Alternatives Finally Bear Fruit--but Take Care

Before allocating, investors must be clear about what they're buying.

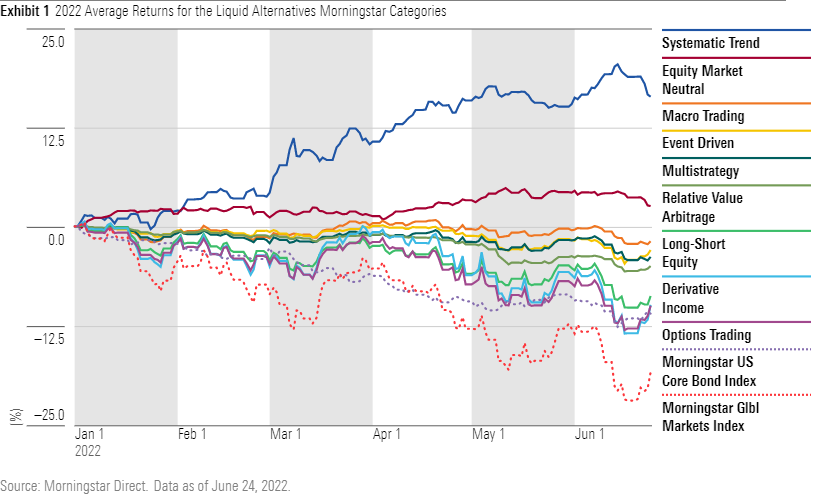

Investors have been granted little reprieve this year. The Morningstar Global Markets Index was down 18.1% year to date through June 24, 2022, while the Morningstar US Core Bond Index dropped 11.0%. Assets that have stabilized portfolios over the past 40 years, like long duration bonds (the Morningstar US 10+ Yr Core Bond Index is down 23.2%), have also gotten hammered, while the highfliers of recent years like bitcoin and ARK Innovation ARKK have been down more than 70% at their troughs.

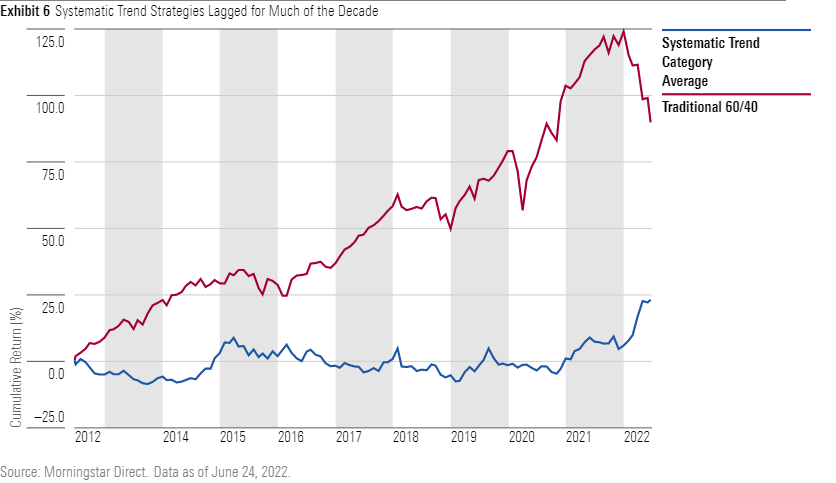

Meanwhile, strategies that diversify away from traditional equity and fixed-income risks are having their moment in the spotlight. The average strategy in the systematic trend Morningstar Category is up 17.2% this year, and other alternative categories have also held up well.

