2022′s Top Sustainable Funds Weather a Tough Market

Some ESG outperformers got a boost from a usually nonsustainable sector: energy.

Editor’s Note: This article has been updated to include the long-term performance table.

After years of solid performance, sustainable investing mutual funds have been roughed up in 2022, but a handful of strategies have been able to outperform.

The catch: Some of them have been given a boost by energy stocks, investments that some investors in environmental, social, and governance funds are trying to avoid.

This year has been difficult for many ESG funds. Energy stocks have been top performers, but most sustainable strategies hold little or no oil company stocks because of the link between oil and gas consumption and climate change. At the same time, sustainable funds tend to have outsize weightings in technology stocks, many of which have taken a beating in 2022.

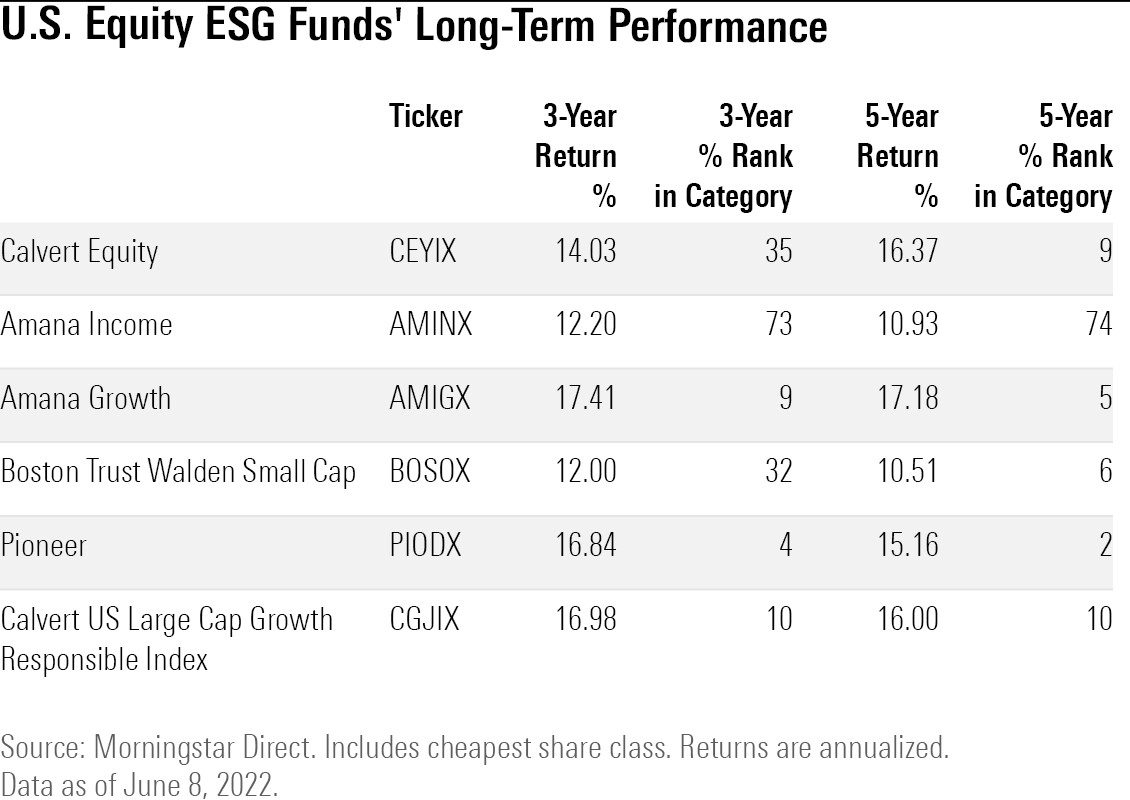

As a result, 65% of sustainable U.S. equity funds sit at the bottom of their Morningstar Category rankings in terms of year-to-date performance. Like any strategy, sustainable funds may over- or underperform over shorter periods. Over longer time periods, ESG funds have, on average, done well, with 53% of U.S. equity ESG funds in the top half of their category.

