GDP Report May Have Showed a Decline, but It's Not a Recession

While there's a risk of recession for 2023, any decline should be mild and short-lived.

Despite the drop in second-quarter gross domestic product, which measures business activity across the country, the U.S. economy was not in a recession in the first half of 2022. But recession risk is on the horizon, which is partly why we expect the Federal Reserve to start cutting rates in 2023 in order to prop up the economy.

U.S. real GDP fell at a 0.9% annual rate in the second quarter from the previous quarter. This follows a 1.6% drop in GDP in the first quarter. This meets one common definition of a recession as “two consecutive quarters of negative real GDP growth.”

However, the National Bureau of Economic Research is the traditional authority on when U.S. recessions begin and end, and it looks unlikely to declare a recession for now. Part of the reason the NBER is unlikely to do so is that most other economic indicators—including employment, industrial production, and consumer spending—all continued to trend up in the first half despite the decline in GDP.

Key Takeaways From the GDP Report:

- There's very little reason to think the U.S. economy was in a recession in the first half of 2022, despite the drop in GDP.

- Recession risk is on the horizon, especially for 2023, as the impact of the Fed's rate hikes have yet to be fully felt.

- There's no reason to panic, since any recession is likely to be mild and short-lived.

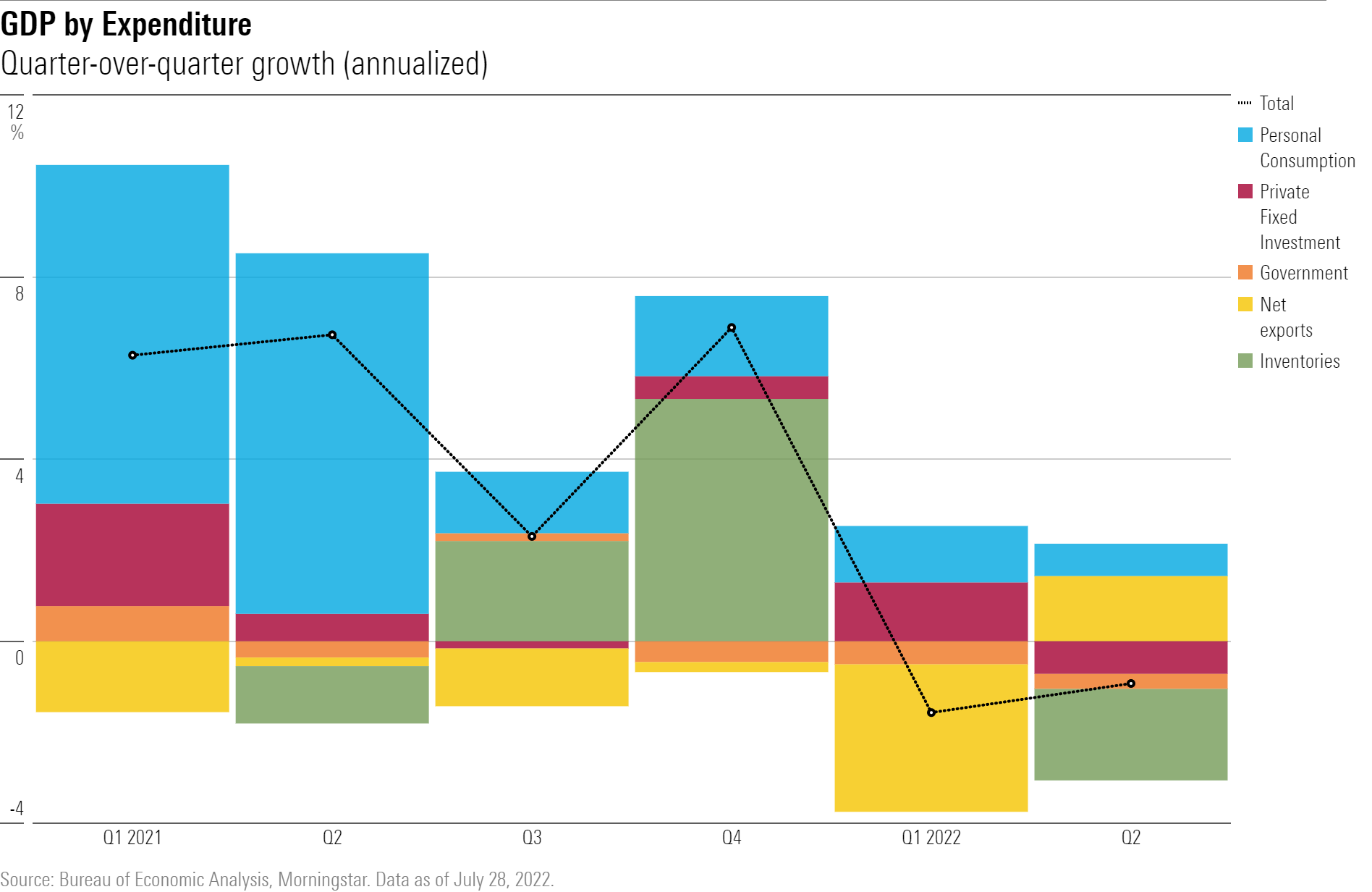

Digging deeper into the GDP report, we see further reason not to declare a recession for now. The decline in GDP in the first half of this year was driven by its noisiest components: net exports (the value of exports minus the value imports) and inventories. Final private domestic demand (consumption plus fixed investment) actually grew by about 3% in the first quarter, though it was flat in the second quarter.

Real personal consumption increased at a 1% annual rate, with services spending up 4.1%, while goods spending fell 4.4%. This disparity between services and goods growth reflects the ongoing normalization in consumer spending, following the pandemic period when the spending mix was tilted toward goods much more than usual.

The monthly data on real personal consumption does show that consumption growth slowed to 0.1% in June, which gives more reason for concern about a possible recession going into the second half of the year.

