How Much Can Tax-Managed Model Portfolios Save on Taxes?

A case study using Vanguard's tax-efficient model portfolios.

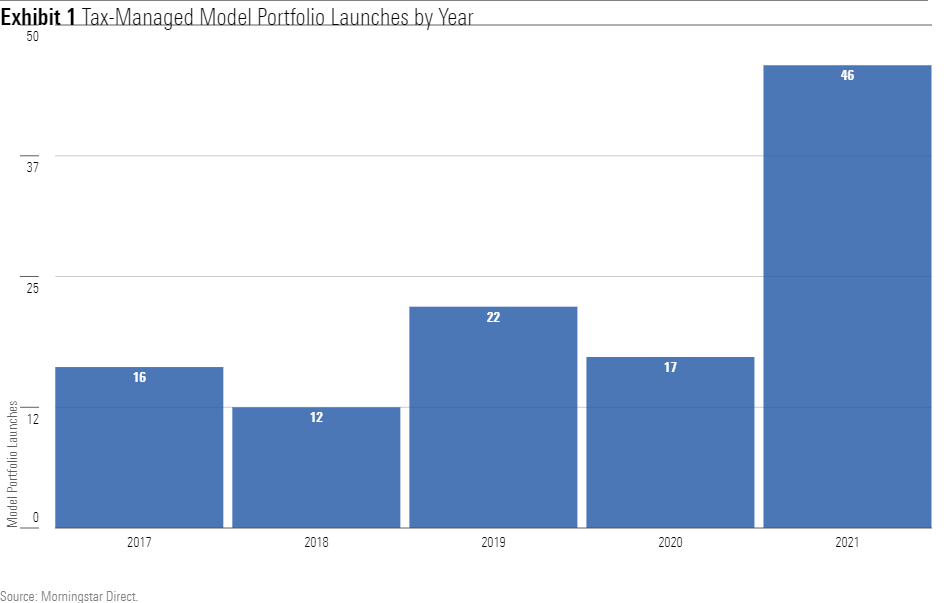

The number of model portfolios designed to maximize aftertax returns is growing quickly. At the end of 2021, there were more than 275 models reported to Morningstar that list tax management as an objective. Last year 46 tax-managed models were launched, the most in the past five years, as shown in Exhibit 1.

As highlighted in Morningstar's 2022 Model Portfolio Landscape, these models tend to use municipal bond funds for all, or most, of their fixed-income exposure and often don't trade as often as their tax-agnostic counterparts to reduce capital gains. Passive exchange-traded funds are also popular for equity exposure because of their inherent tax advantage over mutual funds (the low costs don't hurt either).

A Case Study: Vanguard Versus Vanguard

To see how much tax-managed model portfolios can save investors in taxes, we ran a case study using the Vanguard Tax-Efficient model portfolios and the Vanguard Core model portfolio series. Both earn Morningstar Analyst Ratings of Gold. We chose models with 20%, 40%, 60%, and 80% equity to cover a wide range of risk tolerances and to see how taxes affected portfolios of different allocations.

