Global Fund Flows Show a Moderate Pullback from Fixed-Income

Meanwhile, stock investors stayed put.

If you are an investor who follows market news, chances are you’ve frequently been exposed to stories about fund flows, or how investors are moving their money into and out of funds. But interpreting fund flows, and what they mean for you as an investor, isn’t always straightforward. Morningstar’s latest Global Fund Flows Report gives context to how investors are moving their money around the world and the global trends that may be affecting that flow of money.

As an individual investor, broad fund flows probably shouldn’t be a key consideration as you manage your portfolio. Understanding how the underlying environment that drives those flows may affect you is a more worthwhile pursuit. Morningstar’s Christine Benz offers solid advice about how to think about making changes to your portfolio amid market volatility.

Here are some takeaways on global fund flows from the first half of 2022.

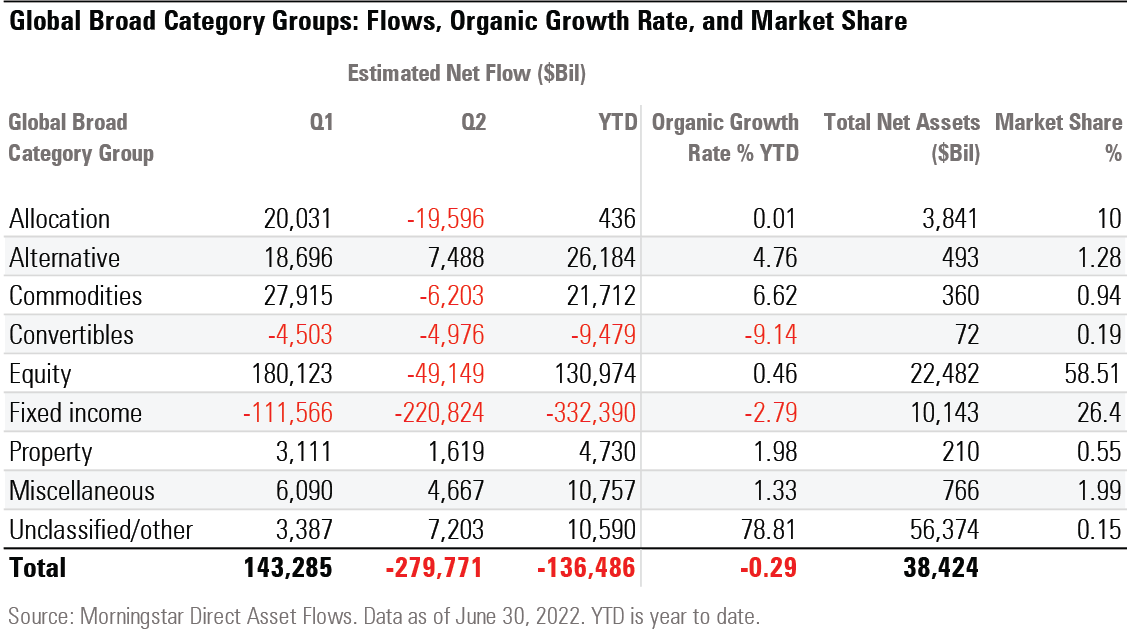

Global Outflows Were Moderate Despite Market Volatility

Long-term mutual funds and exchange-traded funds had $136 billion of estimated outflows as assets fell to $38 trillion from $48 trillion at the end of 2021. Assets shrank organically by 0.29%, a distinct reversal from 2021′s robust 5.7% annual rate. While outflows prevailed across asset classes, the rate of outflows has been moderate relative to previous periods of volatility.

One compelling explanation for the absence of investor panic is that portfolios are implemented through programs now more than ever. Programs include schemes like the United States’ 401(k) system, which primarily employs target-date and target-risk funds; model portfolios; and plain old allocation funds, which remain popular in Europe and Canada. Investments in these programs are made regularly and automatically, and the strategies themselves rebalance to adhere to their stated investment policies.

