Are Bank Stocks Undervalued?

Valuations are now closing in on recession average lows for JPMorgan, Bank of America and other high-quality bank stocks.

Investors have been selling U.S. bank stocks as fears of a potential recession have sent share prices plummeting. Yet the fundamentals behind their businesses signal that investors' worries may have swung too far to the negative, leaving many companies at a discount.

Recession risks have dragged on bank stock returns as investors have become less optimistic about the economy having a soft landing in the current inflationary environment, says Morningstar strategist Eric Compton.

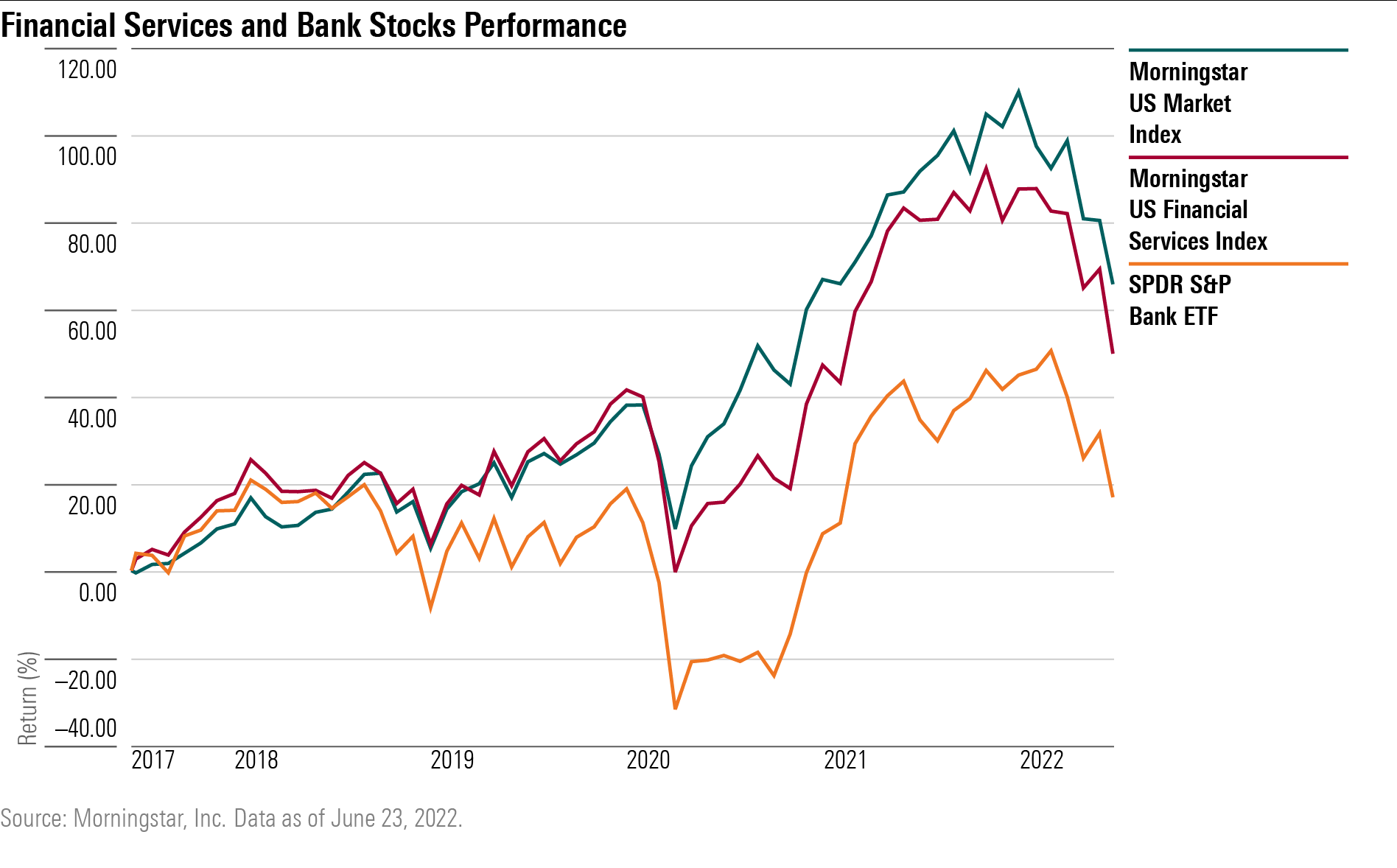

As of June 23, the SPDR S&P Bank ETF KBE has fallen 28.32% from its high on Jan. 13. The Morningstar US Financial Services Index is down 23.77% in the same period. Bank of America BAC, First Republic Bank FRC, and JPMorgan Chase JPM are down 25% or more, and are among the worst performing bank stocks this year.

