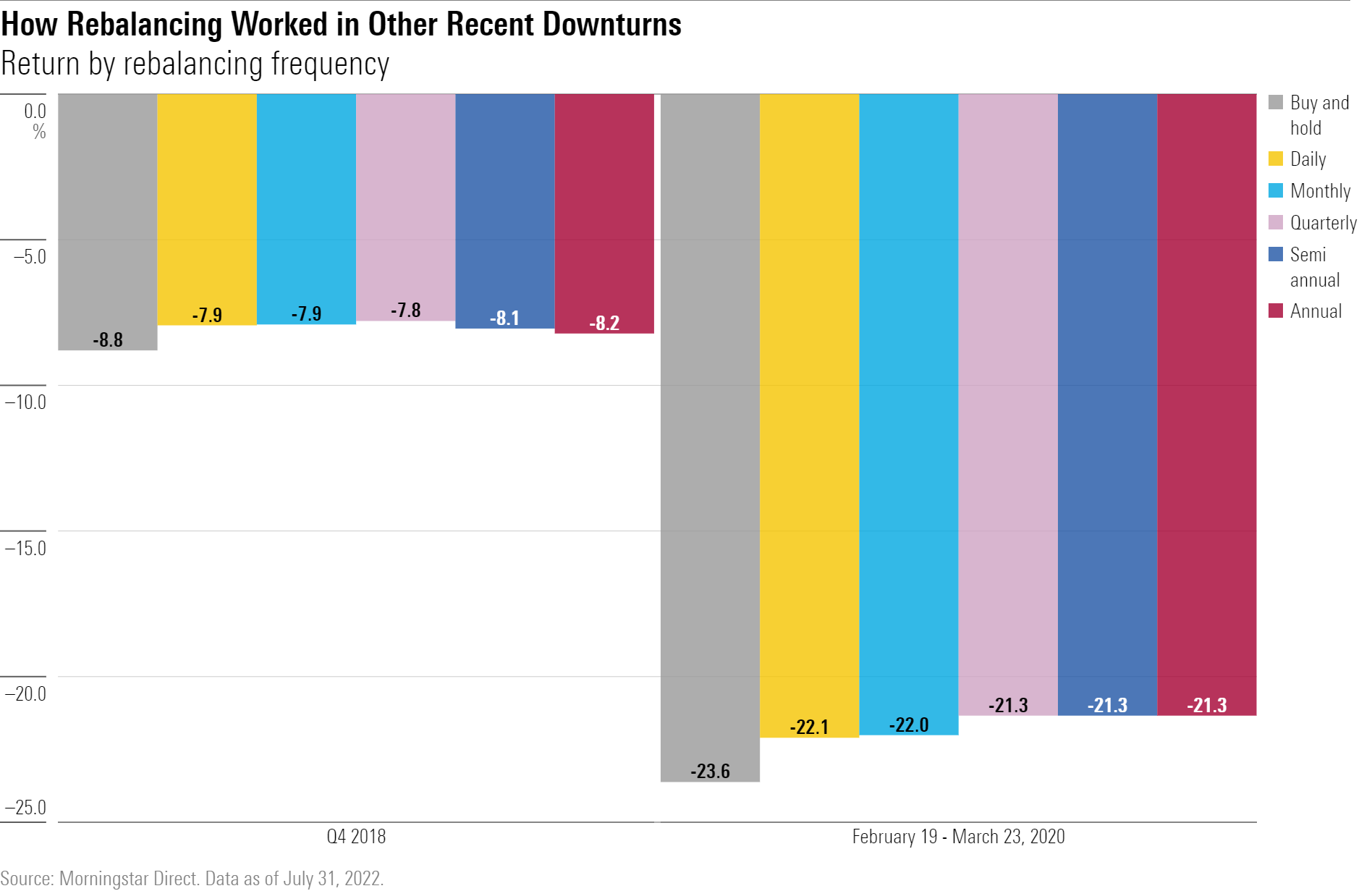

Rebalancing would have also helped limit losses in the fourth quarter of 2018, when recession fears touched off a sudden downturn, and during the novel coronavirus-driven bear market in early 2020.

When Rebalancing Doesn't Work

Rebalancing doesn't always improve returns, though, or even reduce risk in the short term.

The clearest benefits from rebalancing show up for portfolios that investors have held for several years. In other cases, a recently established portfolio may or may not benefit from rebalancing depending on the timing and pattern of market drawdowns.