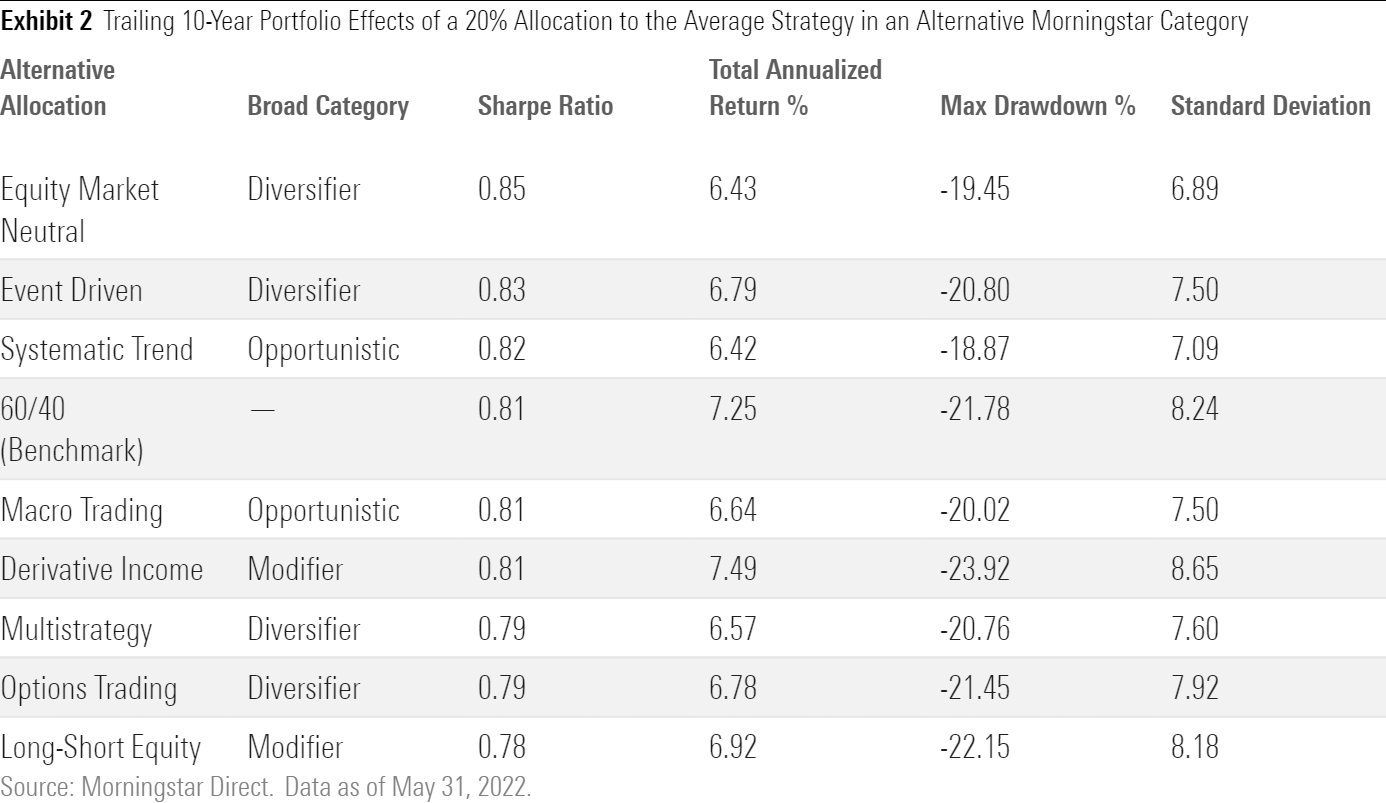

While performance-chasing almost always leads to poor results, market volatility can provide an opportune time to assess a portfolio's strategic allocations to see if they still make sense. The performance of alternatives this year provides an excellent example of the role they can serve in a portfolio and should give investors confidence that alternatives are able to fulfill the role they're intended to. Indeed, carving out an allocation to an "average" alternative strategy—as represented by Morningstar Category averages—would prove beneficial for many alternative types. Exhibit 2 shows how a 20% allocation to the average category constituent—funded equally with a 10% carveout from the equity and fixed-income allocations—would have impacted a 60/40 portfolio over the trailing 10 years.

All but two of the strategies improved the maximum drawdown, with three strategies improving the portfolio's risk-adjusted returns (as measured by the Sharpe ratio) over the trailing 10 years—impressive considering these strategies struggled for much of the 2010s. Still, before carving out an allocation to alternatives, investors need to understand what these strategies do and how they will behave in different environments.

What's Out There?

Though many in the industry apply the alternative moniker broadly, at Morningstar we think more nuance is necessary. We group these strategies into three broad buckets—modifiers, diversifiers, and opportunistic—which describe the role they can serve in a portfolio.

