Despite Shopify’s Stock Split, Investors Should Look Elsewhere

With the company's sales slowing, investors may be better off with Amazon shares.

Shopify SHOP is set to split its shares next week and if the company’s aim was to make its stock more affordable to investors they don’t have to worry: the market has already taken care of that.

A steep fall in its price, the adoption of a new share class that cements voting control with the founder and chief executive, and an uncertain financial outlook suggest investors may be getting less value than they might think from a planned 10-1 stock split.

Shares of the once highflying e-commerce company changed hands recently at about $343 per share, after hitting a low last week of $297.64. The company is down about 81% from an all-time high of nearly $1,763 in mid-November and has plunged 75% this year. Shopify is a Canadian company based in Ottawa, Ontario, and is listed on both the New York and Toronto stock exchanges.

“It almost now doesn’t make sense to split,” says Dan Romanoff, senior equity analyst on the technology and media team at Morningstar. Romanoff now assigns a fair value estimate of $450 a share to the four-star rated narrow-moat Shopify, revising it down from $730 after disappointing first-quarter results released May 5. After the stock split, the fair value estimate will be $45 per share.

In such a precarious economic environment as this, Romanoff is more confident recommending Amazon AMZN, the dominant player in the e-commerce arena.

“Amazon is easier to support,” Romanoff says. He points out that the company has been through economic cycles and recessions and has multiple revenue sources in addition to e-commerce. It also has a strong relationship with consumers, unlike Shopify. Amazon has higher margins, better cash flow, and there is more certainty surrounding its financial performance because it provides quarterly guidance.

After completing its own 20-1 stock split recently, wide-moat, five-star Amazon trades at $109.73 a share, a 43% discount to Romanoff's fair value estimate of $192 a share.

“If I had to pick an e-commerce stock, it would easily be Amazon,” Romanoff says.

New Share Class Created

If Shopify's stock split was designed to generate buzz, a more controversial shareholder proposal approved at the company's June 7 annual meeting stole its thunder. A change in governance structure gave founder and chief executive Tobias Lutke, his family and affiliates 40% voting control over the company's shares. Three major shareholder proxy advisory firms--Institutional Shareholder Services, Glass Lewis & Co., and Egan-Jones Ratings Co.,--opposed the new share class and recommended voting against it.

