Markets Brief: How High Can Mortgage Rates Go?

Existing home sales figures from May are on deck. Energy stocks lose juice, while Chinese ADRs continue to rally.

Already cooling, the once red-hot housing market appears headed to a deep freeze.

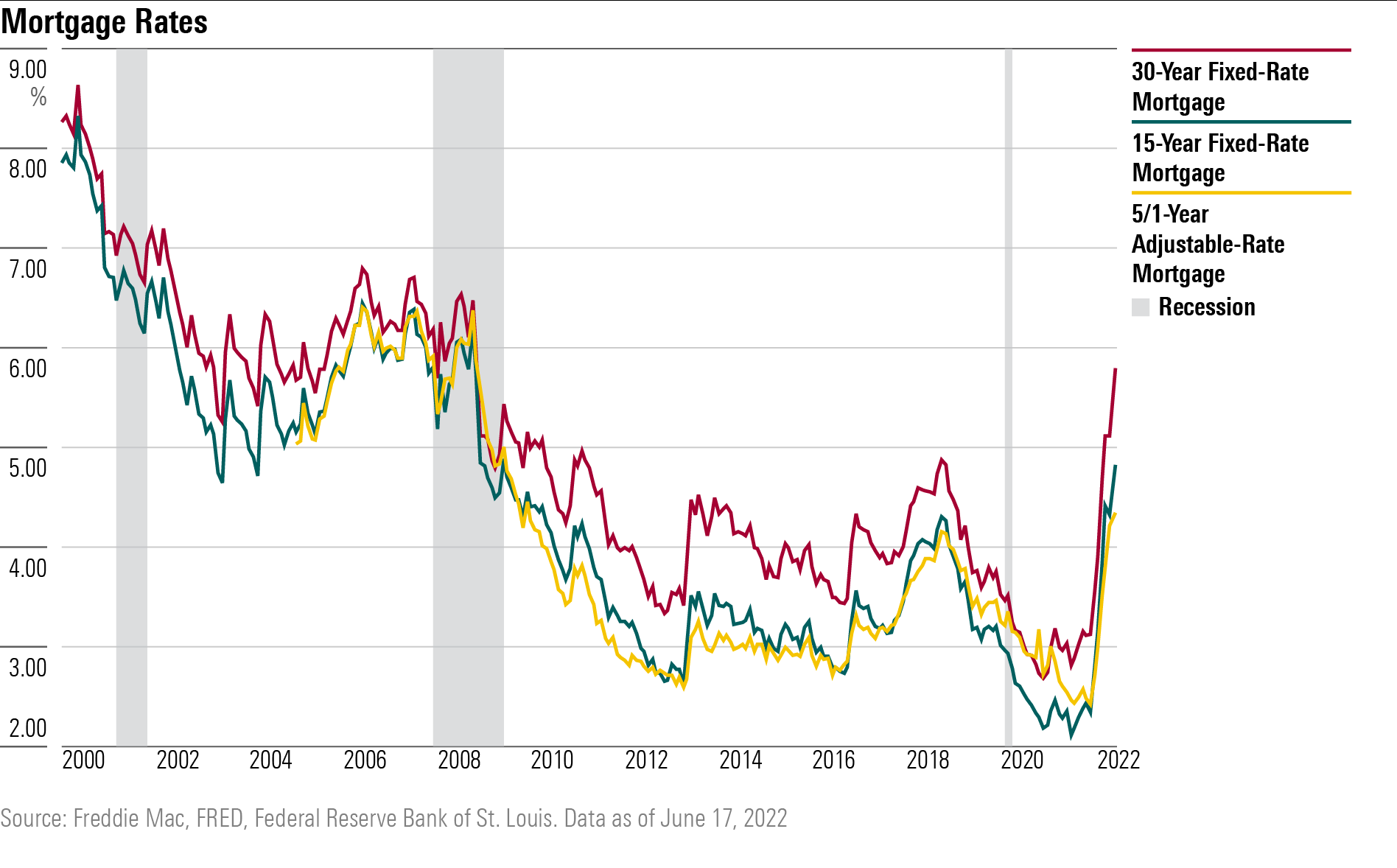

The average 30-year fixed-rate mortgage climbed by more than half a percentage point in the week through June 16 to 5.78%. This marked the largest one-week increase since mortgage lender Freddie Mac began tracking the data in 1987, and the rate is now at its highest level since 2008. That compares with 5.23% last week, and 2.93% one year ago.

The action in the mortgage market signals that the inflation-busters at the U.S. Federal Reserve are having an impact reining in prices in one area of the economy that ballooned in the zero-rate policies of the pandemic years.

