TIPS Can Help With Inflation, but Are You Courting Other Risk?

Treasury Inflation-Protected Securities are one of the best direct hedges against inflation, but they're subject to other types of risk.

Treasury Inflation-Protected Securities are often thought of as relatively sedate vehicles. As Treasury instruments, their credit quality is gilt-edged, and they often appeal to more-conservative investors seeking a hedge against inflation risk.

However, this year’s turbulent market has been a stark reminder that TIPS are still subject to their own types of risk, and can be especially vulnerable during periods of rising interest rates.

How TIPS Work

TIPS were originally introduced in January 1997 and are currently sold in five-, 10-, and 30-year maturities. Unlike other bonds, which generate returns in nominal terms, TIPS are designed to be a direct hedge against inflation. Their principal value is designed to move up or down in line with the Consumer Price Index: If the CPI increases, their principal value increases. If the CPI decreases, the principal value will decrease.

While TIPS have fixed semiannual coupons at the time of purchase, their interest payments will adjust based on the changes in the principal value. (In other words, if the inflation-adjusted principal amount goes up, the interest payment will adjust to reflect the higher principal value.) TIPS are also designed to protect against deflation; investors holding TIPS to maturity will receive either the adjusted principal amount or the original principal amount, whichever is greater.

Performance Quirks of TIPS

While the mechanics are fairly straightforward, TIPS can be subject to a few performance quirks. For one, they typically yield less than Treasuries with similar maturity dates; investors have to give up some yield in exchange for the inflation protection. In some previous periods, such as 2021, their yields have actually been negative.

In addition, returns for TIPS don’t track inflation perfectly. That’s because returns partly depend on the inflation expectations embedded in a bond’s price at the time of purchase and how well those match up with how inflation actually unfolds. The break-even inflation rate—which measures the difference between the yield on a nominal Treasury and a TIPS yield for a bond with the same maturity date—is a key metric here. For example, as of July 27, 2022, the market was pricing in a break-even inflation rate of 2.42% for the next 10 years, and 2.61% for the next five years. If inflation turns out to be above than those numbers, investors will benefit from higher principal adjustments as well as coupon payments, but if it turns out to be lower, the premium price won’t pay off.

TIPS can also be highly sensitive to changes in interest rates. Like other bonds, their principal value declines during periods of rising interest rates, and that may or may not be offset by adjustments for higher inflation at the same time. Interest-rate risk can be particularly pronounced for TIPS because issuance has historically been weighted more toward longer-term bonds; as a result, most TIPS benchmarks have relatively long durations.

