4 Charts to Improve Your Tax Management

Here are a few tax-management best practices for advisors and investors to consider.

Tax management is a valuable lever that investors and advisors can pull to boost take-home returns. With experts increasingly forecasting a low investment return environment, investors have good reason to police all the costs they pay, including tax costs.

Here are four smart tax-management tips from Morningstar’s “A Guide to Tax-Managed Investing.”

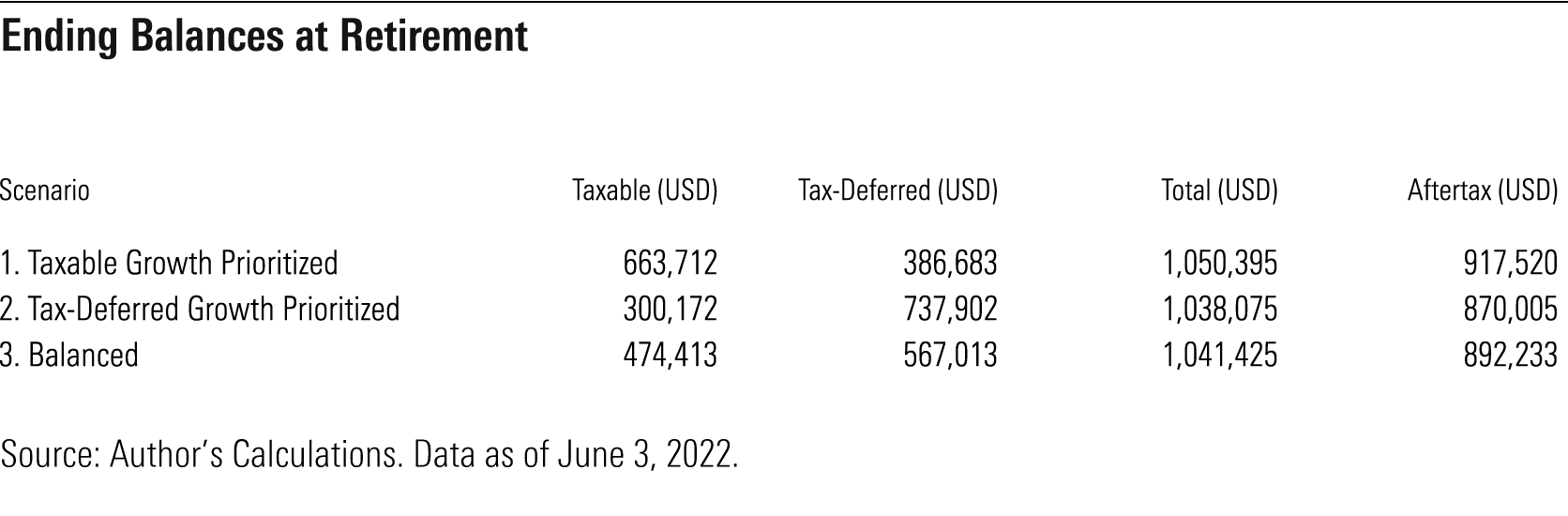

Determine Your Optimal Asset-Location Structure

Identifying the proper location or account type for each investment often gets lost in the shuffle of portfolio construction and implementation. For instance, investors in their working years still accumulating assets naturally use retirement plans to house long-term savings, namely stocks. Yet bonds benefit from tax sheltering, too. Their regular income payments are taxed at ordinary rates, while qualified equity dividends are taxed at lower long-term capital gains rates.

Here are a few scenarios to illustrate the trade-offs involved in asset-location decisions. In each, we assumed an investor with 35 years to retirement had $100,000 split evenly between taxable and tax-deferred assets and modeled three situations:

- Focusing the taxable account on equities for as long as possible.

- Focusing the tax-deferred account on equities for as long as possible.

- Maintaining similar equity/bond splits in both account types.

Since most investors’ risk profiles shift over time, we started with an overall split of 92% stocks/8% bonds, and gradually rebalanced over time (recognizing the appropriate tax consequences in taxable accounts) before finishing at 43/57 at retirement. The results were enlightening:

We found that scenario 1 provided the best outcome, both before and after taxes, and comes with some additional benefits. Taxable accounts have considerable estate planning benefits over their tax-deferred counterparts, namely cost-basis step-up at death, and are inherently more flexible.

Remember, however, that the assumptions of these scenarios may not fit your situation. The optimal asset-location structure for every investor is personal. Investors should first determine the asset-location structure that suits their preferences, then tactically work toward those targets over time to damp any tax consequences.

