4 Undervalued, Recession-Resilient Software Stocks

Solid earnings from Okta, Elastic, and others come as investors look for stocks that could weather a slowdown.

After months of punishing losses, many software stocks have enjoyed a bounce as recent earnings results blow investor expectations out of the water.

Still, despite a rebound, shares of a number of top software companies are well below their highs and trading at attractive prices.

Adding to their potential appeal: For software companies focused on data management and protection for corporate clients, their business models can be resilient in the face of an economic slowdown. Worries about the potential for a softening of the economy, and even a potential recession, have grown as the Federal Reserve has signaled that raising interest rates to fight inflation is its current priority.

On this front are companies that provide services to help businesses' information technology teams keep their data systems running smoothly, known as full-stack monitoring companies. Firms such as Elastic ESTC, Datadog DDOG, Dynatrace DT, and Splunk SPLK are among the undervalued names in this space.

“Even if there is a recession, a customer’s expenditure in these services will not take a nosedive,” says Morningstar equity analyst Malik Ahmed Khan. “A lot of these companies have integrated themselves into their customer’s IT expenses; giving them up would open up potential security and operating vulnerabilities.” The push to move data from on-site computers to the cloud has only magnified the need for full-stack monitoring software to ensures that systems are operating correctly while businesses undergo a digital transformation.

The stickiness in enterprise software does not extend to software companies whose primary market is individual consumers, according to Khan. Individual software firms, such as Dropbox DBX or NortonLifeLock NLOK, face a higher degree of competition as software for consumers is easier to build out than enterprises, he says.

Products aimed toward consumers also tend to be on shorter subscriptions, leaving more exit points. "The individual consumer base also churns more as they may cancel a software subscription if unforeseen expenses come up in their personal lives," Khan says. In contrast, enterprise software customers generally have longer-term contracts and higher switching costs.