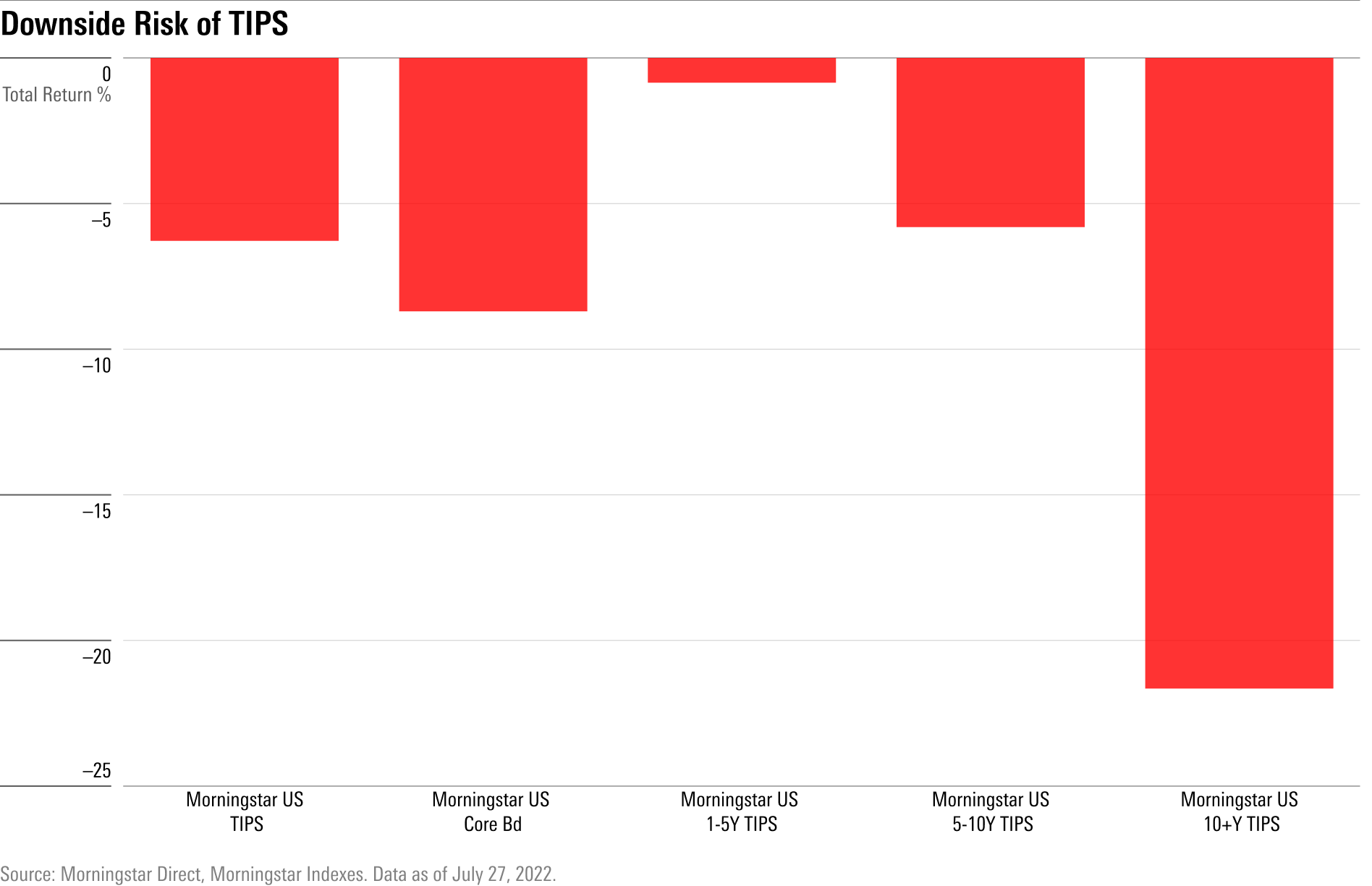

This risk has been all too apparent so far in 2022, as shown in Exhibit 1 below. As yields on the 10-year Treasury have spiked from 1.52% at the beginning of the year to 2.78% as of July 27, 2022, TIPS have posted negative total returns, with long-term TIPS suffering the deepest losses. As shown in the exhibit, Morningstar’s US TIPS index lost nearly 9% for the year-to-date period, while the 10-plus year TIPS index has lost nearly 22%.

These returns might come as a shock to investors who expected TIPS to be a straightforward hedge against inflation, which has been running at a 9% annualized rate. But over shorter time periods, TIPS can actually be more sensitive to changes in interest rates than they are to changes in inflation. In other words, TIPS investors ignore interest-rate risk at their peril.

