Bitcoin’s Big Chill

How a temporary freeze by a lending platform called Celsius left bitcoin investors out in the cold.

Temperatures may have soared across the continental United States in recent days, but watchers of cryptocurrency markets are shivering. The industry has experienced a prolonged contraction and may be in the early stage of what’s known as a “crypto winter”: the fallow period of flat returns between booms and busts.

Those concerns intensified last week as Celsius, a centralized lending platform for cryptocurrencies, announced a temporary suspension of withdrawals. Individuals who deposited their digital assets with Celsius woke up Monday, June 13, to find they could no longer access their savings–estimated at more than $11 billion–for the foreseeable future.

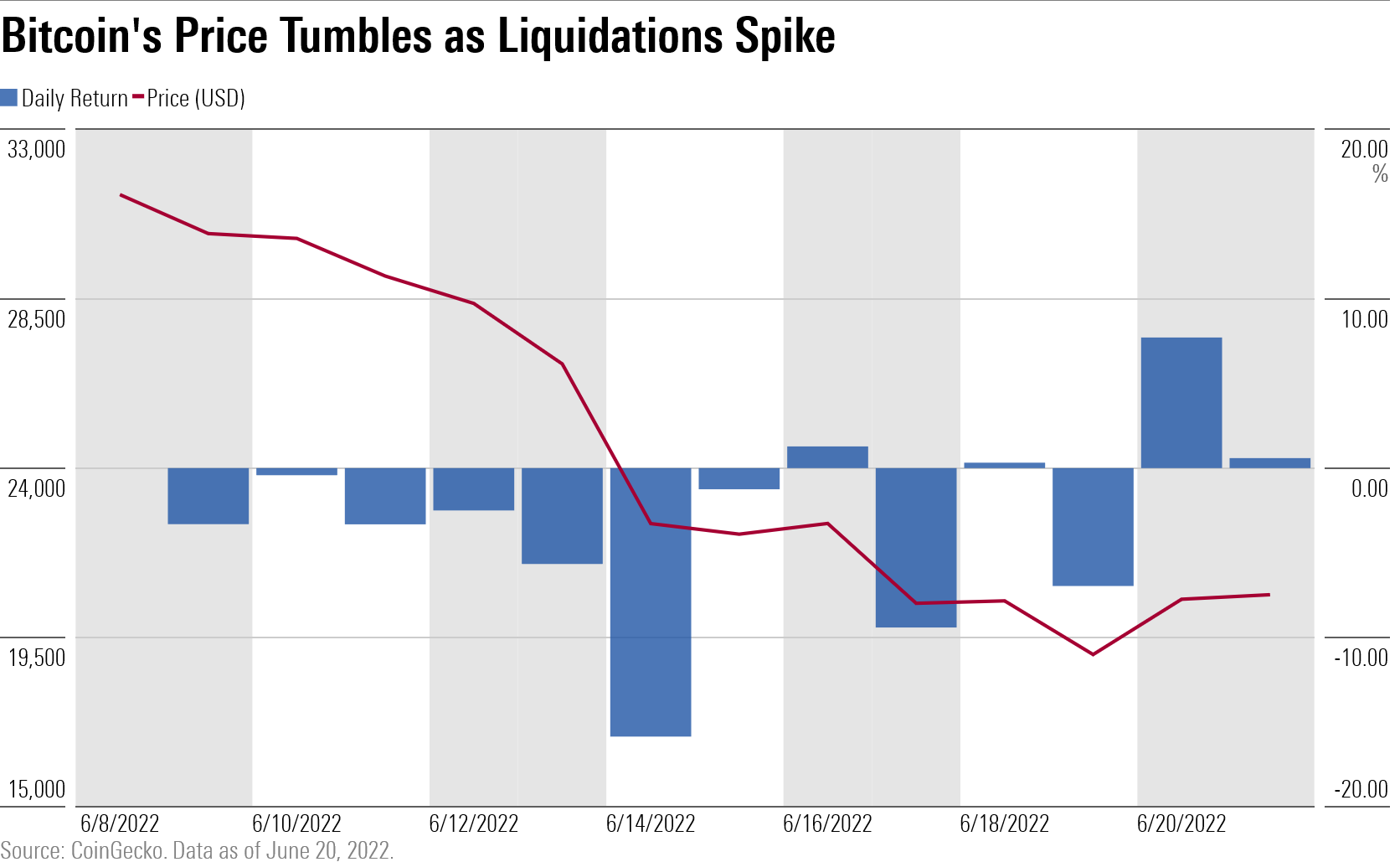

The news sent the price of bitcoin plunging from $29,000 on June 11 to below $20,000 by June 18, a breathtaking 39% drop even amid the ongoing slump in cryptocurrency prices. The relationship between a tiny lender and a $413 billion behemoth is not immediately clear, but an examination into the cause-and-effect relationship that links the two reveals how the closed cryptocurrency circuit can spur a destructive feedback loop in the wrong conditions.

Staked Reputation

Like many financial conflagrations before it, Celsius’ meltdown started in media res with a seemingly unrelated incident. Cryptocurrency watchers began sounding the alarm on a market phenomenon on June 8 known as a “de-pegging,” where digital assets that should trade in tandem begin to diverge in price. (This is the same kind of phenomenon that cratered the Luna stablecoin ecosystem back in May.) In this case the two securities involved were different incarnations of the same asset: ether, the native cryptocurrency of the Ethereum blockchain, and staked ether, which is practically identical to traditional ether, except it has far less liquidity.

How is this possible? Ethereum will most likely undergo an upgrade to its blockchain sometime over the next 12 months. The upgraded version of that blockchain is live but currently still in the pilot phase. Staked ether is simply ether that’s been locked up in this test environment. The owner of the staked ether still has a claim on that coin, but can’t access it until the upgraded version replaces the current version.

