Markets Brief: Will the Fed Stay the Course or Step It Up on Rate Hikes?

FOMC meeting ahead; Chinese tech stocks jump, cruise line stocks sink.

Inflation continues to run hot, putting the spotlight squarely on the Federal Reserve as its policy-setting committee meets Wednesday to address the best course to battle rising prices.

The May consumer price index released Friday showed prices rising 8.6% from a year earlier, the highest level in more than 41 years, and higher than the 8.3% economists expected. Core CPI, excluding food and energy prices, rose 6% compared with the 5.9% level expected.

The Fed has adopted a more-aggressive whatever-it-takes stance to bringing inflation down to a 2% target and maintained it would adjust its expectations depending on the data and evolving conditions. In a May 12 interview with NPR’s Marketplace, Federal Reserve Chair Jerome Powell said, “If things come in better than we expect, then we’re prepared to do less. If they come in worse than we expect, then we’re prepared to do more.”

Morningstar chief U.S. economist Preston Caldwell thinks there’s a great chance the “more” could come at the June meeting in the form of a 0.75-percentage-point increase in the federal-funds rate instead of a half-point increase. Paul Hickey, founder and president of Bespoke Investment Group, an independent investment research firm, would also like the Fed’s actions to match the urgency that its recent commentary has suggested might be needed. “The Fed has acknowledged the extreme levels of inflation and an urgency to contain it, but they are slow-walking to get there,” says Hickey.