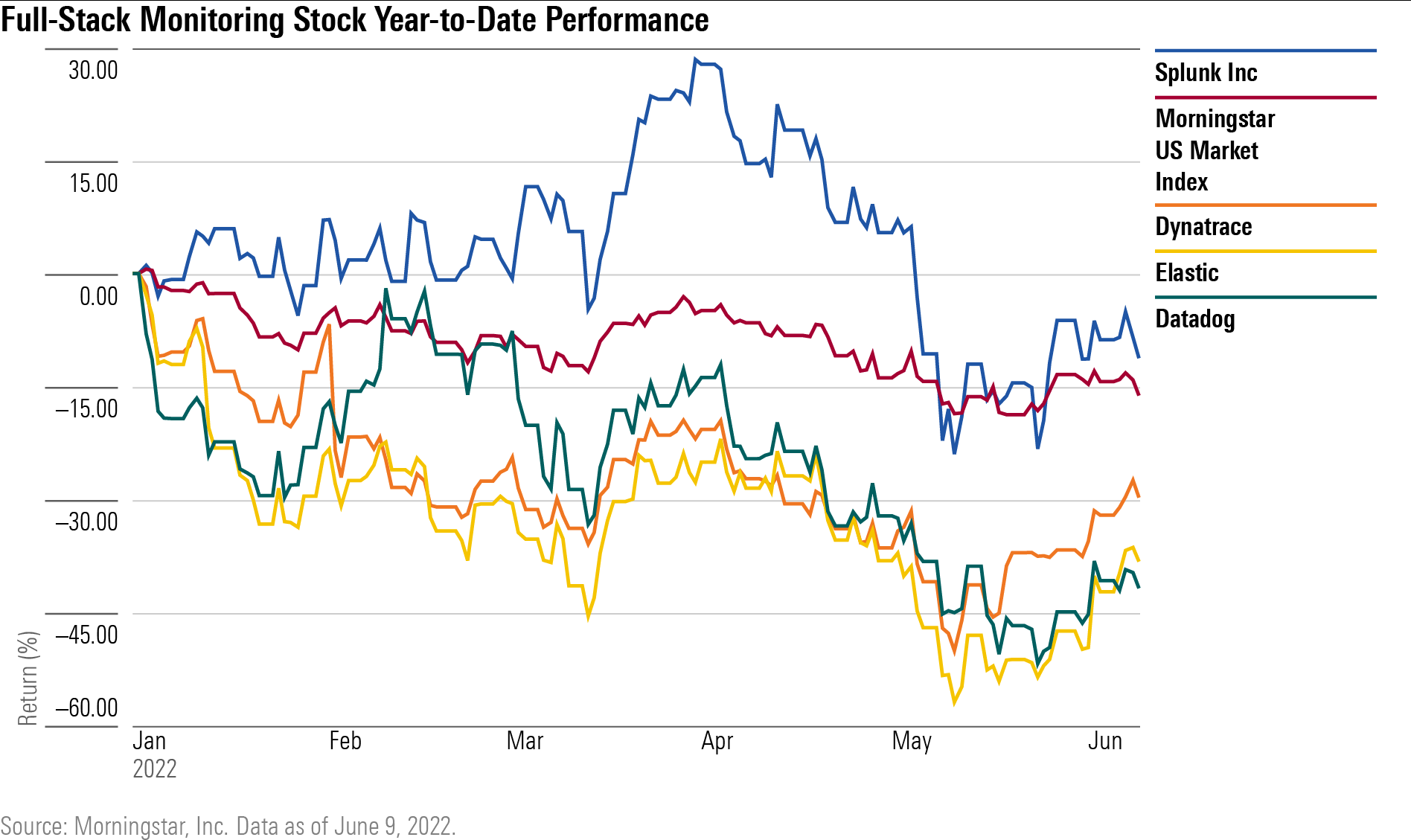

The technology sector and, to a greater extent, software stocks have been among those hardest hit during this year’s selloff. The S&P SPDR Software and Services ETF XSW is down 34.12% from its last peak on Nov. 10. In that same period, the Morningstar US Technology Index is down 21.52% and the broad US Market index is down 15.02%.

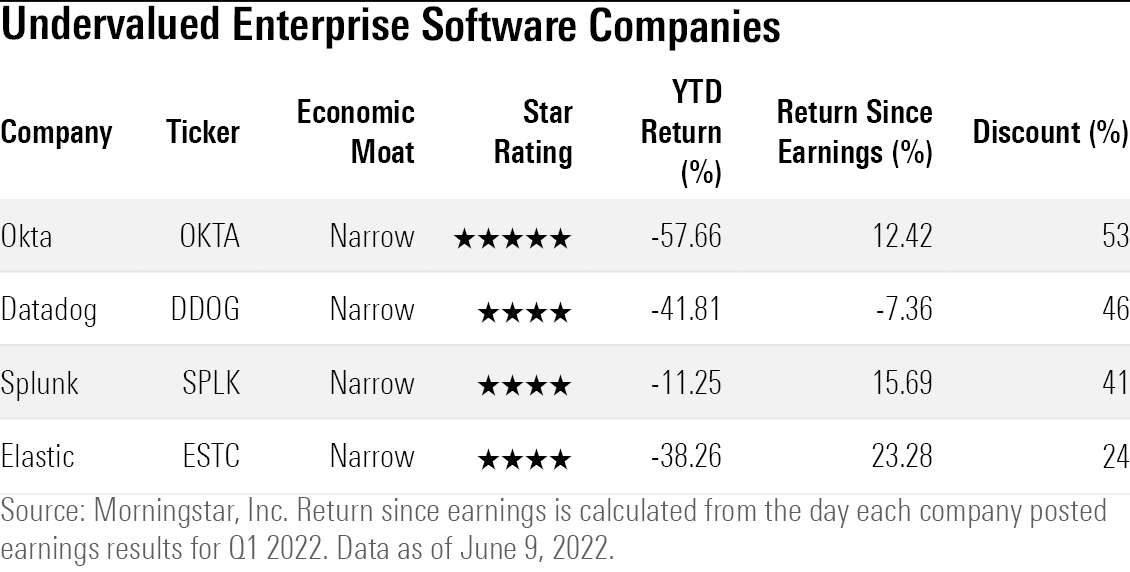

Recently, there have been signs of life among software stocks, fueled in part by strong earnings results. Among those posting solid gains since reporting first-quarter earnings are Salesforce CRM, which rallied 13.33% and Okta OKTA, with 12.42%.