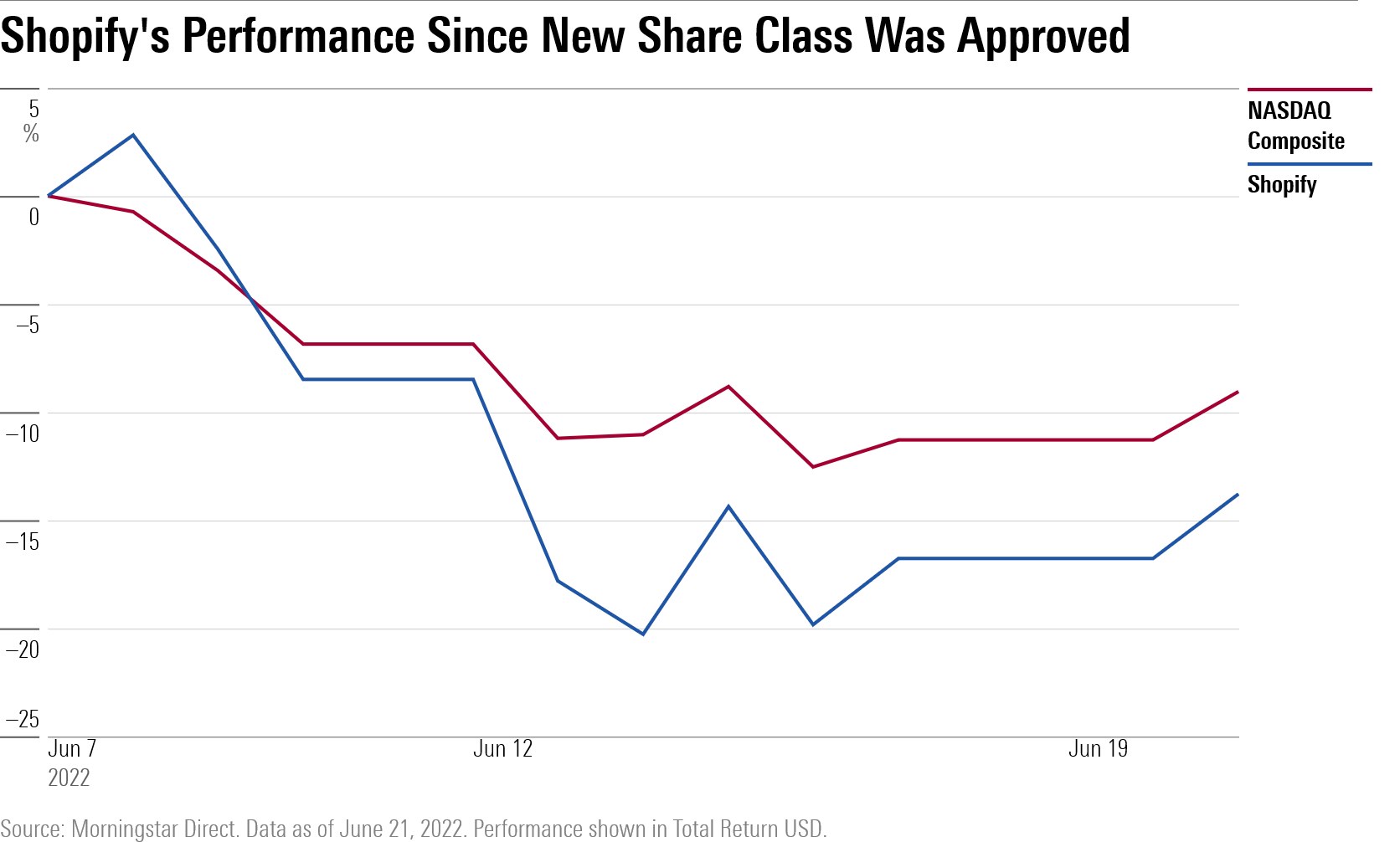

Since the annual meeting, Shopify shares have lost 10% compared with a loss of 8.9% in the tech-heavy Nasdaq Composite. Prior to adding the new “Founder” class of shares, Shopify had a dual class share structure in which the founder and one board member owned Class B shares that represent 10 votes for each share.

The powerful voting bloc represented by the Class B shares edged out minority shareholders in the final vote, according to Glass Lewis. By adopting the new class of stock, Shopify averted the risk that the multi-class structure would collapse should the Class B shares fall below 5% of the outstanding stock. At the time of the vote, Class B shares represented 9.5% of the outstanding shares, but 51% of the voting rights.

“I don’t want to see ownership concentrated in the hands of any one person,” Romanoff says. “It’s not very shareholder friendly.”

Good Potential Value, but Not a Top Pick

This was the second consecutive quarter that Romanoff cut his fair value estimate on Shopify based on missed expectations. While his current estimate represents significant upside potential, Romanoff notes the stock isn’t among his top three picks, nor even his top five.

It’s too soon to know “what post-COVID normal looks like for Shopify and other companies that benefited from COVID lockdowns,” he says.

Revenue growth of 22% slowed significantly year over year in Shopify’s first quarter to $1.2 billion. That compares with 57% in the first quarter of 2021 and 86% in 2020. The latest results missed Wall Street estimates. Revenue from both subscriptions and merchant solutions fell below Romanoff’s expectations in the quarter.

“Over the last several quarters the firm has only been missing on subscriptions, so this latest development, despite the challenging comparison a year ago, only further increases uncertainty,” he says.

Shopify posted a net loss of $1.5 billion in the most recent quarter, a loss of $11.70 per share, compared with year-earlier net income of $1.3 billion, or $9.94 a share.

The company provides small and midsize businesses software tools to sell their wares on custom websites and claims shoemaker Allbirds BIRD, Tupperware TUP, floral delivery service FTD, and medical apparel maker Figs FIGS among its customers.

The company stopped providing specific financial guidance years ago. Yet, when it released its first-quarter results, Shopify said reinvesting in its business, including its $2.1 billion acquisition of Deliverr to enhance its merchandise fulfillment network, stock-based compensation expenses, and the expected impact of inflation on consumer spending, would be dilutive to its operating margin this year.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)