Why Higher Fiduciary Standards Help Everybody

Trusting societies tend to be both happier and wealthier.

Separate and Unequal

Historically, financial advice has come in two flavors. Licensed brokers and insurance agents were compelled to recommend “suitable” investments, while Registered Investment Advisors—along with those serving retirement-plan investors, who are covered by the Employee Retirement Income Security Act—were mandated to act as fiduciaries, by considering solely the best interests of their clients.

Few investors appreciated the distinction; for most outsiders, the turf battles between financial-advisor groups made no more sense than the squabble between The People’s Front of Judea and the Judean People’s Front. However, the difference was meaningful. Under the standard of suitability, brokers could 1) suggest high-commission products, 2) compete in sales contests, or 3) favor investments from companies that take them golfing. Fiduciaries could not.

This might seem to be a minor disparity. After all, suitable investments were required to be acceptable. Also, advice from fiduciaries was also imperfect. Not only did fiduciaries sometimes make mistakes (that being the human condition), but over time the asset-based fees they preferred sometimes proved costlier to their clients than even high-commission investments.

The Big Picture

The problem occurred when adopting a broader perspective. Because many brokers had divided loyalties, investors became wary of all financial professionals, fiduciaries included. In a 2011 survey (it’s dated, I know, but I doubt the results have much changed), several thousand participants were asked their views of 1) stockbrokers and 2) investment advisors, with a response of 1 indicating “I do not trust at all” and a response of 5 meaning “I trust completely.” Half the scores for investment advisors were 1 or 2, as were 67% of the scores for stockbrokers.

Distrust is unproductive. When buyers doubt the veracity of sellers, they may decide not to complete a deal. Or they may proceed, but only after researching the source. The first decision prevents the transaction entirely, while the second permits it, but with a frictional cost. Neither outcome is optimal.

Even if the exchange does occur, without requiring extra work from the customer, unmet expectations can impose additional costs. To cite a very recent case—I received the phone call just a few hours ago—my son learned upon arriving in Paris that his room rental host had exaggerated when claiming that the unit possessed air conditioning. With Paris projected to hit 97 degrees on Wednesday, my son now will spend time (and likely money) procuring alternative lodging.

The Wallet Test

Such was my hypothesis that a country’s trustworthiness is related to its wealth. Time to run the test. Nowhere could I find a study that measured national business credibility. However, I did find a related item: the frequency with which a country’s citizens returned lost wallets that they found. (In truth, the wallets were planted rather than genuinely lost, making this an untrustworthy test of trustworthiness!) The source for that data was an article from Science, “Civic honesty around the globe,” by Alain Cohn, Michel André Maréchal, David Tannenbaum, and Christian Lukas Zünd.