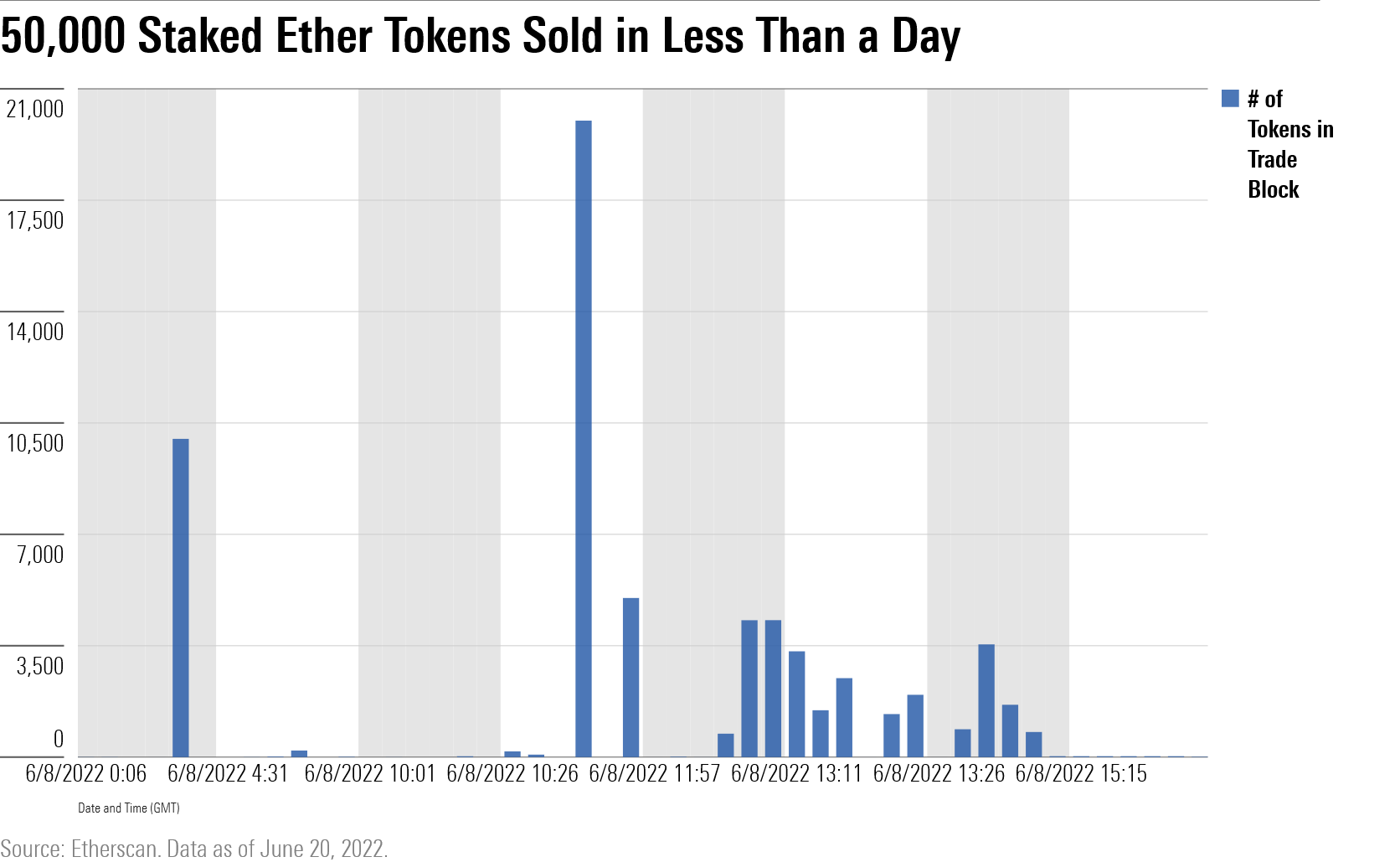

On June 8, a major investor offloaded 50,000 of these staked ether tokens in a short time.

This fire sale flooded the market with staked ether, pushing the price down, and splintering the exchange rate to traditional ether.

According to blockchain research firm Nansen, Celsius stashed at least $475 million in this staked version of the coin. That’s a large position by any stretch of the imagination, but while staked ether doesn’t track the price of ether exactly, with the right risk management strategy a savvy lender can usually weather short-term bumps in the exchange rate even for a position that size.

Hacks and Sacking

Unfortunately, Celsius appears to have inadequately managed risk. It had made previous missteps that put the lender in a wobbly spot–the wrinkle in staked ether’s price was just the last wave that sent it over the falls.

Celsius advertised interest rates of up to 17% on customer deposits. In order to fund those eye-watering rates, Celsius piled its customers’ deposits into risky asset-pooling schemes–the crypto equivalent of junk bonds. Two separate incidents that occurred over the course of 2021 bled Celsius of more than $100 million in assets, weakening its financial position. These losses occurred on different decentralized finance, or DeFi, platforms that lacked proper security features. Celsius suffered an even bigger blow in May 2022 when the collapse of the Luna cryptocurrency forced the firm to reclaim more than $500 million of digital investments that Celsius had parked on behalf of their customers in Luna’s vaults.

Celsius’ customers grew dissatisfied with the firm’s poor risk management. They began pulling out of the platform en masse–according to some reports, yanking out as much as $1 billion between March and May.

As investors sapped Celsius’ liquid reserves of ether, eventually Celsius realized it would have to dip into its staked ether to meet redemptions–even as that token was under pressure from crypto heavyweights. The crumbling exchange rate created major unrealized losses on these positions, leaving Celsius with a choice: either realize the losses or stem the tide of redemptions. The firm chose the latter route.

It’s a Small World After All

Celsius’ meltdown is still rippling through the crypto market, but the impacts are diffuse and unsettled. No one knows where they’ll stop, but after Celsius’ announcement, crypto market participants began the race to identify the next dominoes to fall.

Within a few days, scrutiny transferred to Three Arrows Capital, a hedge fund owned by crypto celebrity Su Zhu. Crypto observers based their research on trading activity in wallets, which contain digital records of cryptocurrency transactions that anyone can review but obscure the identity of the owner.