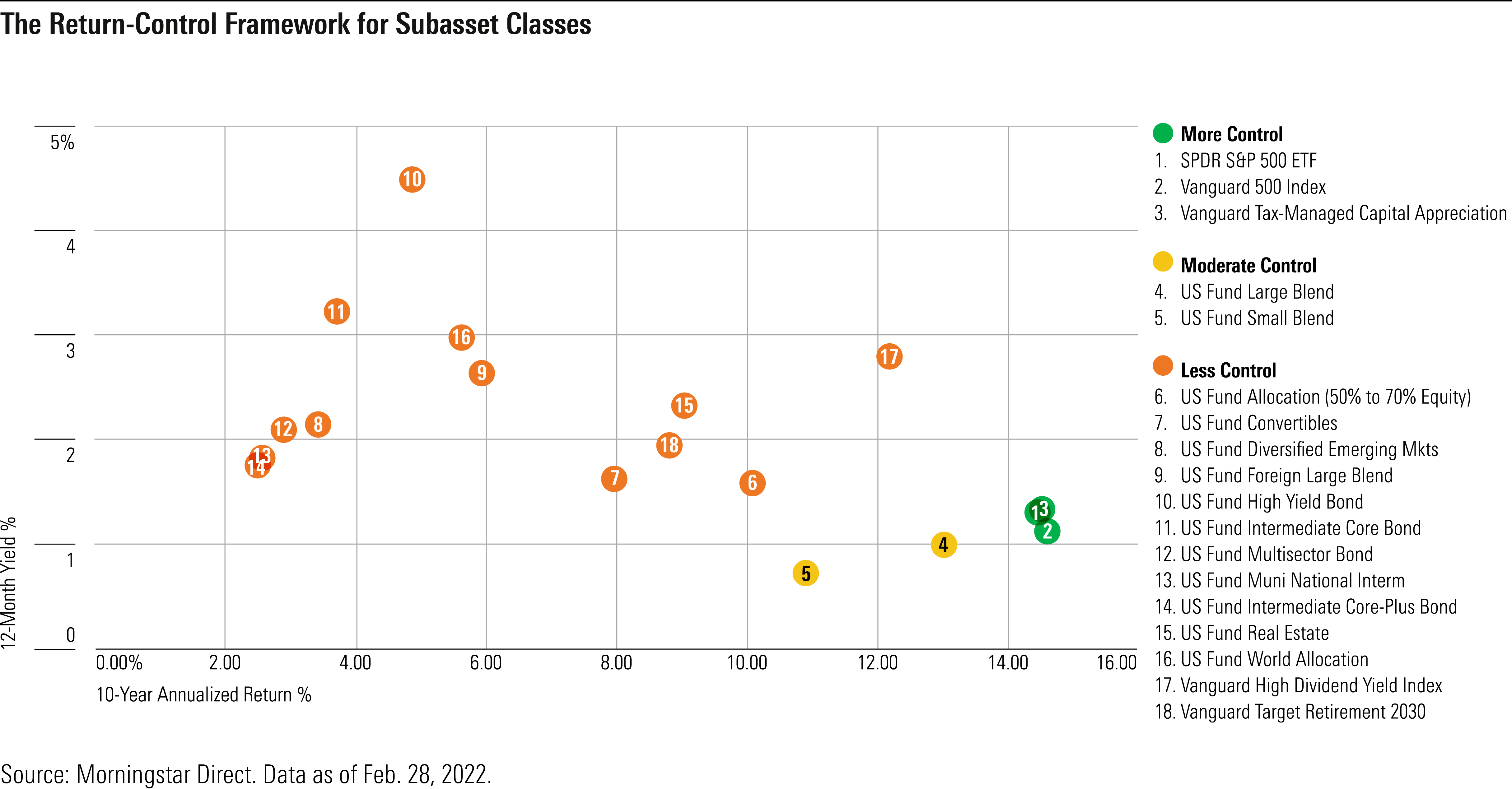

Control What You Can

Knowing if your mutual fund or exchange-traded fund is a serial income or capital gains distributor can also help you decide whether to hold it in a taxable account. We classified popular asset classes and investment vehicles by their return and distribution propensities.

Investors in vehicles where distributions make up a large percentage of total returns have less control over their taxes, especially when the distributions are taxed at ordinary income rates. Investors in vehicles that tend to make fewer distributions, and the few they make tend to be taxed at more favorable rates, have more control.