Despite the headwinds in 2022, six sustainable funds covered by Morningstar analysts rank in the top half of their category. Five of them carry a Morningstar Analyst Rating of Bronze or Silver.

For the most part, the strong 2022 performance for this group of funds isn’t limited to just this year.

For the past three years, five out of the six landed in top two quintiles of performance. In addition, over the past five years, four of the six funds ranked in the top 10% of all funds in their respective category.

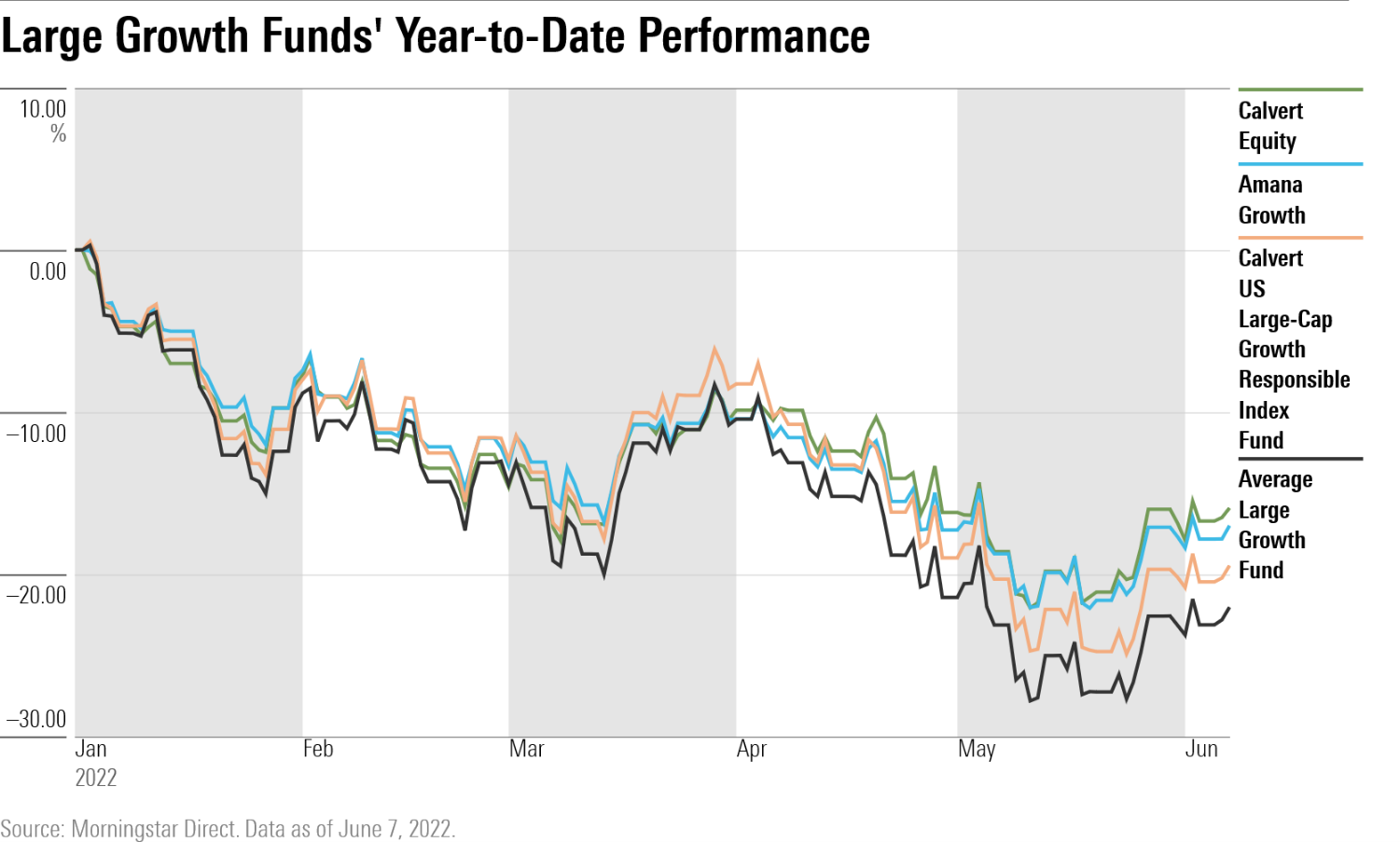

Large-Growth Funds

Calvert Equity CEYIX is one of the ESG funds that has managed to land in the top fourth of its category, with year-to-date performance nearly 6 percentage points better than the average large-growth fund. Calvert Equity has benefited from a lighter weighting in tech stocks than most funds in the category. Only 20% of the portfolio is invested in technology shares compared with the average large-growth fund’s 35% stake.

Calvert Equity also has outperformed thanks to its avoidance of Facebook parent Meta Platform’s stock FB over concerns about the company’s governance practices. Meta stock is down 40.9% this year.

Calvert’s basic-materials exposure has also been a positive. Morningstar associate director Tony Thomas notes that most ESG-focused peers hardly invest in basic materials. But Calvert’s December 2021 portfolio had 7.2% of its assets in that sector.

The fund’s outperformance is not limited to the year-to-date period. Over the past five years, Calvert Equity ranks in the top 10% of its peers.

Calvert US Large-Cap Growth Responsible Index CGJIX has also outperformed in the large-growth category, losing 19.46%. The fund tracks the Calvert US Large Cap Growth Responsible Index, which targets growth companies that operate in a manner consistent with Calvert’s principles for responsible investment, writes Morningstar associate analyst Lan Anh Tran.

Amana Growth AMIGX has been buoyed for a different reason: a large cash stake that has cushioned investors against the stock market’s decline. Amana held 9.3% of its portfolio in cash versus the category average of 1.9% as of May 31.

The fund has also gotten a boost from its holdings of biotech companies Eli Lilly LLY and Amgen AMGN, according to Morningstar Direct. The fund’s sole basic materials holding, Newmont NEM, has also lifted the fund’s performance, with the stock gaining 12.6% on the year as of June 2.

This marks a turnaround for the fund, writes Morningstar senior analyst David Kathman. “The same stocks caused the fund to trail its peers in the past nine months of 2020, when riskier, aggressive growth names led the pack, but in 2021 the fund looked great, ranking in the top 5% of the large-growth Morningstar Category.”

