What Sustainability Risks Are Woven Into Fast Fashion?

Certain low-cost apparel companies have low ESG risks and competitive advantages.

Consumers are able to get their hands on new clothes like never before. However, the added convenience of fast fashion comes with some concerning costs to investors in regard to sustainability.

The meteoric rise of fast-fashion players like H&M, Zara (a brand of Spain’s Inditex ITX), and China’s privately held Shein has brought cheap, quickly made clothes to the masses, driving up the number of garments produced globally by more than double over the past two decades. But while the price may be low for consumers, the cost for stakeholders is often high, stemming from concerns like rising carbon footprints and modern slavery in supply chains. These environmental and social issues are critical for investors to consider when evaluating apparel companies.

Nonetheless, we don’t think these risks should uniformly prevent long-term investment in the fashion industry. Instead, we think investors who are focused on integrating environmental, social, and governance risk into their analysis should strongly consider the valuation implications of these issues versus the price they pay for a stock.

Let’s dive more deeply into these risks.

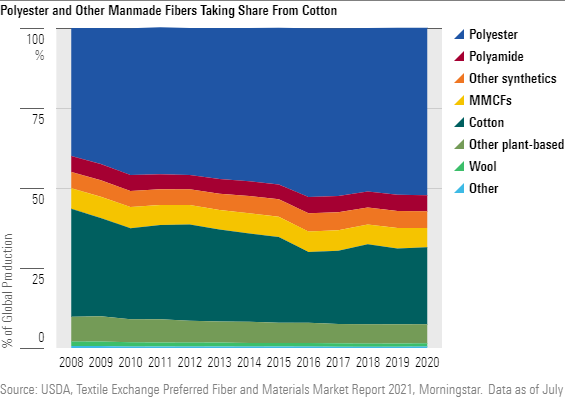

Fast-Fashion Faux Pas: Pollution and Polyester

First, on the environment: The fashion industry is one of the world’s largest industrial polluters, accounting for 10% of annual global carbon emissions—more than all international flights and maritime shipping combined. And the industry is a heavy user of water. Around 20% of wastewater worldwide comes from fabric dyeing and treatment, while textiles contribute 35% (190,000 metric tons) of microplastic pollution in the oceans.

Rising sales of cheaper fast fashion, in particular, is a challenge, given the resulting increasing share of synthetic fibers like polyester. While these fibers have less impact on water and land than grown materials like cotton, they emit more greenhouse gases. A polyester shirt has a more than 25% greater carbon footprint than a cotton shirt (12.1 pounds versus 9.5 pounds), for instance.

And waste is also an issue; according to the U.S. Environmental Protection Agency, about 85% of the clothing that Americans consume is sent to landfills as solid waste to be buried or burned as energy. This amounts to nearly 70 pounds of clothing waste per American per year.

In response to this environmental risk, apparel firms have altered product design and manufacturing to increase use of recycled fibers and build sustainable supply bases. As one example, recycled polyester—made from PET plastic bottles—has risen to 15% of total polyester production from 11% in 2010. Further company-led efforts are likely to push shares of recycled product upward in the future. Fast-fashion leaders have outlined targets for 2025, including H&M’s goal to use 30% recycled materials across its lineup (from 18% in 2021) and 100% of its products to be designed in a circular manner, while Inditex aims to use 100% recycled or sustainable polyester/linen and has partnered with sustainable suppliers.