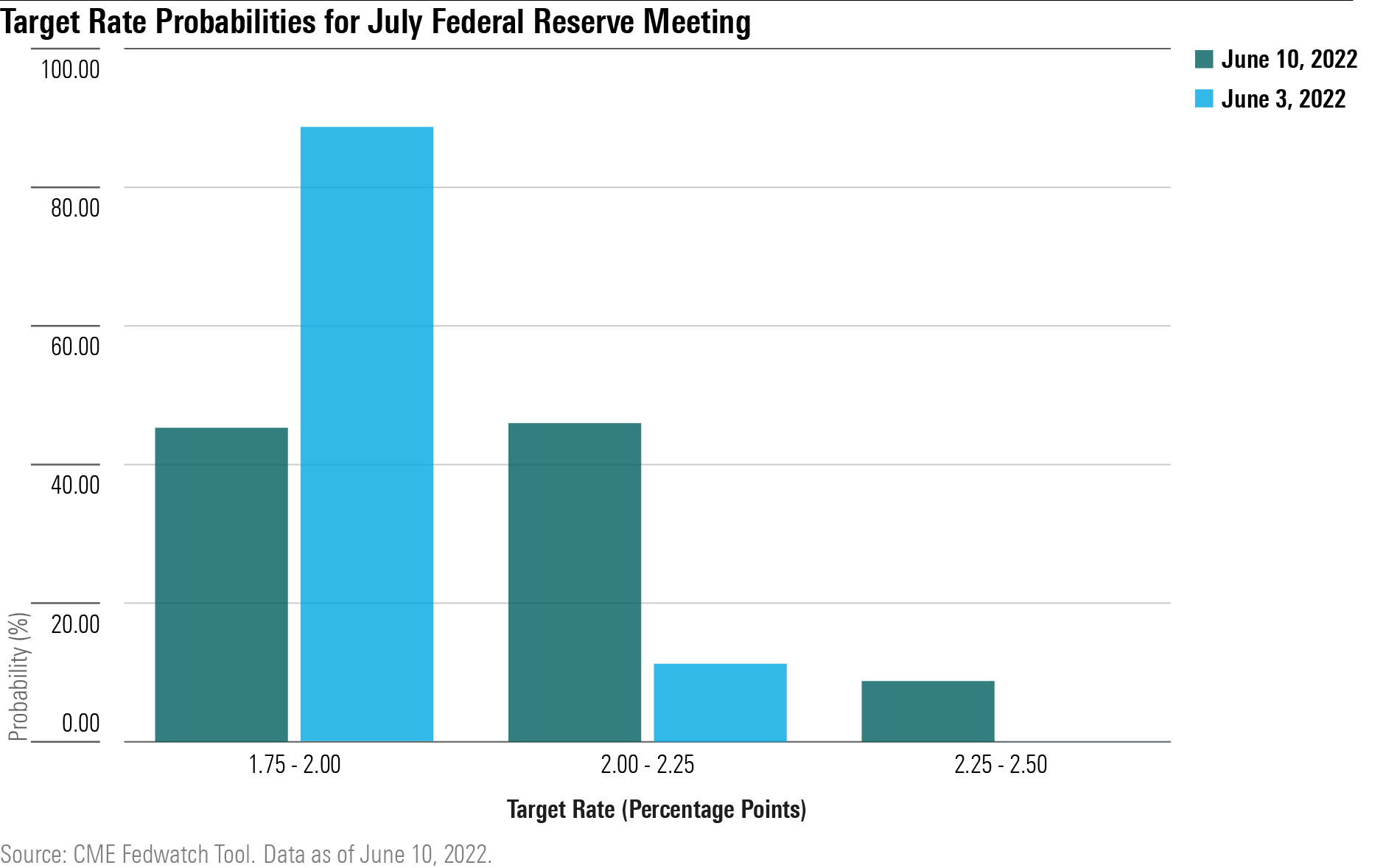

The Federal Reserve has signaled previously it will raise rates by half a percentage point at the June 15 meeting and again in July. Fed watchers and investors are betting that the Fed won't deliver any surprises at this week's meeting, according to the CME Group's FedWatch tool that tracks bets in the bond futures market. But odds are rising for more-aggressive hikes in July and September.

“There’s a fair amount of underlying pressure,” says Andy Kapyrin, co-chief investment officer of RegentAtlantic, a Morristown, N.J.-based Registered Investment Advisor with $6 billion under management. “It gives the Fed the ammunition to stay the course they’ve already set.”

Yet, Kapyrin now expects an additional half-percentage-point jump in September. Ed Yardeni, president and chief investment strategist at Yardeni Research, which provides global investment analysis, points out that a spike in the two-year Treasury yield to 2.96% after the CPI report indicates investors see the Fed raising rates by another two percentage points in the next 12 months.

At Wednesday’s meeting of the Federal Open Market Committee, investors also expect to hear more details about the “quantitative tightening” that began June 1 as the Fed shrinks its $9 trillion balance sheet of Treasuries and mortgage-backed securities.

The Federal Reserve has been clear that its monetary tools can only effect change in demand, not supply. Much of the inflation that’s occurring currently is from the supply side, as energy prices continue to surge along with agricultural commodities and raw material prices.

One area in which the Fed’s policies are having the desired effect is the housing market, which is cooling off quickly. The 30-year fixed-rate mortgage rate is at 5.54% currently, up from 3.07% a year ago. Mortgage applications have fallen to the lowest level in 22 years. The number of pending home sales declined by 3.9% in April, the sixth consecutive monthly drop.

"This is good news,” says RegentAtlantic’s Kapyrin, noting it will bring more balance into a very overheated segment of the economy. More housing data will be released next week.

He notes other positive signs: the U.S. Bureau of Labor Statistics JOLT survey of job openings and labor turnover appears to have plateaued and dipped slightly as of April, and the Personal Consumption Expenditures Price Index shows that spending on goods and services, which had diverged markedly during the coronavirus pandemic years as homebound consumers spent heavily on furnishing homes, is beginning to trend back to normal historical patterns.

Whatever happens this week, “the time to assess whether the Fed can deliver a soft landing will not start until the third quarter,” says Olga Bitel, global strategist at William Blair.

Events scheduled for the coming week include:

Monday: Oracle ORCL reports earnings.Tuesday: May Producer Price Index.Wednesday: John Wiley & Sons WLY reports earnings. May U.S. retail sales Thursday: Adobe ADBE, The Kroger Company KR reports earnings.

For the trading week ending June 10:

- The Morningstar US Market Index fell 5.08%.

- All 11 stock sectors were down for the week. The worst-performing sectors were financial services, down 6.72%, technology, down 6.38%, and basic materials, down 6.01%.

- Yield on the U.S. 10-year Treasury rose to 3.16% from 2.96%.

- Oil rose $2.53 to $120.40 per barrel.

- Of the 867 U.S.-listed companies covered by Morningstar, 69, or 8%, were up, and 798, or 92%, declined.

What Stocks Are Up?