“As recession sentiment has gotten more intense, people have gotten less optimistic about the economy having a soft landing during current rate hike environment as the Federal Reserve battles with inflation,” says Compton, who covers several U.S. banks. “As that sentiment gets worse, the market has fallen, and the banks, which are recession-sensitive, are not immune to that.”

But bank companies have a potential tailwind as well: rising net interest margins, or NIM. As the Federal Reserve hikes rates, it increases the spread between the interest rate banks borrow money from, such as customers depositing money into their accounts, and the interest rates they charge for loans.

Interest income can make up as much as 60% to 80% of total revenue, Compton says, setting banks up for a significant boosts in revenue and earnings in an environment when rates are rising. “That revenue boost is not being priced in,” says Compton, who sees recession fears as drowning out the NIM tailwind and pushing stock prices down.

There has also been little activity in building up loan loss reserves based on first-quarter data. “That is a major debate going on right now,’’ Compton says. ``Do we start to see some buildups in reserves for second-quarter results? Or do the banks mostly keep things steady for now?”

Rising loan loss reserves are often a signal that banks are anticipating an increase losses from customers unable to pay off their debt. Compton’s current impression is that many banks are fairly optimistic, or want to wait and see what happens to the economy before they take action.

That is also the case for banks that generate most of their revenue from credit cards, Morningstar analyst Michael Miller says. Companies as Capital One COF and Synchrony SYF have dropped 25% or more year-to-date. Discover DFS is down 17.79%. Miller attributes those losses to recession fears and worries that an economic downturn may drive up the number of customers not able to pay off their credit card debts. Yet, there hasn’t been a move to start building up reserves to cover potential losses in those firms either, according to Miller.