Red flags started flying when a wallet attributed to Three Arrows by blockchain data provider Nansen posted a flurry of unusual trades. The owner of the wallet offloaded a significant amount of staked ether—the same asset that had taken down Celsius. This slew of transactions included one sale of least 30,000 tokens in one block.

If this wallet did indeed belong to Three Arrows, why would the firm try to sell so much of an illiquid asset in such a short period of time? A sale that massive could indicate many things, but one possibility was that Three Arrows was tipping over the piggy bank to meet margin calls.

Margin calls can happen when a fund borrows money to make a leveraged bet and posts an asset as collateral. If the asset falls in price, the lender calls for more money or securities to back the loan.

This pattern of transactions opened up a frightening possibility. Selling assets at fire-sale prices to meet margin calls usually indicates that a firm has bitten off more leverage than it can chew and is facing liquidation on several fronts at once. If Three Arrows could not scrape together enough assets to answer all its margin calls in time, its lenders would automatically liquidate the cryptocurrency they held as collateral.

On June 16, the firm confirmed the grim news by announcing it failed to meet margin calls over the weekend. Three Arrows, once a $10 billion titan of the crypto native hedge fund world, was functionally insolvent. The same day, BlockFi unveiled itself as one of the lenders that had liquidated Three Arrows. In a twist, Three Arrows had actually made a venture investment in BlockFi in 2020, underscoring that the financial circles at the top of the crypto heap are still fairly small. Further illustrating that point, the Financial Times has reported that Zhu and his co-founders’ own capital make up the majority of Three Arrows’ assets.

Does Tether Have Your Back?