Large-Blend Funds

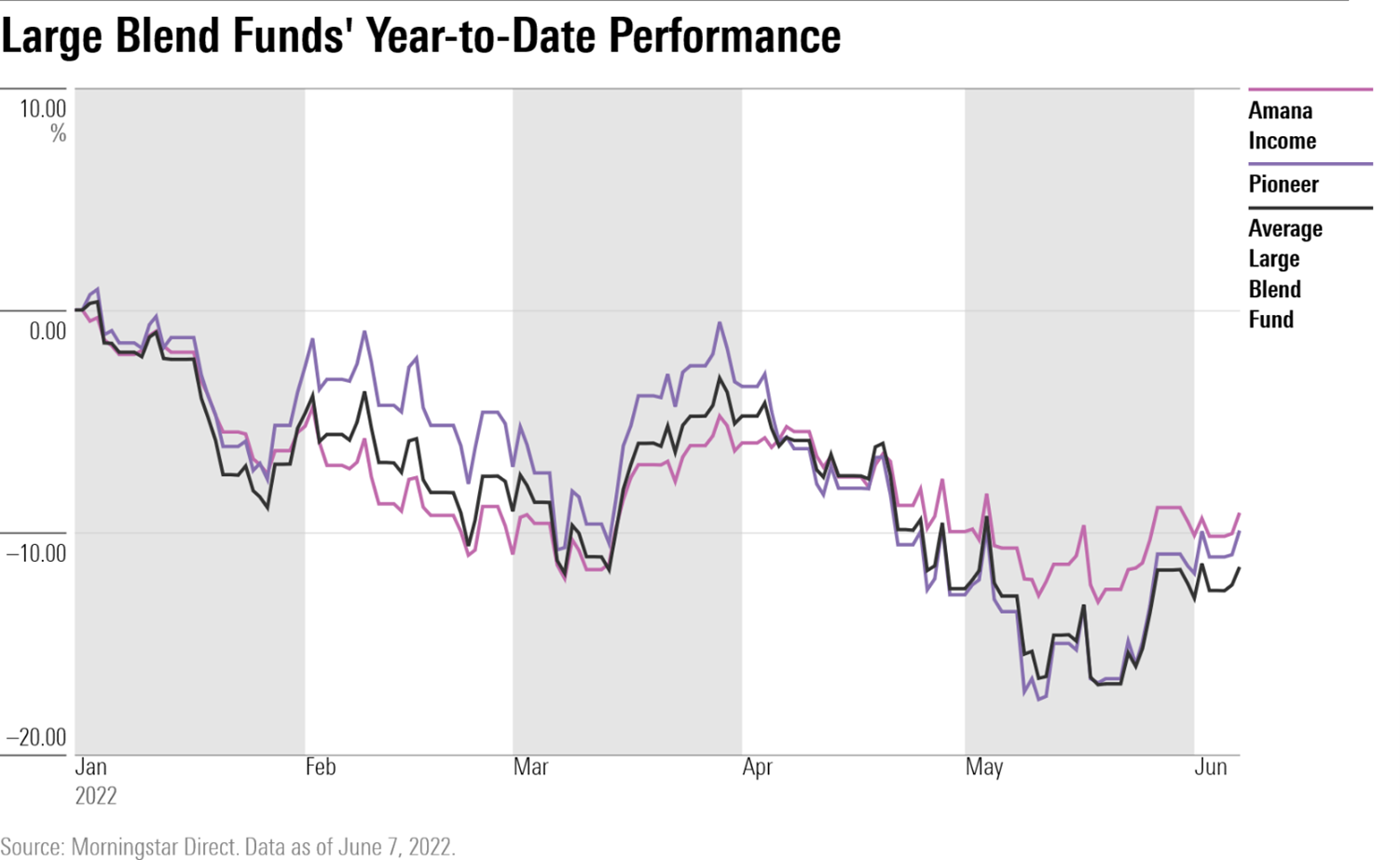

The average large-blend fund has declined 11.4% this year, but Amana Income AMINX has outperformed along with other income-oriented funds in the category, which have fared well as investors sought out the stability of dividend income in a rocky market.

Down just 9% so far in 2022, Amana Income has benefited from its healthcare picks, including Eli Lilly, Bristol-Myers Squibb BMY, and AbbVie ABBV, according to Morningstar Direct. Kathman writes that, “the managers look for stocks that pay a dividend and have yields higher than that of the S&P 500, but also have reasonable price/earnings ratios and consider secular ESG factors in deciding which stocks are attractive.”

Pioneer PIODX lands in the bucket of ESG funds that have fared well in 2022 thanks in part to its holdings of energy stocks. The fund had a 3.8% stake in Schlumberger SLB as of April 30 and a 2.5% position in EOG Resources EOG. Schlumberger is up 64.4% in 2022, and EOG is up 67.1%.

“A surprising part of the fund’s outperformance has been driven an energy overweight, which is a sector that they’ve been underweight in recent years,” says Morningstar analyst Jack Shannon. “They only own two positions in the sector, but they recently purchased EOG in September and have increased their stake in it by over 40% since February, which paid off.”