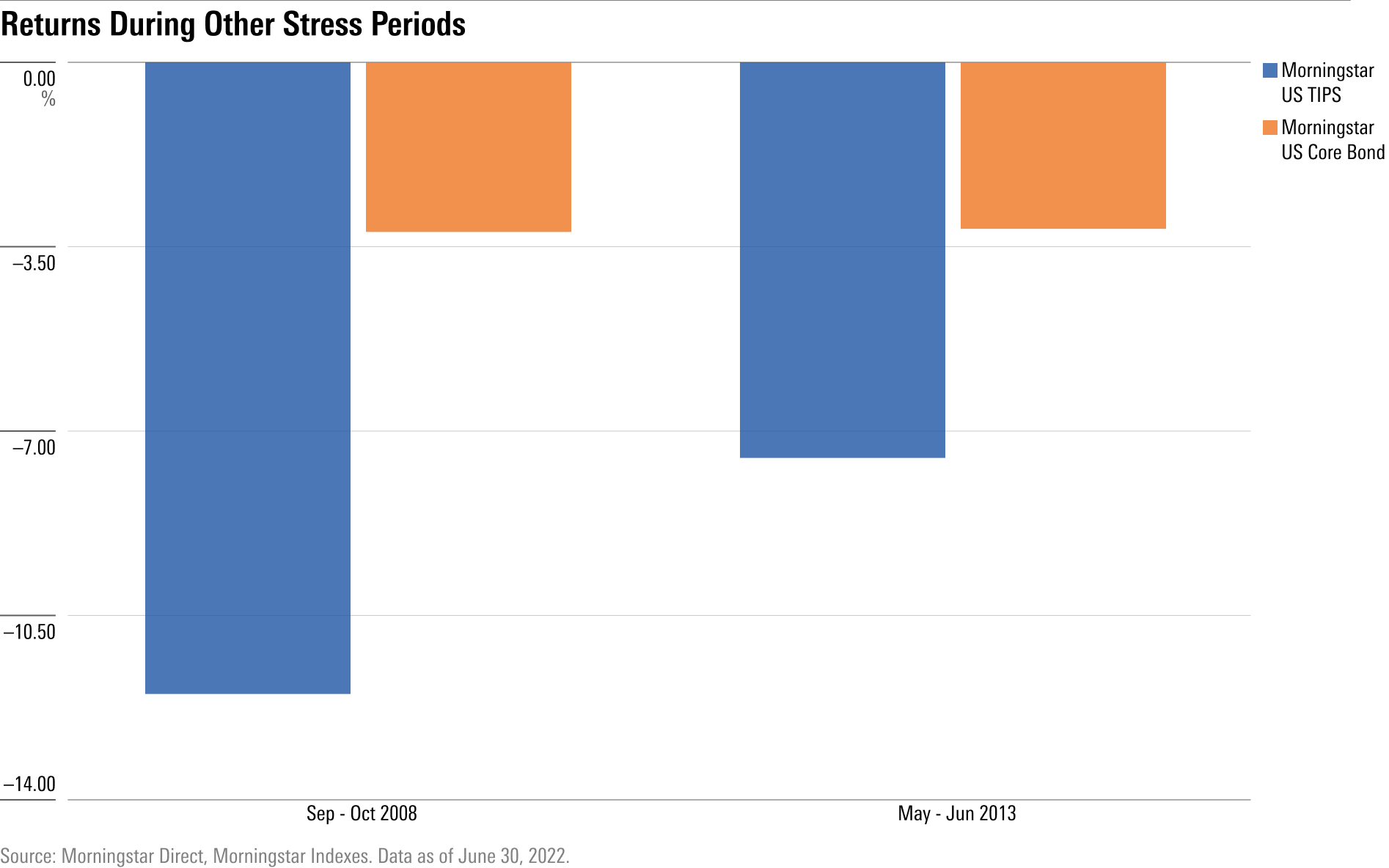

TIPS have also exhibited some performance quirks during previous periods. In 2013, for example, the Federal Reserve announced that it planned to taper off its policy of quantitative easing by slowing the pace of Treasury bond purchases. This touched off a dramatic market reaction (a/k/a the “taper tantrum”), causing a spike in Treasury bond yields in May and June 2013. Morningstar’s US Core Bond Index dropped more than 3% over those two months, but the TIPS benchmark lost more than twice as much.

The sometimes-erratic performance of inflation-protected bonds was also on display at the beginning of the global financial crisis in September and October 2008. Despite their gilt-edged credit quality, TIPS lost nearly 12% of their value over those two months. It’s not exactly clear why this happened, although some observers speculated that it was a side effect of the market’s flight to safety and liquidity. TIPS are far less liquid than nominal Treasuries, which was a liability as investors fled from any type of complex or thinly traded asset.

