Fed Steps Up Inflation Fight Again, but We See Rates Coming Down in 2023

We expect a Fed pivot to lowering rates as inflation comes down and the need to shore up the economy grows.

Although the Federal Reserve is still hiking interest rates for now, we expect the Fed to pivot to cutting rates in 2023 in order to boost an ailing economy.

As expected, the Fed announced Wednesday that it was lifting the federal-funds rate by 0.75 percentage points. The move had been widely telegraphed, reflecting the Fed’s ongoing campaign against high inflation. The June Consumer Price Index report saw inflation reaching a new peak of 9.1% year over year, the highest since 1981.

In raising rates, the Fed noted that "inflation remains elevated" reflecting continued ripples from the pandemic, higher food and energy prices, and Russia's war on Ukraine. "The Committee is highly attentive to inflation risks," the Fed said in a statement.

At the same time, "recent indicators of spending and production have softened. Nonetheless, job gains have been robust in recent months, and the unemployment rate has remained low."

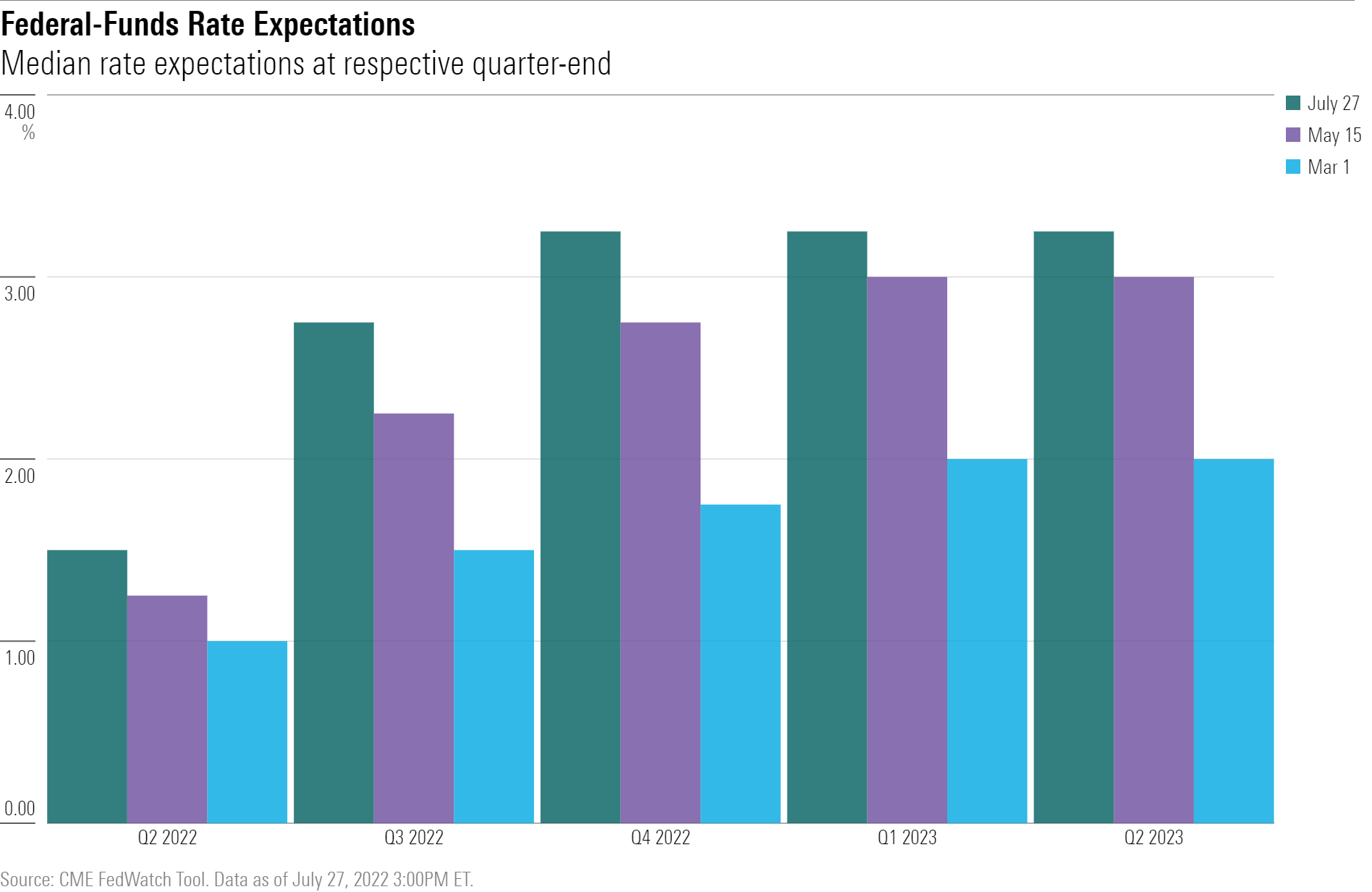

Wednesday’s hike repeats the 0.75-percentage-point increase issued in last month’s meeting, which was the largest since 1994. This brings the federal-funds rate to 2.25%, up from zero at the start of the year. Futures markets imply the federal-funds rate will ultimately rise to 3.25% by the end of 2022, which is consistent with the Fed’s guidance.

Bond yields dipped slightly near the beginning of remarks from Fed Chair Jerome Powell that followed the official announcement, meaning the bond market slightly attenuated its expectations for rate hikes going forward. The yield on the U.S. Treasury 2-year note fell by about 0.08 percentage points. Although the Fed statement reiterated that "ongoing increases in the (fund rate) will be appropriate," Powell emphasized that its approach will be highly data dependent. He also suggested that it will "likely become appropriate to slow the rate of increases" in future meetings.