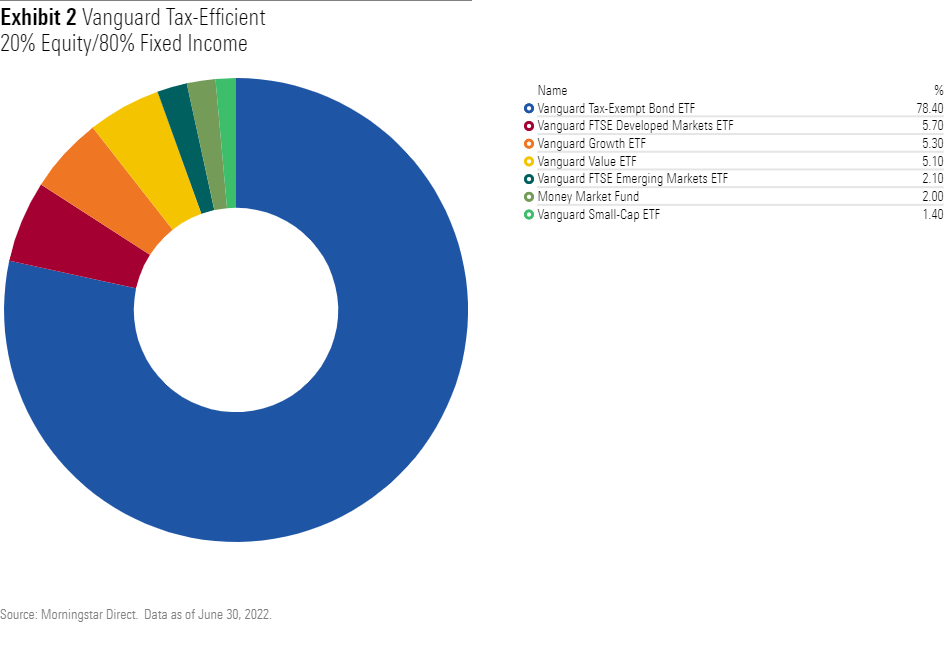

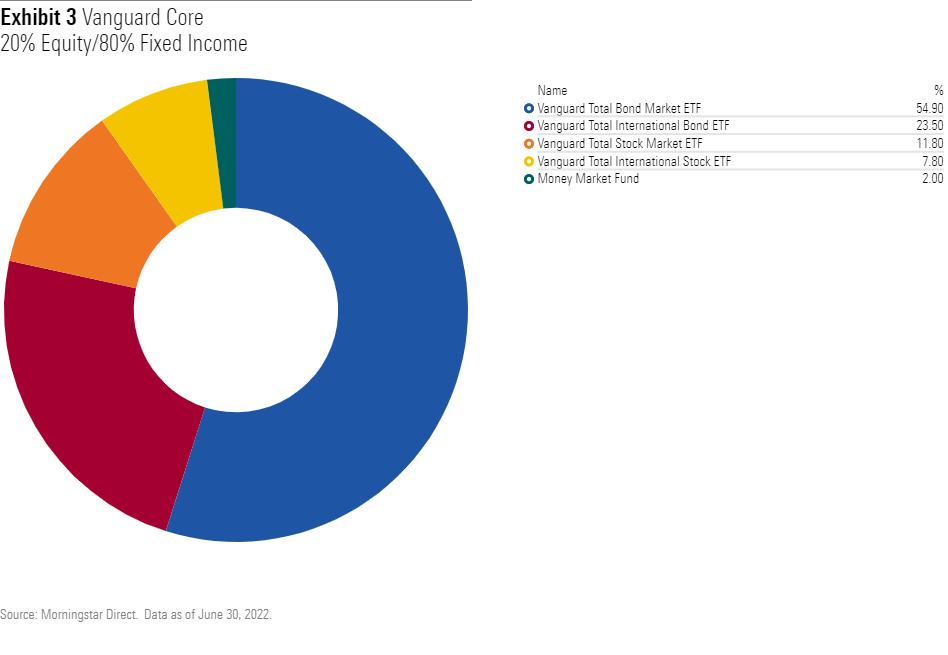

Both series have similar equity portfolios, but the biggest difference is the muni bond ETFs used in the bond portfolio. Exhibits 2 and 3 show a portfolio snapshot of the 20% equity and 80% fixed-income allocations for each series as of June 30, 2022.

The biggest difference is the use of a single muni bond ETF in the tax-efficient model rather than two taxable-bond ETFs covering investment-grade U.S. and international bonds. All three of the bond ETFs earn high marks from Morningstar analysts. Vanguard Tax-Exempt Bond ETF VTEB is rated Gold. Vanguard Total Bond Market ETF BND and Vanguard Total International Bond ETF BNDX are rated Gold and Silver, respectively.

The tax-efficient portfolio also holds more individual equity ETFs, but the overall exposures are nearly identical. Model tinkerers may consider using the two-equity ETF portfolio of the Core series to make it easier to manage.

The Test

We looked at the performance of each series before and after taxes from January 2019 through June 2022. January 2019 is as far back as the portfolio holdings reported to Morningstar reliably go for both portfolio series.

We invested a hypothetical $1 million in each portfolio at the beginning of the period and rebalanced annually (for the first rebalancing we waited a year and a day to avoid triggering short-term capital gains). Vanguard recommends rebalancing annually or if the portfolios’ allocations shift by more than 5 percentage points from their target allocations owing to market volatility. We kept the rebalancing consistent for both series.

To calculate the potential taxes for each model, we applied the highest marginal tax rates for an Illinois resident to any taxable income or capital gains distributed from the portfolios or caused by rebalancing. The gross-of-tax distributions for each model are then reinvested at the appropriate net asset value to calculate the new share counts before moving the simulation forward. Taxes are assumed to be paid with cash on hand, as advisors often recommend, to avoid further taxable events.

