Revenge of the Value-Tilted Robo-Advisors

Value investing is finally having its day in the sun, but its long period in the shadows should give robo-advisors' investors pause.

Two of the largest robo-advisor programs—Betterment and Schwab Intelligent Portfolios—have embedded significant value tilts in their portfolios. They had good reason for doing so, as many academic studies previously found a long-term performance edge for value stocks (typically defined as those that are trading at relatively cheap prices based on metrics such as earnings, book value, sales, or liquidation value).

Recent history, however, has proved more difficult. Value stocks have only recently pulled ahead of their growthier counterparts after lagging far behind over most of the past 12 years. This resurgence gives value advocates a much-needed taste of redemption. But value’s decade-plus stint of wandering through the wilderness raises questions about whether robo-advisors should really be tilting their portfolios toward any investment style, be it value or growth.

Why Overweighting Value Seemed Like a Good Idea at the Time

Value investing as a formal investing philosophy originated in the 1920s, when Benjamin Graham and David Dodd both taught at Columbia University. The two later cowrote the seminal text, Security Analysis [1]. Over the next few decades, several other legendary investors—including Warren Buffett, Mario Gabelli, Chuck Royce, and Chris Browne—adopted Graham and Dodd’s philosophy. At the same time, numerous studies by both investment practitioners and academics found a long-term performance edge for value stocks. Probably most famous among this research was Eugene Fama and Kenneth French’s influential paper on value versus growth [2], which was published in 1988.