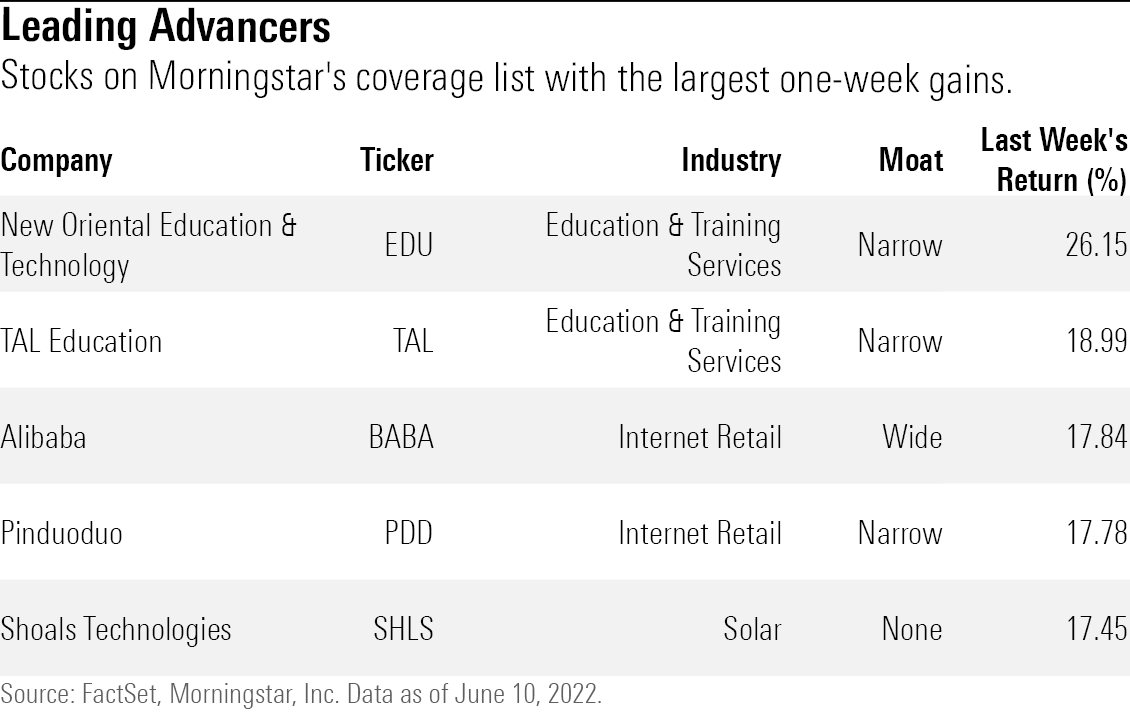

The best-performing companies in the past week were New Oriental Education EDU, TAL Education TAL, Alibaba BABA, Pinduoduo PDD, and Shoals Technologies SHLS.