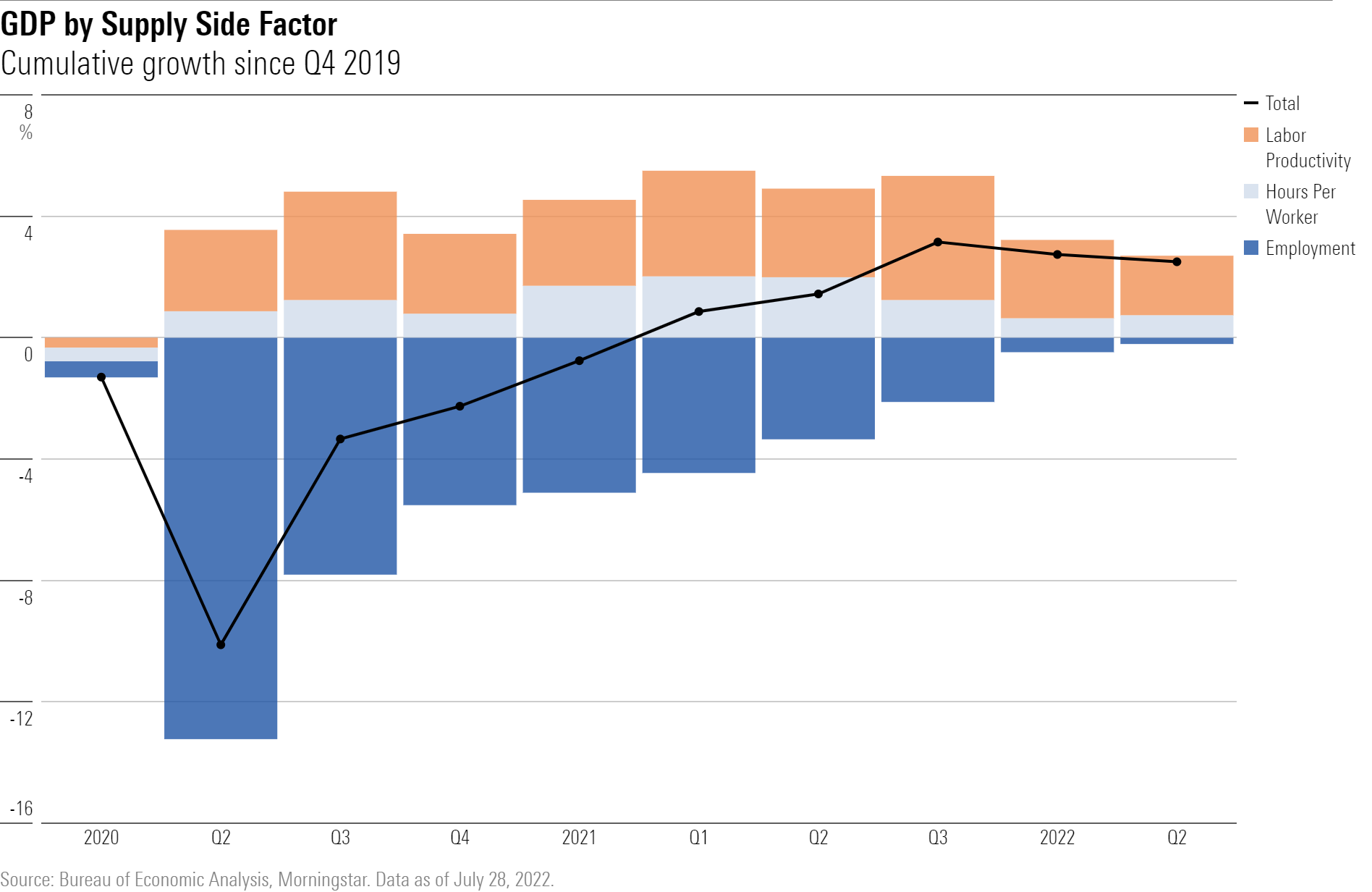

The reported decline in GDP in the first half of 2022 is particularly strange given the strength of employment gains over that period. In fact, putting those two facts together necessarily means that productivity—a key economic measure that reflects the output per hour worked—dropped abruptly in the first half of 2022. It’s hard to explain why such a decline in productivity makes sense, which adds to the case that the decline in GDP was more statistical noise than a genuine fall in economic activity.