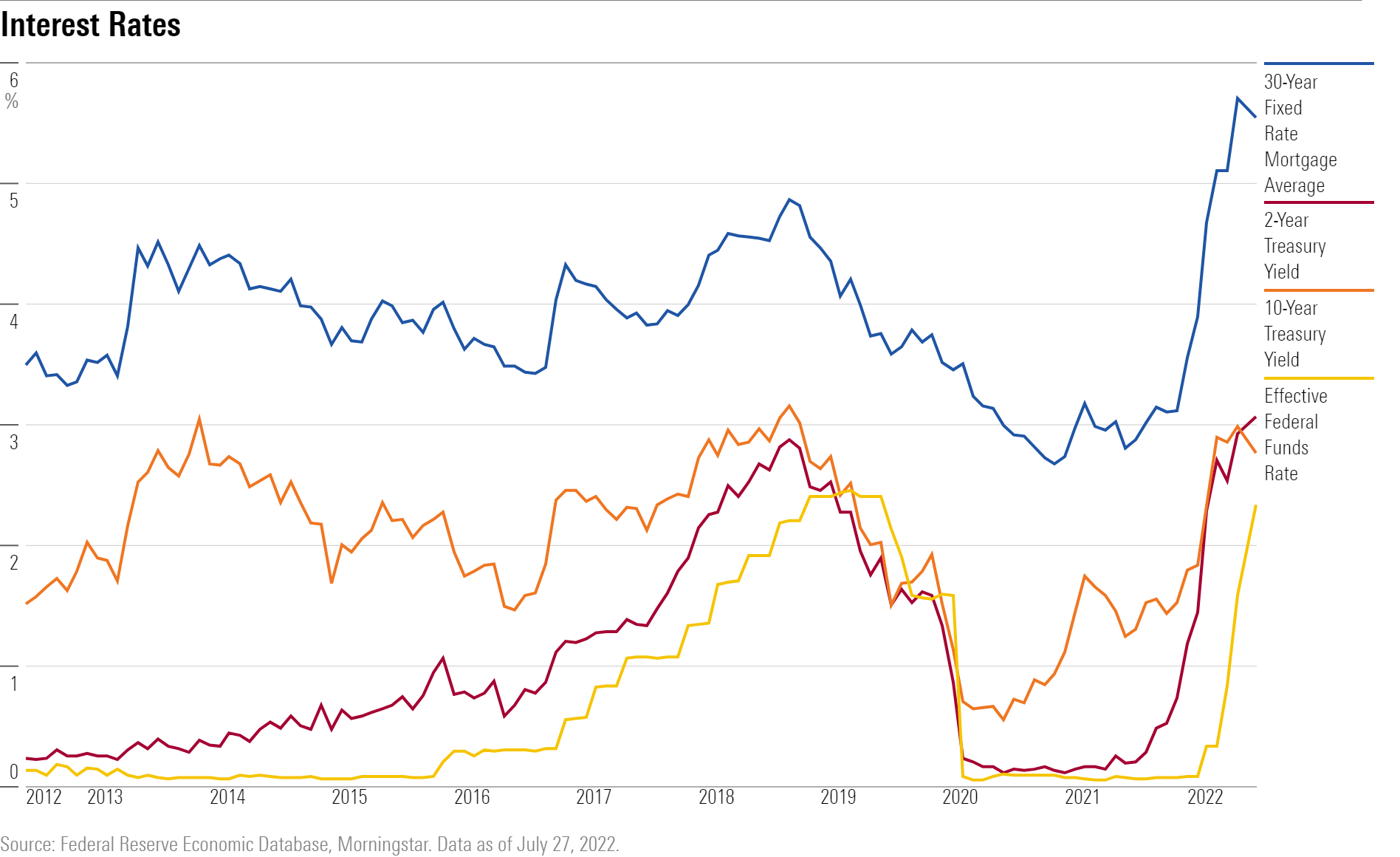

Expectations of a rising federal-funds rate have been incorporated in bond markets for several months now. As a reminder, bond yields should move in line with the expected federal-funds rate. Therefore, bond yields have jumped compared with a year ago. This has translated into higher borrowing costs throughout the economy, such as new mortgage borrowers.

Ultimately, higher borrowing costs slow the rate of economic growth by discouraging spending. This accords with the Fed’s desire to cool off the economy in order to relieve pressure on prices.

