CPI Report Shows Good News on Inflation, but Fed Rate Hikes Remain in the Cards

Easing supply chain pressures, falling energy prices should put continued downward pressure on inflation.

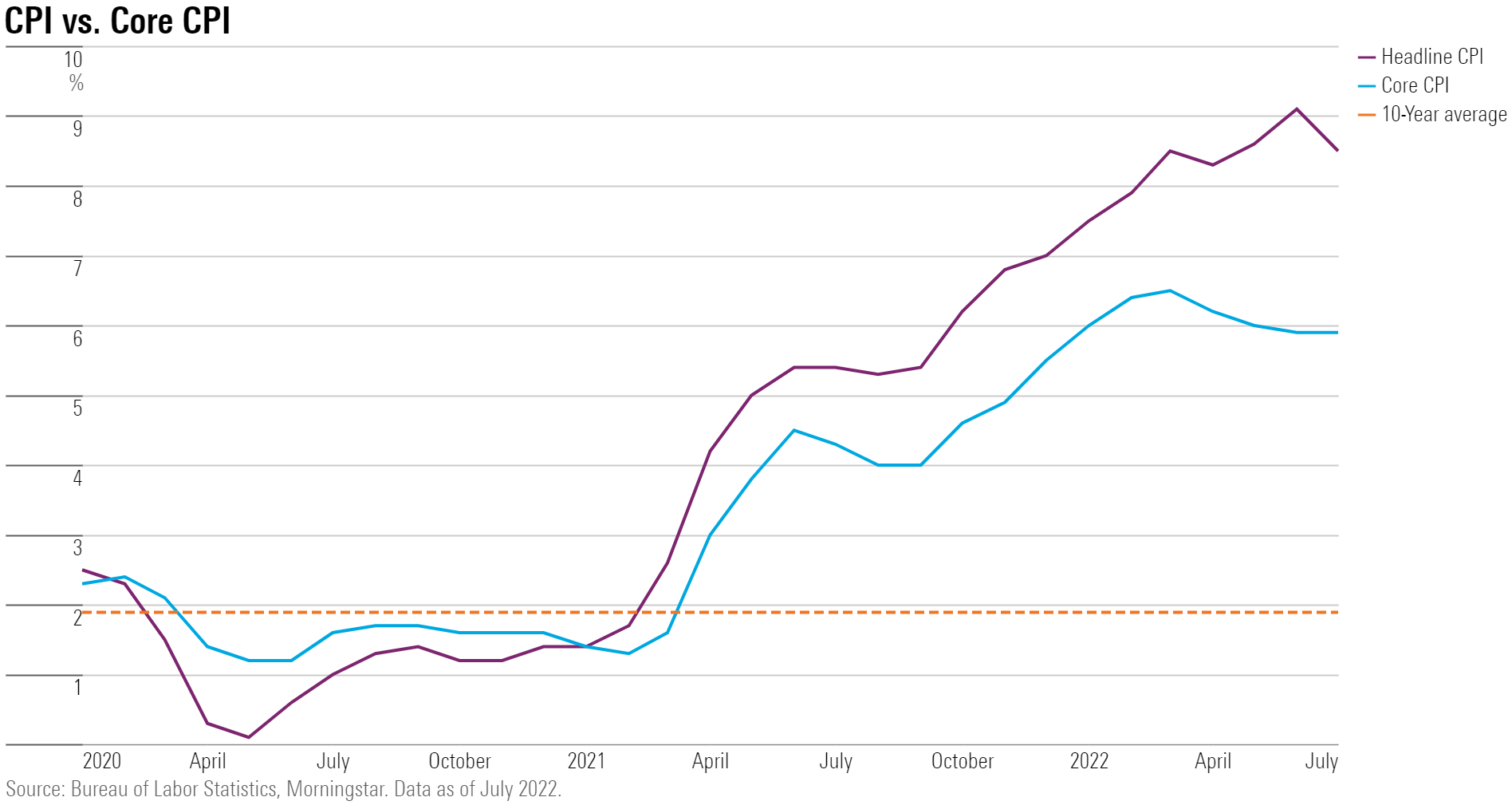

Consumers are finally getting a break on the inflation front as July's Consumer Price Index report at long last showed material signs of a cooling off of price pressures.

However, financial markets aren’t off the hook when it comes to continued Federal Reserve rate increases.

