Your Value Fund Might Be Buying Meta and Netflix Stock

Former growth-stock darlings are now landing in the value stock bucket.

Some formerly high-flying growth stocks have now fallen so far that they’re turning up in value-stock index funds.

That means investors in some value-focused exchange-traded funds and traditional index funds now hold stocks that have long been associated with growth investing: Facebook parent Meta META, Netflix NFLX and PayPal PYPL. At the same time, some growth-stock ETFs are no longer holding those names.

Take the $52.2 billion iShares Russell 1000 Value ETF IWD. Meta is now its fifth-largest holding, making up 1.7% of the portfolio, and Netflix and PayPal have joined the fund. Meanwhile, the $60 billion iShares Russell 1000 Growth ETF IWF used to count Meta as its seventh-largest holding, now it ranks as the indexes 39th-largest holding.

What's more, these stocks may soon start appearing in portfolios of actively managed value funds.

This is the unusual result of a regular revamping of widely followed indexes managed by FTSE Russell, coupled with the significant drop in share prices among a group of stocks that were once the darling of investors seeking out fast-growing companies.

While these index changes are a regular occurrence, Morningstar analyst Ryan Jackson says it’s rare for stocks to enter the index as an immediate top-five position.

“The stature of some of these newcomers makes it a unique rebalance,” he says. He points to a June 2020 rebalancing of the same large-company stock indexes that saw healthcare stocks were moved into the value category. But even then, the biggest weighting of the newcomers represented just 0.24% of the Russell 1000 Value Index.

Russell's style indexes use price/book ratio to determine what constitutes a value stock, and the fall in Meta's share price put it in value territory. (Technically, the stock went from pure growth to what Russell considers a "partial" value stock.)

The stock has plunged 50% this year. Netflix is down 68% and PayPal is off 58.8%. Those falls have also made them value stocks by Russell's methodology. Technology stocks will comprise roughly 9% of the index, according to Russell, up from 7.4% before the changes.

“But it’s important to remember that IWD is still a relatively low-turnover fund that won’t look dramatically different after this. Most of the newcomers are split between this fund and IWF, its growth counterpart. So, while IWD will feature a new batch of stocks that investors don’t tend to consider “value,” it should stay true to its performance patterns,” he says.

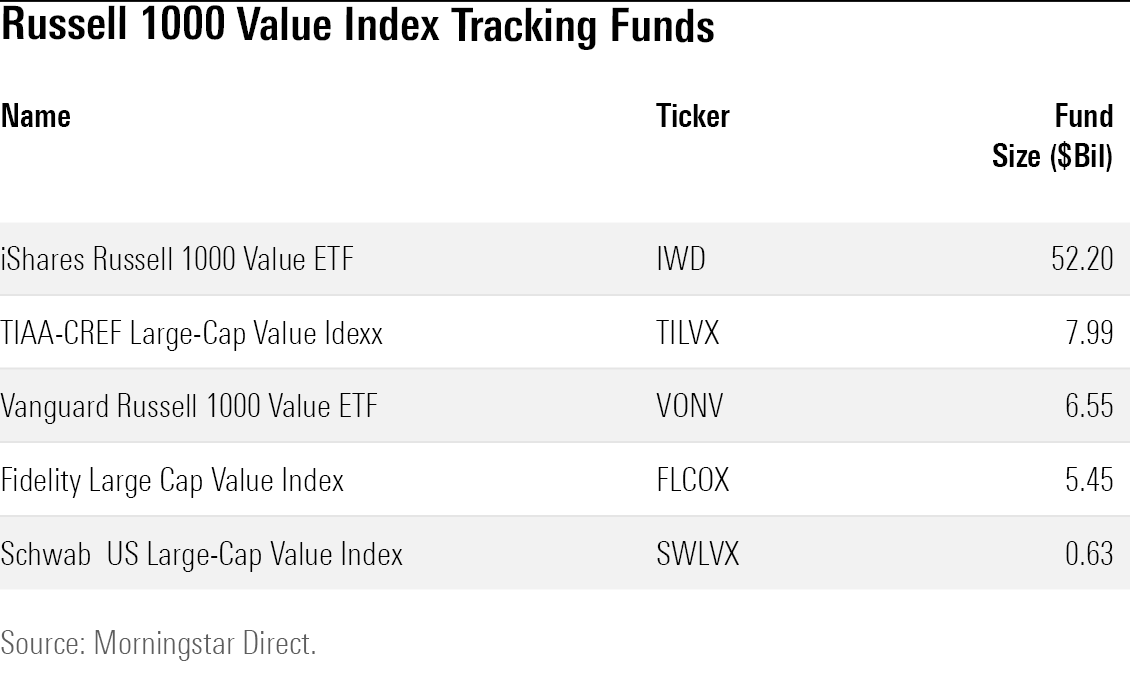

Five index funds directly track the Russell 1000 Value Index, and as a result, were directly affected by the change, including $6.6 billion Vanguard Russell 100 Value ETF VONV, and the $5.4 billion Fidelity Large Cap Value Index FLCOX.

Morningstar employs a different approach to determining where stocks land in the spectrum of growth, blend and value. Morningstar’s style score is based on a metrics such as growth rates for earnings, sales, book value, and cash flow. In addition, it factors in dividend yields and relative valuations such as the price/projected earnings ratio, price/book, price/sales and price/cash flow.

Growth stocks have higher readings on earnings and sales ratios, for example, and low dividend yields. Companies that end up at the lower end of the spectrum on these metrics land in the value category, and in the middle, core.

This shift could spill over to actively managed funds as well, as managers benchmark their portfolios against the Russell indexes and make changes to align with those indexes. Both the Russell 1000 Growth and Russell 1000 Value are benchmarks for many funds offered by major fund companies, including Vanguard, T. Rowe Price, and Fidelity Investments.

Russel Kinnel, director of mutual fund research at Morningstar, says it appears more value funds have already been buying shares of Meta recently. "I think that's more about the company getting cheap, rather than moving to the value index," he says. "I think some funds will add it because it's now in their benchmark, especially those who have wanted more social-media exposure but needed to be true to a value benchmark."

Up until recently, few value funds own big stakes in Meta. Only eight large value funds hold more than 3% of their portfolios in the company, according to Morningstar Direct.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)