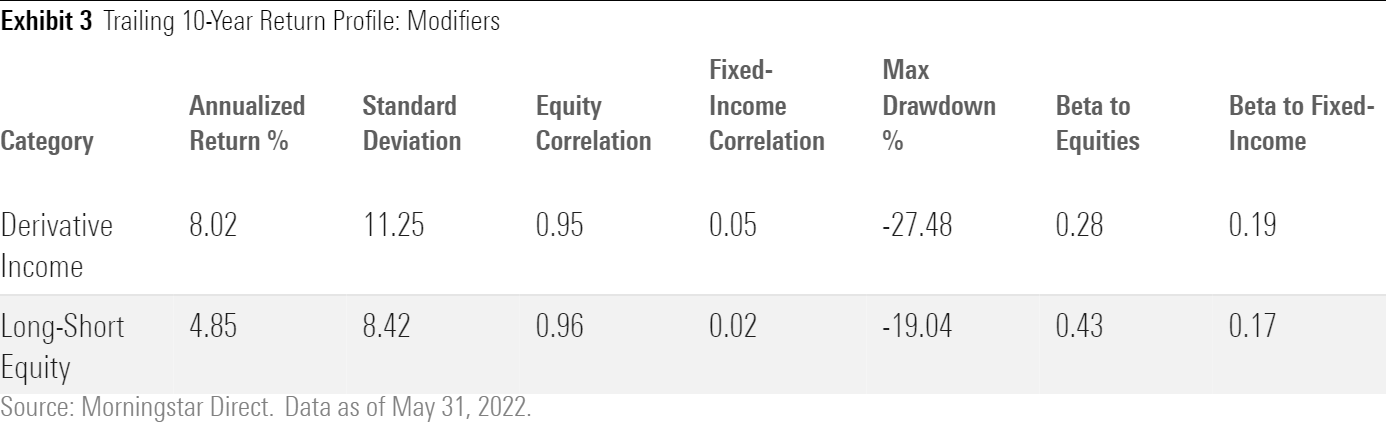

Modifiers are correlated with the common risk factors of equities and fixed income but seek to "modify" that exposure with tools like derivatives or short-selling. Strategies in this bucket—like long-short equity and derivative income funds—will often be highly correlated to traditional markets but perhaps have less volatility. For example, a long-short equity strategy that is 100% long and 40% short will still move directionally in line with equity markets, but the magnitude of its moves should be smaller than a 100% long equity strategy.