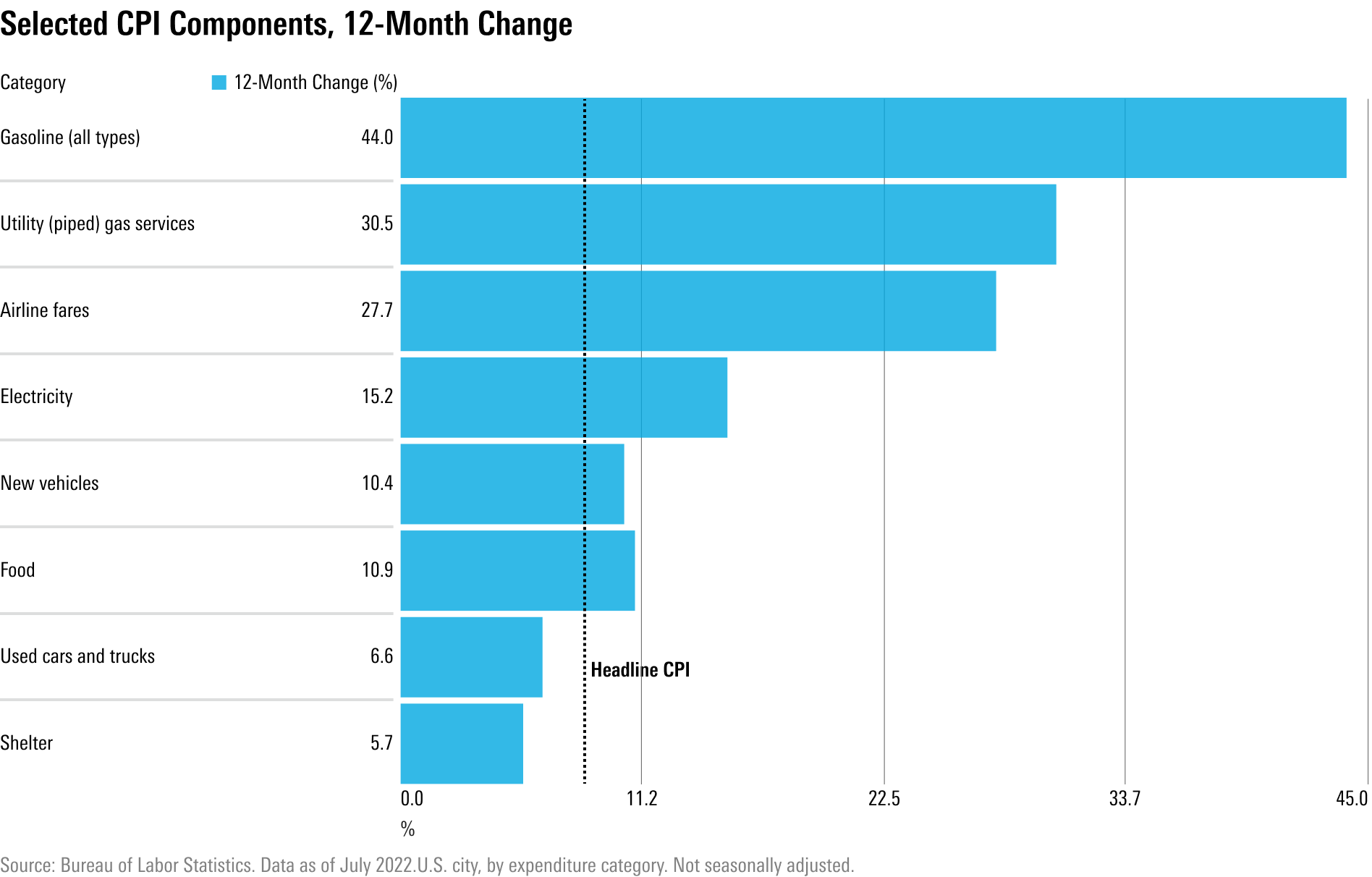

The Labor Department reported that CPI was unchanged in July from June, the weakest reading since late 2020, as fuel prices, airline fares, and used-car prices declined. On an annual basis inflation rose 8.5% in July, down from the 9.1% increase seen in June but still at exceptionally high levels by historical standards.

When volatile food and energy costs were stripped out, inflation was still tamer than economists had predicted. So-called core CPI rose just 0.3% in July, the lowest reading since March and down from a 0.7% increase posted in June.

Victory Over Inflation Isn't Assured

While upward pressure on prices may have peaked, that likely doesn't significantly change the outlook for the Fed. "While today brought good news on inflation, it's too early for the Fed to declare victory," says Preston Caldwell, Morningstar's chief U.S. economist.

Even with an easing of upward pressure on prices, inflation remains well above the Fed’s 2% target. For example, the CPI excluding food and energy was still up 5.9% over the last 12 months.

