Markets Brief: Stocks Close July With Best Rally Since November 2020; Jobs Report Ahead

First Solar, Sunrun gain on climate bill news. Disappointing earnings results send Roku shares plunging.

Stocks continued their advance off of the bear-market lows seen in June, despite a recessionary reading on the economy, an interest increase by the Federal Reserve, and another hot reading on inflation.

The Morningstar US Market Index rose 4.26% in the past week and is now up 12.92% from its 52-week low on June 16.

All sectors in the market rose by 1.50% or more for the week, led by big gains in the energy, utilities, and industrial sectors. Driving those moves was recent news about the climate bill, which led to solar and other renewable energy stocks soaring ahead the rest of the market. Oil companies gained, as West Texas Intermediate crude prices rose to $98.12 per barrel as of July 29, from $94.70 a week prior.

Recent gains lifted the Morningstar US Market Index up 9.27% for July, making it the best monthly gain for the index since November 2020, when it rose 11.79%. All sectors also finished the month in the green, with consumer cyclical, which rose 18.02%, and technology, up 13.22%, the top performers. Consumer defensive stocks lagged, rising 3.52%.

While higher interest rates are expected to continue to slow economic growth, recent earnings results from bellwether stocks like Amazon AMZN and Microsoft MSFT have soothed investors’ concerns about the ability of companies to navigate the tough macro environment.

Earnings results will continue to be announced in the coming days, giving more insight into how companies are doing. But the focus will also be on the July employment report, which will provide a fresh reading on the state of the economy. Economists are expecting job growth to slow from its recent fast pace, with nonfarm payroll employment rising by 240,000, according to FactSet. That would be down from 372,000 in June. The unemployment rate is expected to hold steady at 3.6%.

Events scheduled for the coming week include:

- Tuesday: Uber UBER and SoFi Technologies SOFI report earnings.

- Wednesday: Occidental Petroleum OXY and Energy Transfer ET report earnings.

- Thursday: Paramount PARA, Marathon Oil MRO, and Eli Lilly LLY report earnings.

- Friday: July employment data update.

For the trading week ending July 29:

- The Morningstar US Market Index rose 4.26%.

- All sectors rose for the week, with the best-performing being energy, up 10.47%, and utilities, up 6.38%.

- Yields on the U.S. 10-year Treasury fell to 2.64% from 2.79%.

- WTI crude-oil prices rose $3.42 to $98.12 per barrel.

- Of the 859 U.S.-listed companies covered by Morningstar, 687, or 80%, were up, and 172, or 20%, declined.

