Experts Predict Stock and Bond Market Returns: Bear-Market Edition

Lower valuations, higher bond yields drive higher return expectations.

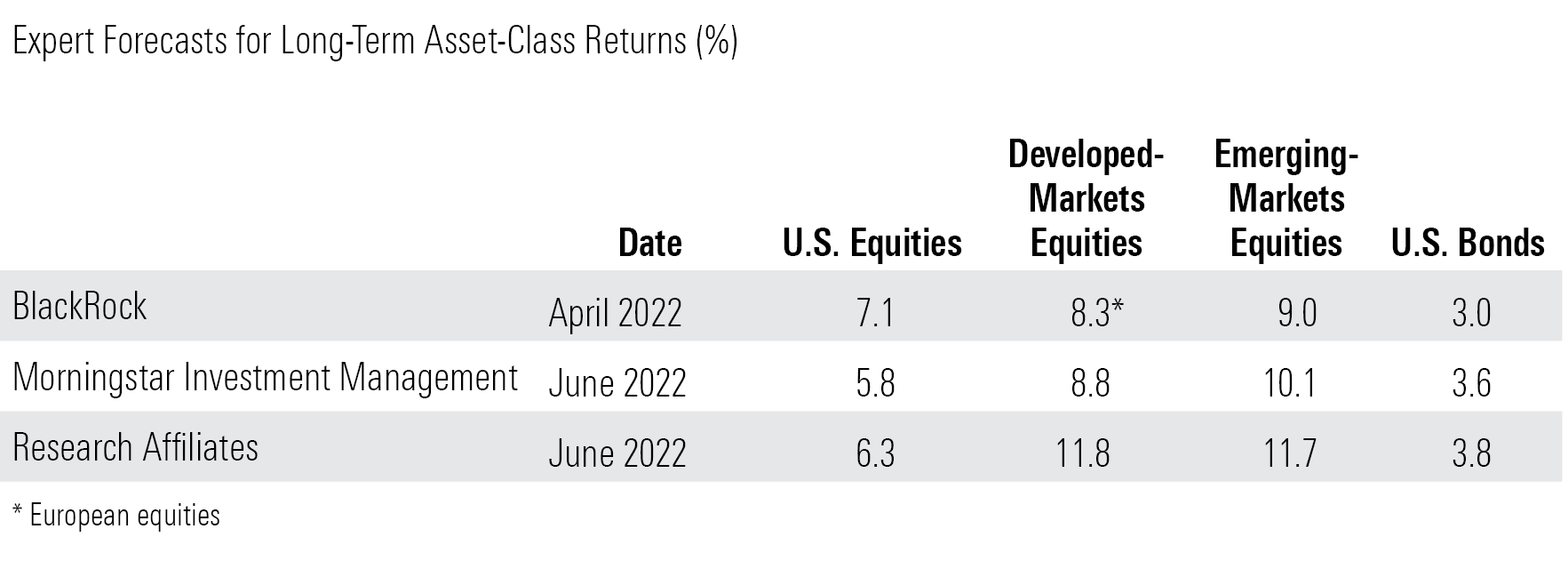

Coming into 2022, the capital markets assumptions from major investment providers were decidedly downbeat. The expected long-term returns for U.S. equities clustered in the low-single-digit range, and expectations for fixed-income returns were even lower thanks to ultralow starting yields.

Six months, an equity bear market, and a series of interest-rate increases later, however, and the forecasts for stock and bond returns are generally looking up among the firms that have updated their forecasts to reflect recent market action. While most firms still expect better returns from non-U.S. stocks than U.S. names over the next decade, U.S. return expectations have improved markedly as stocks have fallen. And because starting yields are closely correlated with subsequent bond total returns, the expectations for bond returns have also increased, though they're nothing to write home about in absolute terms, especially on an inflation-adjusted basis.

How to Use Them

While it's almost impossible to guess the market's direction on a short-term basis, return expectations can be useful—and are arguably even mission-critical—when setting up your financial plan. After all, you need to plug in some type of long-term return assumption when deciding whether your savings rate and time horizon are appropriate given what you'd like to achieve. And if you're retired, being realistic about return expectations is also essential when determining an appropriate withdrawal rate.

Before you take these or any other return forecasts and run with them, however, it's important to bear in mind that these return estimates are more intermediate-term than they are long. The firms I've included below all prepare capital markets forecasts for the next seven to 10 years, not the next 30. (BlackRock does provide a 30-year forecast, but it's an outlier in terms of making such far-reaching forecasts available to the public.) As such, these forecasts will have the most relevance for investors whose time horizons are in that ballpark, or for new retirees who face sequence-of-return risk in the next decade. Investors with very long time horizons (20-30 years or longer) can reasonably employ long-term historical returns.