Long-Term Performance Trends

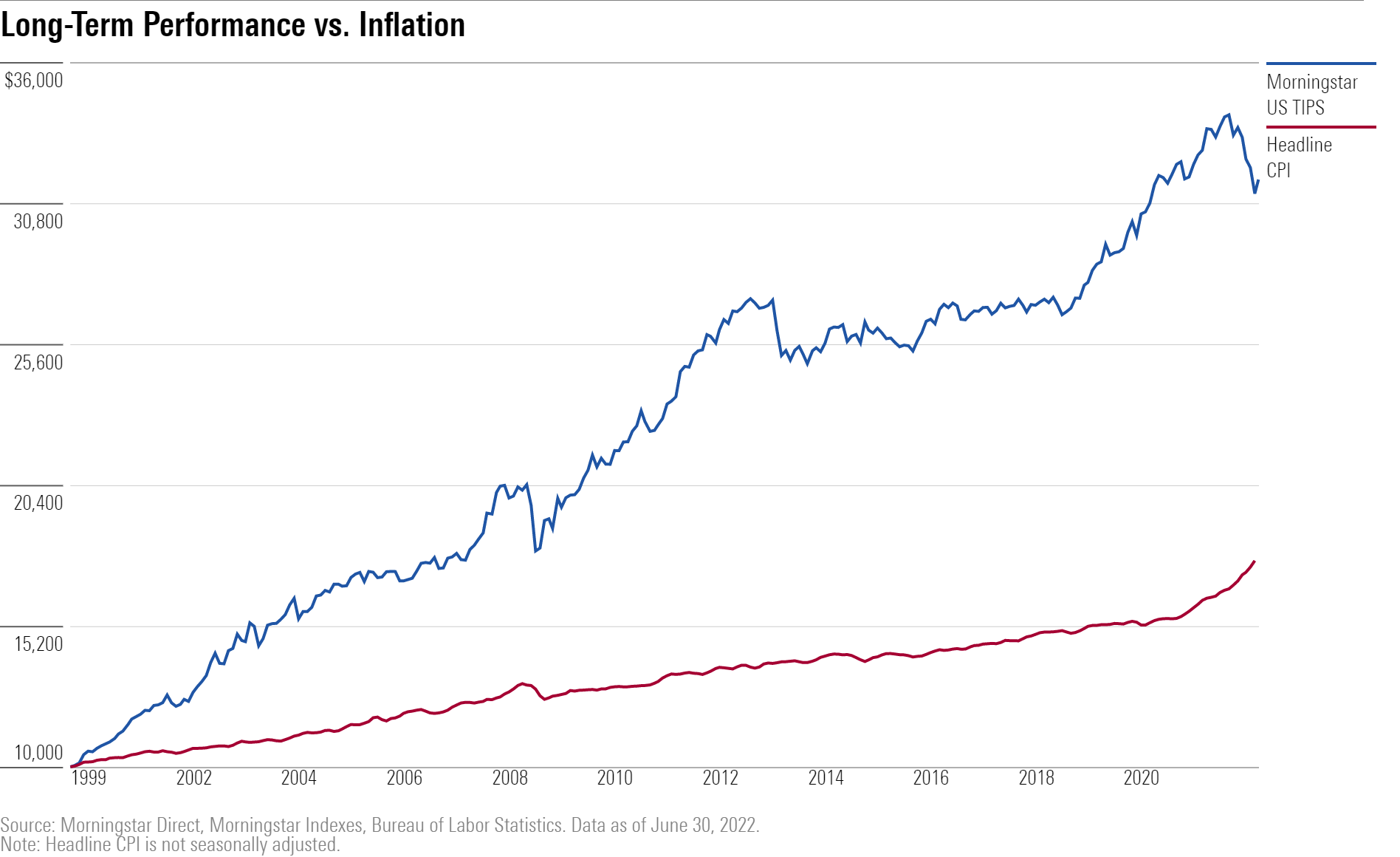

Despite their sometimes unpredictable performance, TIPS have generally proven themselves a reliable inflation hedge over the long term. As shown in Exhibit 3, Morningstar’s US TIPS index has come out well ahead of inflation over the trailing 20-plus years.