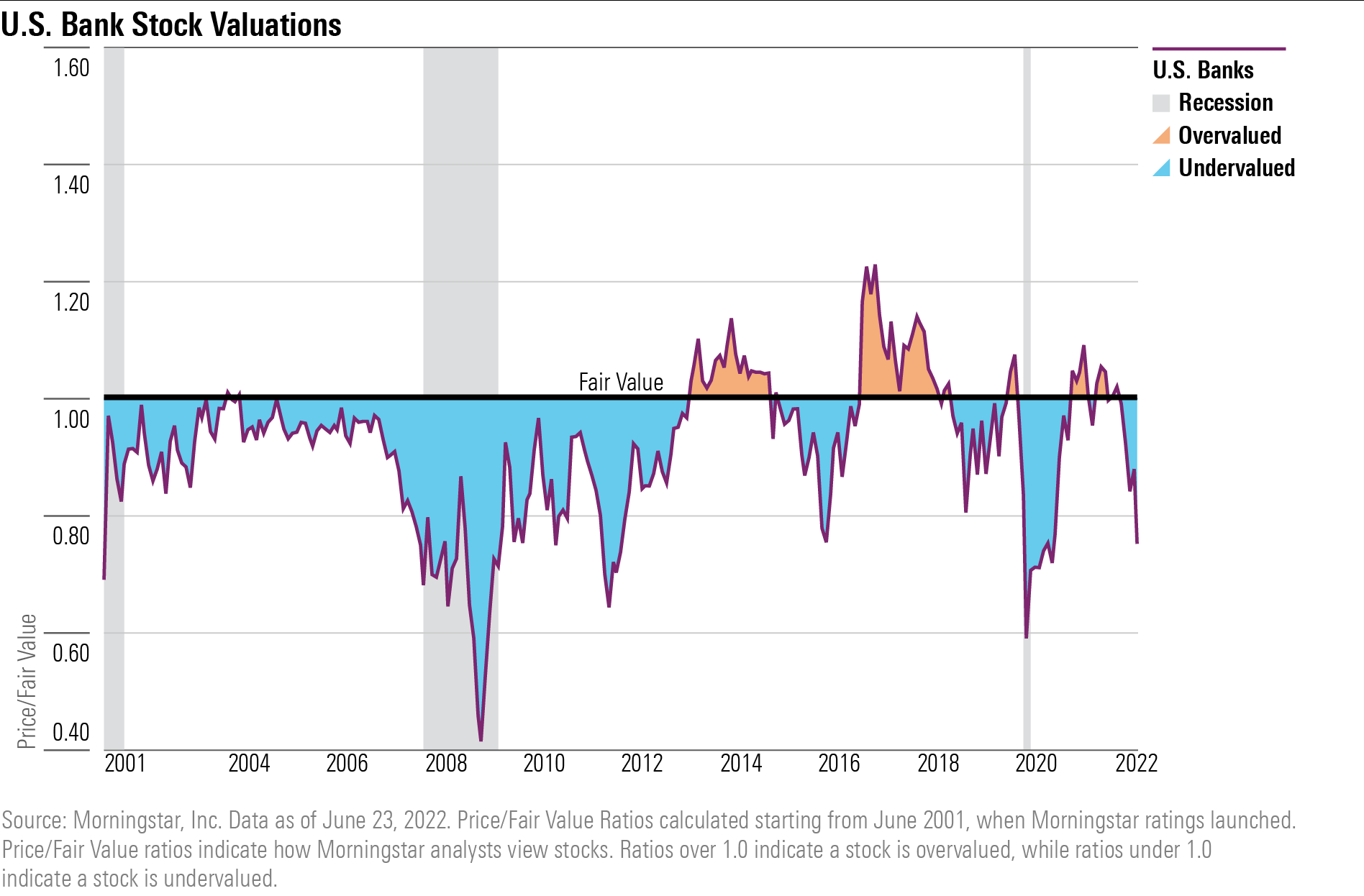

The decline in stock prices has opened up ample room for long-term investors to pick up beaten down bank stocks. U.S. bank stocks are trading at an average discount of 25%. That’s roughly 50% of the average discount bank stocks traded at when they’ve bottomed during previous recessions.

And while Compton does not currently model a recession for his base-case fair value estimates, he notes that for long-term oriented investors, it may not matter.

“Recessions do take away earnings in year one, and depending on how long the recovery takes, maybe more, but we generally have a recovery to where we were forecasting [prior to a recession],” he says. “If we did forecast a recession in our base case, it would probably result in a low single-digit percentage impact to our fair values on average.”

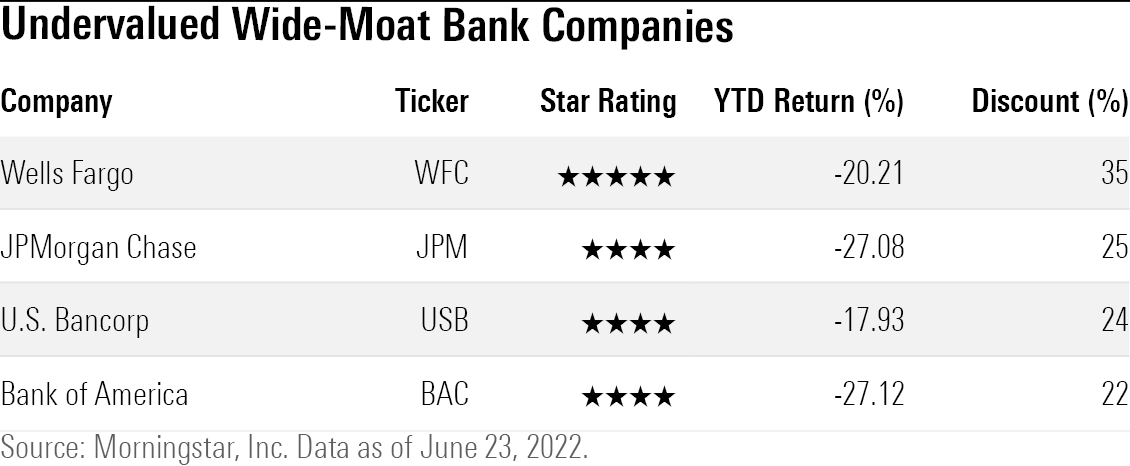

The recent declines have left many bank stocks trading at attractive valuations, leaving significant room for a margin of safety. Of the 30 U.S.-listed bank stocks covered by Morningstar analysts, 24 of them are considered undervalued, with a Morningstar Star Rating of either 5- or 4-stars. We further filtered our screen for companies with wide economic moats -- companies that Morningstar believes to have a competitive advantage that will protect their excess returns on capital for the next 20 or more years.