Assessing the Social Landscape

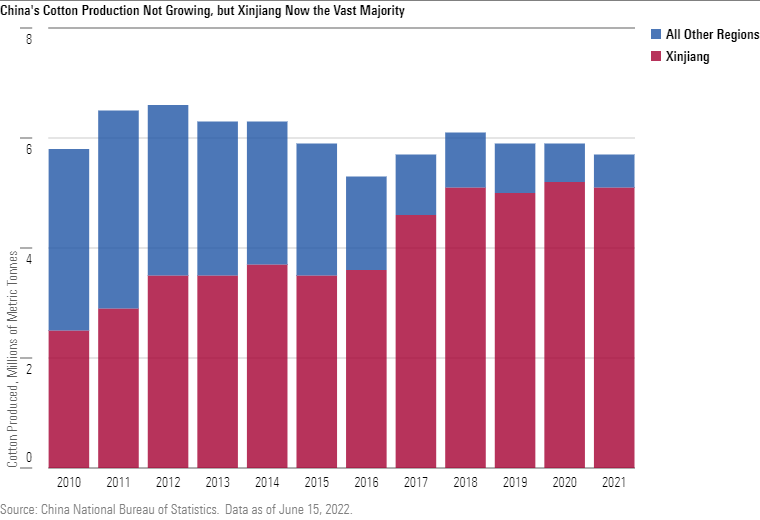

The second major ESG risk is planted in the social landscape: Modern slavery and human rights remain critical issues. Forced labor is estimated to take place in 25% of the world’s 75 cotton-producing countries, highlighting it as a key supply chain risk for clothing producers.

Most recently, the treatment of the Uyghur population in China’s Xinjiang region has faced scrutiny for alleged human rights violations. On June 21, 2022, the United States began to enforce the Uyghur Forced Labor Prevention Act. Under this new law, any imports from Xinjiang will be presumed to have been made with forced labor unless the responsible company can provide clear and compelling contrary evidence. This will have ramifications for apparel providers, given the Xinjiang area produces the vast majority of China’s cotton, and some 20% of the world’s cotton in an average year.

In response, companies like H&M, as well as non-fast-fashion firms like Nike NKE and Burberry, have outlined plans to end their direct Xinjiang sourcing. However, full supply chain transparency is notoriously difficult to enact. Morningstar Sustainalytics notes that audits are the main tool used by companies to monitor their sites or supply chains. But audits alone can fail to reveal a full or true picture of working conditions, leading to concerns that companies are still not detecting modern slavery violations. This will be critical, as cotton and yarn produced in Xinjiang are used in other key garment-producing countries such as Cambodia and Vietnam. Overall, roughly 16% of cotton clothes on store shelves in the U.S. had fiber from Xinjiang. Together, efforts to reduce environmental footprints, increase supply chain visibility, and find alternative sourcing could lead to up-front investment, higher costs, and potential shipment delays. And we doubt retailers will be able to push these costs onto customers through increased prices. Although younger consumers say they’re more willing to pay up for greater sustainability in their clothing, these buyers represent a minority of shoppers overall, and many are attracted to fast fashion at the onset by its promise of low prices.