The Results

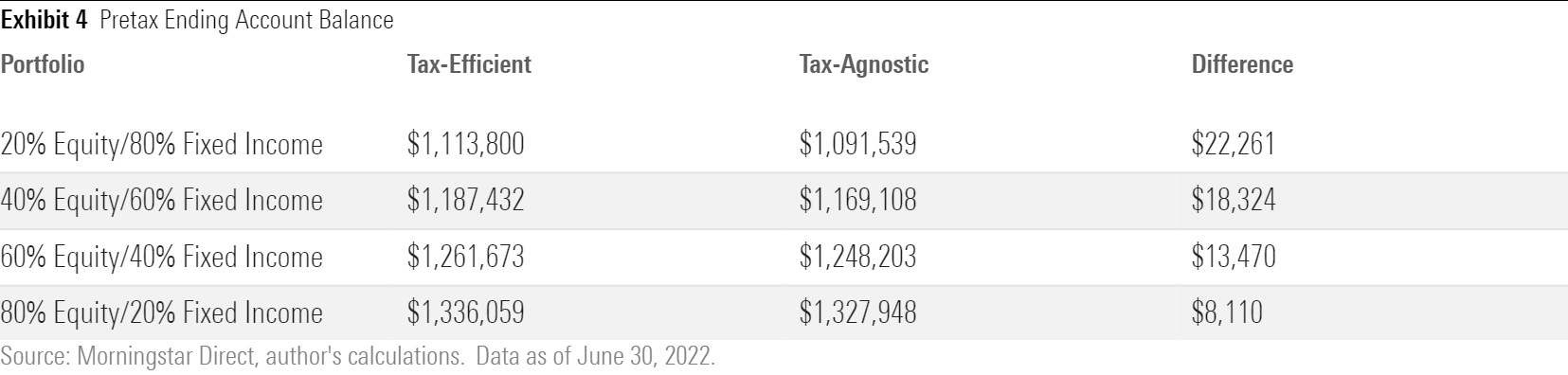

Before accounting for taxes, the portfolios had similar performance, as we would expect given the fact that the portfolios theoretically have identical exposures. Exhibit 4 shows the pretax returns for both model series.

The tax-efficient portfolios outperformed by a small amount, with the bond-heavy portfolios having the biggest difference. VTEB's 1.31% annualized return over the period outpaced both taxable-bond ETFs, which explains the outperformance.

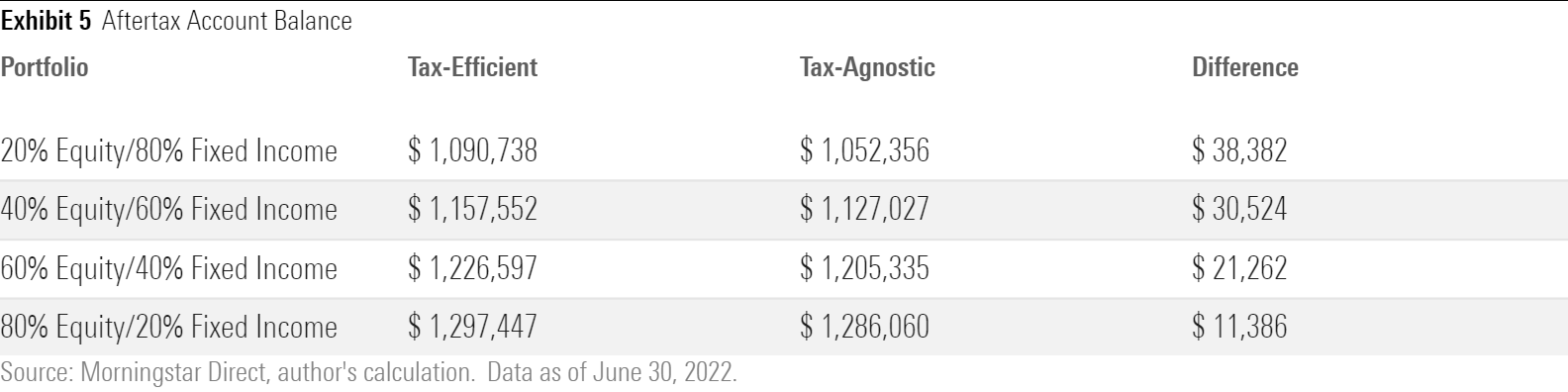

After taxes, the results are even better for the tax-efficient portfolios.

The difference between the tax-efficient and tax-agnostic 20% equity/80% fixed income grew to $38,382, up from $22,261 before taxes. That's a 72% increase.