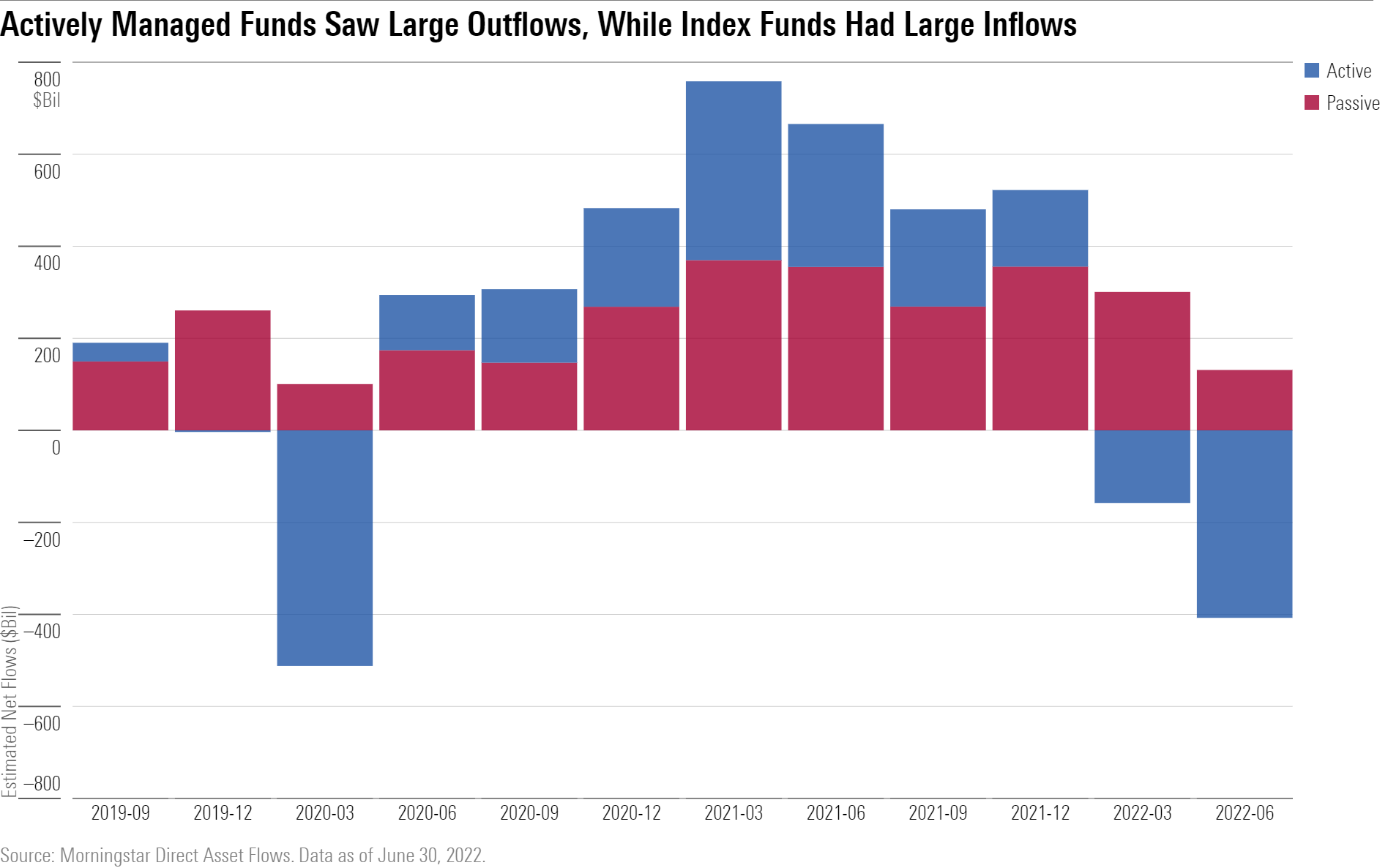

The Bear Market in Bonds Took a Big Bite Out of Actively Managed Funds Worldwide

Actively managed funds had $568 billion of outflows, while index funds had $432 billion of inflows. In absolute terms it was the second-worst six-month period for actively managed funds since the beginning of our global assets coverage in 2008. Only the six-month period ended Dec. 31, 2008, the height of the global financial crisis, was worse, with $681 billion of outflows.

Fixed-income funds accounted for $422 billion of actively managed outflows. Because only 26% of fixed-income assets are passively managed, it’s not surprising that so much of actively managed funds’ outflows came from fixed income.

On the equity side, passively managed funds had $311 billion of inflows, while their actively managed counterparts had $180 billion of outflows. As of June 30, index funds accounted for 48% of equity assets worldwide.