While the bubble hasn't burst, it's deflating considerably. The Federal Reserve just lifted its benchmark interest rate by three fourths of a percentage point in its quest to squelch skyrocketing inflation. Mortgage rates have been rising since the beginning of the year as the Fed signaled it would begin to tighten its monetary policy.

"These higher rates are the result of a shift in expectations about inflation and the course of monetary policy," said Sam Khater, Freddie Mac's chief economist. "Higher mortgage rates will lead to moderation from the blistering pace of housing activity that we have experienced coming out of the pandemic, ultimately resulting in a more balanced housing market."

The rate of change is catching market participants off guard.

"Affordability has completely deteriorated," said Morningstar's director of industrials equity research Brian Bernard, who covers homebuilders. "We weren't expecting mortgage rates going so high so fast."

Homebuilder stocks fell to fresh 52-week lows last week. The nation's largest homebuilder D.R. Horton DHI has seen its stock drop 45% so far this year. Toll Brothers TOL shares are off 44% in the same period, and Lennar LEN shares are down 46%. The iShares U.S. Home Construction ETF ITB is off 41% year to date.

Morningstar's Bernard updated his forecasts for housing starts to decrease by 10% in 2023 to 1.435 million units and by another 10% in 2024 to 1.3 million units. Those levels would be in line with prepandemic new home construction levels in 2018-19. Bernard reduced the fair value estimates for the homebuilders he covers, with D.R. Horton's fair value estimate falling to $107 per share from $113 and Lennar's fair value dropping to $115 from $123. Toll Brothers' fair value is now $66 per share, down from $70. Despite the reductions, Bernard still sees the stocks as undervalued at recent prices. Toll Brothers has a Morningstar Rating of 4 stars, while D.R. Horton and Lennar are trading in 5-star territory.

Housing starts and building permits have been dropping significantly, and Bernard said he expects continued weakness in housing data through year-end.

Residential housing starts in May fell 14.4% to a seasonally adjusted annual rate of 1.55 million from April's revised rate of 1.8 million and 3.5% below the May 2021 rate of 1.61 million. It was the lowest level of starts since September 2021. However, the revised April rate marked the strongest since 2006.

Building permits, widely viewed as a gauge of future construction trends and mostly reflecting single-family houses, dropped in May to 1.7 million, 7% below April's rate of 1.8 million and about flat with the year-ago number.

"Demand is falling and more supply is on the way," Bernard said. "Prices have probably peaked. We expect affordability will improve over the next two years as mortgage rates subside and home prices become more tenable."

May tallies on existing and new home sales are set to be released next week by the U.S. Census Bureau and the Department of Housing and Urban Development.

Sales of existing homes, which account for most of the activity in the housing market, declined by 2.4% to 5.61 million in April, the lowest level since June 2020 and slightly below forecasts of 5.65 million, according to the National Association of Realtors. It was the third-straight month of declines as high home prices and high mortgage rates kept buyers away.

Sales of new single-family houses in April totaled 591,000, based on a seasonally adjusted annual rate, according to the U.S. Census Bureau and the Department of Housing and Urban Development. That was nearly 17% below March's revised figure of 709,000 and 27% below the year-ago estimate of 809,000.

Events scheduled for the coming week include:

- Monday: Markets closed in observance of the Juneteenth holiday.

- Tuesday: Lennar reports earnings. Existing home sales update for May.

- Wednesday: Federal Reserve chair Jerome Powell testifies during the semiannual Monetary Policy Report to Congress.

- Thursday: Darden Restaurants DRI and FedEx FDX report earnings.

- Friday: New home sales update for May.

For the trading week ended June 17:

- The Morningstar US Market Index fell 6.01%.

- All 11 stock sectors were down for the week, with the worst performers being energy, down 17.30%, and utilities, down 9.13%.

- Yields on the U.S. 10-year Treasury rose to 3.24% from 3.16%.

- Oil prices fell $11.11 to $109.56 per barrel.

- Of the 867 U.S.-listed companies covered by Morningstar, 45, or 5%, were up, and 822, or 95%, declined.

What Stocks Are Up?