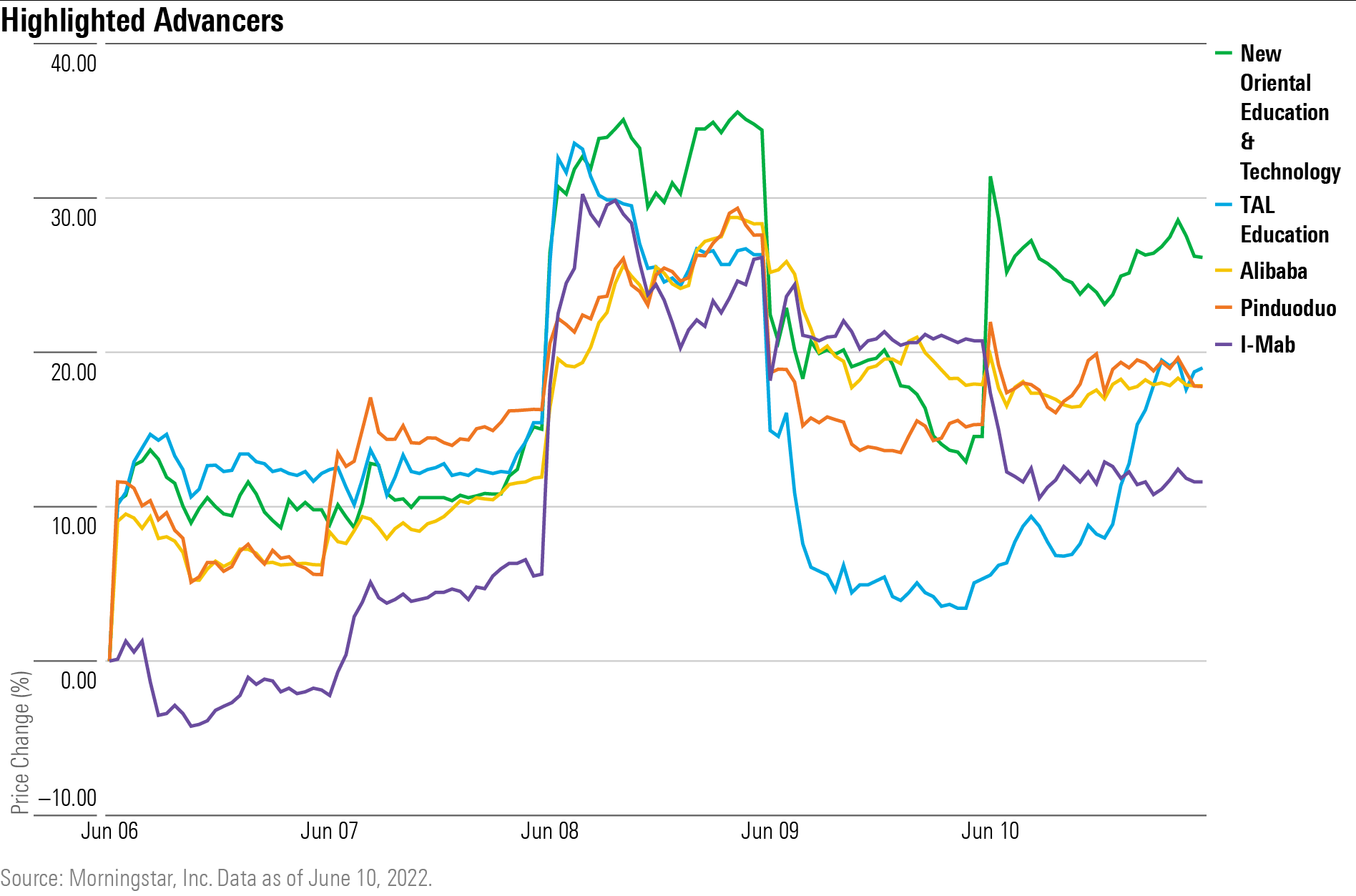

Shares of Chinese ADR-listed stocks soared in the past week after Chinese authorities announced a series of measures to help jump-start the economy. Leading the gains were New Oriental Education Group, Pinduoduo, TAL Education Group, and Alibaba. Shares of I-Mab IMAB, VNET Group VNET, and JD.com JD also rose.

What Stocks Are Down?