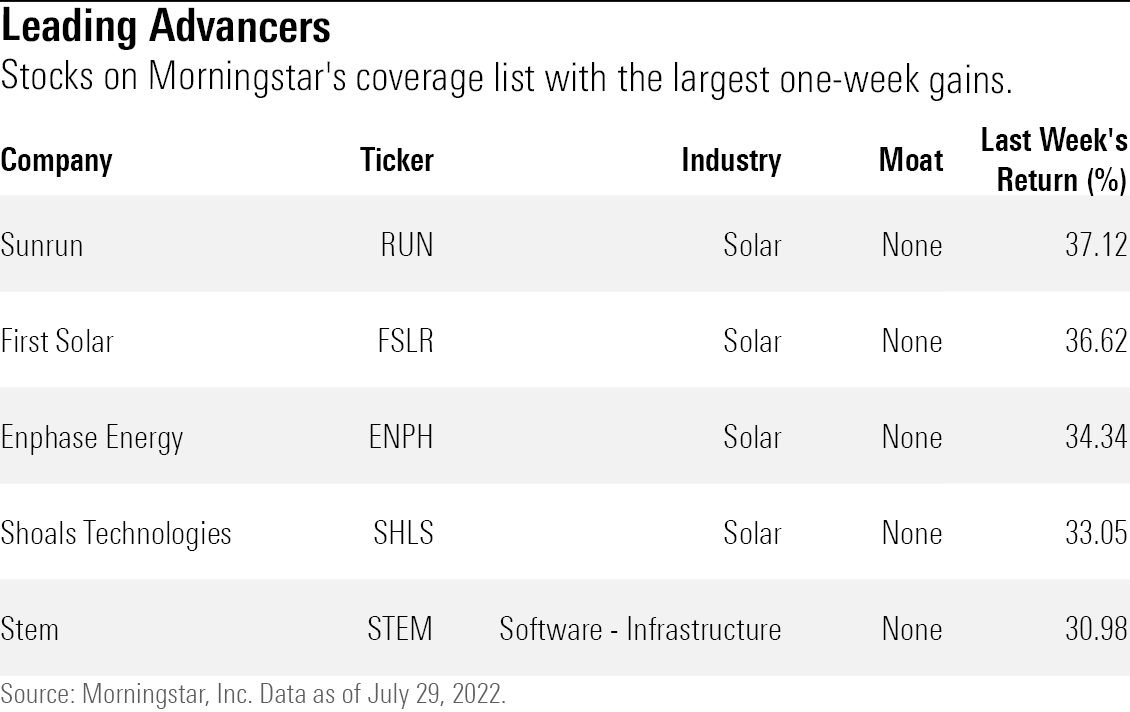

What Stocks Are Up?

The best-performing companies this past week were Sunrun RUN, First Solar FSLR, Enphase ENPH, Shoals Technologies SHLS, and Stem STEM.

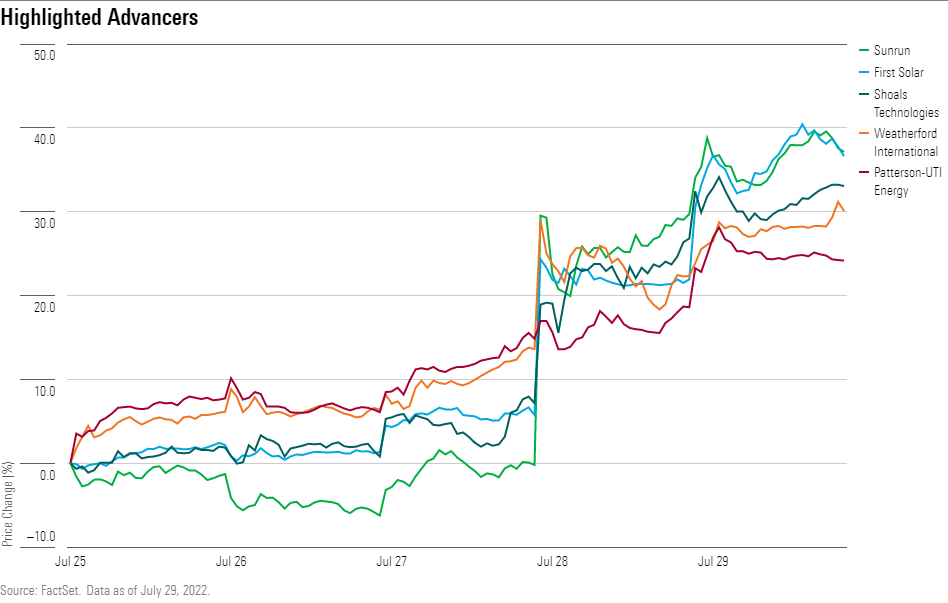

Solar stocks surged following news of an agreement on a bill expected to funnel hundreds of billions of dollars into projects meant to fight climate change. Leading the group was First Solar, Sunrun, and Shoals Technologies.

Oil companies also rose as WTI crude prices closed up for the week. Among those benefiting the most were drilling rig and oilfield-services providers Weatherford WFRD, Patterson-UTI PTEN, and Helmerich & Payne HP.