We Expect the Fed to Pivot to Cutting Interest Rates in 2023

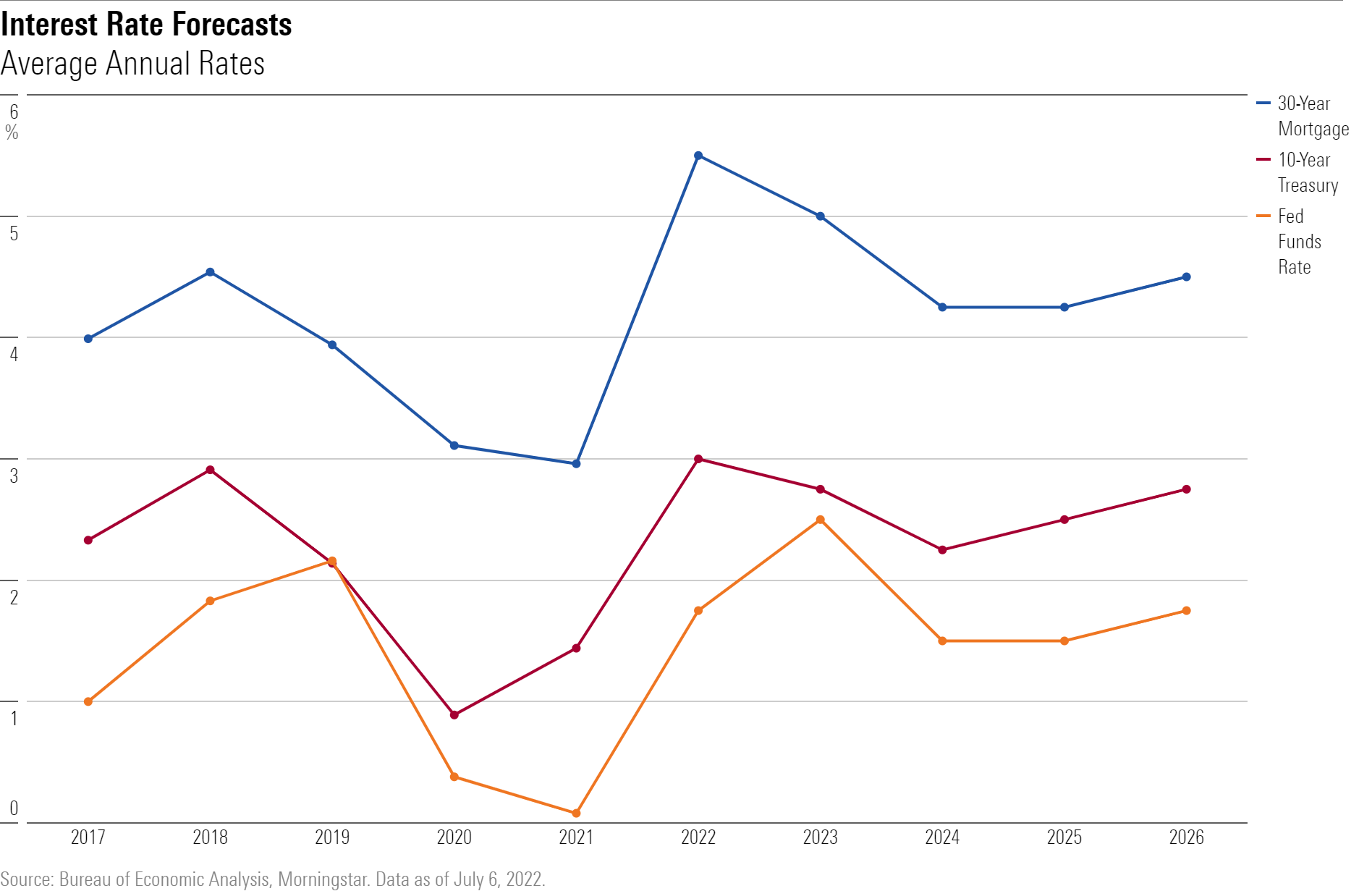

We expect the Fed to pivot to easing monetary policy in 2023 as inflation falls back to the central bank's 2% target and the need to shore up economic growth becomes paramount. We project the federal-funds rate to fall from a peak 3% at the start of 2023 to 1.5% by 2024. Accordingly, longer-term yields—including mortgage rates— should fall as well.