How to Add Fashion Stocks to Your Portfolio

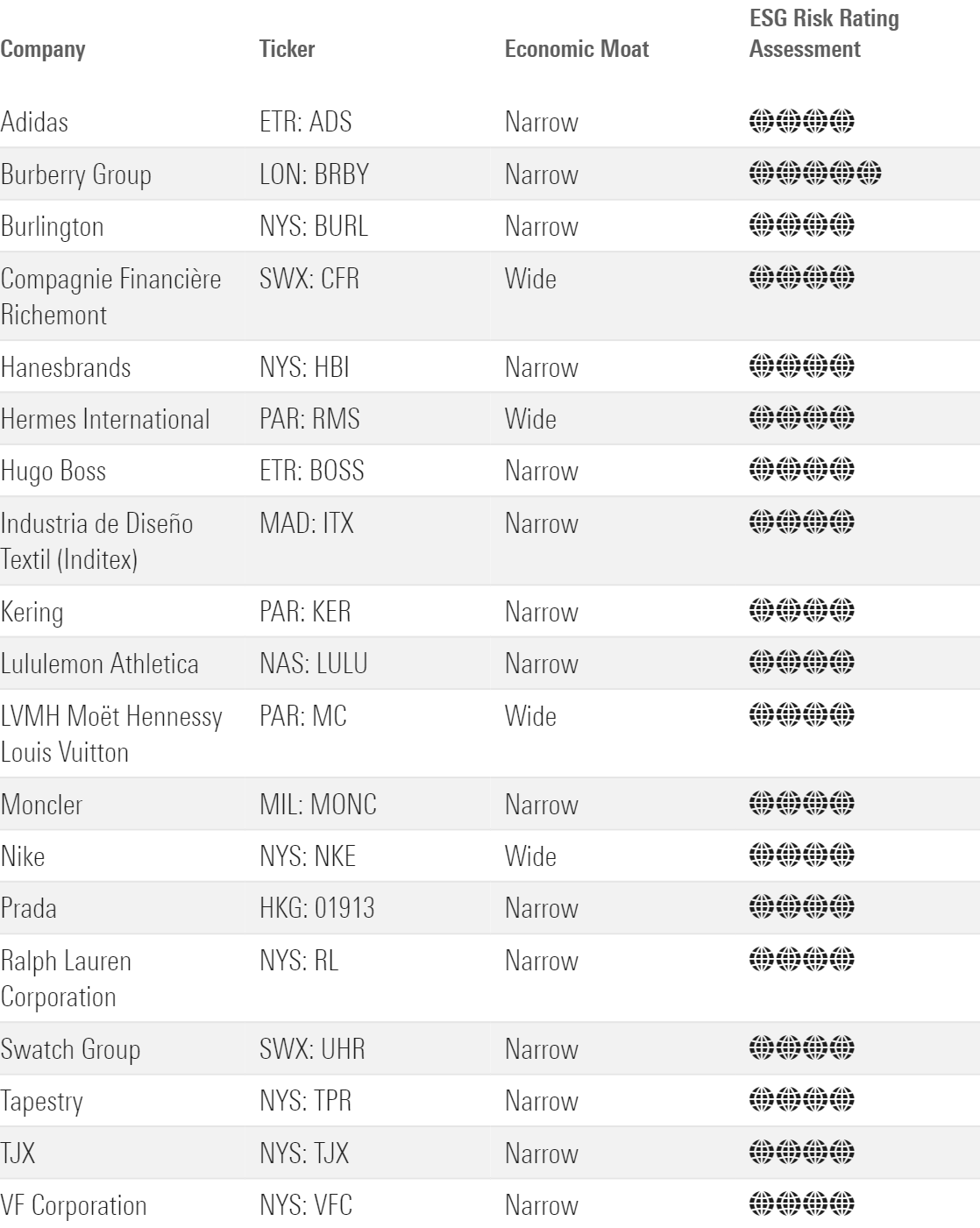

So, how should investors respond? Once again, we recommend focusing on valuation, not values. Despite ESG concerns, many large public companies have worked to manage their identifiable risks. Among our equity research team’s coverage of 36 companies in the apparel industry, nearly all have garnered a 4-globe Morningstar ESG Risk Rating Assessment.

We also expect bigger, brand-advantaged players to share some of the increased sustainable sourcing costs with their suppliers. In our view, companies with brand-led intangible asset economic moats, resulting pricing power, and potential volume leverage are best placed to share pain with their suppliers to weather this risk. This consists of about two thirds of our relevant apparel coverage, including several names outside the fast-fashion arena that have Morningstar Economic Moat Ratings of wide, such as Richemont, Hermes, LVMH, and Nike.

We can fish in this pond of opportunities to find stocks that combine low ESG Risk Ratings, narrow or wide economic moats, and attractive valuations. To highlight a few:

Hanesbrands HBI, Morningstar Rating of 5 stars

Our narrow moat rating is based on Hanes’ intangible brand asset. We believe Hanes owns some of the best-known brands in basic innerwear in the U.S., which has enabled some of its products to achieve good pricing and outsell those of competitors. While short-term issues, such as the pandemic and supply chain challenges, have weighed on shares, the market seems to underestimate the popularity of Champion, the company’s improved mix shift, and its free cash flow generation.

Industria de Diseño Textil (Inditex), Morningstar Rating of 4 stars

Inditex benefits from an economic moat because of its intangible assets and cost advantages as a result of its scale and fast supply chain. With its low-single-digit penetration rate of global apparel sales, we believe Inditex is well positioned to capture market share from weaker players, and the company was proactive and ahead of most peers in transitioning business online.

Nike, Morningstar Rating of 4 stars

Wide-moat Nike’s powerful brand and digital strategy position it well despite some short-term issues. Importantly, while the firm tends to be a lightning rod for controversy due to its high visibility, and the company has faced financial ramifications from labor issues in China, we don’t believe the ESG risks that affect Nike will have a material long-term impact on its investment prospects.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)