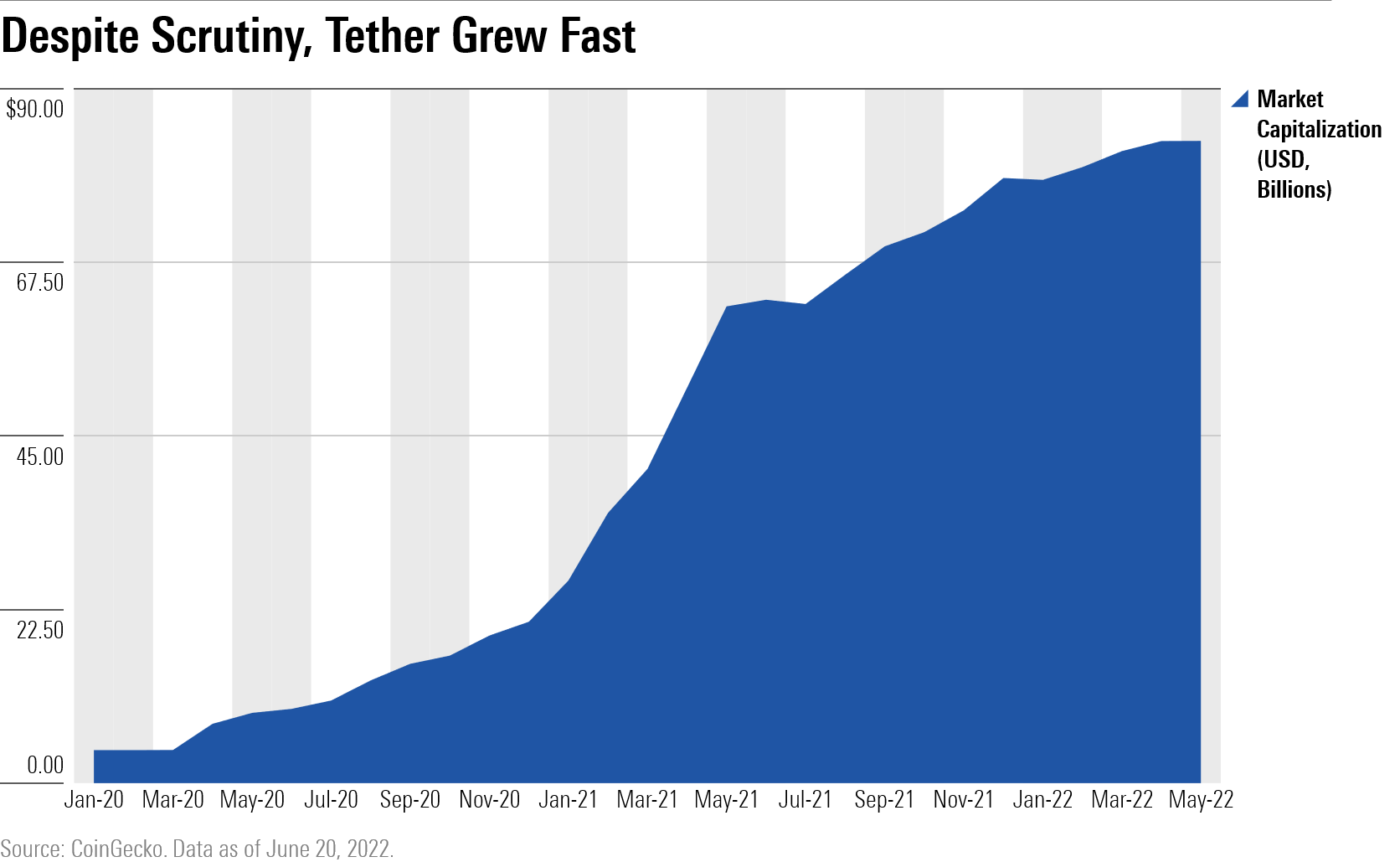

The same cannot be said of Tether, the largest stablecoin in the cryptocurrency ecosystem. Tether seeks to maintain a fixed exchange rate with the U.S. dollar and claims to hold at least $1 worth of cashlike securities for every coin that it issues.

That’s a nice sales pitch, but Tether relies on investors to take it at its word. The firm has skirted questions about the quality of its reserves for years, opting to weather the ensuing waves of scrutiny. In lieu of a detailed audit of the firm’s holdings, it has offered only a statement of attestation from a Cayman Islands-based accounting firm. Just recently, the firm shot down the suggestion of sharing details on its $40 billion portfolio of U.S. government bonds, claiming it would jeopardize the firm’s “secret sauce” for generating yield. Incredibly, Tether’s strategy worked: The coin exploded in popularity, becoming the third-largest cryptocurrency by market cap and embedding itself in the fabric of the cryptocurrency trading ecosystem in the process.