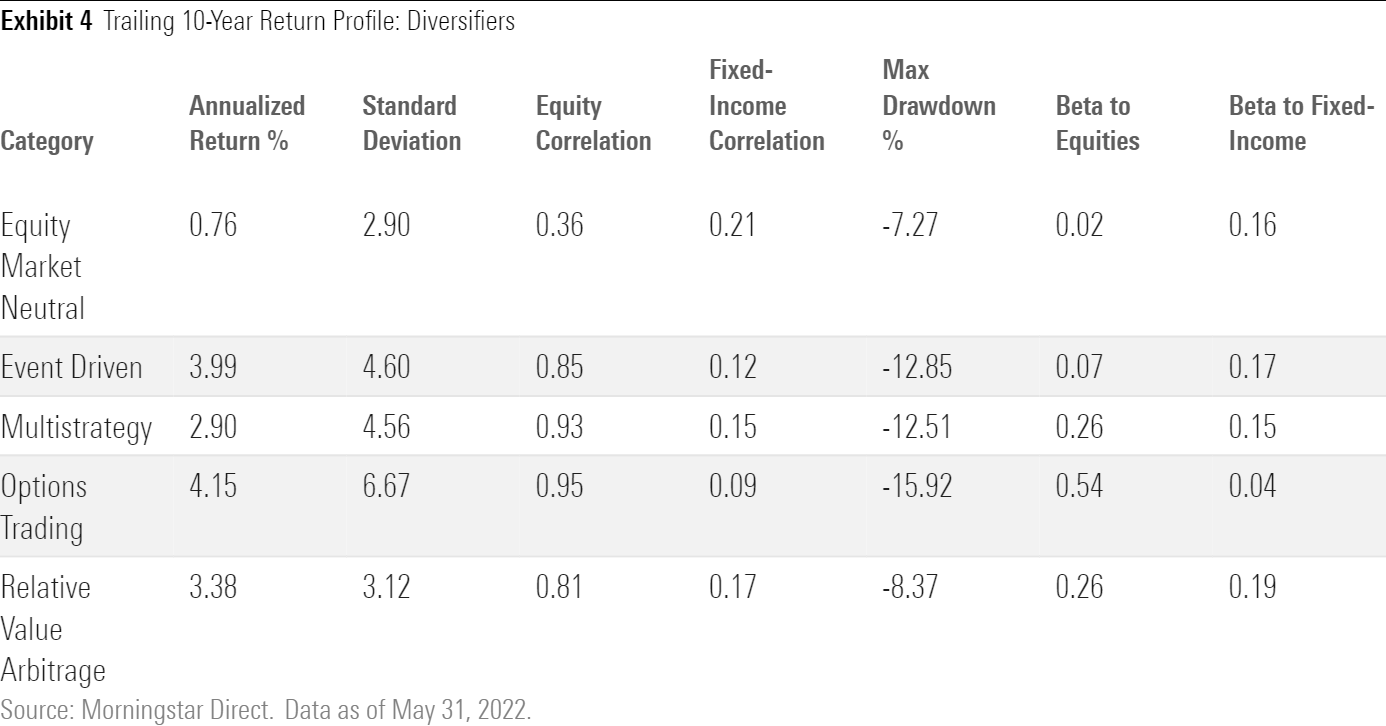

Diversifiers offer exposure to a broader set of risk factors—separate from equities or fixed income—that we call nontraditional or alternative betas. These include event-driven trades like merger arbitrage, relative value trades like convertible arbitrage, and equity market neutral strategies. While some of these trades have exposure to broader macro themes (mergers are more likely to be announced and go through in favorable economic environment), in general these strategies are influenced by idiosyncratic and security specific factors, which add diversifying elements to a portfolio.

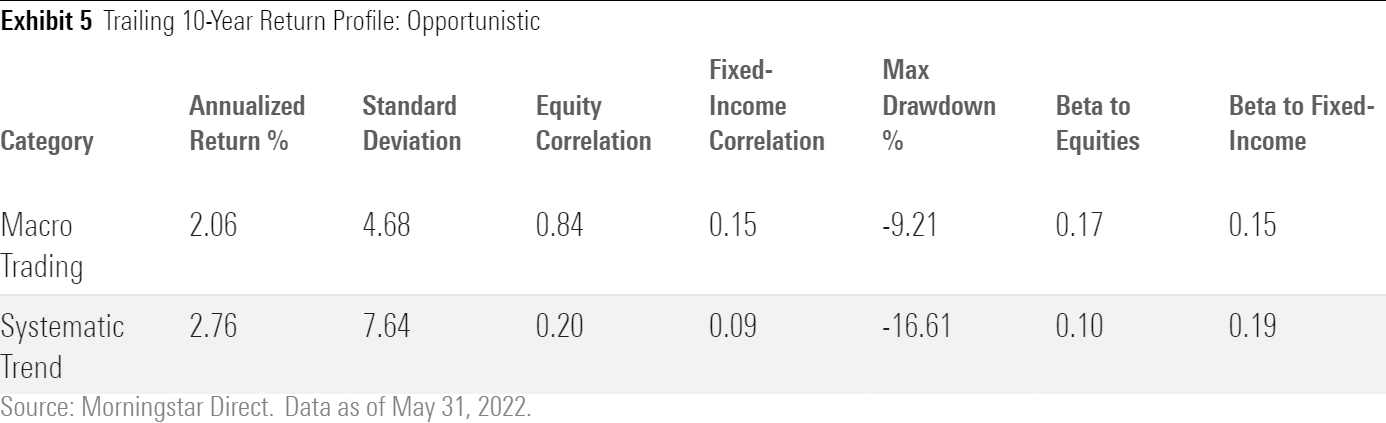

Opportunistic strategies focus on absolute returns and aim for positive returns in all markets. They move in and out of long and short positions as opportunities arise, which brings added complexity. While they tend to lose less in drawdowns, they can also be caught out of step and fall while traditional markets surge. Macro-trading strategies are based on a combination of macroeconomic indicators and fundamental data for security selection, while systematic trend strategies rely on trend-following price momentum signals. Both types of strategies can take long and short bets across equity, fixed-income, currency, and commodities markets, which can help them thrive during bear markets and broad market drawdowns.

