If the Q2 GDP Report Is Negative This Week, Is It Really a Recession?

A Fed rate hike Wednesday could be followed by news that the economy shrank for the second quarter in a row.

The Federal Reserve may be expected to continue its campaign against inflation by aggressively hiking interest rates at its Wednesday meeting, but Thursday could bring news that the U.S. economy shrank for the second quarter in a row.

Usually, two negative quarters of gross domestic product is seen as showing we've entered a recession. But this time around it isn’t so clear.

Before the GDP report Thursday, we’ll get the results of the Fed’s two-day policy setting meeting.

On Wednesday, the Fed is widely expected to announce a 75-basis-point increase in the federal-funds rate, the same amount it announced after last month's meeting, which was the largest increase since 1994. If it does, this week’s hike would bring the federal-funds rate to 2.25% (bottom of target range), up from 0% at the start of the year.

This nearly unprecedented pace of monetary tightening reflects the Fed’s heightened determination to quell high inflation. The June Consumer Price Index report saw inflation reaching a new peak of 9.1% year over year, the highest since 1981. Futures markets imply the federal-funds rate will ultimately rise to 3.25% by the end of 2022, which is consistent with the Fed’s guidance.

Rate hikes help to fight inflation only insofar as they slow the rate of economic growth, at least temporarily. This cools off the economy and thereby relieves pressure on prices. Therefore, the Fed’s aggressive monetary tightening has raised the specter of a recession.

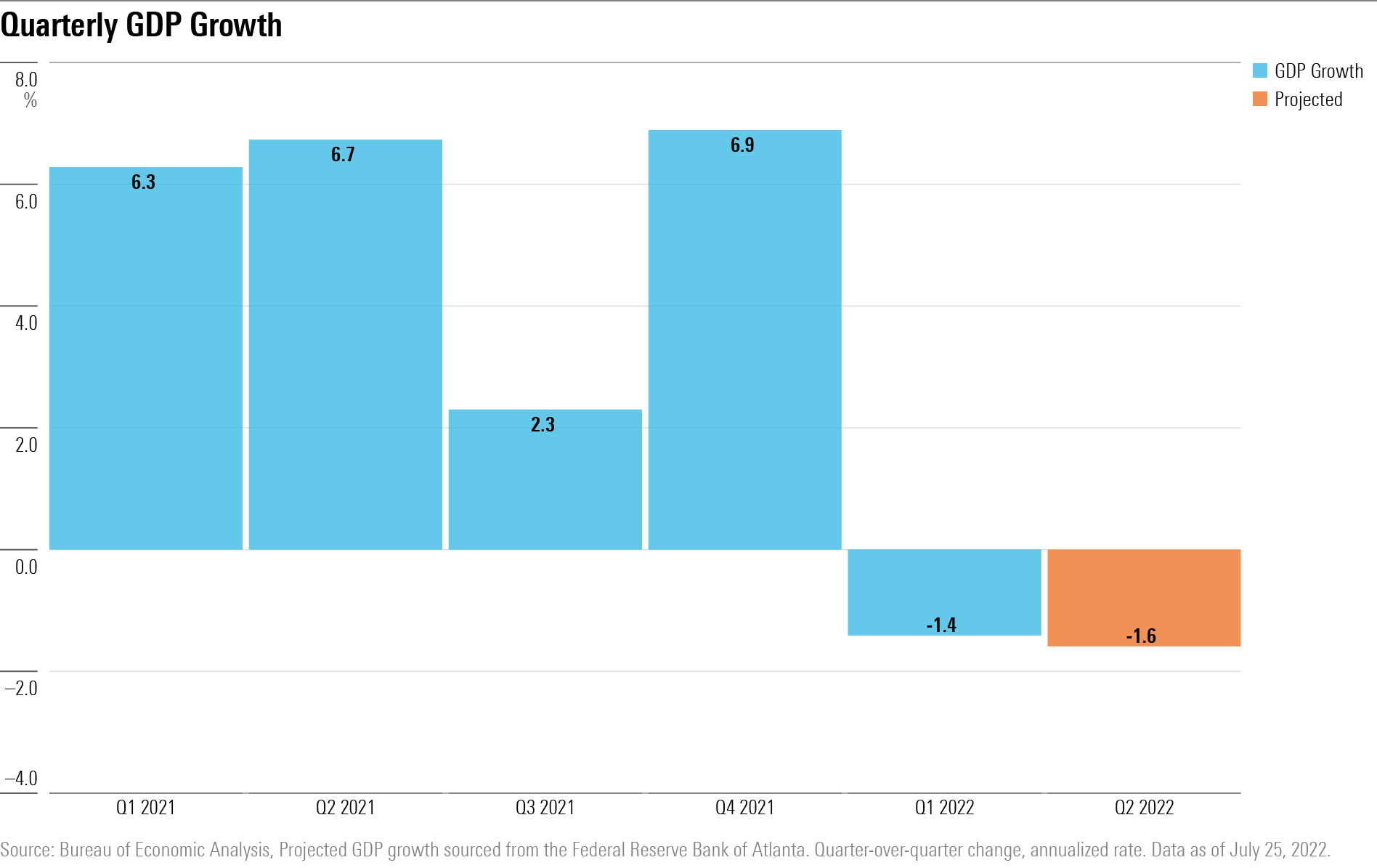

In fact, we may find out with Thursday's GDP release that the U.S. economy already entered a recession in the second quarter, at least by one definition. The Atlanta Fed is projecting that real GDP contracted by 0.4% (1.6% annualized) in the second quarter, following the 1.6% annualized drop in the first quarter.

There’s no hard and fast rule for when a recession starts and begins, but a common definition is two consecutive quarters of negative real GDP growth. However, the National Bureau of Economic Research is the traditional authority on when U.S. recessions begin and end, and it looks unlikely to declare a recession for now.

Part of the reason the NBER is unlikely to declare a recession is that most other economic indicators—including employment, industrial production, and consumer spending—all continued to trend up in the first half despite the decline in GDP. Similarly, we've argued that much of the decline in first-quarter GDP reflected noise, rather than a genuine slowdown in economic activity.

None of this is to say that recession risks are nothing to worry about. Rather, we expect that recession risk will crest in 2023, as that's when the economy will feel the brunt of Fed tightening. In particular, rising interest rates are starting to trigger a downturn in the housing markets. We expect housing starts to decline 10% in 2023, which will weigh heavily on broader economic activity.

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)