Cheap Stocks With the Largest Fair Value Changes in Q2 2022

Lithium stocks, miners and big oil lead among undervalued names with big valuation increases.

Against the backdrop of a bear market for stocks, rising interest rates, high inflation, and the growing risk of recession, it was a rare stock that saw a significant fair value estimate increase by a Morningstar analyst during the second quarter.

Only 52 of the 859 U.S.-listed companies covered by Morningstar saw fair value increases of 10% or more, that's nearly half the quarterly average of 98 in the past five years. Conversely, 66 companies saw their fair value estimate decline by at least 10%, more than double the quarterly five-year average of 30.

Overall, fair values declined an average of 0.4% between April 1 and June 30 compared with the average quarterly increase of 3% in the five years prior to the second quarter of 2022.

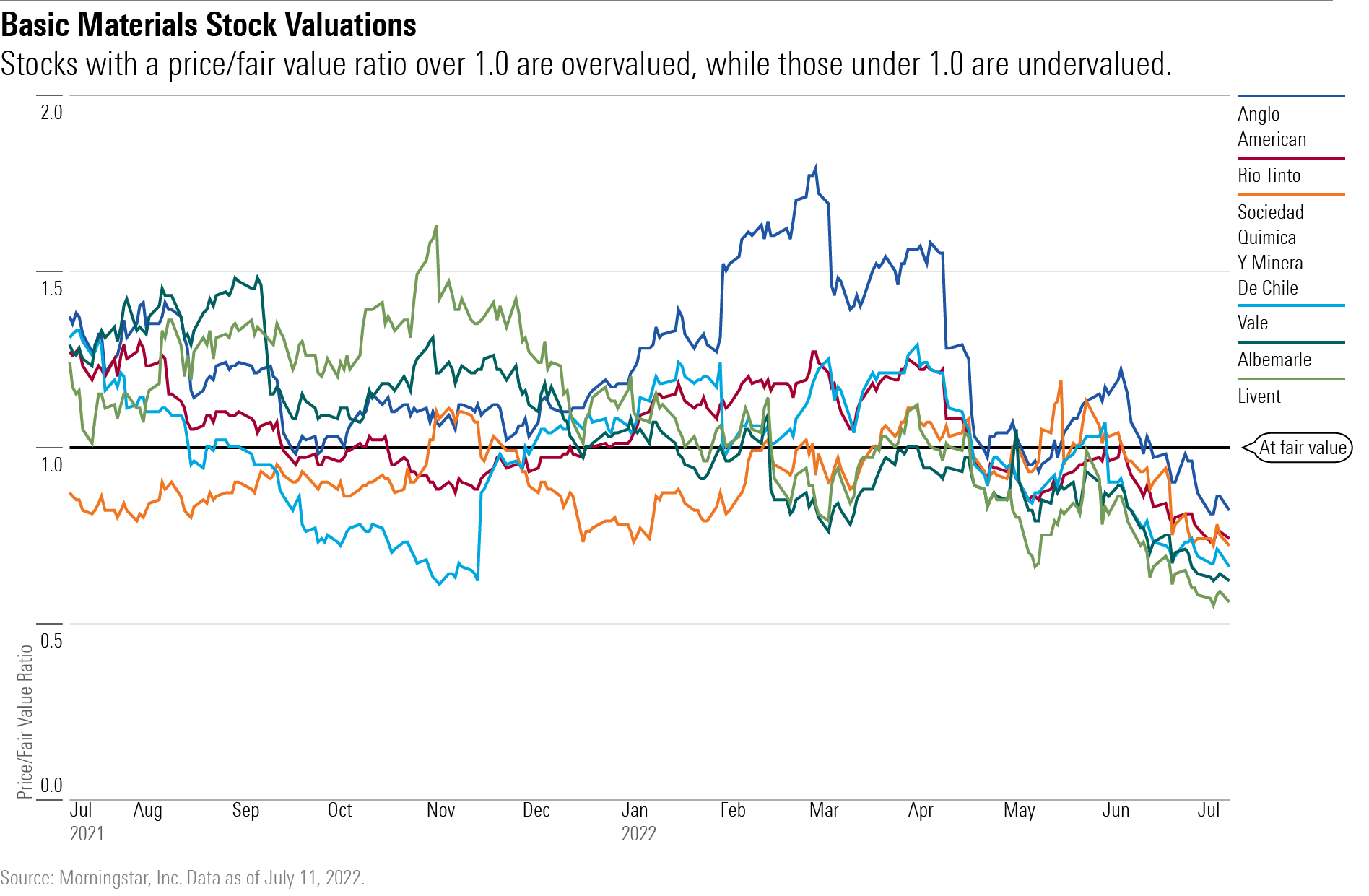

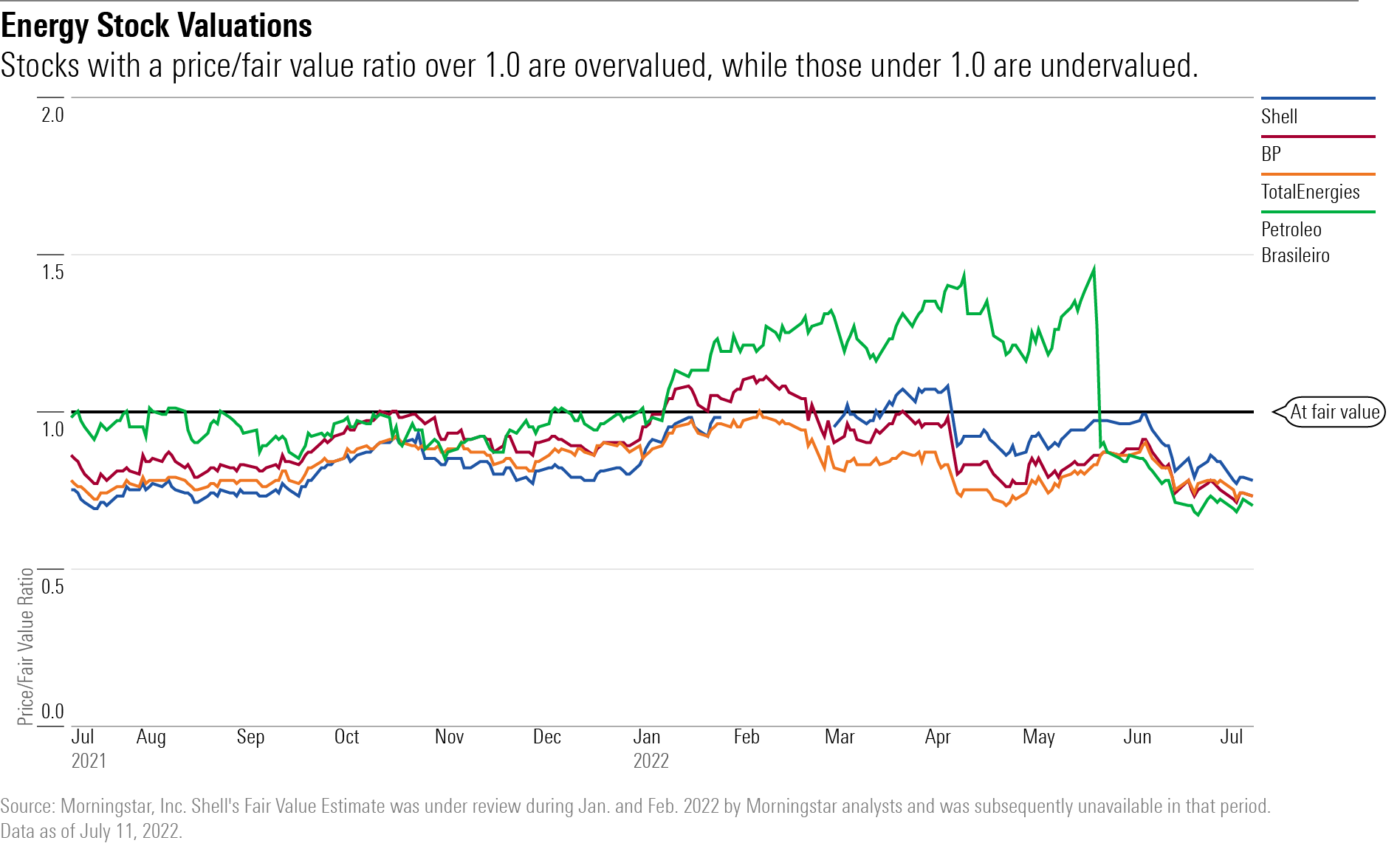

Morningstar's fair value estimate is a measure of what analysts think a company's share price should be worth. The fair value is based on how much cash analysts believe a company will generate in the future. Stocks priced above their fair value estimates are seen as expensive, while those below it are cheap compared with the growth Morningstar analysts expect to see them generate over the long term.

Despite the slim pickings, stocks that saw meaningful fair value increases and trade well below those estimates could provide long-term investors with opportunities.