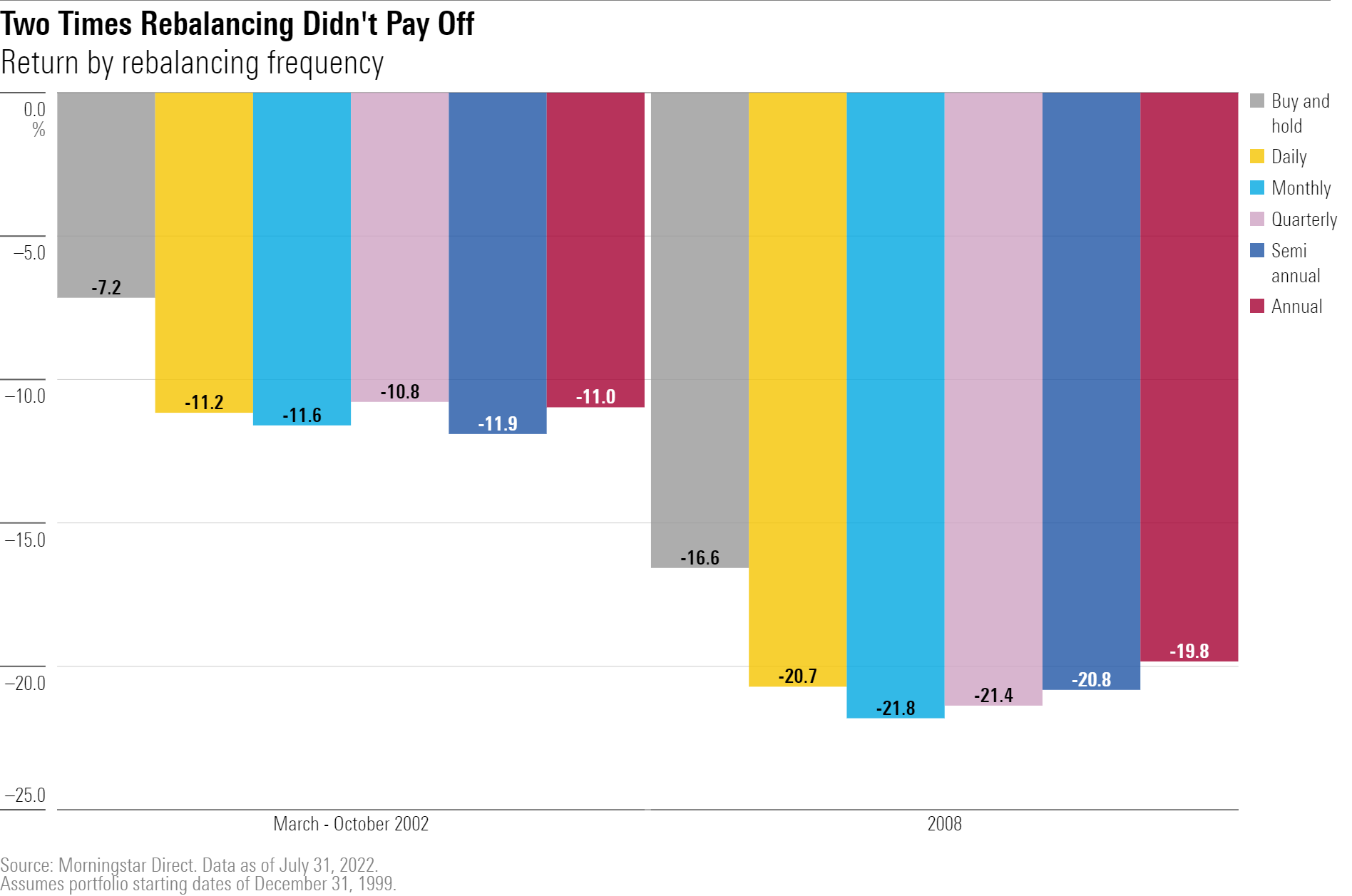

For example, a portfolio set up at the end of 1999 and periodically rebalanced would have suffered more thanks to the pattern of three straight years of equity market losses in 2000, 2001, and 2002. Periodic rebalancing would have meant continuously buying into weakness and maintaining significant equity exposure as stocks continued dropping. On the flip side, the buy-and-hold approach would have resulted in shrinking equity exposure, which would have buffered losses to some extent as the market continued its decline.

The same pattern occurred during the global financial crisis in 2008. Thanks to the string of equity market losses from 2001 through 2003, the buy-and-hold portfolio would have still had lower equity exposure by the end of 2007, which would have limited losses versus the rebalanced portfolios to the tune of roughly 4 percentage points in 2008.

Rebalancing can also limit returns on the upside. Going back to the original set of portfolios (which assume a starting date at the end of 2016), the rebalanced portfolios would have generated about two or 3 percentage points less in calendar-year returns during 2021 versus the buy-and-hold portfolio, which was able to capture more of the market's consistently strong equity returns for the year.

Conclusion

At the end of the day, there's no guarantee rebalancing will improve returns in a given market. And given that equity markets statistically generate positive returns more often than not, an investor who wanted to maximize returns would just let the winners ride, confident that more equity exposure should lead to better long-term returns. The problem with that approach, though, is that it also involves taking on more and more risk over time.

Indeed, the strongest argument in favor of portfolio rebalancing is to keep risk in check. In fact, our previous studies have found that any rebalancing frequency (ranging from daily to annual) led to similar reductions in portfolio volatility over longer periods. Annual rebalancing had a slight edge for risk reduction, but the differences in results between rebalancing frequencies weren't large enough to lose any sleep over. Any consistently applied rebalancing strategy—whether time-based or based on setting a threshold to limit asset-allocation drift—is better than none when it comes to risk control. This year's rebalancing results help reinforce that lesson.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)