For example, the high-yield bond Morningstar Category is in the top left quadrant because income, or yield, constituted much of the group’s total return. Bond income is often taxed at higher rates than capital gains or qualified equity income.

Equity index ETFs, like iShares Core S&P 500 ETF IVV, are at the other end of the spectrum because their dividend payments tend to be smaller and receive more favorable tax treatment. And since most equity index ETFs do not make capital gains distributions, investors have more control over when they realize capital gains by selling or trimming their holdings.

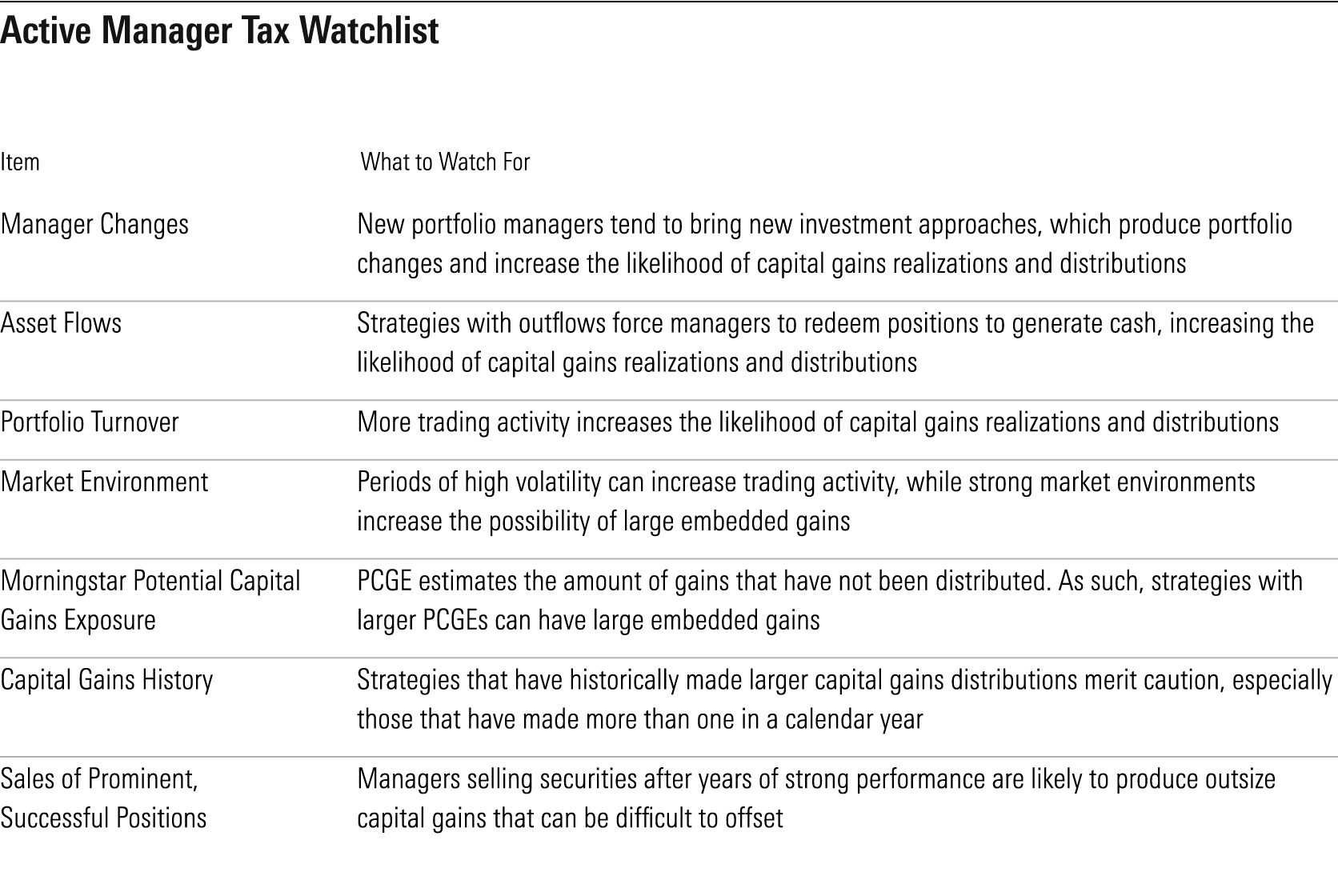

Pay Close Attention to Actively Managed Strategies in Taxable Accounts

Actively managed strategies require more oversight than passive funds. They can produce capital gains distributions for myriad reasons, regardless of whether shareholders buy or sell their fund shares. The following watchlist can help tip off prospective and existing investors about potential distributions.