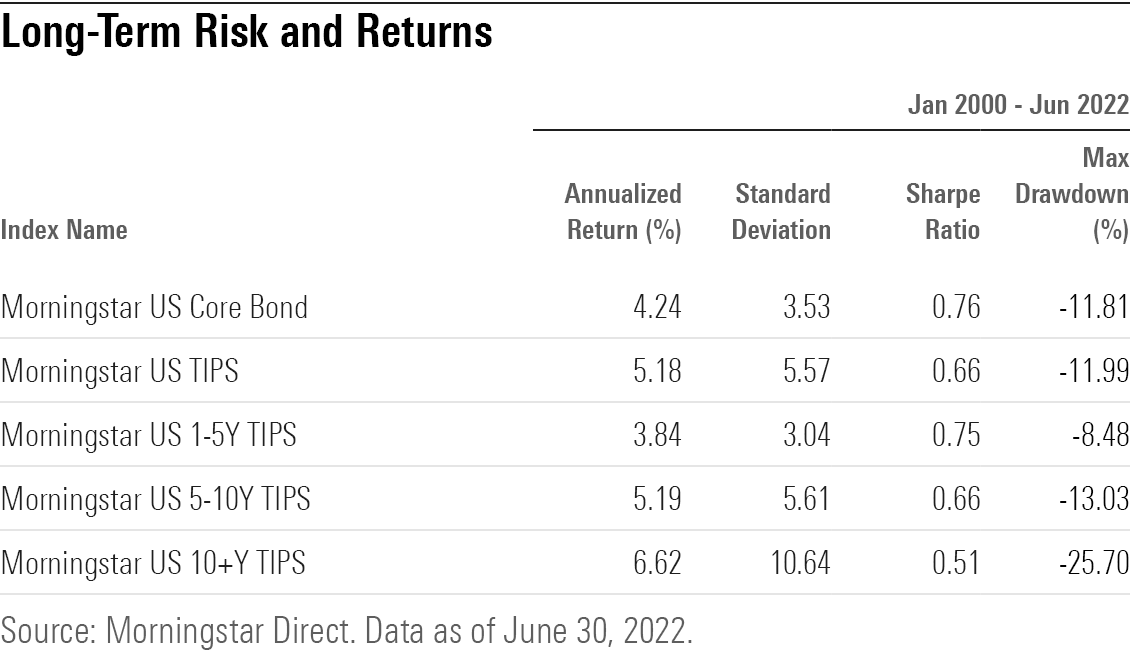

But not all TIPS are created equal. As shown in Exhibit 4, long-term TIPS have subjected investors to far greater risk than their shorter-term counterparts. Shorter-term TIPS have generated lower total returns, but have also courted less volatility and significantly less drawdown risk. Overall, TIPS with shorter-term maturities have produced the most attractive balance of risk and returns, as measured by the Sharpe ratio.

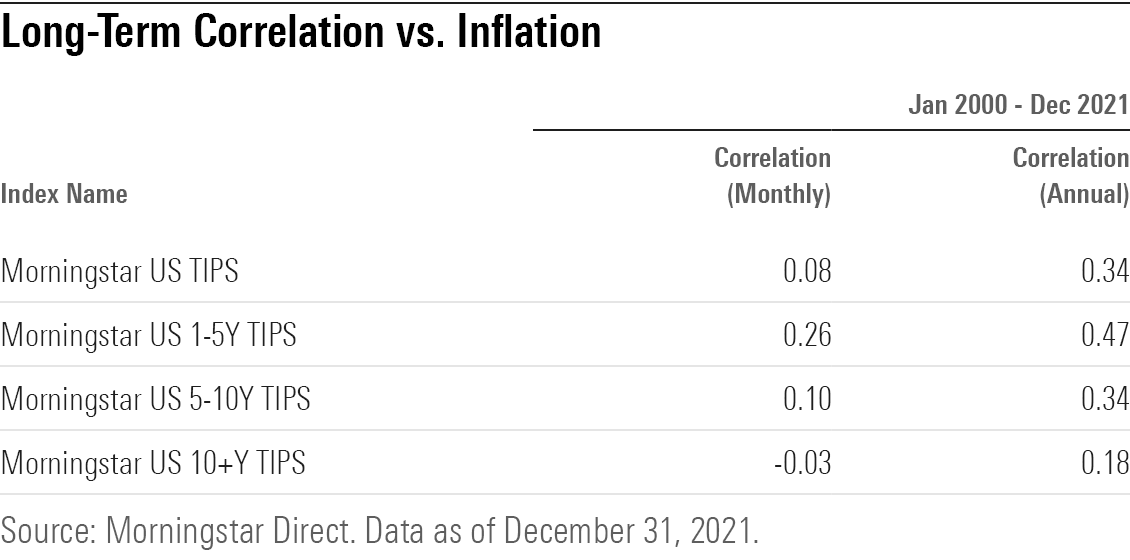

Moreover, the short-term end of the TIPS spectrum has done a better job of hedging inflation, as detailed in a 2017 study from Vanguard [1]. I found a similar pattern using Morningstar’s TIPs indexes over the period from 2000 through mid-2002. As shown in Exhibit 5, returns for the 1-5 Year TIPS index had the highest correlation with inflation when measured over both monthly and annual periods.

Conclusion

From a portfolio perspective, investors who want to hedge against inflation risk over a specific time period can still be well served by holding individual TIPS with durations that match their time horizons. For investors purchasing individual bonds, TIPS can also be more attractive than I-Bonds because they’re not subject to the same annual purchase limits ($10,000 per individual or trust for I-Bonds, in most cases).

But for most investors, it’s easier to hedge against inflation risk by purchasing TIPS through a fund, such as Vanguard Short-Term Inflation-Protected Securities VTAPX. Investors can also avoid taking on unexpected risks—and accomplish a more precise inflation hedge—by staying toward the shorter end of the maturity spectrum.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)