Bank Stocks Look Attractive Again as Q2 2022 Earnings Come in Strong

Executives say the economy is in good shape despite rising fears about recession.

With help from the Federal Reserve's interest-rate increases, major U.S. banks are posting strong second-quarter earnings. And thus far, executives say the economy looks a lot healthier than many in the markets seem to think.

Despite a complex backdrop of rising borrowing costs, surging inflation, and geopolitical tensions, banks have reported that consumer spending remained healthy and that corporate clients were seeing robust demand despite economic headwinds.

Importantly, bank executives are saying the economic strains that have many investors worried about a recession are so far not translating into meaningful problems among borrowers when it comes to paying back loans or making credit card payments.

- JPMorgan Chase JPM: Chief executive Jamie Dimon is forecasting an economic "hurricane," though the storm has yet to appear. Dimon says the "U.S. economy continues to grow and both the job market and consumer spending remain healthy."

- Citigroup C: Top executive Jane Fraser says, "Little of the data I see tells me the U.S. is on the cusp of a recession." While a recession could occur in the next two years, Fraser says "it's highly unlikely that it would be as sharp a downturn as others in recent memory."

- Truist Financial TFC: Executives described a "benign" credit environment. "While we believe the economy is currently healthy, the effects of ongoing geopolitical uncertainty, coupled with still too high inflation and an aggressive forecast for tightening the monetary policy, have somewhat diminished the economic outlook as we move further into this year and into next," chief executive Bill Rogers says.

- Citizens Financial Group CFG: Chief executive Bruce Van Saun told CNBC that the bank isn't seeing signs of worsening credit among either consumers or businesses. "Even if the Fed causes a recession it think it would be very shallow and very short," he says.

Morningstar strategist Eric Compton says that based on second-quarter results, "bank earnings remain strong amid the economic uncertainty."

Still, "bank stocks could continue to face some pressure in the near term, as recession concerns do not seem likely to go away anytime soon," Compton says. "In the meantime, we think valuations for our U.S. bank coverage are looking much more interesting."