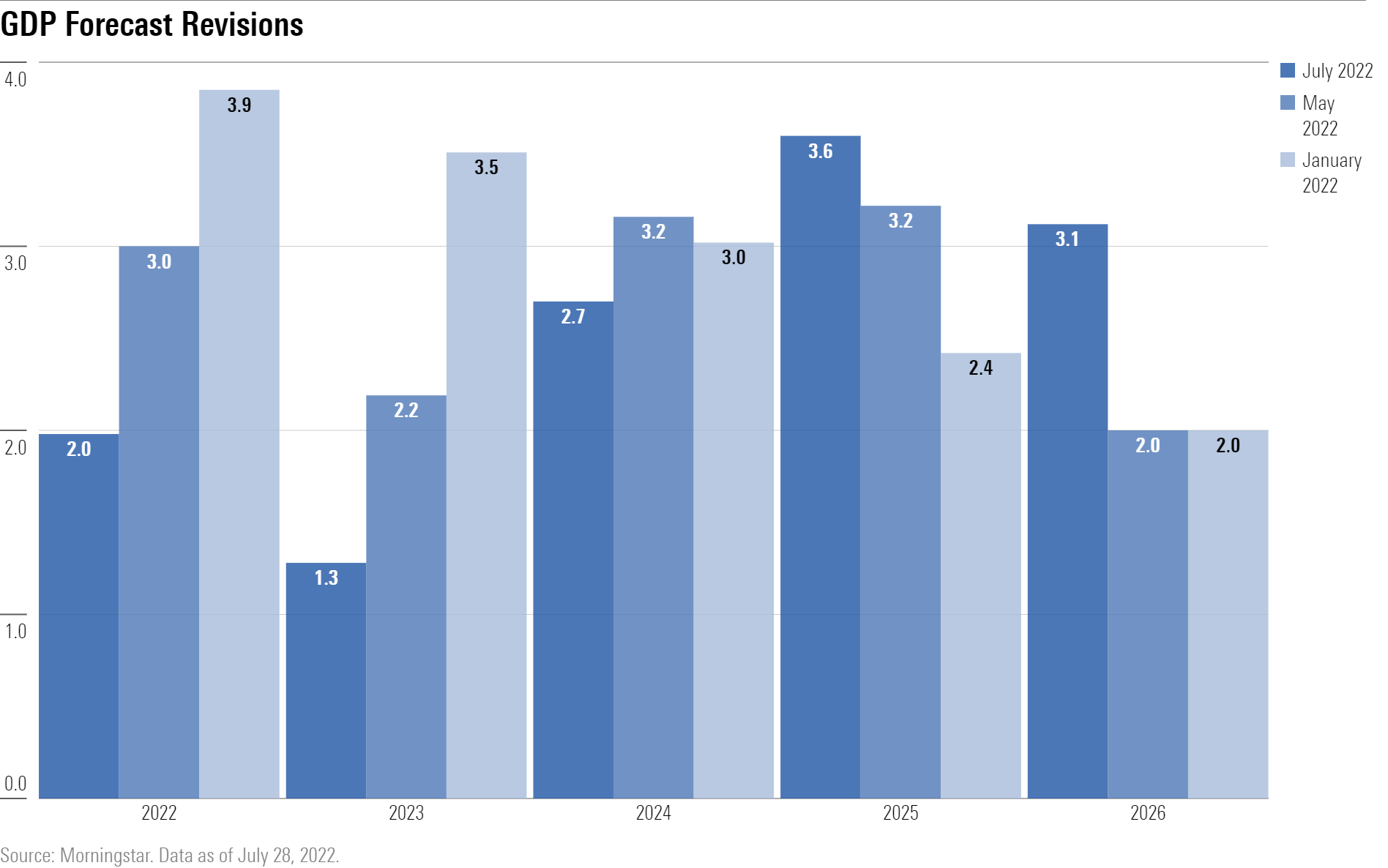

For now, we’re still projecting real GDP growth of 2% for this year. This is partly because second quarter GDP was actually up 1.6% year over year, reflecting a jump in the fourth quarter that boosted the level of GDP heading into 2022. Additionally, we’re expecting a modest rebound in growth in the second half of this year.

Recession Looks More Likely in 2023

We expect growth headwinds to peak in 2023 and see a GDP growth rate of 1.3%. Recession will be a strong possibility. But in 2024 and after, we’re expecting growth to rebound as the Fed pivots to easing monetary policy.