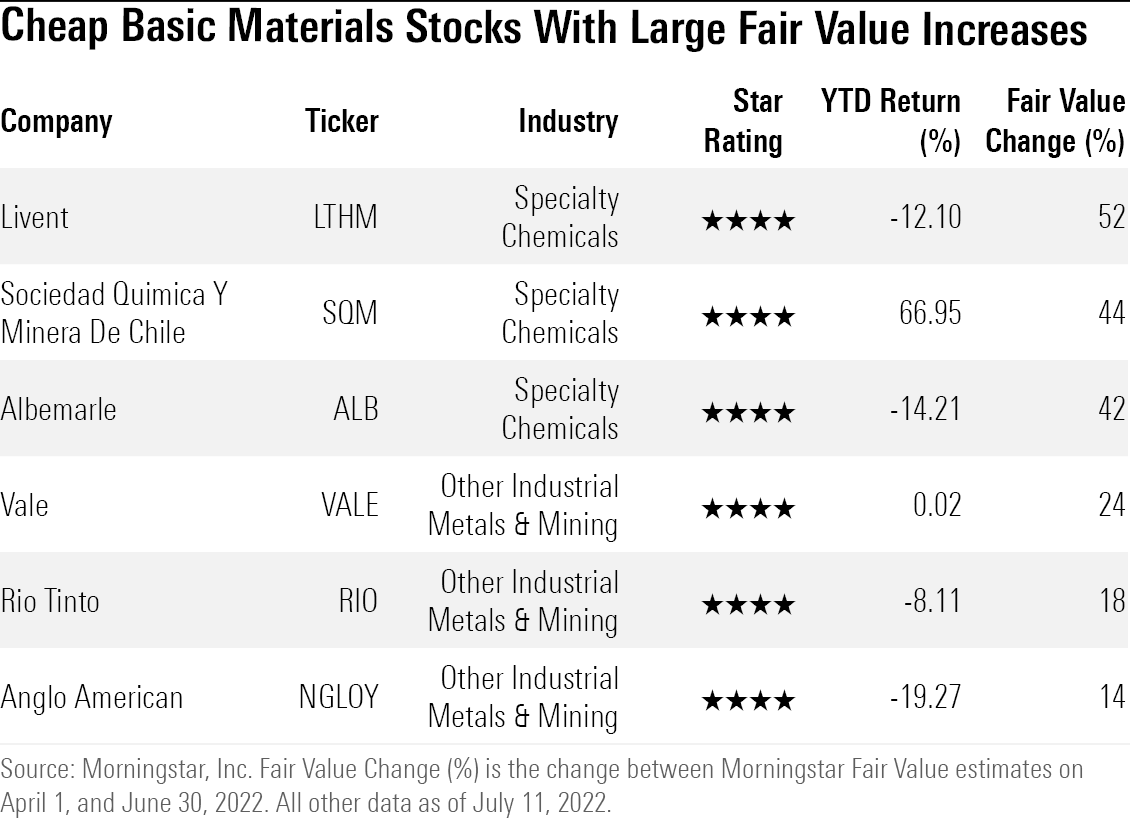

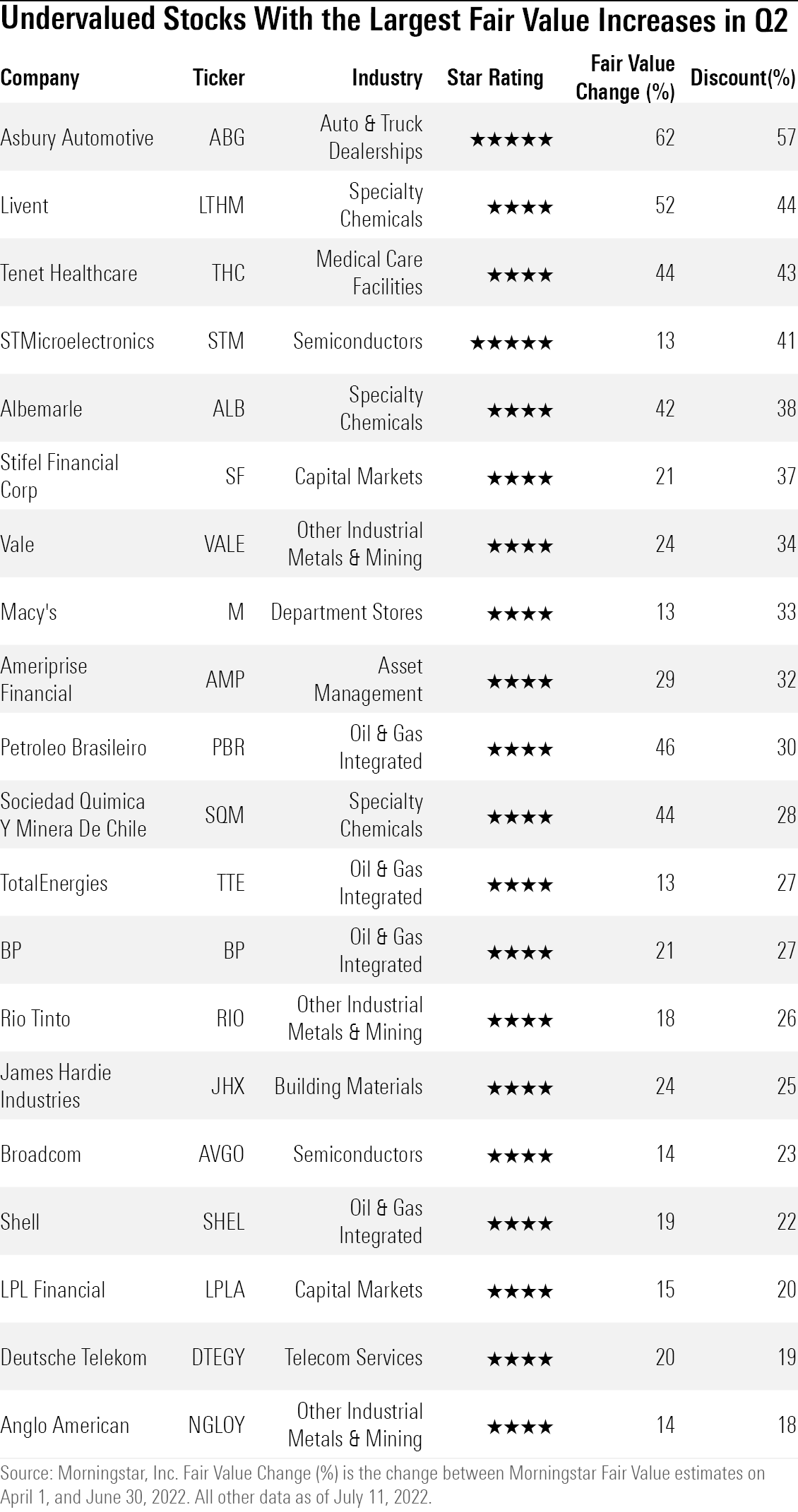

We screened for companies with the largest fair value increases between the start, and end, of the second quarter. Then we looked for companies that are undervalued carrying