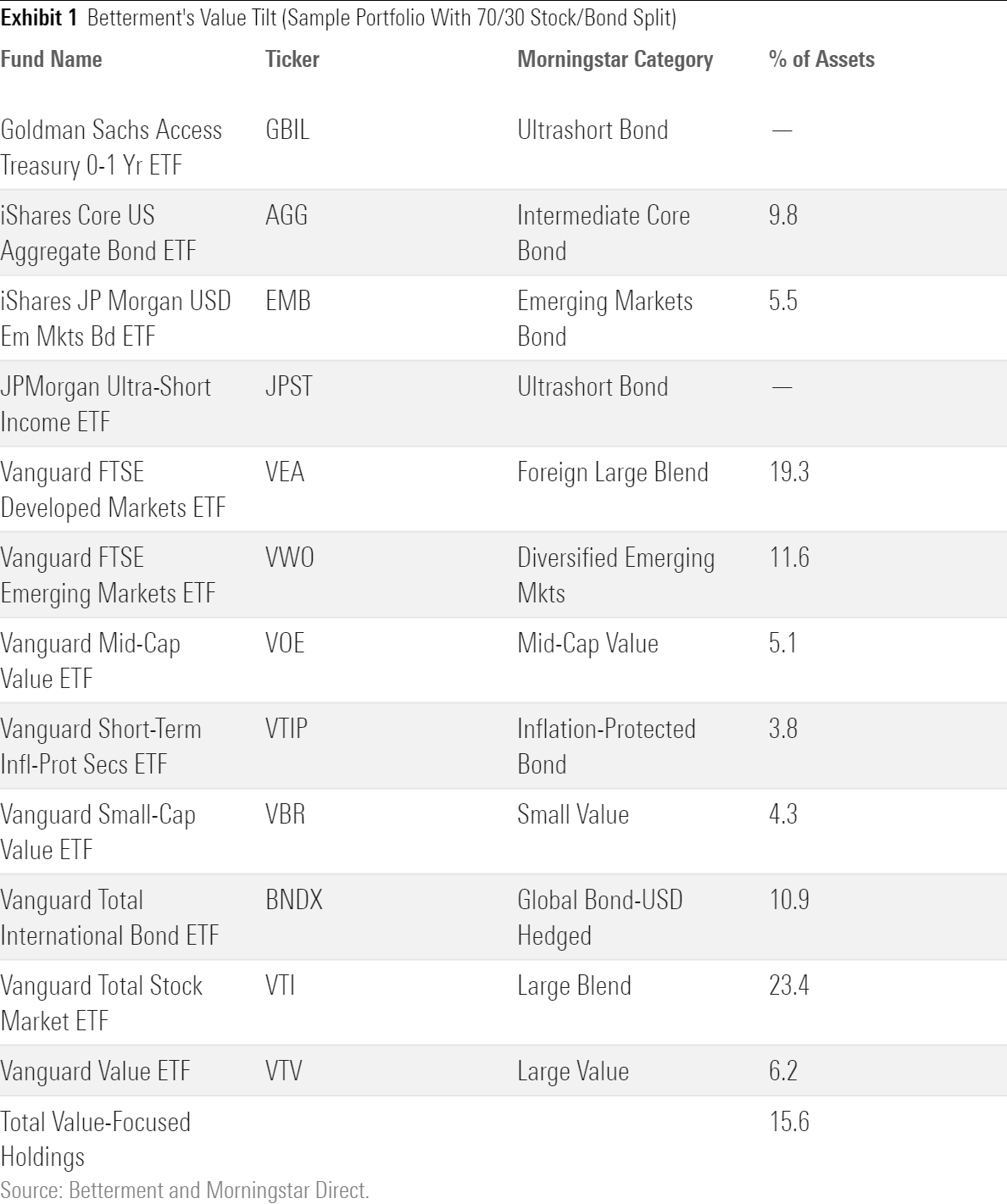

By the time Betterment and Schwab introduced their robo-advisory offerings (in 2010 and 2015, respectively) value stocks had experienced a few slumps, but were still on solid theoretical footing. Thus, it probably seemed reasonable to tilt portfolio allocations toward the value side. And both Betterment and Schwab did just that, and in a significant way. (Several other robo-advisors also incorporate value tilts, but generally to a smaller extent.) For example, a sample 70/30 portfolio from Betterment currently carves out a total of 15.6% of assets to large, mid-, and small-cap value exchange-traded funds from Vanguard.