Inflation Landscape for July

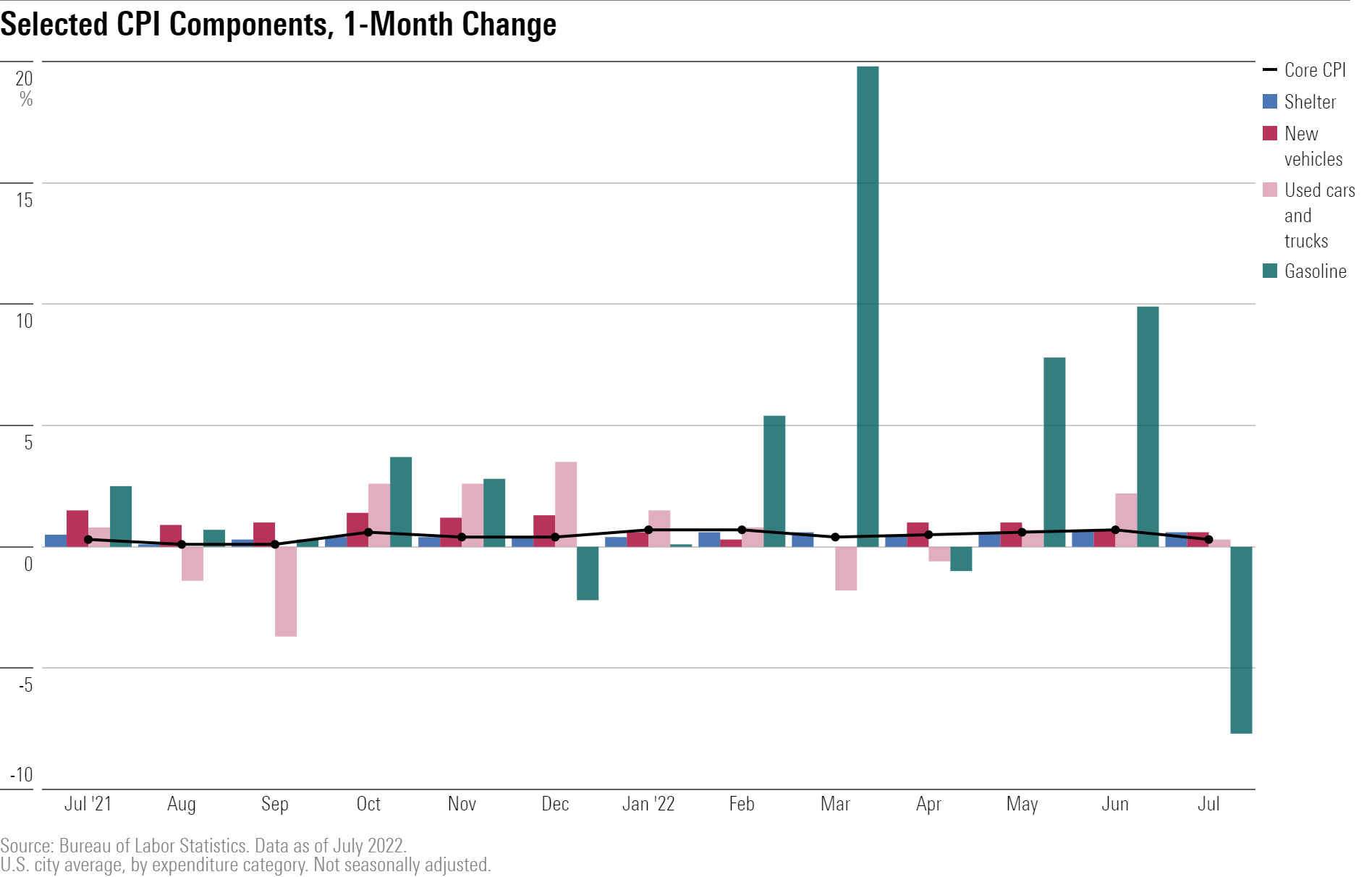

The biggest shift in the inflation landscape in July was in energy costs. The energy index overall fell 4.6% after rising 7.5% in June. That drop was led by a 7.7% decline in gasoline prices, following an 11.2% increase in June.

"The impact of energy prices was well known in advance, as market prices for oil products fell throughout July,” says Caldwell. “These prices have fallen further going into August, so we should see energy prices also drag down the CPI report released next month. As of today, oil prices are still elevated about 60% above our long-term forecast, so we see further deflation over the next couple years.”

The drop in energy costs also helped keep core inflation low, Caldwell says, reflecting a pass-through of those lower costs for businesses.

Caldwell says that the easing of supply chain issues may also have contributed to the slowdown in core inflation. He points to a sharp decline in the New York Fed's Global Supply Chain Pressure Index, and to vehicle prices, which contributed greatly to inflation over the past two years, that were flat in July. "Alleviation of the semiconductor shortage is allowing vehicle production to rise, but it will take some time to catch up with the backlog in demand," Caldwell says.

Fed Looks to Avoid Mistakes of the 1970s

While the July report provided welcome news for consumers and investors, the Fed is likely on track to continue its battle against inflation.