Small-Blend Funds

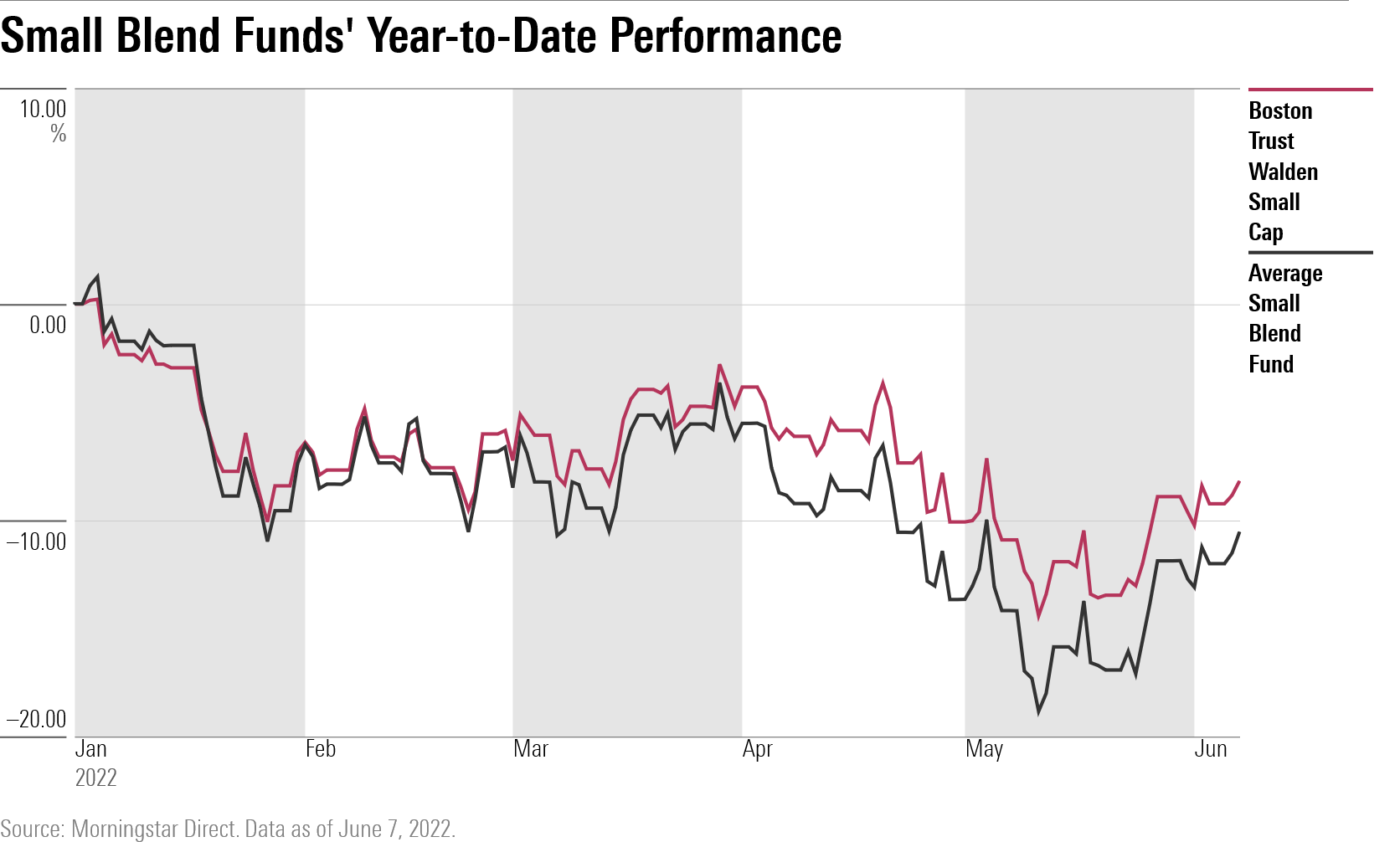

Similarly, in the small-blend category, Boston Trust Walden Small Cap BOSOX has outperformed in part due to its energy exposure. “Contrary to some ESG offerings, this team is willing to own firms in the energy and materials sectors,” writes Morningstar associate director Andrew Daniels. “Within energy, the team believes drilling firm Helmerich & Payne HP and wellhead manufacturer Cactus WHD have strong operating positions in addition to low ESG risks relative to peers.”

The fund’s portfolio also ranks as one of the least-volatile small-blend options contributing to an excellent long-term track record on a risk-adjusted basis, writes Daniels. The fund ranks in the 5th percentile of all small-blend funds for five-year returns.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q27ZB7KFPZBMHFKY6IURRWJQHM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)