It's also important to note that the parameters for these return estimates vary a bit; some of the return expectations are inflation-adjusted, while most are not (nominal). In addition, some of the experts forecast returns for the next decade, while others employ slightly shorter time horizons.

"As of" dates also vary, though I focused on those that came out in the first or second half of 2022. The firms also vary in their approaches to formulating the forecasts, though most rely on some combination of valuations, current yields, earnings growth, and inflation expectations. Finally, it's worth noting that the market is always moving, so expect these forecasts to be pretty ephemeral, too.

BlackRock Highlights: A 7.1% 10-year expected nominal return from U.S. large-cap equities; 8.3% 10-year average expected return from European large-cap equities; 9.0% average expected return from emerging-markets large-cap equities; and 3.0% for U.S. aggregate bonds (as of April 2022). All return assumptions are nominal (non-inflation-adjusted).

BlackRock's asset-class return forecasts are often among the most optimistic of those we gather, and its April 2022 numbers are no exception. Not surprisingly, the firm's outlook for most major asset classes has trended up since its 2021 release. European large-cap equities are a notable exception, however. While the firm was forecasting a 9.2% 10-year annualized return from such stocks back in September 2021, that number dropped to 8.3% as of April of this year. The firm's highest return forecast is for private equity—13%—albeit with a huge amount of variability around that figure.

GMO (Grantham Mayo Van Otterloo) Highlights: Negative 3.5% real (inflation-adjusted) returns for U.S. large caps over the next seven years; negative 2.9% real returns for U.S. bonds; 4.6% real returns for emerging-markets equities; and 0.8% real returns for emerging-markets debt (April 30, 2022).

Thanks to the recent market volatility, Grantham Mayo Van Otterloo's equity and bond market return expectations for the next seven years have generally increased since November 2021. However, the firm's return forecasts are typically among the most pessimistic in our roundup, and its outlook through April 2022 fits with that mold. The firm forecasts that both U.S. stocks and bonds will be in the red on an inflation-adjusted basis. Meanwhile, GMO believes that overseas stocks—especially emerging-markets names—will offer the only opportunity for investors to earn a positive return over the next seven years: The firm is forecasting a 0.6% real return for international large caps, a 2.1% real return for international small caps, a 4.6% real return for emerging-markets equities broadly, and a 6.9% real return for the subset of emerging-markets value stocks.

Morningstar Investment Management Highlights: 5.8% 10-year nominal returns for U.S. stocks; 8.8% 10-year nominal returns for international developed-markets stocks; 10.1% 10-year nominal returns for emerging-markets stocks; 3.6% 10-year nominal returns for U.S. aggregate bonds (June 30, 2022).

Morningstar Investment Management's return assumptions have increased dramatically since the end of 2021. Whereas the firm was forecasting just a 1.6% nominal 10-year return for U.S. equities at the end of 2021, at midyear 2022 its return forecast for U.S. equities had jumped to nearly 6% nominally. Expected bond market returns have increased by 2 percentage points to 3.6%. Consistent with its forecasts from the past several years (and with other firms), MIM is expecting better returns from non-U.S. stocks: an 8.8% annualized return for international developed-markets equities and 10.1% for emerging markets. These forecasts aren't publicly available on a quarterly basis but will appear in the Morningstar Markets Observer each January.

Research Affiliates Highlights: 6.3% nominal (2.0% real) returns for U.S. large caps over the next 10 years; 3.8% nominal (negative 0.6% real) returns for aggregate U.S. bonds (June 30, 2022; valuation-dependent model).

Research Affiliates' expected returns have increased as the stock market has declined and bond yields have risen. The firm was forecasting negative real returns for both stocks and bonds at the end of 2021, but its forecast for U.S. large caps now pops into the black on a real basis. The firm's forecast for small-cap U.S. stocks is even more positive—9.8% on a nominal basis and 5.4% real. Consistent with the forecasts from other firms, Research Affiliates is most sanguine about the prospect for non-U.S. stocks. It's forecasting a 11.8% nominal/7.5% real return for the MSCI EAFE Index of developed-markets equities and an 11.7% nominal/7.4% real return for emerging-markets stocks. The firm remains fairly downbeat on the prospects for U.S. high-quality bonds, however: All high-quality U.S. fixed-income groups are forecast to land in the red on an inflation-adjusted basis over the next decade.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)