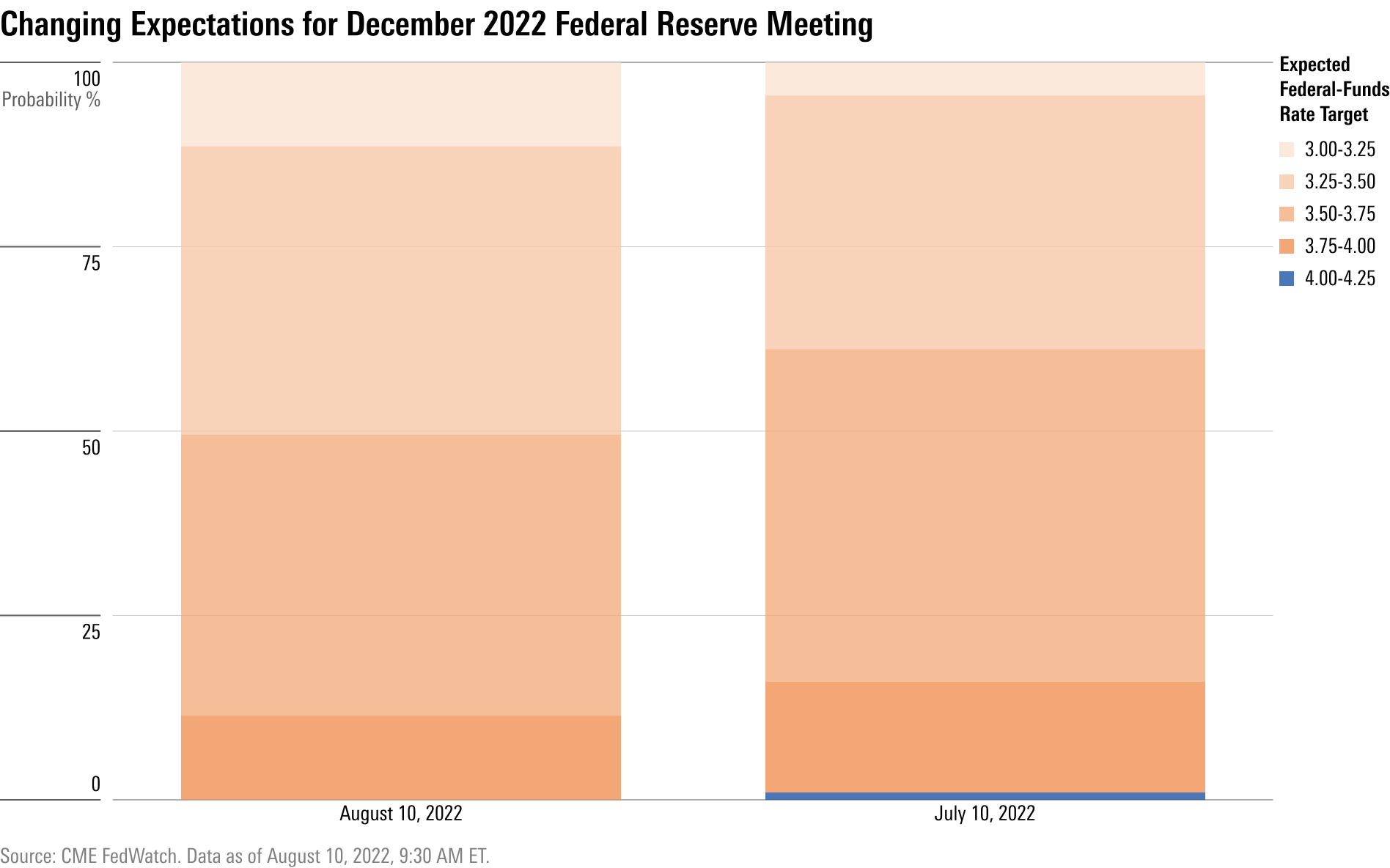

According to the CME FedWatch Tool, market expectations for rate hikes at the central bank's September meeting were little changed following the report with odds seen favoring a half-percentage-point increase from the current 2.25% to 2.50% target. However, there was some easing of expectations for future rate hikes. The Fed is now seen as being more likely to have a 3.25% to 3.50% target for interest rates at its December meeting. A month ago, the largest group in the futures market expected rates to reach 3.50% to 3.75% by December.

“Today's report of falling inflation provides welcome news, but it won't cause the Fed to shift gears yet,” Caldwell says. “There will be one more CPI report prior to the Fed's September meeting to set monetary policy. If the inflation news remains encouraging, then we'll likely see the Fed opt for a 50-basis-point hike in September rather than a 75-basis-point increase.”

However, Caldwell says that “in order to make sure that inflation is really quashed,” the Fed will move slowly in pivoting to a less hawkish stance on raising rates.

“Fed leadership has no desire to repeat the mistakes of the 1970s,” Caldwell says, “when the Fed pivoted from tightening to easing too early, allowing inflation to roar back again.”

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)