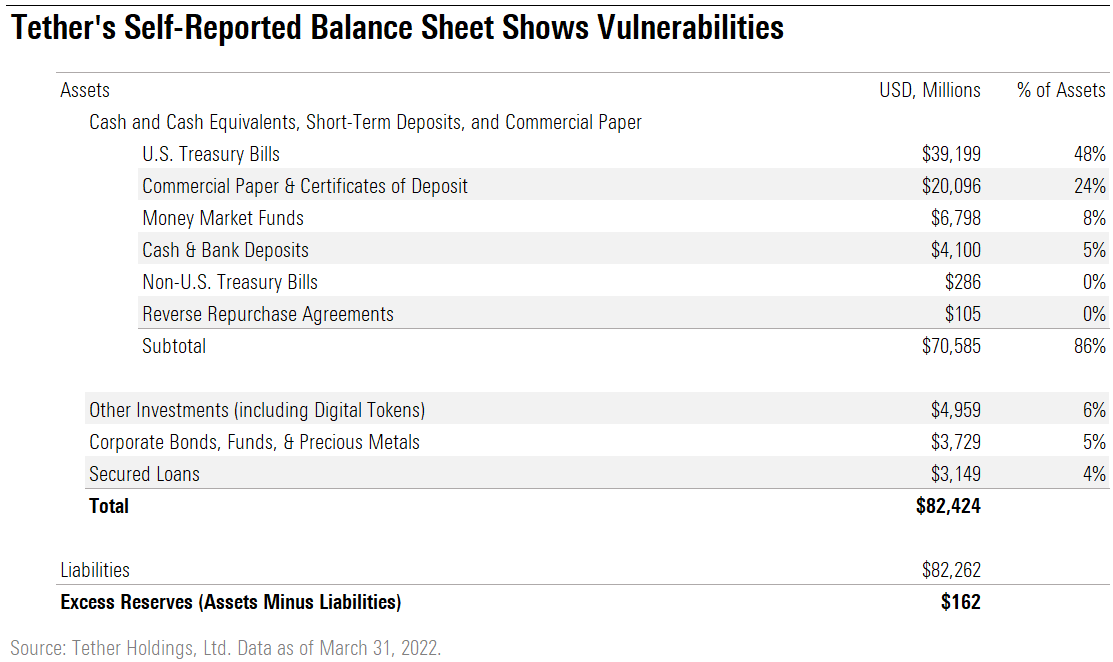

Tether’s caginess is still suspicious, though, because backing deposits by more than 100% does not make for good business. For every dollar’s worth of deposits you receive, you have to go out and spend or earn more than a dollar in order to guarantee it. In the past, this has led researchers to speculate that Tether has taken shortcuts to maintain a fully funded balance sheet by buying lower-quality commercial paper that generates a higher yield. There’s also the fact that Tether counts among its assets a string of loans to other cryptocurrency market participants, including Celsius, collateralized by bitcoin.

Although Tether aspires to serve as a digital savings account, there is no FDIC insurance nor legal restriction on the risks it takes. Plus, Tether’s margin for error is slim. As of its last attestation back in March, it had only $162 million in excess reserves: That’s $1.002 for every $1 it owes investors. Nearly every corner of the financial markets is down 0.2% since then, and it’s likely that Tether’s $4.9 billion digital assets portfolio has lost more than that.

Tether has reassured the market by pointing out that it allows its investments to mature rather than selling them, which means it receives the full par value of the investment (assuming no defaults). Setting aside the question of defaults, Tether can only hold its assets to maturity if it doesn’t face more redemptions than its maturing assets.