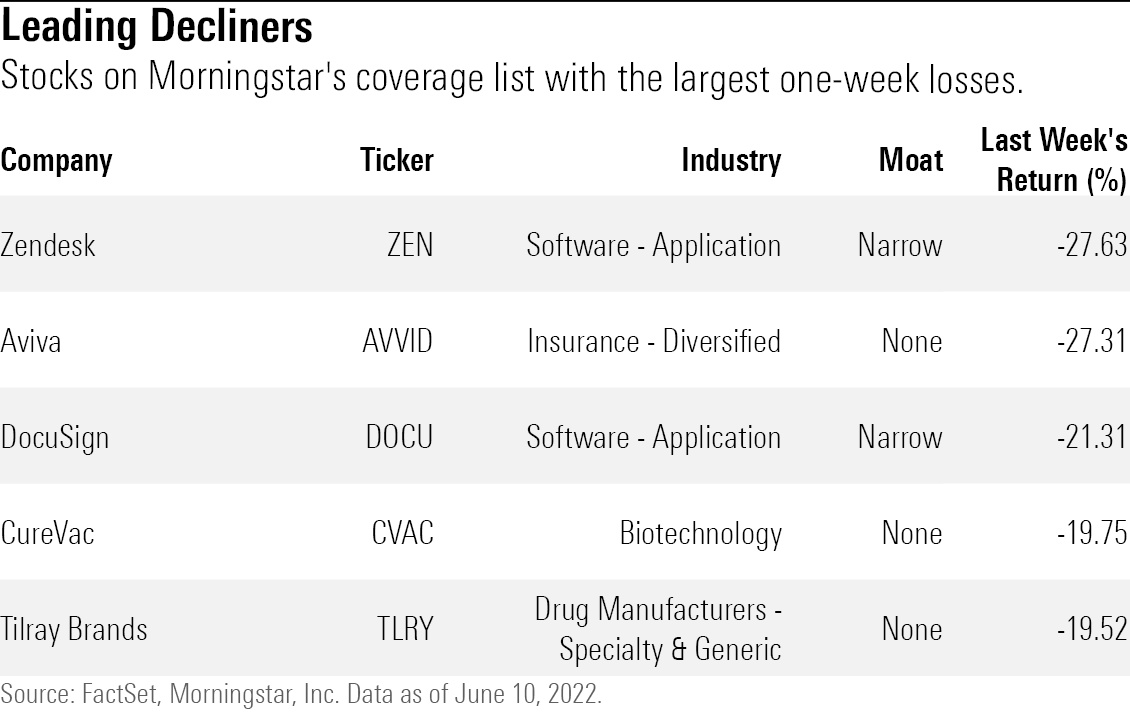

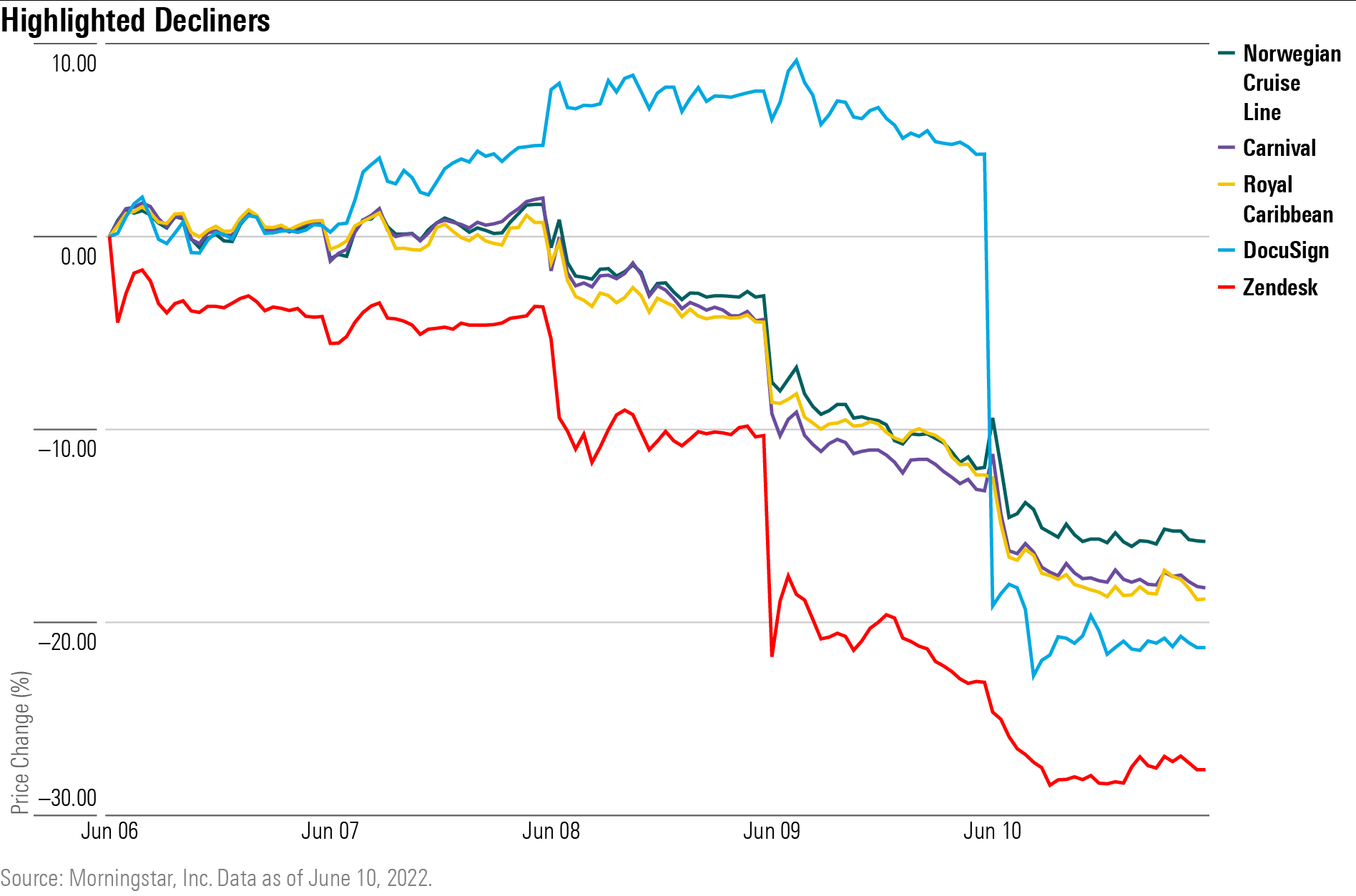

The worst-performing companies were Zendesk ZEN, Aviva AVVID, Docusign DOCU, CureVac CVAC, and Tilray TLRY.

Zendesk shares fell after the company ended its search for a buyer, opting to remain independent.

DocuSign's stock price dropped after the firm lowered its billing outlook. Additionally, the firm did not raise its full-year profitability outlook, despite moderating hiring.

Cruise line stocks such as Carnival CCL/CUK, Royal Caribbean RCL, and Norwegian Cruise Line NCLH fell after a report from Bank of America Global Research showed that ticket prices fell in the last month, suggesting demand may be softening.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)