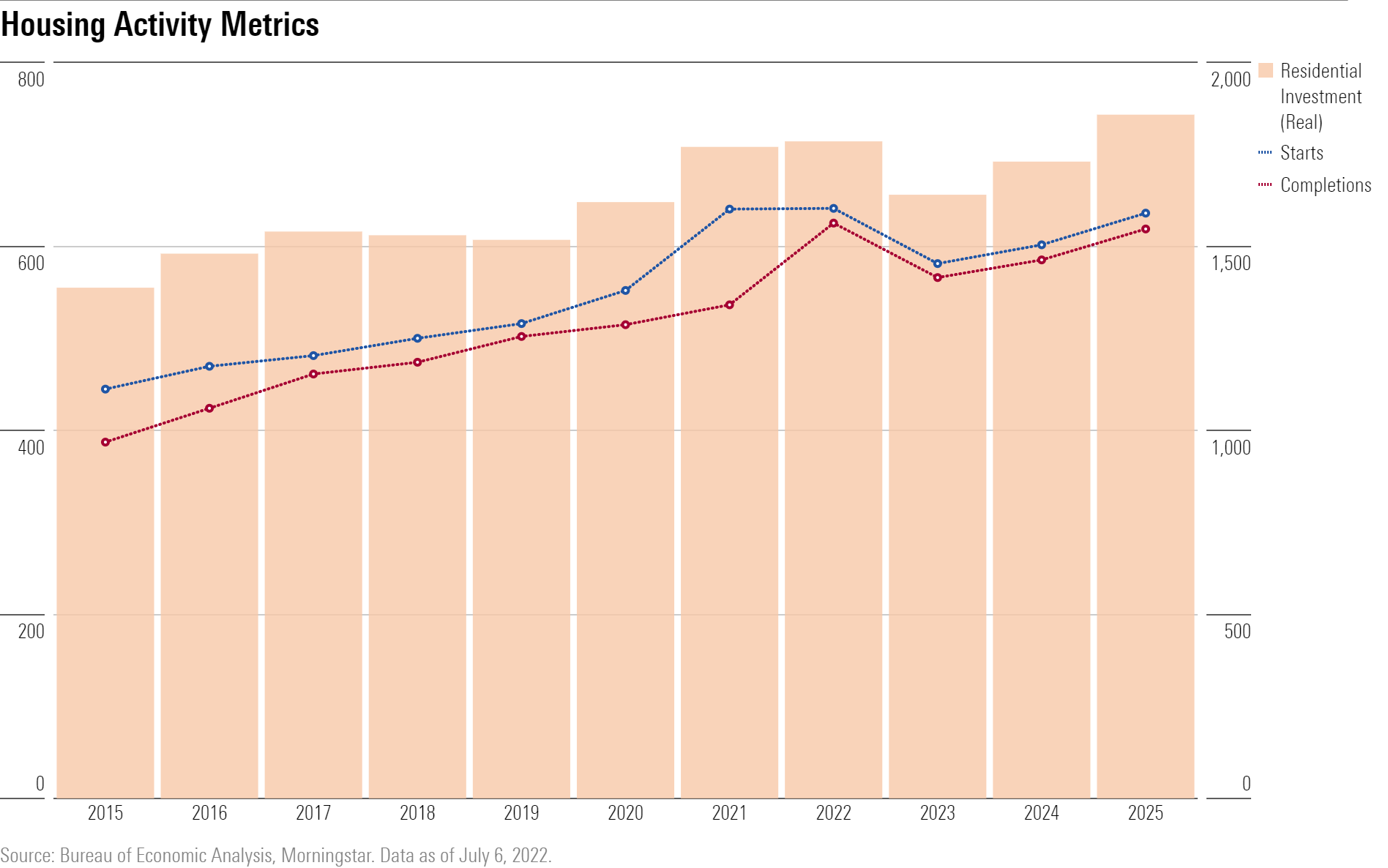

The main reason we expect recession risk to peak in 2023 is that the impact of the Fed’s rate-hike campaign will be felt most by then. In particular, we’re expecting housing starts to drop 10% in 2023, meaning that residential investment will fall sharply as well. This will constitute a major negative impact to economic activity in 2023.

Don't Panic About a Recession

Despite mounting recession risk, we don't think it's time to panic. We've argued that the binary question of whether a recession occurs misses the point. Economic recessions come in many different varieties, so merely asking the question of whether a recession will occur isn't very meaningful for investor outcomes or the long-run trajectory of the economy.

If a recession does emerge over the next two years, we think it would be relatively mild and short. The Fed should be able to course-correct and get GDP growth back on track.

The only plausible scenario in which a severe recession occurs would be if inflation remains heavily entrenched in the economy. But even in this scenario, we’d expect the pain to be acute but short-lived. This could entail a repeat of the 1981-82 downturn, which was the quintessential “V-shaped” recession and followed by an economic boom.

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)