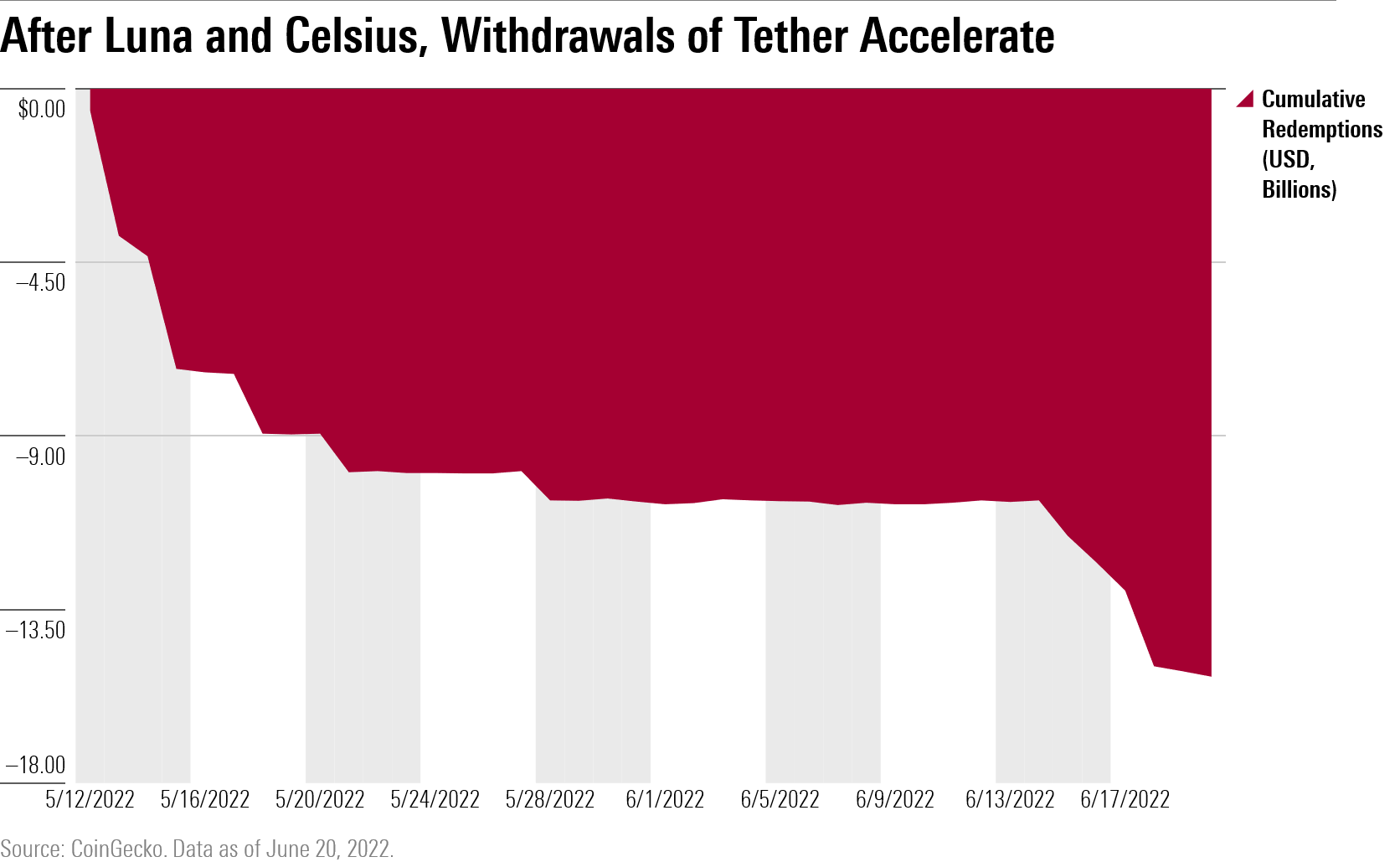

Back in May, we posed the question of whether fear brought on by the collapse of the Terra stablecoin ecosystem would spread. Indeed, redemptions of Tether have accelerated since Terra’s default, putting Tether’s liquidity management to the test. Investors have pulled more than $13 billion from Tether since Luna’s collapse on May 12, none of which is captured in its most recent attestation. At this point, Tether’s financial condition is far from stable, and will remain so until its next report–presumably after the second quarter wraps up in June.

All Roads Lead to Bitcoin

The mayhem happening with Celsius, Three Arrows, and Tether makes just a dent in the price of bitcoin because of the unique way leverage works in the cryptocurrency ecosystem. Celsius used customer deposits of bitcoin (and ether) to borrow stablecoins, which track the U.S. dollar.

It’s common in the crypto markets to post bitcoin as collateral. It’s the largest and most-liquid cryptocurrency, so market participants view it as a reserve asset; many lenders, like Tether, accept bitcoin as collateral on money they lend out. The problem with highly leveraged borrowers like Celsius and Three Arrows is that as the crypto market tumbled, the firms’ assets shrunk while their debts did not change. Once these borrowers ran out of assets to sell to prop up their loan, lenders like Tether were forced to sell the bitcoin that borrowers gave them before it fell below the dollar value of the loan to ensure they remain solvent. (This is called a liquidation.) As one lender sells its bitcoin, that pushes the price down. This triggers other lenders that hold bitcoin deposits as collateral at a more-favorable price, and so on down the line. Bitcoin’s price chart illustrates that domino effect.

Compared with other reserve assets like gold and the U.S. dollar, Morningstar analysts agree that bitcoin does not have many practical use cases outside of the cryptocurrency financial system. That means there’s no stabilizing external force to counteract the cascade of liquidations coming from inside the house. With each meaningful price milestone that bitcoin plummets past–first $30,000, then $25,000, now $20,000–it triggers a new wave of sales. With no fundamental floor value like a par value or a claim on residual assets, it’s unclear when crypto investors will be able to get off this ride.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)