Morningstar Star Ratings of 5- or 4-stars.

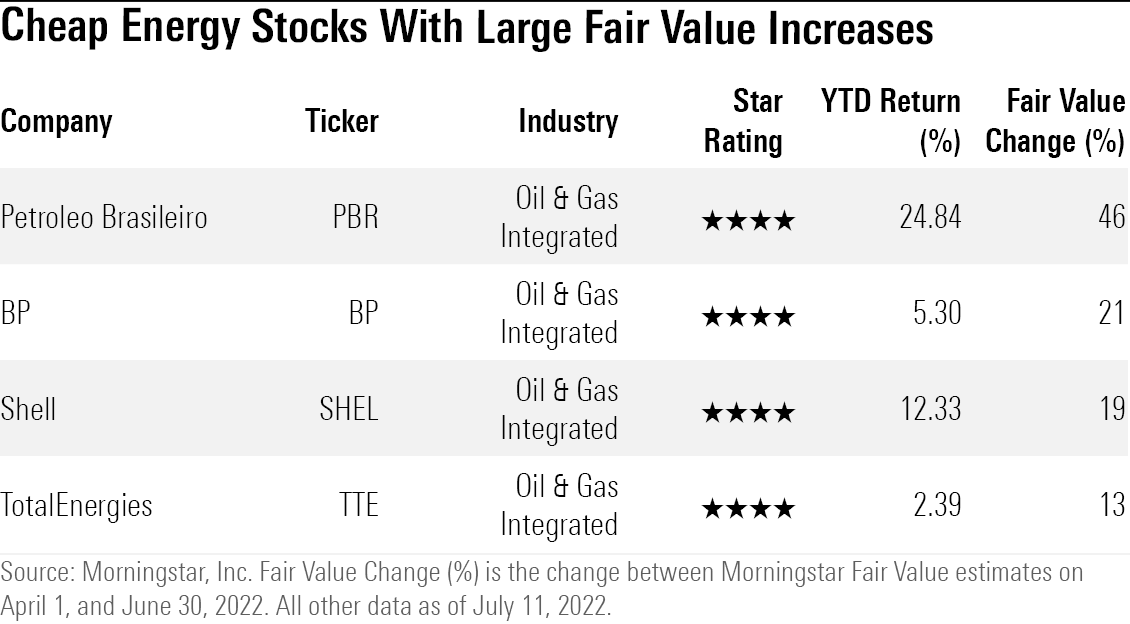

Leading the second quarter’s fair value increases were stocks in the basic materials sector, whose estimates rose an average of 9%, and energy, up an average of 5%.