“Investors oversold a lot of these companies. What’s happening now is a rebound,” says Khan.

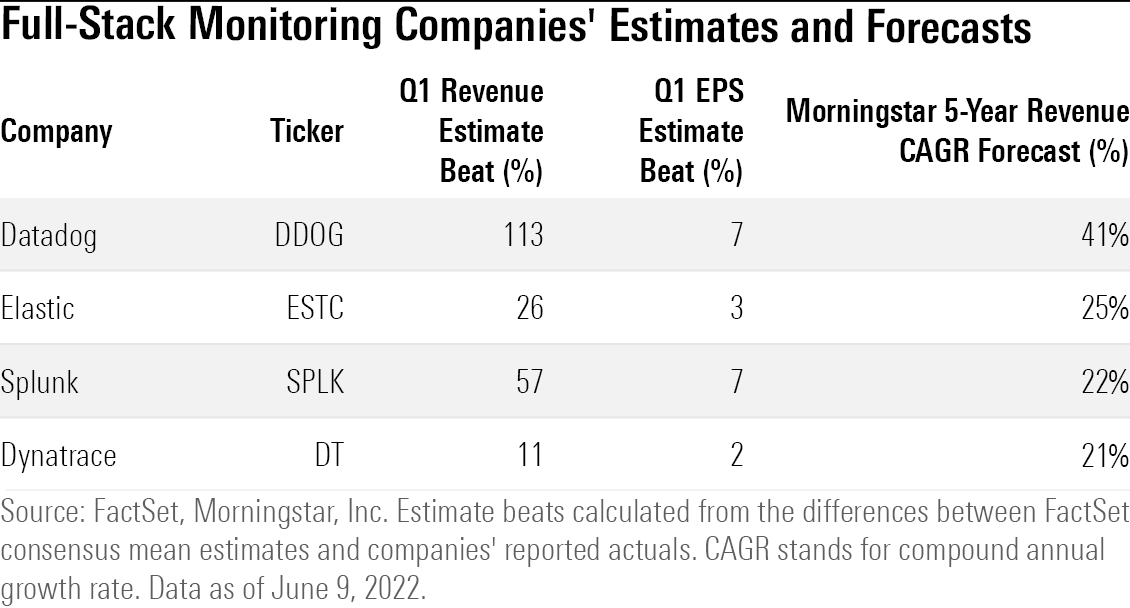

Software Stock Earnings Come in Strong

Recent results are reaffirming the importance of full-stack monitoring companies to their customers, Khan says. Take Elastic, which not only beat Wall Street’s first-quarter earnings per share and revenue estimates but also revealed a long-term revenue target of $2 billion for fiscal 2025, more than 3 times its total revenue of $608 million in fiscal 2021. While Khan believes that target is somewhat optimistic, he nonetheless anticipates the firm to hit $1.8 billion in revenue in 2025 and over $2 billion by 2026. Shares rose 23.28% after their earnings release but are still down 38.26% for the year.

Likewise, Datadog, Dynatrace, and Splunk all beat expectations for first-quarter results. Both Dynatrace and Splunk rose higher since. Dynatrace is up 29.2% since it released its results but is down 29.76% for the year to date. Splunk rose 15.69% after earnings but is still down 11.25% for the year.

