Two American Funds Strategies Get Upgrades

Here are some ratings highlights from July.

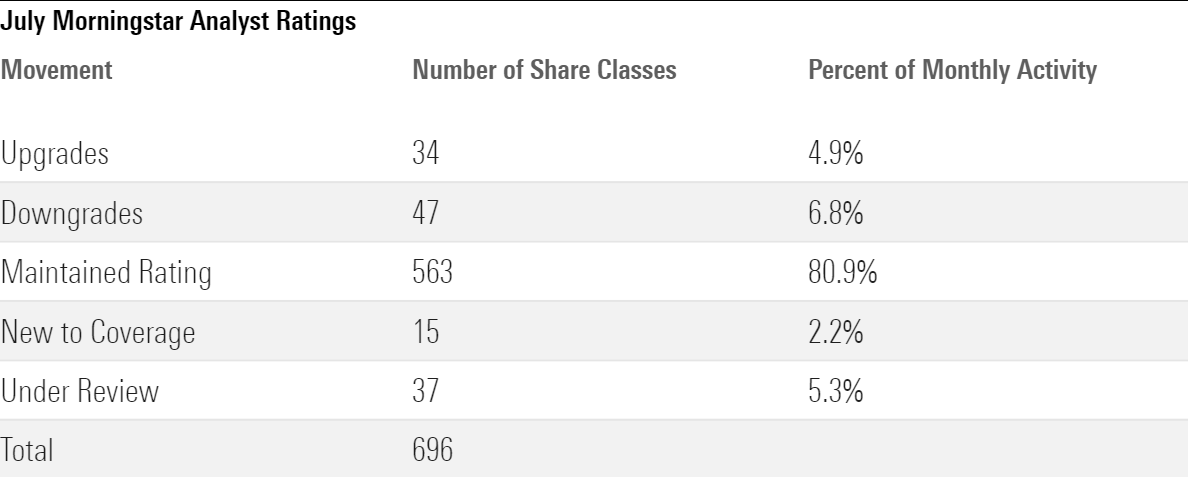

Morningstar updated the Analyst Ratings for 696 fund share classes, exchange-traded funds, separately managed accounts, collective investment trusts, and model portfolios last month. Of these, 563 maintained their previous rating, 34 earned upgrades, 47 received downgrades, 15 were new to coverage, and 37 went under review owing to material changes such as manager departures.

Looking through share classes and vehicles to their underlying strategies, Morningstar issued 178 Analyst Ratings during July. Of these, five were new to coverage, and the remainder had at least one investment vehicle that a Morningstar analyst had previously covered.

Below are some highlights of the upgrades, downgrades, and strategies new to coverage.

Upgrades

The continued improvement of American Funds Tax-Aware Growth and Income model portfolio series' asset-allocation team earned a People Pillar rating upgrade to High from Above Average, boosting its Morningstar Analyst Rating to Gold from Silver. Capital Group has added personnel and resources to its portfolio solutions committee that oversees this strategy's asset allocation, fund selection, and monitoring. It focused on American Funds' fund-of-funds strategies, whose underlying funds have some of the most-experienced and well-resourced teams in the industry. Most assets are invested in Gold- and Silver-rated funds, a standard that few other allocation strategies can match.

Owing to some peer changes in the foreign large-growth Morningstar Category, American Funds EuroPacific Growth's AEPGX eight cheapest share classes were upgraded to Gold from Silver. A multimanager structure enables this fund to handle its massive—roughly $135 billion—asset base. The managers' experience, tenures at the firm, and past successes drive this fund's High People rating. Capital Group's three equity subsidiaries, each of which draws on about 50 analysts, split up the assets and the managers look for attractive growth stocks in independently run portfolio sleeves. The portfolio consistently lands in the growth portion of the Morningstar Style Box, but it's not as aggressive as many peers. The fund has struggled recently, but the managers' distinct approaches have helped the fund perform well across market cycles.

Downgrades

The loss of longtime lead manager Phil Davidson from American Century Equity Income TWEIX led to the downgrade of the strategy's four cheaper shares to Bronze from Silver, while the four more-expensive ones dropped to Neutral from Silver or Bronze. Davidson has guided this strategy for more than two decades but will step down at the end of 2022. Brian Woglom, who joined this fund as a comanager in 2019, will succeed him. Davidson built the American Century value team's process, and on this strategy his expertise was particularly on display in its nonequity holdings designed to boost income and lower volatility: convertible bonds, fixed-to-floating-rate preferred shares, and derivatives. Concerns about the impact of his departure drove downgrades of both the People and Process Pillars here. While Woglom has decent experience overall, he lacks a track record separate from Davidson on these nonequity assets.

Invesco EQV Emerging Markets All Cap's GTDDX Process rating dropped to Average from Above Average on some concerns about the team's risk management, pushing its overall rating to Bronze from Silver for most share classes. The portfolio's traits often deviate from peers and the MSCI Emerging Markets Index, which can result in wider relative performance swings. At times, this process does not sufficiently account for its risks (especially the political risks) involved in heavily overweighting countries or regions. A heavy Russia stake—more than 3 times the index weighting—burned these managers in early 2022, as an overweighting to Turkey had done four years earlier. Despite some questionable risk management, the managers here still stand out for their experience and continuity, along with a consistent willingness to break from the pack, earning a High People rating.

New to Coverage

Avantis U.S. Small Cap Value AVUV, which launched in September 2019, debuted with a Morningstar Analyst Rating of Bronze. A new portfolio management team built around experienced and capable people runs the fund. Its four managers joined Avantis in 2019 from DFA, where they ran similar strategies. The systems they have built to run its portfolios, though, haven't been around long. The fund sifts through the small-cap universe for stocks with the best combination of value and profitability characteristics. Both factors have historically been tied to market-beating returns, and they tend to excel at different times. Threading the needle between both should enable the fund to remain competitive in most market environments.

/s3.amazonaws.com/arc-authors/morningstar/f941dc8b-2530-4a0b-ad78-555027eae4c1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/f941dc8b-2530-4a0b-ad78-555027eae4c1.jpg)