The Second Quarter in U.S. Equity Funds

Deep-value funds showed some resilience, while aggressive-growth offerings crashed.

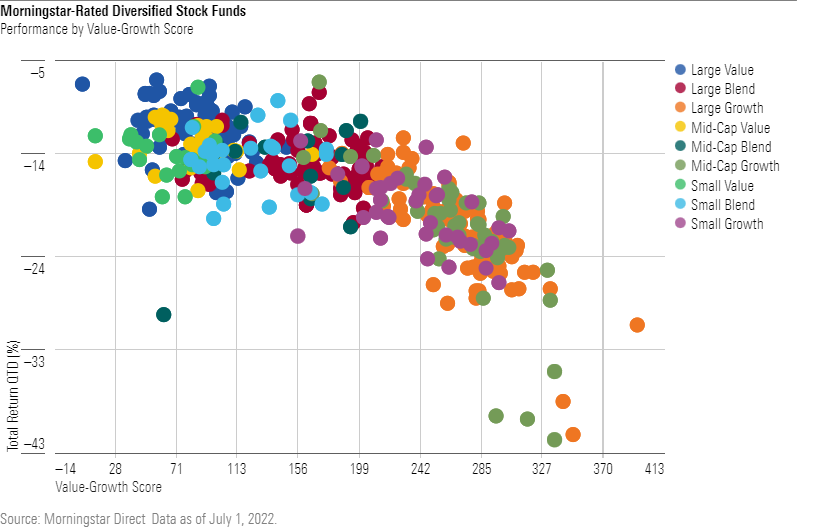

U.S. stocks posted steep losses in 2022’s second quarter. After sliding 5.3% in the first quarter, the Morningstar U.S. Market Index fell 16.8% from April through June 2022. Value funds—which focus on stocks trading at low multiples of their earnings—continued to outperform their growth counterparts. In fact, a fund’s Value-Growth Score, which measures the value and growth characteristics of its underlying stock holdings, said a lot about its relative performance during the quarter: The lower the fund’s measure (with 0 being the most value-leaning), the better it performed. Larger-cap equities fared a bit better than smaller-cap stocks, but the effect was modest. A few sectors, such as utilities, energy, and consumer-defensive stocks, had modest losses, while traditional growth sectors, such as communication services, technology, and consumer cyclical, had big declines.

Morningstar Category returns told a similar story. While all nine diversified stock categories posted losses, the large- and mid-cap value categories performed best, with losses of 11.4% and 12.9%, respectively. Meanwhile, large- and mid-growth funds lost 20.8% and 20.6%, respectively—the quarter’s worst-performing peer groups. While the typical utilities, energy, and health funds posted losses ranging from 6% to 11%, losses for financial, communications, and technology sector funds ranged from 17% to 25%.

Funds That Won by Losing Less

None of the funds that Morningstar analysts cover posted gains for the quarter, but the most value-oriented funds in each category tended to hold up better than their growth-leaning counterparts. Poplar Forest IPFPX slid just 7.3%, which was better than most large-value Morningstar Category rivals and 4.9 percentage points better than the Russell 1000 Value Index. Managers J. Dale Harvey and Derek Derman build one of the category’s most deeply value-oriented concentrated portfolios. Healthcare picks such as United Therapeutics UTHR and Merck & Co. MRK, whose shares had double-digit gains, helped to mitigate the fund’s overall decline.

Vanguard Dividend Growth VDIGX lived up to its reputation as a conservative fund that makes up ground in down markets. Its 9.2% second-quarter loss was much better than the 15.0% and 16.1% losses for its typical large-blend peer and the S&P 500, respectively. Manager Don Kilbride looks for reasonably priced dividend growers and has favored consumer defensive and healthcare stocks, which gave it an edge. Household and personal products company Colgate-Palmolive CL and health insurance giant UnitedHealth Group UNH were among its top contributors.

Vanguard Capital Opportunity VHCOX fell 14.0% in the quarter but ranked in the large-growth category’s top-decile and lost less than the Russell 1000 Growth Index’s 20.9% decline. It has a big helping of value-oriented healthcare stocks, which lost less than the pricier, tech-related growth stocks that constitute a larger portion of the index and typical peer’s portfolio. Eli Lilly LLY, Seagen SGEN, and Biomarin Pharmaceuticals BMRN had double-digit increases during the quarter.

Aggressive-Growth Funds Took It on the Chin

Aggressive-growth offerings, particularly those focused on technology stocks with high valuations, fell sharply during the quarter. ARK Innovation ETF ARKK has taken a sharp turn since posting triple-digit gains in 2020. It fell 39.7% during 2022’s second quarter and was among the worst performers in the mid-growth category. Manager Cathie Wood has a huge appetite for edgy tech stocks, such as artificial intelligence and blockchain companies that she and her team think will revolutionize their sectors and globe. Many of the fund’s largest tech holdings, such as cryptocurrency exchange Coinbase COIN, digital payments company Block SQ, and video game developer Unity Software U, lost a third of their value.

Morgan Stanley Institutional Growth’s MSEQX fortunes also have reversed since it posted eye-watering gains in 2020. It dropped 41.2% in the second quarter, roughly double the declines of its typical large-growth rival and the Russell 1000 Growth. The feast-or-famine behavior is typical for the compact, high-conviction portfolio that manager Dennis Lynch and his team of researchers build. Its massive technology stake—particularly top holding Cloudflare NET--weighed on results. But the fund has rebounded from rough patches.

Cryptocurrency’s crash hurt few thematically driven funds as badly as Emerald Finance & Banking Innovation HSSIX. The fund’s massive 38.8% drop placed it woefully behind its financials-sector category rivals. It has become much more volatile since longtime managers Kenneth Mertz and Steven Russell shifted their focus from regional banks toward cryptocurrencies and crypto-related businesses in late 2020. Top-20 holdings Silvergate Capital SI and Galaxy Digital Holdings BRPHF, which have businesses dedicated to the digital assets and blockchain technology industries, fell precipitously and detracted the most during the quarter.

/s3.amazonaws.com/arc-authors/morningstar/7ea530af-5221-4333-b9d9-200e96a1641c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/7ea530af-5221-4333-b9d9-200e96a1641c.jpg)