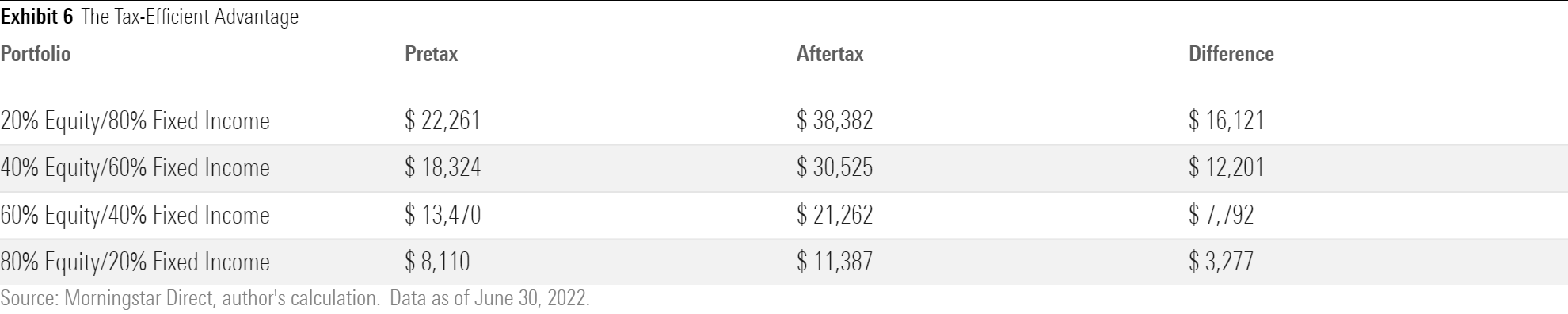

As the equity portion of the portfolio grows, however, the extra boost from the muni funds wanes. Still, the tax-efficient 80% equity/20% fixed-income aftertax balance difference grew by 40%, which is a significant boost. Exhibit 6 shows the difference between the pretax and aftertax returns for all eight models.

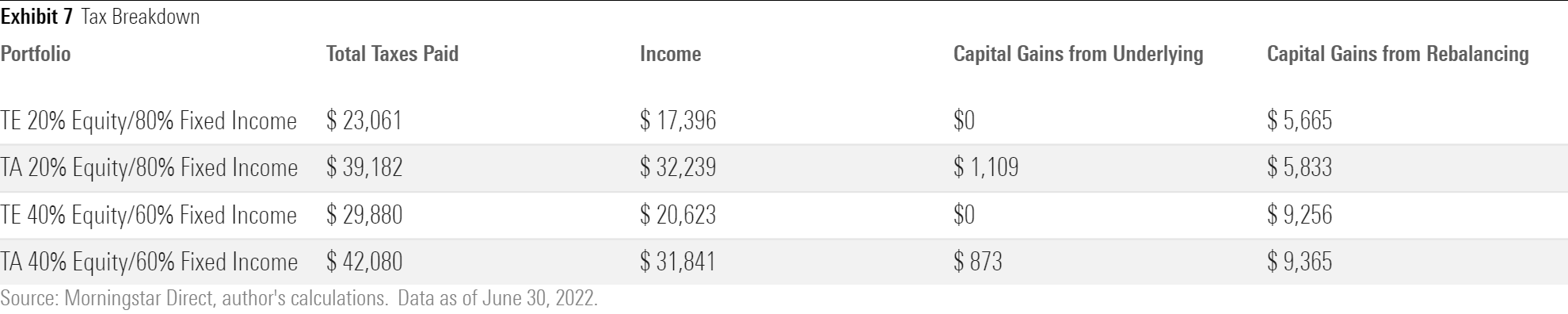

Where did the extra returns come from? Largely the federally tax-free income from the muni bond portfolios. Exhibit 7 shows the taxes paid for each distribution from the underlying model and capital gains related to rebalancing the portfolio annually for the 20% and 40% equity models.

The taxable-bond ETFs did have small capital gains distributions in 2021 and 2020. It’s also interesting to note that the capital gains triggered from rebalancing were about equal for both portfolios, despite the tax-efficient portfolios having more line items.

More Ways to Save on Taxes

Tax-managed model portfolios are only one way to reduce potential tax drags on your returns. For more tips and tricks, check out Morningstar's Guide to Tax-Managed Investing.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/s3.amazonaws.com/arc-authors/morningstar/a9934929-bc1b-4947-9568-208bd9d6ba90.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a9934929-bc1b-4947-9568-208bd9d6ba90.png)