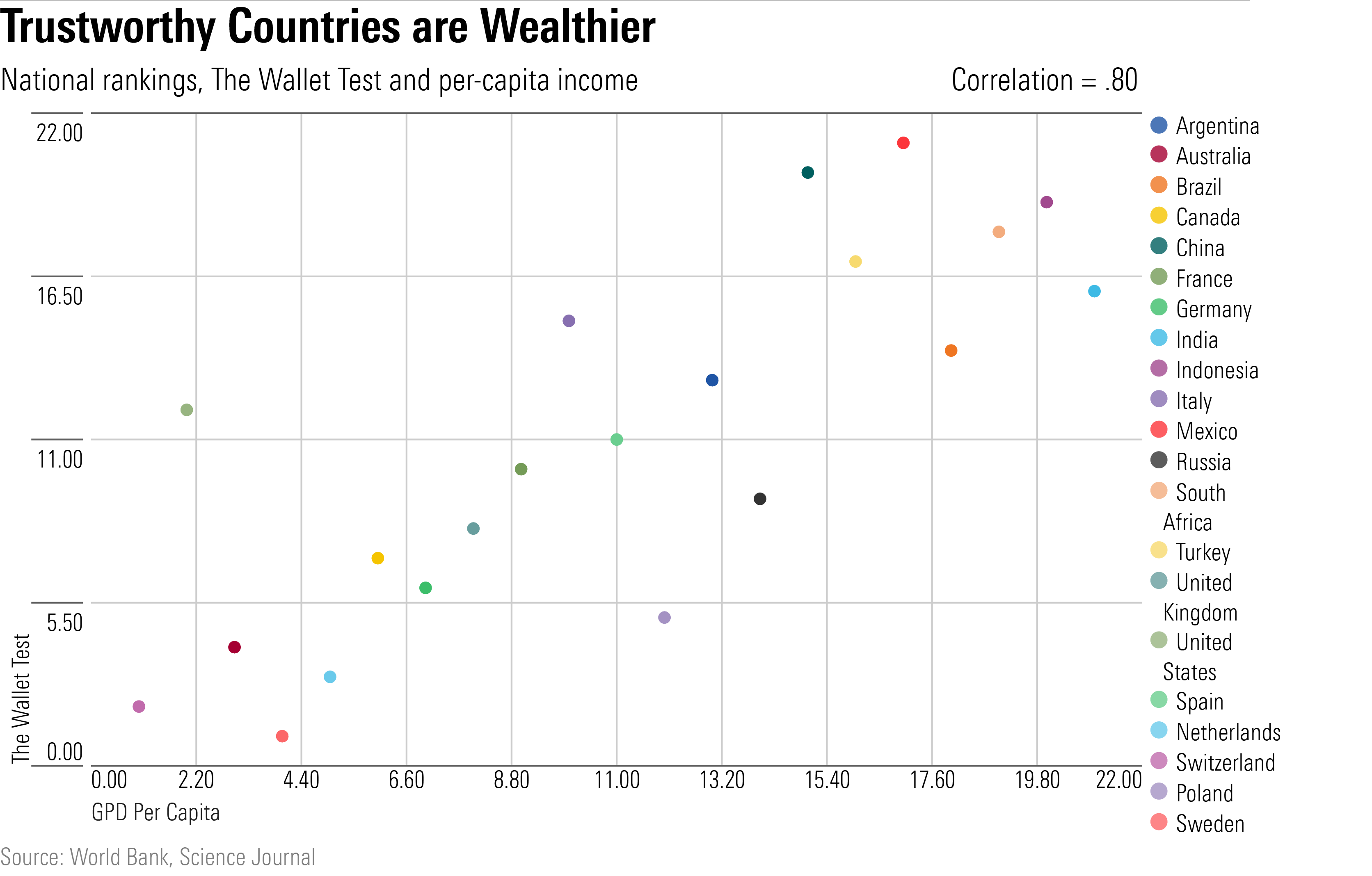

Close enough. I ranked the results for the lost-wallet study for 21 large economies, which I then compared against the national rankings for per capita gross domestic product. Thus, Sweden scored first on the lost-wallet test, with more than 80% of its citizens returning wallets that contained money, while landing fourth in per capita GDP. In contrast, only 15% of Mexican subjects returned wallets, placing Mexico 21st on the lost-wallet test. The country had the 17th highest per capita GDP.

As suggested by those cases, the two measures showed a positive relationship. Citizens of wealthy countries tend to be more trustworthy.

Happy Days

Besides introducing inefficiencies, distrust breeds headaches. Better a deal that can be settled by a handshake than one that necessitates a sharp-eyed lawyer, should the other party attempt a swindle. Who needs the hassle? As my son’s phone call demonstrated, nor do customers enjoy learning they have been baited and switched. Quite the contrary: They tend to stew over the experience.