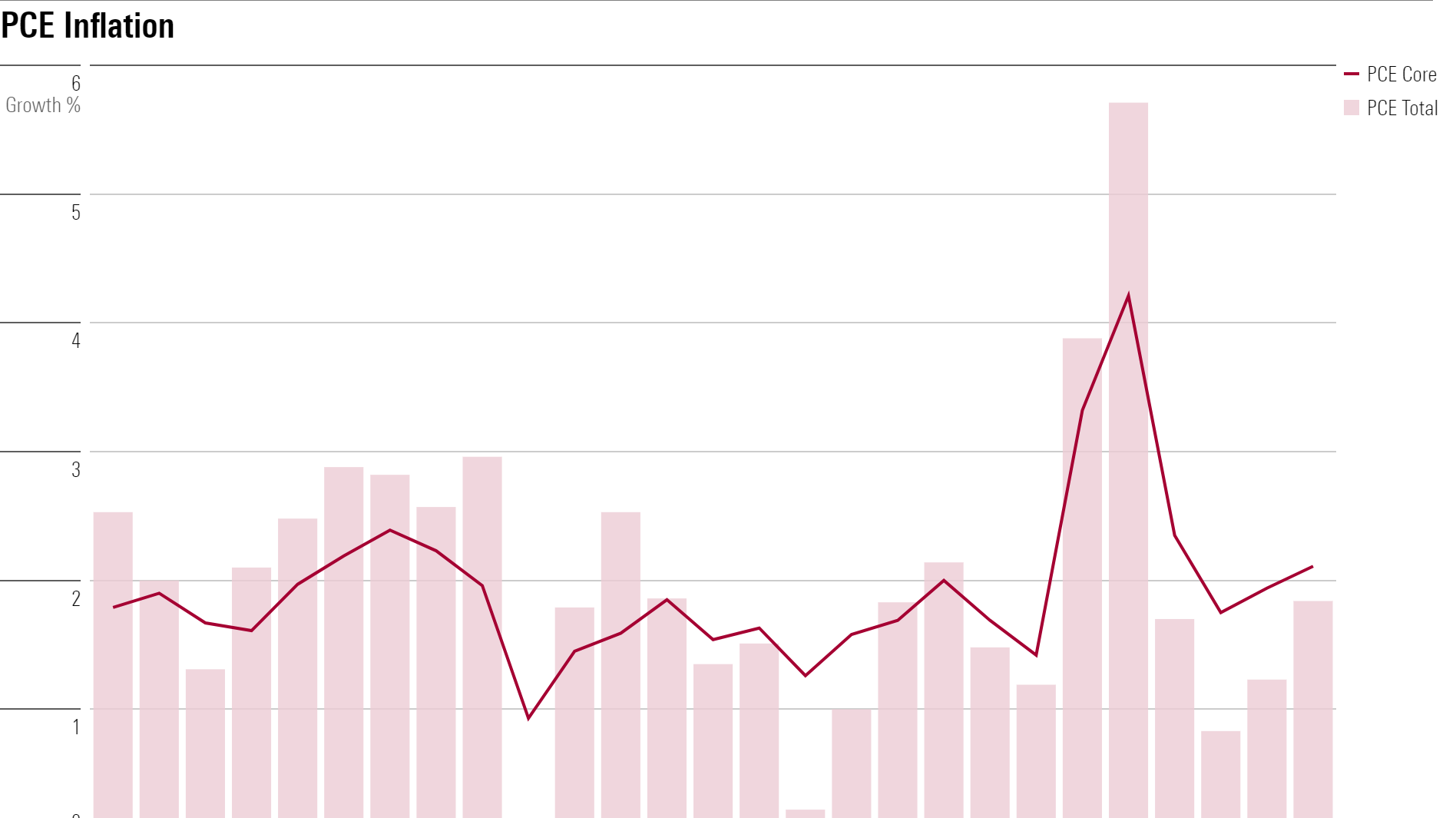

Falling inflation should clear the way for the Fed to cut interest rates. We're projecting price pressures to swing from inflationary to deflationary by 2023, owing greatly to the unwinding of price spikes caused by supply constraints in durables, energy, and other areas. As such, we project inflation to average just 1.5% over 2023 through 2026.

Once the war on inflation is won, the Fed could shift to doing what’s needed to jump-start economic growth. We’re projecting that real gross domestic product growth remains in positive territory on a full-year basis. But growth will be uncomfortably low in the near term (we project 1.3% in 2023), and that assumes the Fed pivots to easing.