Below are four undervalued bank companies for long-term investors looking for the largest margin of safety, and with wide moats. A full list of all currently undervalued bank companies can be found at the end of the article.

Wells Fargo WFC

“Wells Fargo remains in the middle of a multiyear rebuild. The bank is still under an asset cap imposed by the Federal Reserve, and we don't see this restriction coming off in 2022. Wells Fargo has years of expense savings related projects ahead of it as the bank attempts to get its efficiency ratio back under 60%. We also see a multiyear journey of repositioning and investing in the firm's existing franchises, including growing its capital markets wallet share, bringing an increased focus on cards, and revitalizing an advisory group that has lost advisors for years. We're already starting to see glimpses of the transition to offense from defense, as the bank released two new card products in 2021, the first attempt to do so that we can think of in years. However, we expect the full transition to be a multiyear undertaking.’’

“Despite the bank's issues, Wells Fargo remains one of the top deposit gatherers in the U.S., with the third most deposits in the country behind JPMorgan Chase and Bank of America. Wells Fargo has one of the largest branch footprints in the U.S., excels in the middle-market commercial space, and has a large advisory network. We believe this scale and the bank's existing mix of franchises should provide the right foundation to eventually build out a decently performing bank. Wells Fargo may not reach the types of returns and efficiency that peers like JPMorgan and Bank of America have achieved, but we expect Wells Fargo to remain larger than any other regional bank and stay competitive as such. We're also gaining confidence that CEO Charlie Scharf is guiding the bank in a new and positive direction.”

-Eric Compton, Morningstar strategist

JPMorgan Chase

“JPMorgan Chase is arguably the most dominant bank in the United States. With leading investment bank, commercial bank, credit card, retail bank, and asset and wealth management franchises, JPMorgan is truly a force to be reckoned with. The bank's combination of scale, diversification, and sound risk management seems like a simple path to competitive advantage, but few other firms have been able to execute a similar strategy. Even the best-managed banks are not immune to the occasional stumble, but JPMorgan has managed to seemingly put all the pieces together in a more cohesive and less error prone way than peers. With the importance of scale (including having integrated national platforms) and technology only increasing for the banks, we think it will be hard for competitors to catch up.”

“Scale and multiple revenue sources allows the bank to increase customer switching costs, generate more revenue per risk-weighted asset than smaller peers, and also have a larger percentage of revenue come from fees. The bank also has a larger, more scalable tech budget, which should only increase in importance in the future.”

-Eric Compton, Morningstar strategist

U.S. Bancorp USB

“U.S. Bancorp is one of the strongest and best-run regional banks we cover. Few domestic competitors can match its operating efficiency, and for the past 15 years the bank has consistently posted returns on equity well above peers and its own cost of equity. U.S. Bancorp’s exposure to moaty nonbank businesses and its consistently excellent core banking operations make us like the company's positioning for the future. If we were to have a complaint, it would be that the bank was already on top of its game years ago, making it difficult for the firm to further optimize efficiency and returns, while peers seem to be gradually "catching up" over time.”

“U.S. Bancorp has an attractive mix of fee-generating businesses, including payments, corporate trust, investment management, and mortgage banking. The payments and trust businesses tend to be highly efficient and scalable due to relatively fixed cost structures. Barriers to entry tend to be high as the initial investment and scale necessary to compete are prohibitive, although competition within payments has heated up in the last several years as software and technology offerings are increasingly important.”

-Eric Compton, Morningstar strategist

Bank of America

“Bank of America has been investing in its technology platforms and organic growth initiatives across its franchises. The bank has opened hundreds of new financial centers across the U.S. over the last several years, as the bank has attempted to build its client base across its product offerings. For example, targeting areas where they may have a good credit card client base, but a more limited overall retail presence, or areas where the wealth presence could be improved. This has occurred against a backdrop of relatively flat expenses from 2016 through 2020.''

“We expect the bank will continue to gradually take share with its scaled and integrated retail and commercial offerings. While Bank of America has historically lagged the return profile of JPMorgan, we think the bank will begin to get very close. Further, the bank is one of the most rate-sensitive under our coverage, and should see some of the strongest revenue growth among peers for the next several years.”

-Eric Compton, Morningstar strategist

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/R7HDJUUCAVCXZH56GSOH6M55CU.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Y5GCIVFOLREPXPM42MPMPEEMDI.jpg)