Any combination of these items, such as manager changes at strategies with high Morningstar Potential Capital Gains Exposure scores, significantly raises the possibility of capital gains distributions.

Take Advantage of Tax-Loss Harvesting

Tax-loss harvesting can eke something good out of taxable account losses. Investors can use realized losses to offset gains in the same calendar year. If they have more losses than gains, investors can use the losses to deduct up to $3,000 from their adjustable gross income and carry forward any unused losses indefinitely to use against future gains.

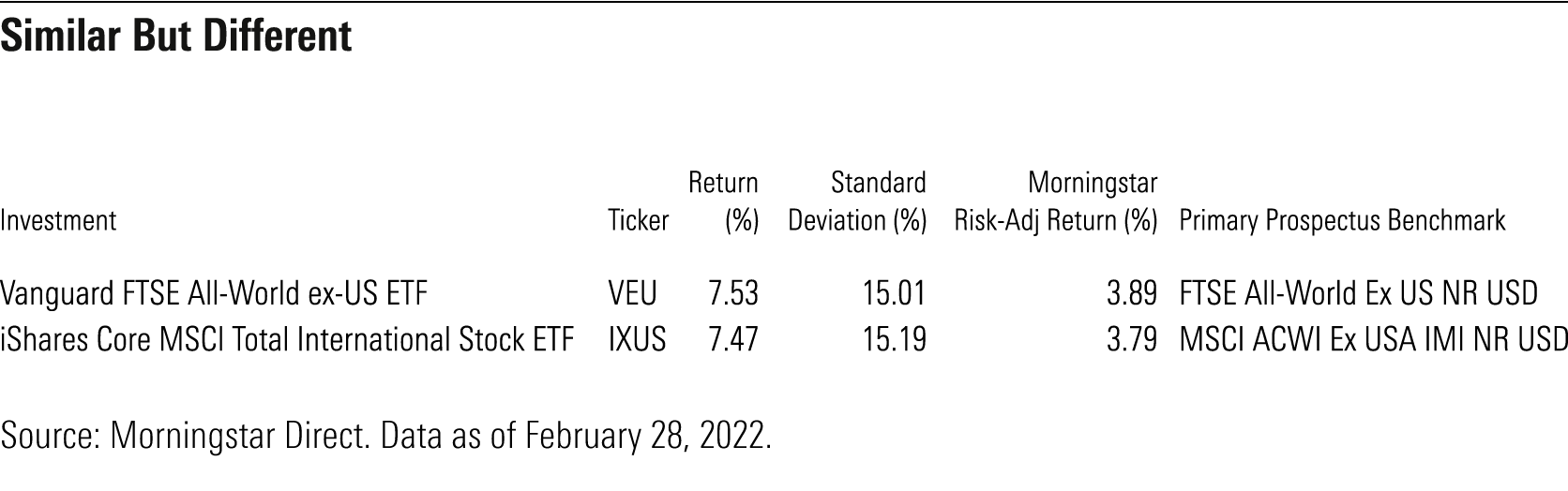

As a rule, larger portfolios of more volatile holdings offer more opportunities for tax-loss harvesting. Still, investors with portfolios of a few broadly diversified funds and ETFs can take advantage of it. One harvesting strategy consists of selling stocks or funds that have lost money and temporarily putting the proceeds into index funds or ETFs tracking a similar area of the market to maintain your asset allocation. (You cannot buy the same fund, stock, or a “substantially identical” investment back within 30 days without running afoul of IRS “wash sale” rules.)

For example, if you were sitting on a loss in Vanguard FTSE All-World ex-US VEU, you could sell and harvest those losses while buying iShares Core MSCI Total International Stock IXUS, which covers much of the same territory while tracking a different index.

Use Market Volatility to Upgrade Your Portfolio

The current market selloff underscores the unpredictability of investment returns. Yet savvy investors can wring some benefit from the volatility and secure better take-home results. Smart tax-loss selling techniques allow investors to lower their tax bills while rebalancing to long-term allocation targets. And the more frequent portfolio reviews that inevitably come with shaky markets provide opportunities to make more deliberate asset-location choices.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/cfa8a92a-3493-4cb4-80ba-e3af514136a0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_1997613e43634249b59dd28db9b24893_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/cfa8a92a-3493-4cb4-80ba-e3af514136a0.jpg)