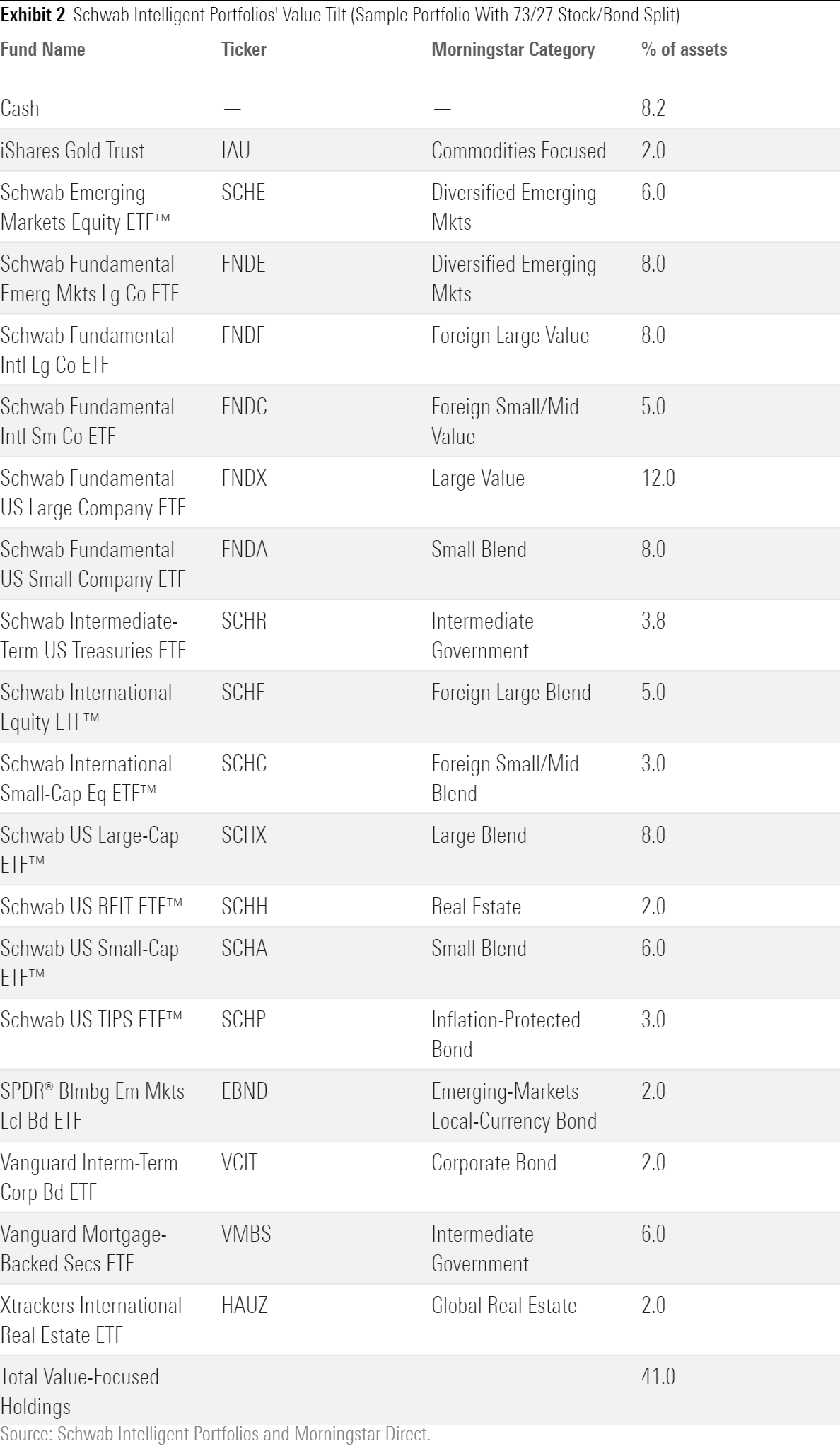

Schwab Intelligent Portfolios leans even more heavily on value stocks. In a portfolio that allocates 73% of total assets to stocks and 27% to bonds and cash, for example, Schwab currently allocates 35% of assets to five of its proprietary Fundamental Index funds, which weight their holdings based on fundamental measures of company size such as revenue, operating cash flow, dividends, and share buybacks. While not officially labeled value offerings, the weighting methodology used by these funds effectively leads to heavier allocations to value stocks (as Schwab discusses on its website). Morningstar classifies three of these funds (totaling 21% of assets) as value offerings.

How Robo-Advisors’ Value Tilts Worked in Practice

Unfortunately, value-oriented stocks later went on to lag their growth counterparts for an unusually long stretch, falling behind in every calendar year starting in 2009 except for 2011 and 2016. Value stocks suffered partly because of what they’re not: high-growth names with heavy exposure to technology and other sectors that dominated the market. Value stocks also suffered because of their heavier exposure to sectors such as energy and financial services, which were out of favor during most of the past decade.

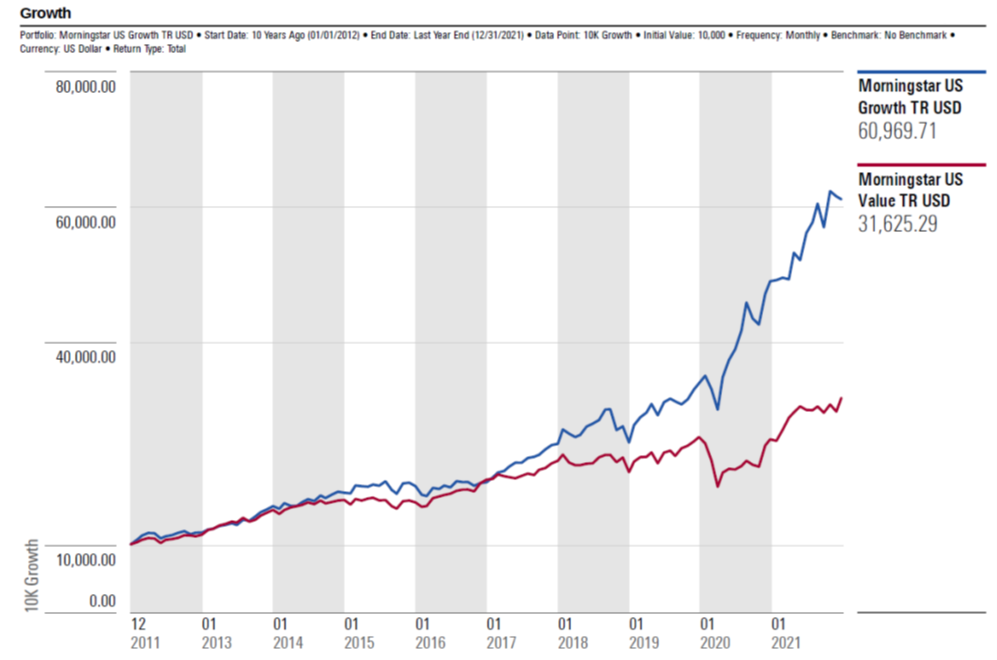

Exhibit 3: Value versus Growth (2012 Through 2021)

- source: Morningstar Direct, as of Dec. 31, 2021.