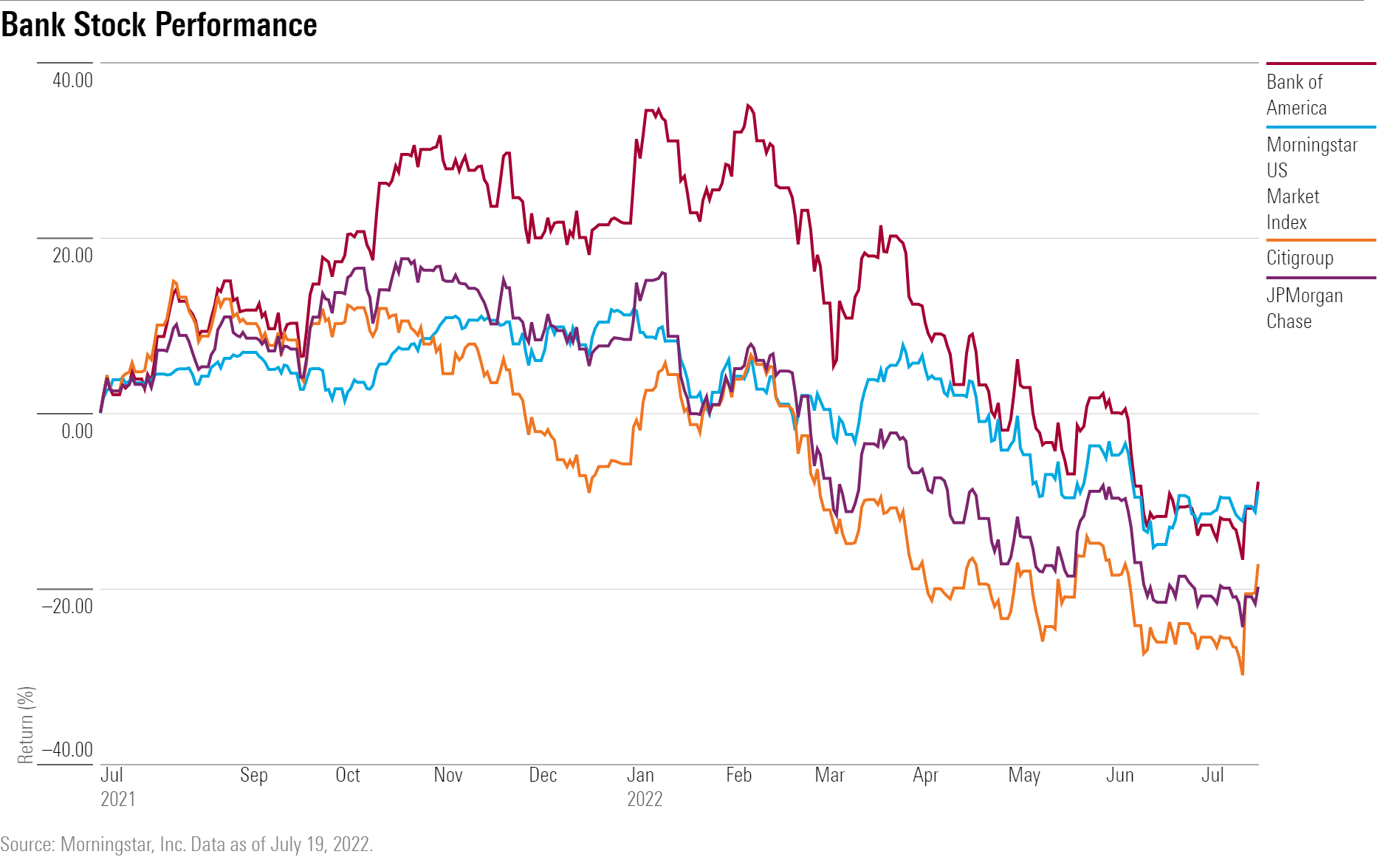

Bank Stock Performance

Many big stocks have fared worse than the broader market in 2022. But recently, financials have rallied on earnings results, with investors bidding up JPMorgan Chase, Citigroup, Bank of America BAC, Goldman Sachs GS, and Wells Fargo WFC, among others.

The Morningstar US Financial Services Index was up 6.53% in July through the 19th, compared with a gain of 7.18% for the Morningstar US Market Index. For the year, the Morningstar US Financial Services Index is down 16.1% versus a loss of 18.0% for the Morningstar US Market Index.

Executives remain on guard for a potential downturn, with most noting the sharp drop in consumer confidence. Reflecting the increase in lending activity during these uncertain times, banks are boosting loan-loss reserves commensurately, nicking earnings. Yet, the increases are on very low levels, especially compared with a year ago when banks began to free up billions from their reserves when expected losses related to the pandemic never materialized.