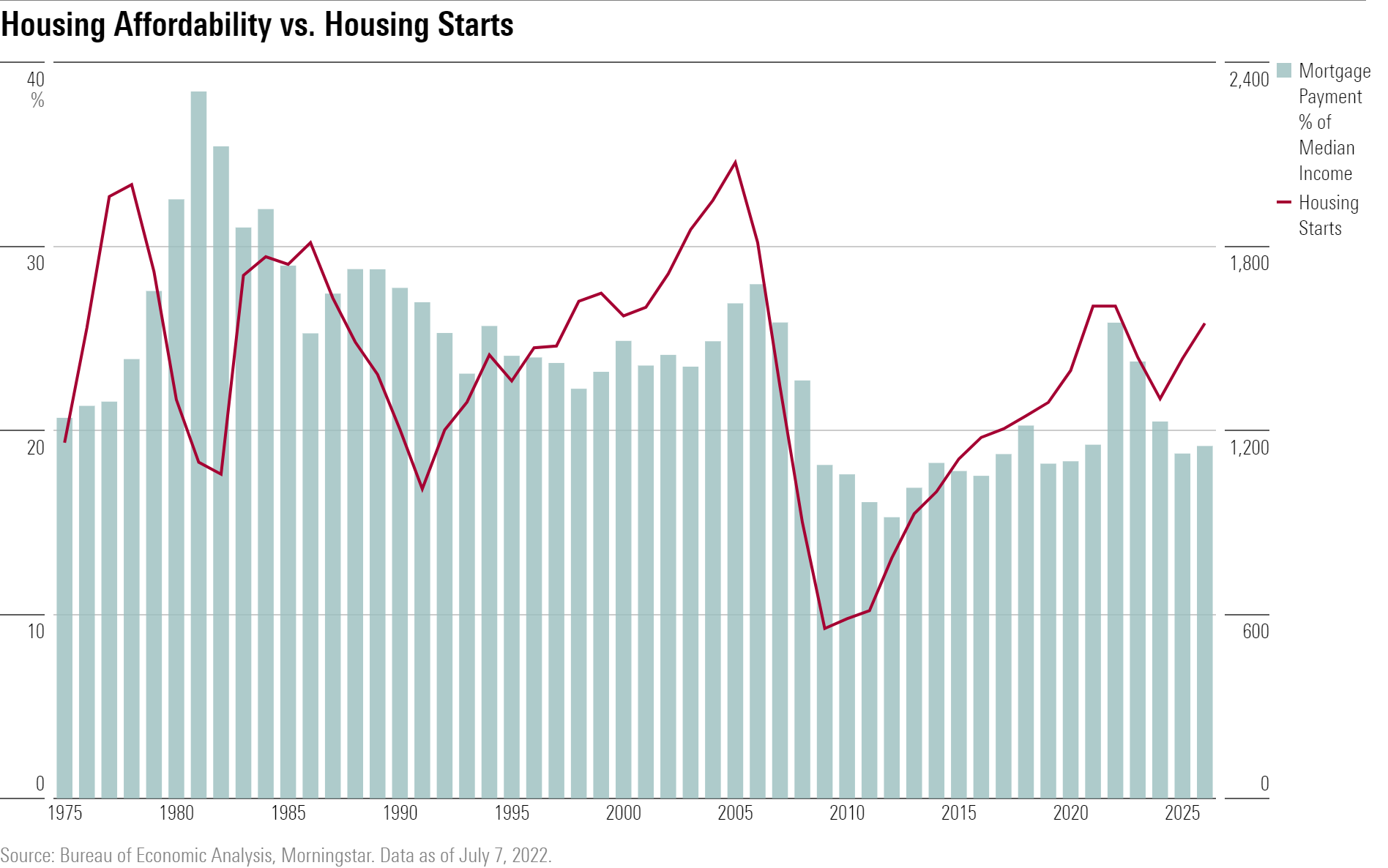

Soaring home prices have combined with the jump in mortgage rates to put home affordability—in terms of the ratio of the median mortgage payment to income—at its worst since 2007. That means housing demand and activity are set to fall sharply. We expect housing starts to fall 10% in 2023 and 2024. Historically, changes in housing affordability have been a major driver for housing demand. This was especially the case before the 1990s, when monetary policy was more volatile.

In order to resurrect housing, and therefore overall economic activity, the Fed will need to improve housing affordability by cutting interest rates. We expect housing starts to bounce back strongly in 2025 and 2026 in response to the Fed’s easing. In addition to housing markets, monetary policy easing will boost the economy in other ways, including by likely providing support to asset prices.

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)