Top Stock Picks Among Lithium Producers

A higher price forecast for the metal boosts our valuations for the stocks.

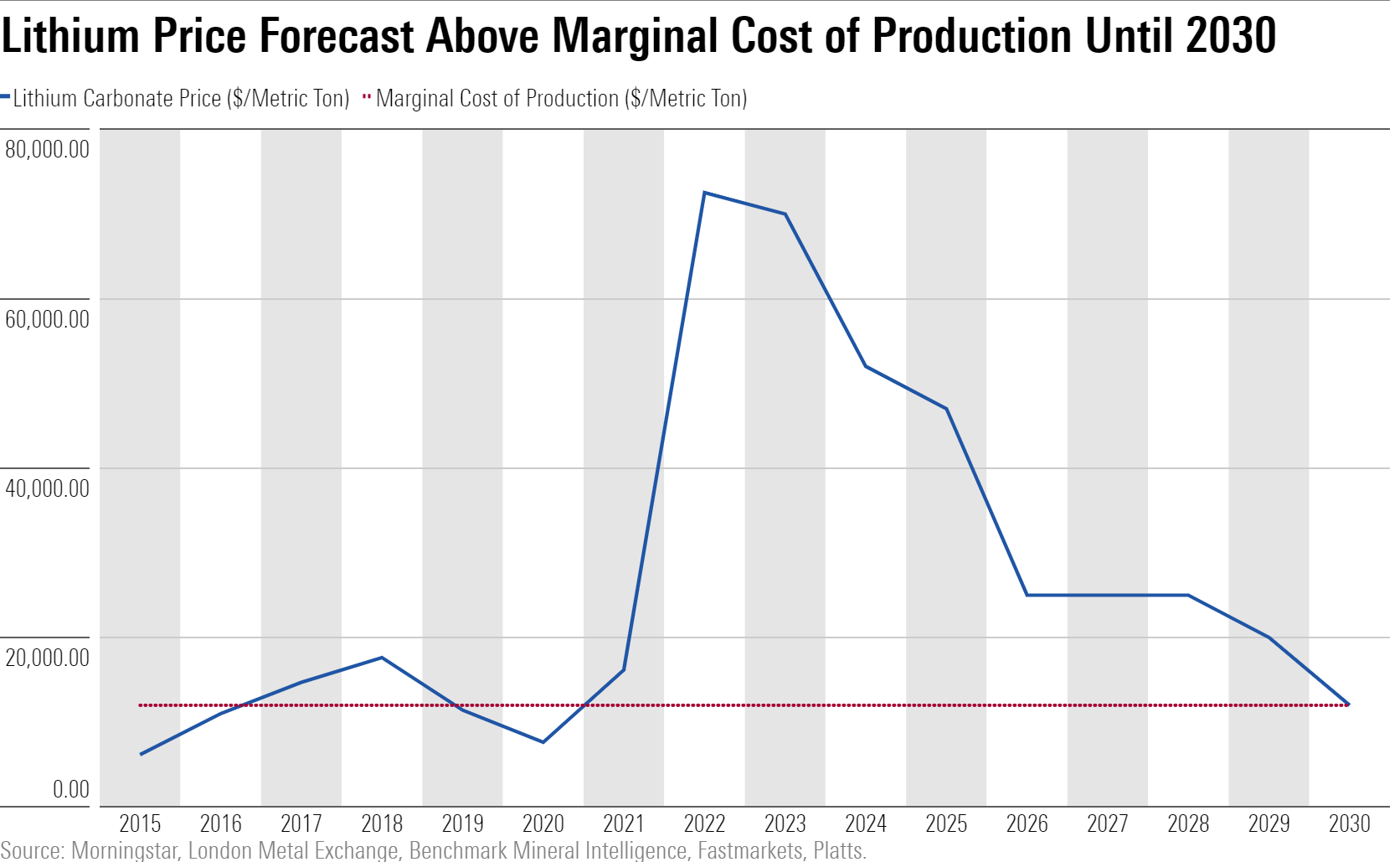

Thanks to undersupplied market conditions, lithium prices per metric ton are currently in the mid-$70,000 range. This is near the all-time highs set earlier this year and well above our marginal cost estimate of $12,000 per metric ton. To reflect the current environment, we have raised our near- and medium-term lithium price forecast. While we expect prices to moderate slightly, we forecast lithium carbonate prices will average $70,000 per metric ton in 2023, down less than 10% from current levels.

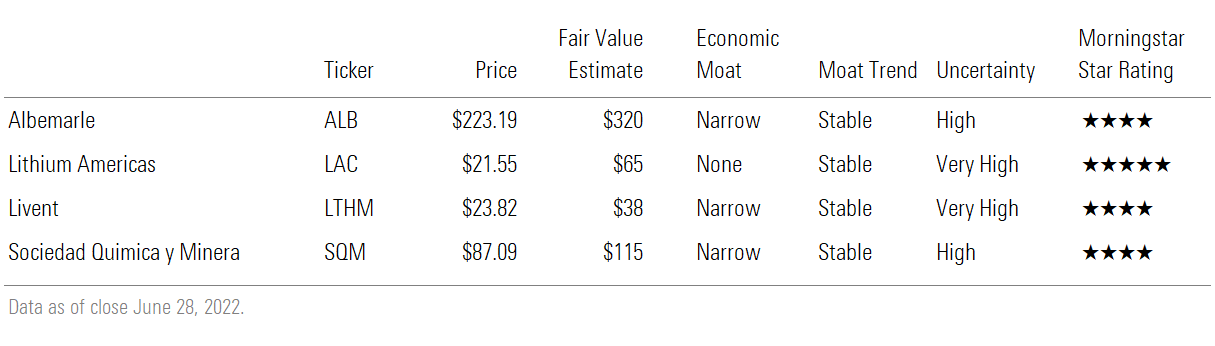

After updating our valuation models to incorporate our higher price forecast, we raised our fair value estimates for the lithium producers we cover.

- Our fair value estimate for narrow-moat Albemarle ALB increased to $320 per share from $290.

- Our fair value estimate for no-moat Lithium Americas LAC increased to $65 per share from $49.

- Our fair value estimate for narrow-moat Livent LTHM increased to $38 per share from $35.

- Our fair value estimate for narrow-moat SQM SQM increased to $115 per share from $100.

Our top pick is Lithium Americas, whose stock is trading in 5-star territory at roughly one third of our fair value estimate. For investors who can withstand the additional company-specific risk, we view Lithium Americas’ current price as an excellent opportunity to pick up shares of an emerging producer. The company holds additional risk largely because it has not yet produced any lithium; any of its three resources under development may underperform management expectations for timing, cost, or volume. This underpins our very high uncertainty rating for Lithium Americas versus our high uncertainty ratings for Albemarle and SQM, which already have proved their ability to increase production.

For investors who want to eschew increased company-specific risk, we also view Albemarle, Livent, and SQM as undervalued; all trade in 4-star territory based on our updated fair value estimates. Of these three, our top pick is Albemarle on the basis of an attractive valuation and lower relative risk.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2UWGQD7LCJCYNF3WQ5HHLP7UBE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)