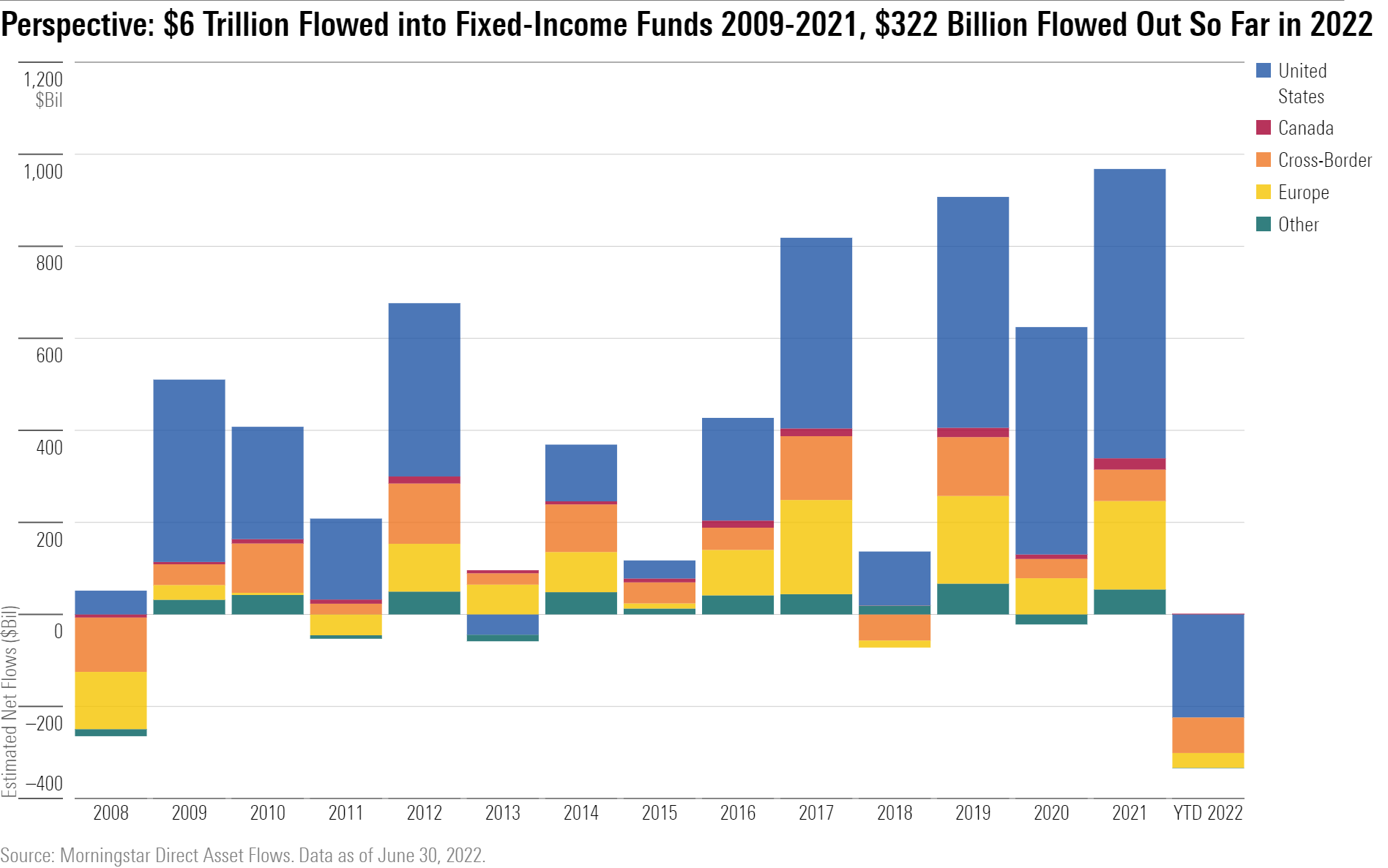

Fixed-Income Outflows Contrast 2021′s Record Inflows

It is not surprising that fixed-income funds have had significant outflows this year given that Morningstar Category group’s historic performance drawdown.

Fixed-income funds’ year-to-date outflow of $332 billion is certainly large in magnitude but small compared with the $6 trillion of inflows the group enjoyed from 2009 to 2021. It is even small against 2021′s record inflows of $968 billion. Further, much of the outflows were from high-yield and municipal-bond funds, which are not core to a diversified portfolio.

Flows into the asset class over the past decade were driven less by a desire for bonds than a need to diversify. As equity returns soared, so did their allocations within portfolios. Massive purchases of fixed-income strategies were required to maintain balanced portfolios.

Global Flows Show Investors Are Staying the Course

Investors’ response to 2022′s market volatility has been one global, collective shrug. Most investors say they are in it for the long haul; their actions in 2022, or lack thereof, demonstrate their commitment. Investors don’t control interest rates, inflation, the economy, geopolitics, or public health, but they can control their investing decisions in any environment. Thus far, they have held the line.

For a more detailed breakdown and further analysis of global fund flows from the first half of 2022, read Morningstar’s Global Fund Flows report.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/96c6c90b-a081-4567-8cc7-ba1a8af090d1.jpg)

/s3.amazonaws.com/arc-authors/morningstar/e3601478-840b-4f9a-ab6f-261f14c3ddd5.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96c6c90b-a081-4567-8cc7-ba1a8af090d1.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e3601478-840b-4f9a-ab6f-261f14c3ddd5.jpg)