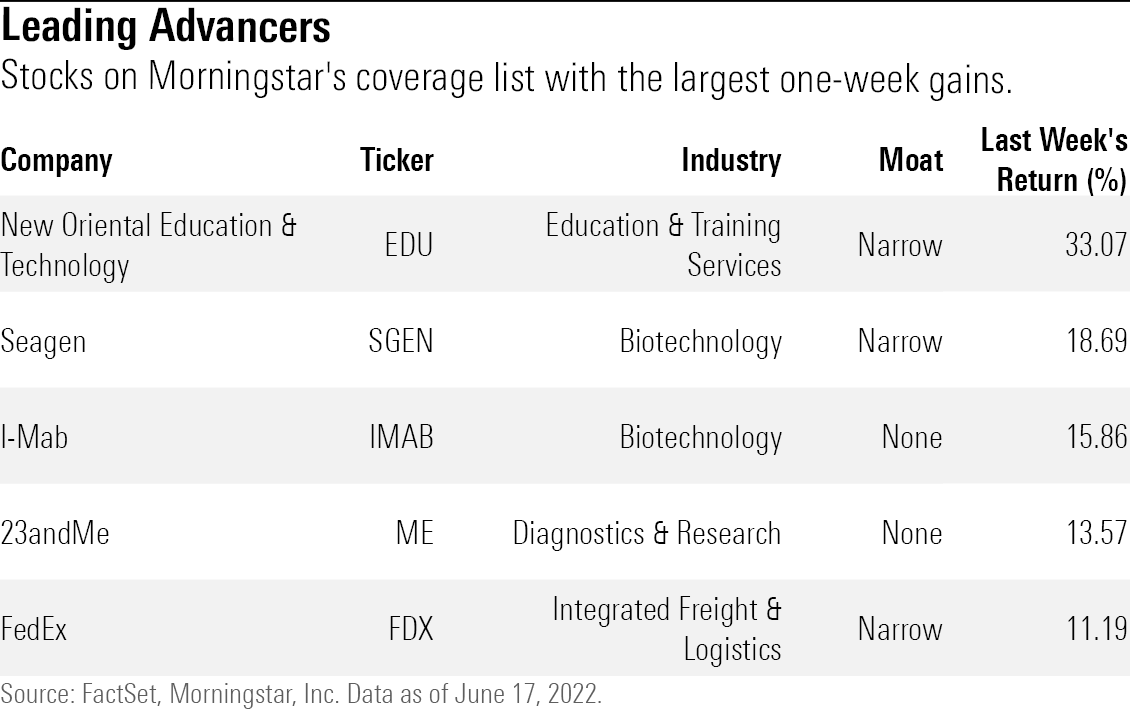

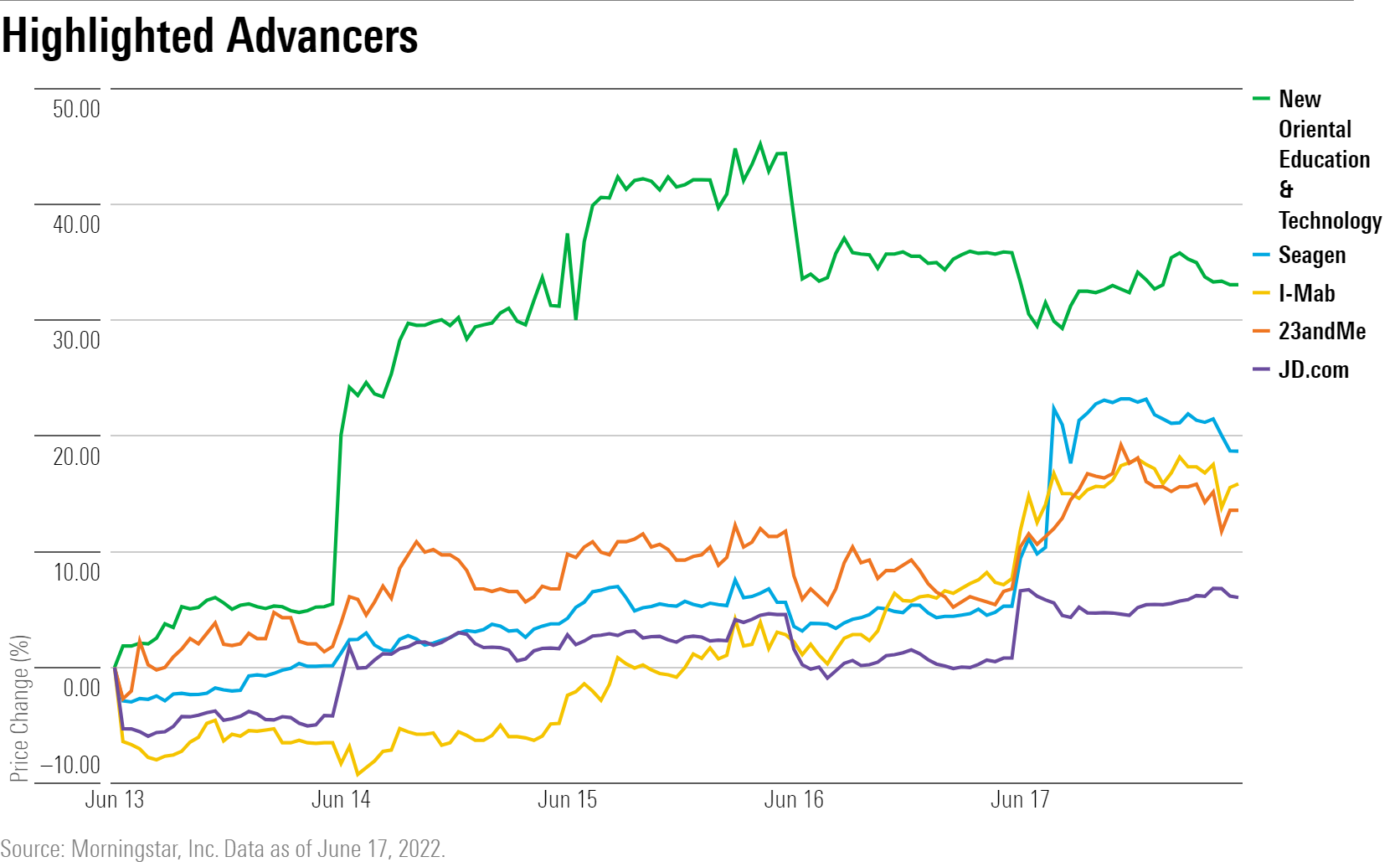

The best-performing companies in the past week were New Oriental Education & Technology EDU, Seagen SGEN, I-Mab IMAB, 23andMe ME, and FedEx.

Chinese ADR-listed stocks rallied as investors contemplated reduced regulatory risk from authorities, extending gains from the prior few weeks. Shares of New Oriental Education & Technology, I-Mab, and JD.com JD were among the best-performers in the past few days.

Shares of Seagen surged Friday over news that the biotech firm was in talks to be purchased by pharmaceutical company Merck MRK, The Wall Street Journal reported.