Higher Rates Have Their Benefits

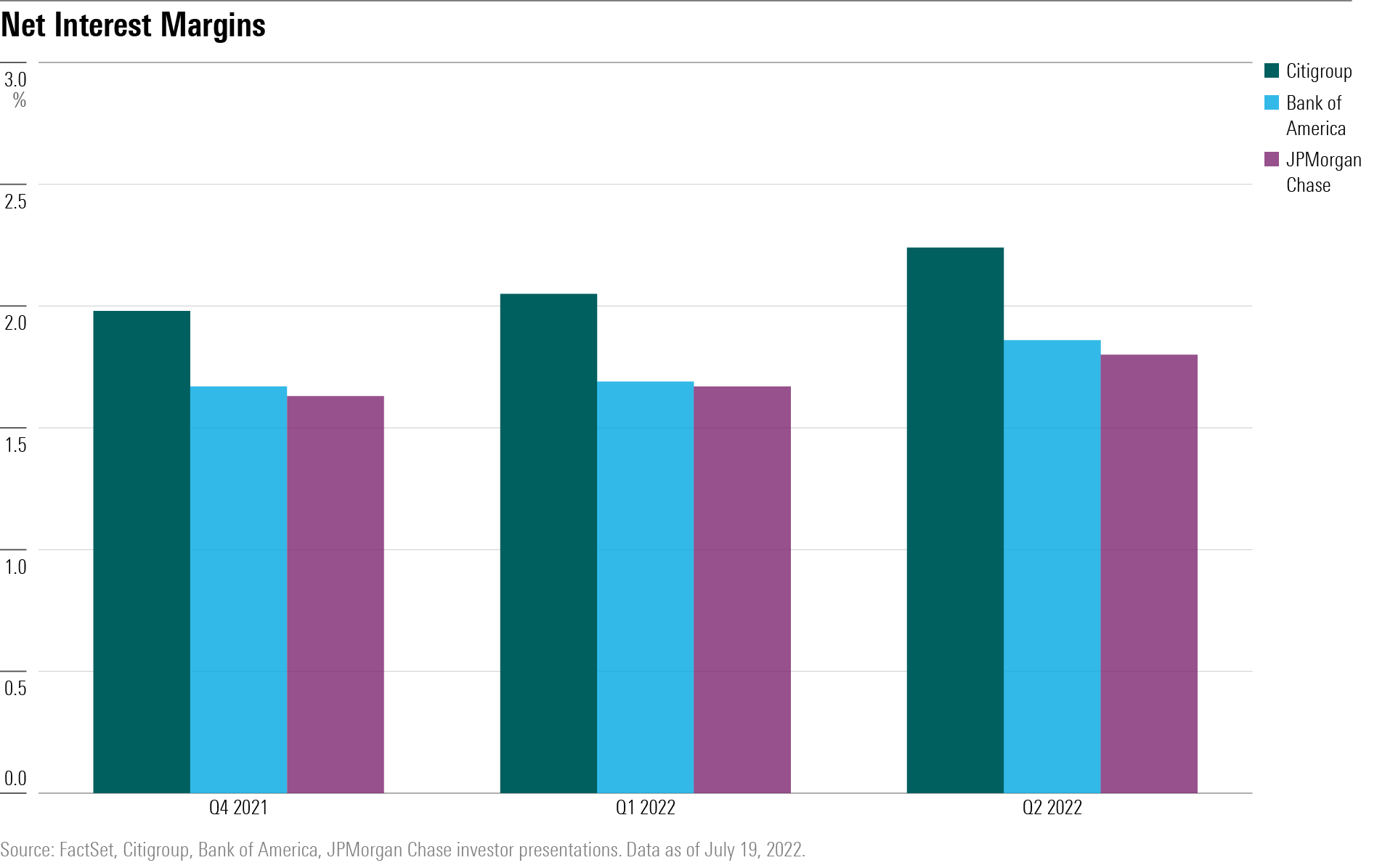

Rising interest rates may lead to a slower economy, but they are also helping to boost bank earnings.

When the Fed increases borrowing costs, banks are able to increase the rates that borrowers pay on loans in comparison to the rates that they pay on savings deposits. This shows up in a key metric of profitability: net interest margin. The average net interest margin for banks in prepandemic 2019 was 3.31%.

Bank Stocks Are Undervalued

Compton's top pick for this year is still no-moat Citigroup, despite its recent runup. Citi's stock, which has a Morningstar Rating of 5 stars, was recently trading at $51.72--a 36% discount to the $78 fair value estimate that Compton assigns to the shares. It's the most undervalued bank he covers and has the most to gain from positive developments, as its performance showed July 15 when it gained about 11% on the day.

"Citigroup reported excellent second-quarter earnings," Compton says. "Earnings per share of $2.19 came in well ahead of the FactSet consensus of $1.68 and ahead of our own estimate of $1.82. Top-line revenue came in at $19.6 billion compared with consensus of $18.4 billion, showing a relatively healthy beat all around."

Wide-moat, 4-star Bank of America posted stronger-than-expected net interest income of $872 million in the quarter, up from guidance of $650 million. Management estimates that could increase to the $900 million-$1 billion range in the third quarter.

"If this growth rate stays the same or even accelerates in the fourth quarter, Bank of America could reach a roughly $14.5 billion quarterly run rate or higher, or nearly $58 billion in annual net interest income," Compton says. "This is well above the previous $49 billion peak in 2019. Given that there is no fundamental increase in expenses associated with this type of revenue growth, we expect most of it to fall straight to the bottom line."

At a recent price of $33.45 a share, Bank of America's stock trades at a 21% discount to Compton's $41 fair value estimate.

JPMorgan Chase's stock at a recent price of $114.52 trades at a 26% discount to Compton's fair value estimate of $151 a share. The wide-moat, 4-star-rated bank lifted its full-year net interest income guidance to $58 billion from $56 billion.

"We expect this overall theme to continue, with higher rates driving exceptional net interest income growth while fees (from investment banking and wealth management) face pressure over the medium term due to economic uncertainty," Compton says.

The nation's largest bank still posted a return on tangible equity of 17% and showed continued strength in loan growth, says Compton. Misses on fees are generally more cyclical in nature, so it is not all that surprising to see some weakness at this phase in the cycle.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)