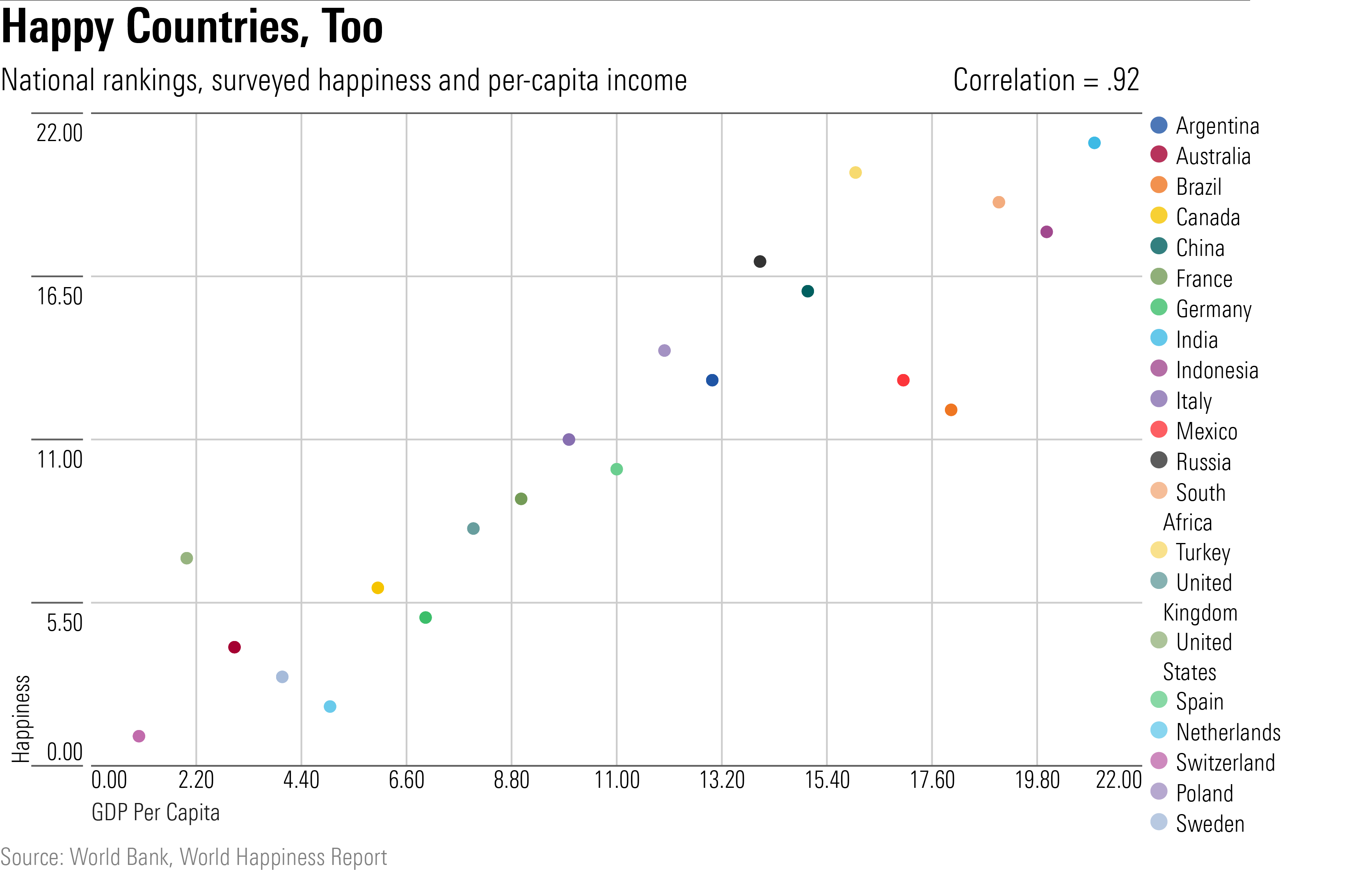

In short, societies that enjoy mutual trust are likelier to be happy than those that are constantly on guard. They therefore are also likelier to be wealthy, as happiness is not merely a state of mind. It is also a state of the pocketbook. As it turns out, happiness is even more strongly correlated with national income than are the results of the lost-wallet rest.

The following chart supports that statement. It once again depicts the per capita GDP rankings of those same 21 countries, this time against the rankings derived by the World Happiness Report, which asks citizens of 146 countries to rate their level of happiness. Among this group, Switzerland is both the happiest and wealthiest country, while India is both the unhappiest and poorest.

It would be imprecise to say that money brings happiness. Perhaps it is happiness that brings money. That explanation seems implausible, but it is possible, because correlation statistics cannot separate cause from effect. We know only that the relationship exists, as does the link between trustworthiness and wealth. This column’s charts do not directly prove my assertion that trust breeds happiness, and happiness leads to wealth. But they are consistent with the claim.

The Good News

Fortunately, for those who are convinced by my argument, the Securities and Exchange Commission has done its part to advance the national cause. In June 2020, the SEC enacted Regulation Best Interest, which upgraded the suitability standard by mandating that brokers consider their customers’ “best interest.” This requirement is not as strict as it sounds—unlike fiduciaries, brokers are not “solely” responsible to their clients when making recommendations—but it certainly improves upon what it replaced.

Consequently, I expect that over time American investors will become more trusting of financial advisors, thereby upgrading the nation’s collective mental health, as well as its wealth. In the grand scheme of things, of course, the SEC’s regulation is just one drop in a very, very large social bucket. But better a drop be added than removed.

Correction: Article was corrected to include Michel André Maréchal's full name.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5N6PBZJLMJEIXBH6EHTKPDK6NE.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FIN36RNGOFABFDS2NCP2RCCG3I.png)