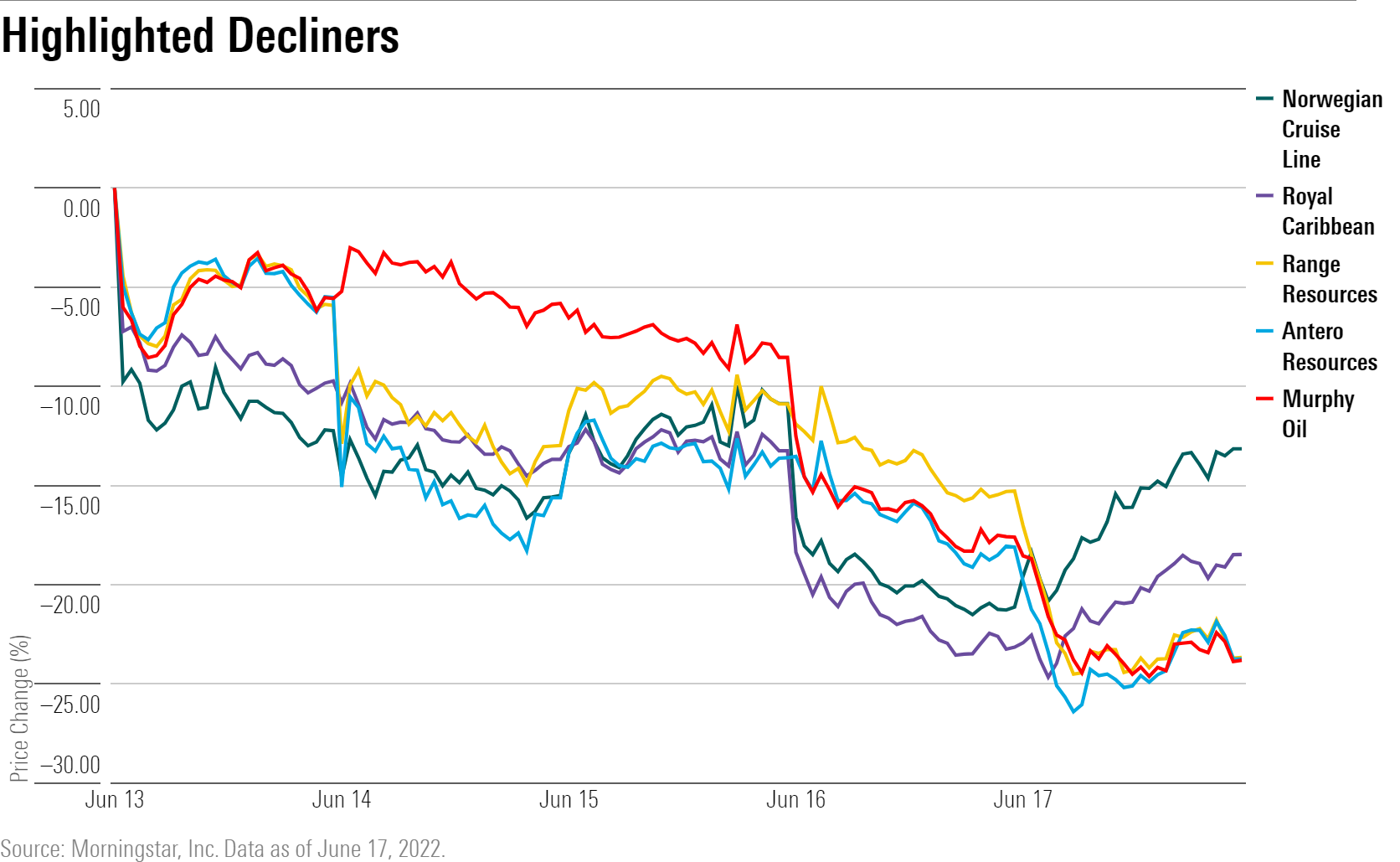

What Stocks Are Down?

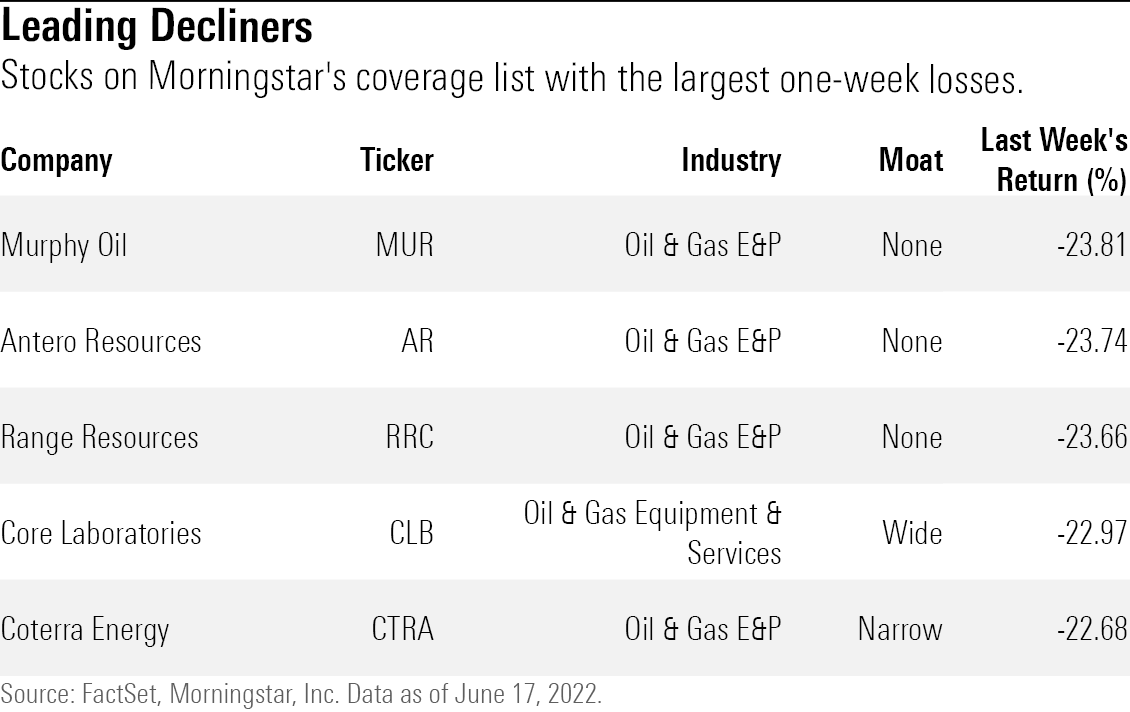

The worst-performing companies were Murphy Oil MUR, Antero Resources AR, Range Resources RRC, Core Laboratories CLB, and Coterra Energy CTRA.

Oil and gas companies faced some of the biggest losses in the past week after oil and gas prices slipped on concerns over demand. The West Texas Intermediate oil benchmark was down 9.21%, while henry hub gas prices fell 14.99% for the week.

Shares of travel companies also slipped over concerns over a slowing economy reducing demand for their services. Royal Caribbean RCL, Norwegian Cruise Line NCLH, and Sabre SABR closed the week lower.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)