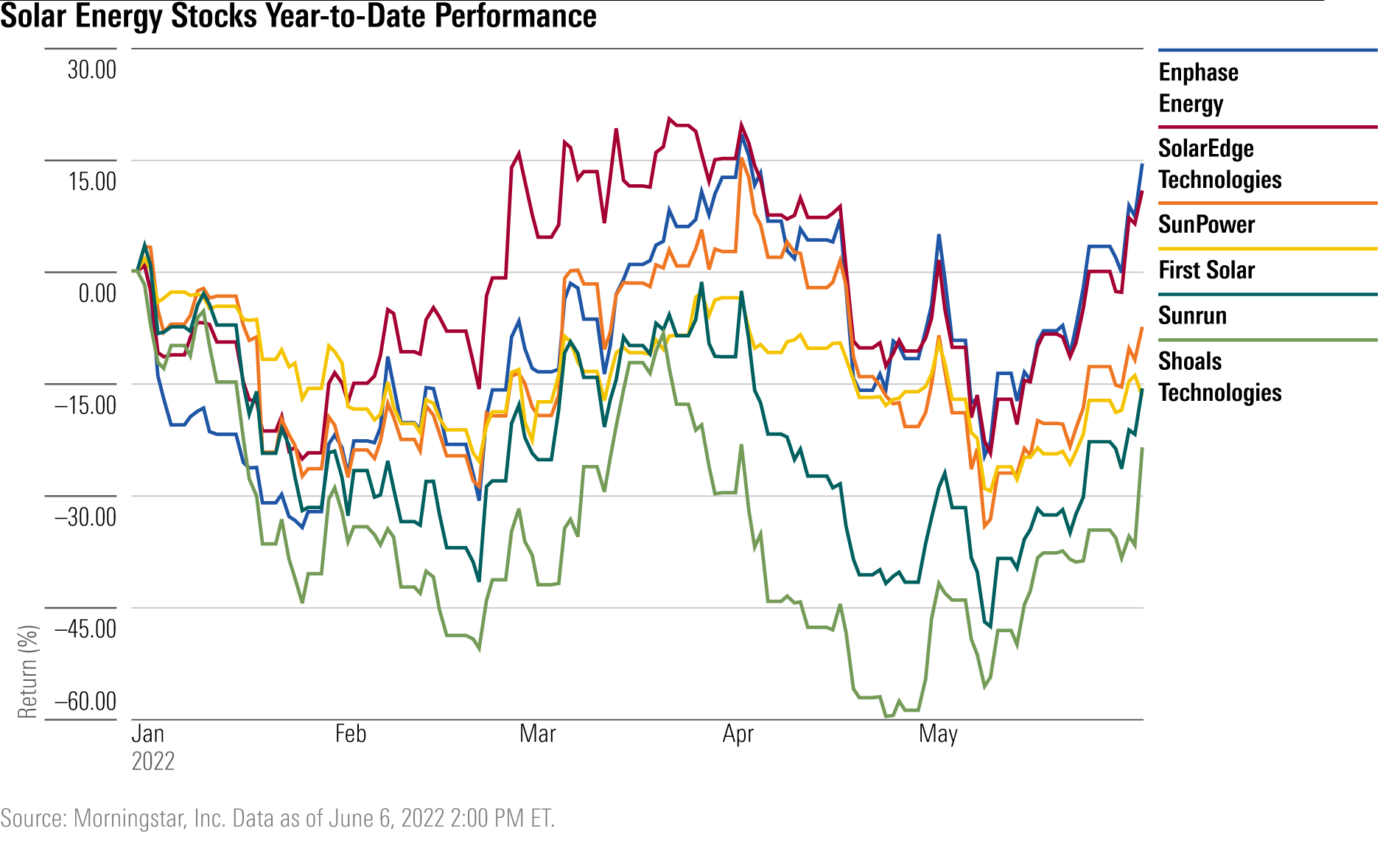

Solar Stocks Rally on Biden Tariff Suspension

Shoals Technologies leads the gains, but First Solar misses out on the rally.

Solar energy stocks rallied on news that President Joe Biden is suspending tariffs on solar panels from Southeast Asian nations.

Shares of energy balance system developer Shoals Technologies SHLS led the charge, gaining as much as 20% during Monday’s trading session.