What to Expect?

The myriad approaches employed by alternative managers lead to vastly different return profiles for these strategies.

In general, investors can expect modifiers to have the most sensitivity to broader markets, and thus provide the least diversification benefits to a portfolio. Diversifiers rely much more on idiosyncratic risks and thus are much less sensitive, though they have higher correlations during down markets. Opportunistic, absolute-return-oriented strategies often provide the most diversification benefits, but their return patterns can be choppier and challenging to stick with in bull markets for traditional assets.

These different characteristics mean investors need to be deliberate about what they're seeking for their portfolios. A more diversifying strategy like a systematic trend fund can introduce broad portfolio benefits, but it also increases tracking error. This risk is nothing to sneeze at: As stocks and bonds soared throughout the 2010s, the average systematic trend fund lost 0.6%. A 20% allocation to the average systematic trend fund in a 60/40 portfolio would have resulted in an annual drag of about 1.45 percentage points. Prolonged periods like this can lead to second-guessing and thoughts about whether the approach is broken, or if something has fundamentally changed.

Meanwhile, an allocation to a highly correlated hedged equity strategy can keep pace with markets when they're trending up but will also sell off as they fall. An investor expecting their alternative to offset losses in the rest of their portfolio in 2022 might be upset with an options-trading fund, where the average fund is down 9.7% through June 24.

Use Cases

Given this heterogeneity, understanding the types of portfolio exposures that investors are seeking can steer them to liquid alternatives strategies that make sense for their objectives. The below rules of thumb are good starting points to help narrow one’s search.

Owing to their high correlation to traditional markets, modifiers typically have the slimmest ability to diversify a portfolio. Investors in long-short equity and derivative income strategies may be seeking an equitylike return profile with less volatility and more downside protection. Though these strategies may induce some behavioral benefits and allow investors to weather downturns, their effect on a portfolio's overall risk-adjusted returns will likely be minimal, as they don't introduce any diversifying sources of returns into a portfolio.

Diversifiers offer exposure to nontraditional risk factors, and thus can provide a different set of return drivers to an investor's portfolio. By expanding the opportunity set into returns that are less correlated to traditional markets, investors can construct more-efficient portfolios that can generate better expected returns at a given level of risk. These strategies can sometimes—but not always—provide a boost when broader markets struggle. For example, the average event-driven strategy was up 1.6% in 2018, while the Morningstar Global Markets Index fell 9.8%.

Opportunistic strategies provide capital preservation over long periods, the potential for strong returns, and the ability (but not promise) to excel in broad market drawdowns. These strategies tend to have low correlations to traditional markets, which, when combined with positive absolute returns, can improve a portfolio's risk-adjusted returns. Though beneficial over the long term, there's potential for these strategies to have significant drawdowns over shorter periods of time. For example, in 2012, the average opportunistic strategy lost 7.4% while the Morningstar Global Markets Index rose 16.5%. On the other hand, when positioned well, they can soar. They've performed admirably in 2022, as their ability to go long and short markets has led to outsize gains from long commodity positions and short positions in equities and rates. The low correlation is evident in a chart of the category average's performance over the trailing 10 years.

Conclusion

There are two ways to handle alternatives in a portfolio. Either carve out a thoughtful, appropriately sized position that fits your risk tolerance or ignore them altogether. These are not strategies that investors should try to time. While certain market environments may be more favorable than others, in general their uncorrelated nature makes it nearly impossible to identify with foresight how they will perform over the short term. However, investors can benefit from these strategies over longer time periods, provided they match their objectives with the right strategy.

Note: The author used the Morningstar Global Markets GR Index to proxy equities and the Morningstar US Core Bond Index to proxy bonds. Instances of their use include the portfolios in Exhibit 2 and Exhibit 6, and the beta/correlation data points in Exhibits 3, 4, and 5.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)