“The biggest tailwind behind these companies is the shift to digitally transform businesses. A lot of companies currently have outdated IT infrastructure,” Khan says. As companies undergo the process of digital transformation, the amount of data they output grows exponentially, leading to more demand for full-stack monitoring services, he says.

But despite the push to cloud and the need for digital transformations keeping demand intact for these companies, it does not wholly defend them from a potential recession. While Khan sees these companies able to stay afloat under recessionary conditions, he says an extended recession could hurt them by reducing additional spending from clientele seeking to manage costs.

Yet, in spite of their recent rallies, shares of some of these companies remain below where Morningstar analysts peg their fair value estimates, leaving a significant margin of safety for investors.

Okta

"We are lowering our fair value estimate for narrow-moat Okta to $193 from $280 as we are taking a more conservative stance on our long-term profitability assumptions. Nonetheless, our new fair value estimate is still solidly above the company's current share price. We continue to believe that the market’s reaction to recent macroeconomic events has been overdone, with many high-quality software names put to the sword as investors fled from tech.

"As the traditional security perimeter dissipates, security teams are increasingly reliant on user identification for allowing, or preventing, access to resources, whether outside of or inside of a trusted network. Okta's cloud-delivered software solutions for identity-based cybersecurity profoundly disrupted how business and government entities secure their internal users and customers. Changing identity access providers can be terribly disruptive to security and networking teams, and we believe that Okta's approach to identity access management and user-based cybersecurity, including its expanding network of customers and applications, provide it with a durable market presence."

—Malik Ahmed Khan, equity analyst

Datadog

“We are maintaining our fair value estimate for Datadog of $192 after the firm kicked off fiscal 2022 with results better than our above-consensus expectations. We continue to be impressed with the firm’s penetration in the enterprise market.

“In our opinion, Datadog’s sticky product portfolio, a driver behind its narrow economic moat, and strong upselling into the enterprise space should allow the firm to deliver continued shareholder value. Shares are down in line with the market after these results, as broad and indiscriminate selling continues. With shares trading around $110 intraday, we still view Datadog as attractively priced for investors looking for exposure to high-quality SaaS names.”

—Malik Ahmed Khan, equity analyst

Splunk

“We are maintaining our $175 fair value estimate for narrow-moat Splunk as the firm kicked off fiscal 2023 with financial results above our estimates due to strength in the cloud transition. Our bullish thesis is underscored by our belief that Splunk will continue to benefit from secular tailwinds across its end markets and that the firm’s sticky product portfolio and entrenchment in its clients’ systems will allow it to deliver shareholder value.

“While we maintain our confidence in Splunk’s business, we are not oblivious to the tough macroeconomic conditions hampering the technology sector right now. With rising rates, inflation, and global macroeconomic uncertainty, there has been a remarkable cross-sector selloff. However, we think that the market’s adverse reaction to tech stocks has been overly punitive and that this selloff has resulted in a good entry point for investors looking for exposure to moaty software names such as Splunk.”

—Malik Ahmed Khan, equity analyst

Elastic

“We retain our $100 fair value estimate after Elastic finished fiscal 2022 strongly and set forth robust long-term revenue and profitability targets. We have a positive outlook on the firm as it stands to benefit from secular tailwinds across its end markets. In our opinion, Elastic’s sticky set of products, a driver behind the firm’s narrow economic moat, would enable the firm to deliver shareholder value over the long term.

“Recently, the market has dealt overly punitive damage to the valuations of tech companies. As a result, we see Elastic’s shares as trading at an attractive price for investors looking for moaty software-as-a-service exposure.”

—Malik Ahmed Khan, equity analyst

Correction: This article has been updated to reflect an updated outlook for Okta. The Morningstar analyst covering Okta has changed, and he lowered the company's fair value estimate to $193 from $280 since the original time of writing (June 15, 2022).

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/237L6UCCT5DIJOTXSUHF5NKFYM.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/R7HDJUUCAVCXZH56GSOH6M55CU.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)