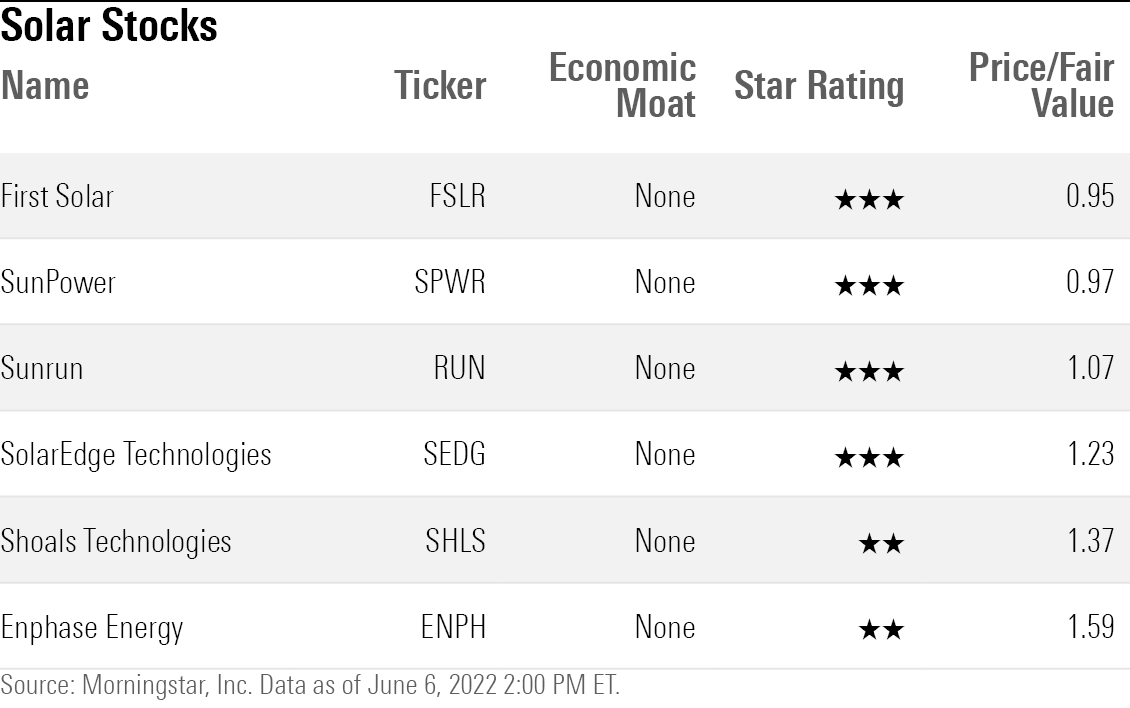

For investors in the space, the news doesn’t change the valuation outlook for solar stocks, according to Morningstar analyst Brett Castelli. Across the industry, the stocks are trading in fairly valued territory or pushing into overvalued ranges.

“Despite the positive news, we view most solar-related stocks to be fairly valued across our coverage list,” Castelli writes.

Biden’s tariff exemption will last 24 months and is expected to reduce the cost of solar panels. Castelli sees the exemption mostly benefiting companies with exposure to utility-scale solar projects, which generate 1 megawatt or greater of solar energy. Solar panels contribute to about 30% of those large-scale project costs, according to Castelli.

The firm with the most exposure to utility-scale solar projects is Shoals, says Castelli, leading to the large jump in its stock price. Other solar stocks that rose on Monday include Sunrun RUN, Enphase Energy ENPH, and SolarEdge Technologies SEDG.

The tariff suspension allows “much-needed near-term certainty for developers,” Castelli writes. “We note many industry participants have delayed projects as they awaited clarity on the tariffs. Additionally, Biden plans to use the Defense Production Act to provide support for U.S.-made solar panels. We view these actions as aimed at balancing continued buildout of solar projects in the near term to support decarbonization goals, while looking to increase U.S. solar manufacturing over time.”

The tariff halt benefit does not extend to U.S.-based solar panel manufacturers, such as First Solar FSLR, which traded slightly lower on Monday.

Despite the news, Castelli does not anticipate much change to the solar companies’ valuations in his coverage.

“We did not make fair value changes when the original tariff inquiry was announced; thus, we do not anticipate making material revisions with this action. While policy questions remain in certain corners of the solar market, such as residential net metering, we expect the focus to shift to the macro environment and the potential positive implications of the high energy price environment,” he writes.

Despite Monday's rally, only Shoals stock changed its Morningstar Rating, to 2 stars from 3 stars.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)