Below, we have highlighted which stocks from those sectors Morningstar analysts believe are significantly undervalued. A more extensive list of 20 undervalued stocks with the largest fair value increases in the second quarter can be found at the end of the article.

Basic Materials

Lithium stocks are at the forefront of those receiving the largest fair value upgrades in the sector. Livent's LTHM fair value estimate rose to $38.00 from $25.00, Sociedad Quimica Y Minera De Chile's SQM increased to $115.00 from $80.00, and Albemarle ALB to $320.00 from $225.00.

Underpinning the increases for those companies is Morningstar’s updated forecast for a rise in lithium demand, buoyed by the push for more electric vehicles in the next decade.

“Lithium spot prices have risen tenfold over the past 18 months and now sit at $73,000 per metric tonne. For producers whose realized prices lag spot movements, the good times are just getting started,” Morningstar strategist Seth Goldstein says. “As demand grows and new supply will likely face delays, we expect undersupply conditions will persist throughout the decade. This dynamic will keep prices well above the marginal cost of production.”

Goldstein and his team expect lithium prices to be around $70,000 per metric tonne in 2023 and then average in the mid-$30,000 range for the remainder of the decade. The marginal cost of production is currently estimated to be around $12,000 per metric tonne, Goldstein says.

The recent fair value boosts, along with recent stock declines, have left Livent, Sociedad Quimica Y Minera De Chile, and Albemarle trading in 4-star territory, at discounts of 25% or more.

Iron mining stocks also saw fair value estimate increases. While Morningstar basic materials sector director Matthew Hodge lowered near-term forecasts for iron prices to $120.00 from $148.00 per metric tonne into 2024. However, he raised his forecasts to $60.00 from $44.00 in 2026.

While lower near-term forecasts would typically decrease each company’s fair value estimate, the longer-term forecasts for iron prices resulted in a net increase in fair value estimates for Vale VALE to $20.50 from $16.50, Rio Tinto RIO, up to $78.00 from $66.00, and Anglo American NGLOY, which rose to $19.70 from $17.30. All three stocks now trade in 4-star territory.

Energy

Integrated oil & gas companies, which have their hands in every aspect of the industry from exploration and extraction to refining and transportation, had some of the largest fair value boosts in the second quarter, as Morningstar analysts updated their models following earnings results and higher oil prices.

The fair value increase, coupled with the 5.96% decline in the sector, has finally brought a number of energy companies back into undervalued territory. Leading the group in both fair value increases and discount is the Brazilian state-owned Petroleo Brasileiro PBR, also known as Petrobras.

Morningstar strategist Allen Good raised Petrobras’ fair value estimate to $16.40 per share from $11.20, due to recent high prices bolstering the firm's revenue, and updated forecasts for near-term oil prices. Good now models Brent oil prices at $104.00 in 2022 and $92.00 in 2023, up from the $76.00 in 2022 and $71.00 in 2023, forecasts that were set last January.

Investors should remain cautious of Petrobras, as the company recently changed its chief executive again, Good says.

“Brazilian President Jair Bolsonaro is behind the moves as he seeks to show he’s taking action over rising domestic fuel prices and possibly find management willing to absorb higher oil prices as Petrobras did in the past,” Good says. The company's current fair value estimate depends on their ability to charge consumers the market price for oil.

“If the government or new management revises the system, then Petrobras could begin incurring losses that would reduce our fair value estimate as well as risk the large payouts it began making given recent debt reduction and strong cash flow.” Good assigned the company a fair value uncertainty rating of Very High. The company is rated 4-stars.

BP BP, Shell SHELL, and TotalEnergies TTE also had fair value increases on updated forecasts for oil prices. BP’s fair value rose to $37.50 from $31.00, Shell’s to $68.00 from $60.00, and Total's to $62.00 from $52.00.

Exposure to Russia is an issue for both BP and Total, Good says. BP’s exposure is due to their 20% stake in Russian state-owned company Rosneft Oil ROSN. BP’s write off of Rosneft would induce a 3% decline to it’s fair value, Good says.

For Total, 17% of their production comes from Russia. While Total intends to stay in the region, a complete removal of its Russian operations could erase 16% from its fair value estimate. Following their increases, BP, Shell and Total are now 4-star stocks, with Total being the most undervalued among them, at a 27% discount.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2UWGQD7LCJCYNF3WQ5HHLP7UBE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)