As a result, a hypothetical $10,000 investment in growth stocks (as measured by Morningstar’s US Growth Index) would have made close to twice as much as the same amount invested in value stocks over the trailing 10-year period ended in 2021. This massive performance gap likely took a significant bite out of returns for the two major robo-advisor programs that overweighted value.

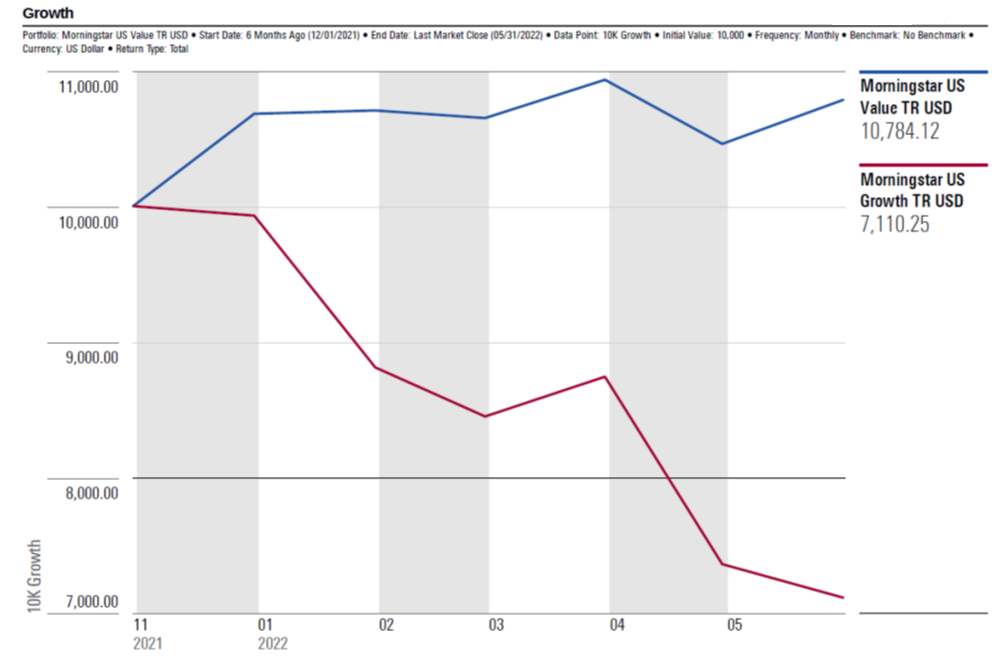

The tide finally started turning toward the end of 2021, as market concerns surfaced about the sudden surge in inflation and the prospect of future interest-rate hikes. Cyclical companies that benefit from strong economic growth pulled ahead, while the specter of rising interest rates dented valuations for the richly valued tech names that previously led the market. As a result, the Morningstar US Value Index enjoyed a 7.8% gain for the trailing six-month period through May 31, 2022, while the Morningstar US Growth Index lost about 29% of its value.

Exhibit 4: Value versus Growth (Trailing Six Months Through May 31, 2022)

- source: Morningstar Direct

What it Means for Investors

It’s impossible to predict how long value’s recent resurgence will last. Cliff Asness recently expressed the view that value stocks remain relatively cheap, as the valuation spread between value and growth hasn’t significantly narrowed. In addition, value stocks could continue to prosper in an era of ongoing interest-rate hikes, which tend to hurt growth stocks more because so much of their worth depends on the present value of their future earnings. On the other hand, value stocks—particularly in economically sensitive sectors such as basic materials, consumer cyclicals, and technology components—would likely suffer if the economy plunges into recession.

Because market leadership is inherently uncertain, investors should think carefully about the wisdom of making pronounced style tilts in any direction, whether value or growth. That’s particularly true for investors using robo-advisor programs, who probably want to automate their investments without worrying about performance when market leadership shifts. Buying into a robo-advisor with a strong value bent requires conviction that 1) value stocks will continue to demonstrate a long-term performance advantage, and 2) this performance edge will be realized during a period that matches a given investor’s time horizon. As the long-running value saga demonstrates, those two things are far from guaranteed.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5N6PBZJLMJEIXBH6EHTKPDK6NE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FIN36RNGOFABFDS2NCP2RCCG3I.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)