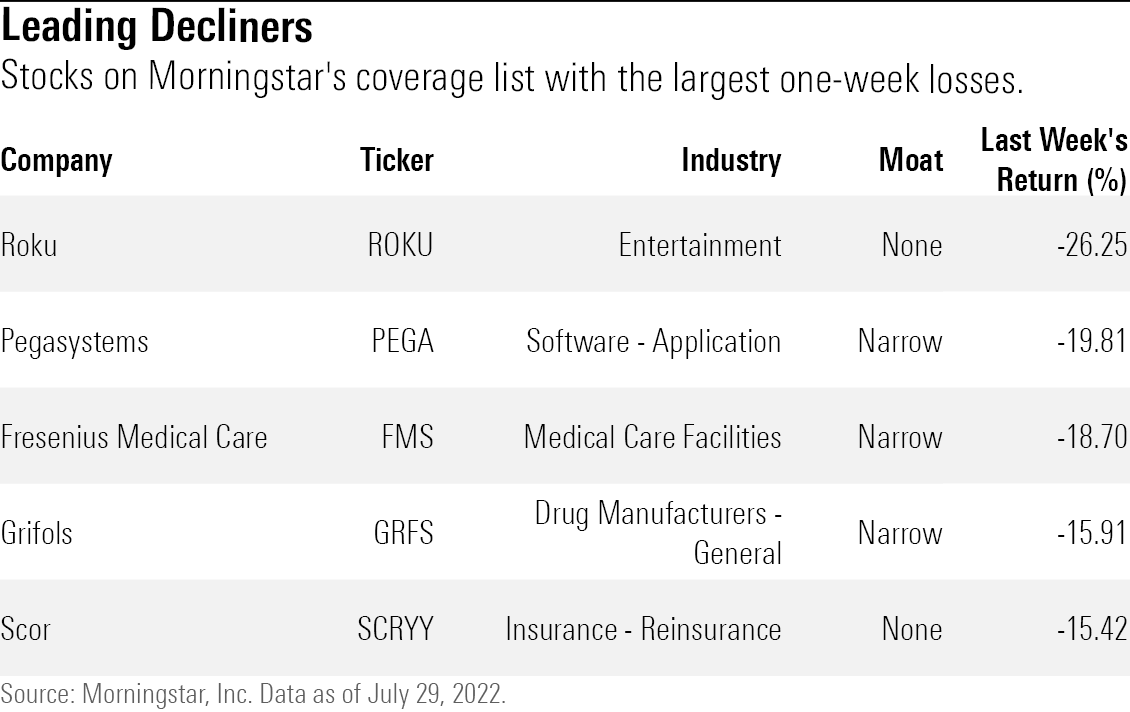

What Stocks Are Down?

The worst-performing companies in the past week were Roku ROKU, Pegasystems PEGA, Fresenius Medical Care FMS, Grifols GRFS, and Scor SCRYY.

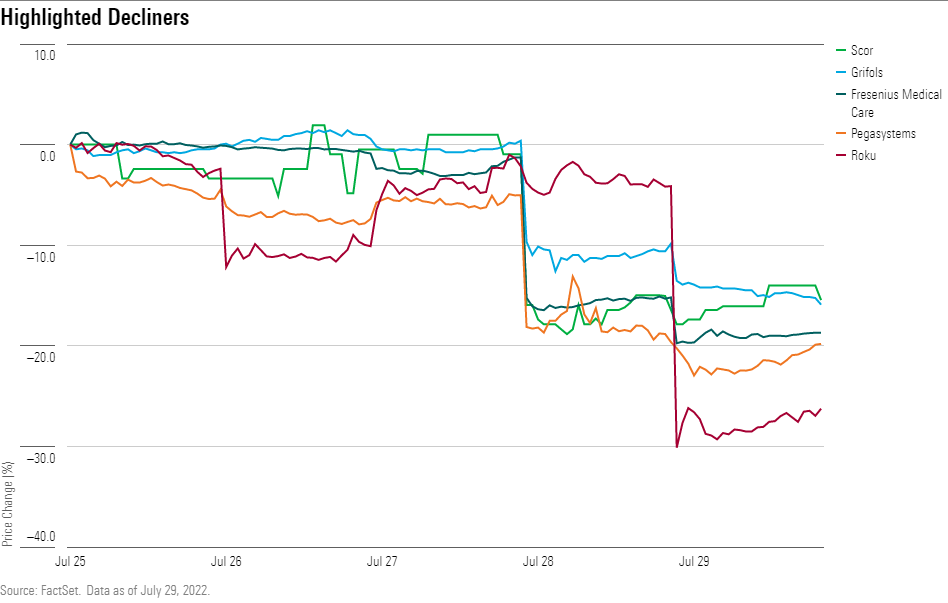

Disappointing earnings results sent the shares of several companies sliding. Roku plunged following weak second-quarter results. A slowdown in consumer spending hurt both advertising revenue and customer acquisition. Total revenue came in at $764 million, below FactSet estimates of $804 million. Earnings per share came in at a loss of $0.82, missing the estimate of a loss per share of $0.71.

Other earnings disappointments included utilities company Pegasystems, which reported an earnings per share loss of $0.38 versus an expected profit of $0.05. Reinsurance provider Scor missed estimates, posting a loss per share of $0.09 versus expectations for a loss per share of $0.03.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JIRPH5AMVETLBZDLUSERZ2FRA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)