Chasing Thematic ETFs' Returns Has Set Investors Up to Fail

By the time you find out about a trend, it's often too late.

A version of this article previously appeared in the May 2022 issue of Morningstar ETFInvestor. Click here to download a complimentary copy.

Thematic funds have exploded in popularity in recent years. Their allure for investors is plain. They simplify investing in the trends that dominate today's headlines and may shape the future. Thematic funds provide a targeted way for investors to make predictions and put their money where their mouths are.

Thematic funds aggregate stocks by a particular theme, giving investors a tool to buy into a trend without having to deeply analyze individual companies. In many cases it is fund investors, not the funds' portfolio managers, who are expected to identify market-beating themes and try to time their bets right.

The problem is that investors are not particularly good at this—and they're not alone. Professional active managers struggle to beat passive benchmarks, and they have greater resources, training, and experience, and they don't have another day job competing for their time. Some combination of hope, compelling narratives, and a fear of missing out can lead investors to chase thematic funds' returns. In 2020, the market for thematic funds took off as retail investors entered the market in droves. This, unsurprisingly, coincided with impressive returns for many of these funds.

The bull market that spawned from the coronavirus-driven selloff was the dawn of a new golden age for thematic funds and the predecessor of the meme-stock boom (which led to meme-stock thematic funds, of course). Investors took to social media to bet on companies like Peloton PTON and Zoom ZM that benefited from the world being stuck in their homes. Asset managers launched three different work-from-home themed exchange-traded funds. WallStreetBets began to enter investors' vernacular, and a cult following for Tesla TSLA, Cathie Wood, and ARK Invest pushed all three onto the center stage.

The returns were tempting. Among the 111 U.S. thematic ETFs listed prior to May 2019 that were still around as of April 2022, 50 gained more than 50% in 2020. Another 17 had annual returns in excess of 100%—five of which came from Wood's ARK Invest.

It's easy to see the appeal of thematic funds. Several funds' 2020 returns were potentially life-changing for investors, and their investment theses are easily digestible. But as many of these funds climbed ever higher, valuations stretched to the end of their elasticity. In 2022, many have broken.

Now That's a Gap!

Funds' time-weighted total returns can be misleading. While they accurately portray how a fund has performed, they fail to capture the experience of a typical investor. Dollar-weighted returns (aka investor returns) give us a better sense of how investors have fared in a fund by accounting for the timing of their purchases and sales. Generally speaking, there tends to be a gap between fund performance (time-weighted returns) and investor performance (dollar-weighted returns).

That's been the case for thematic funds over the past three years. Red-hot performance has often been the prelude to massive inflows. As money has poured in, returns have sputtered, stalled, and eventually reversed course. Looking back, many investors bought many of these funds near the top and set themselves up for disappointment in the process.

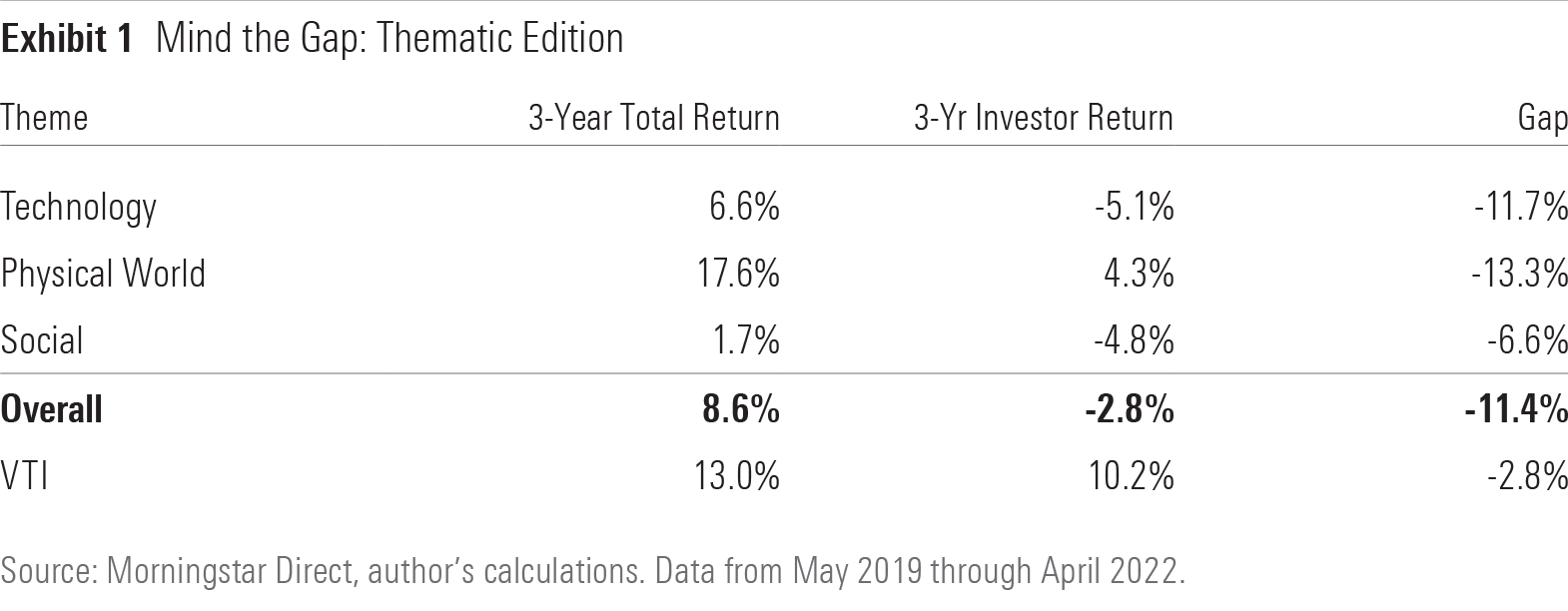

To get a better idea of investors' experience with these funds, I calculated the dollar-weighted investor returns for each of the 111 U.S. thematic ETFs that launched prior to May 2019 and survived through April 2022. Exhibit 1 measures the gap between the three-year total return of the 111 funds in my sample and their investor returns. I've grouped the summary statistics according to the broad themes each ETF belongs to within Morningstar's thematic funds taxonomy.

These funds have generally failed on two accounts. First, 71% of the funds in the sample failed to beat the market, as represented by Vanguard Total Stock Market Index ETF VTI. Said differently, their time-weighted returns were disappointing. Second, and even worse, is that their investor returns were 11.4 percentage points less than their total return, on average. This gap is symptomatic of investors chasing returns and piling in as enthusiasm, valuations, and assets peaked, just as the music was about to stop.

Don't Fly Too Close to the Sun

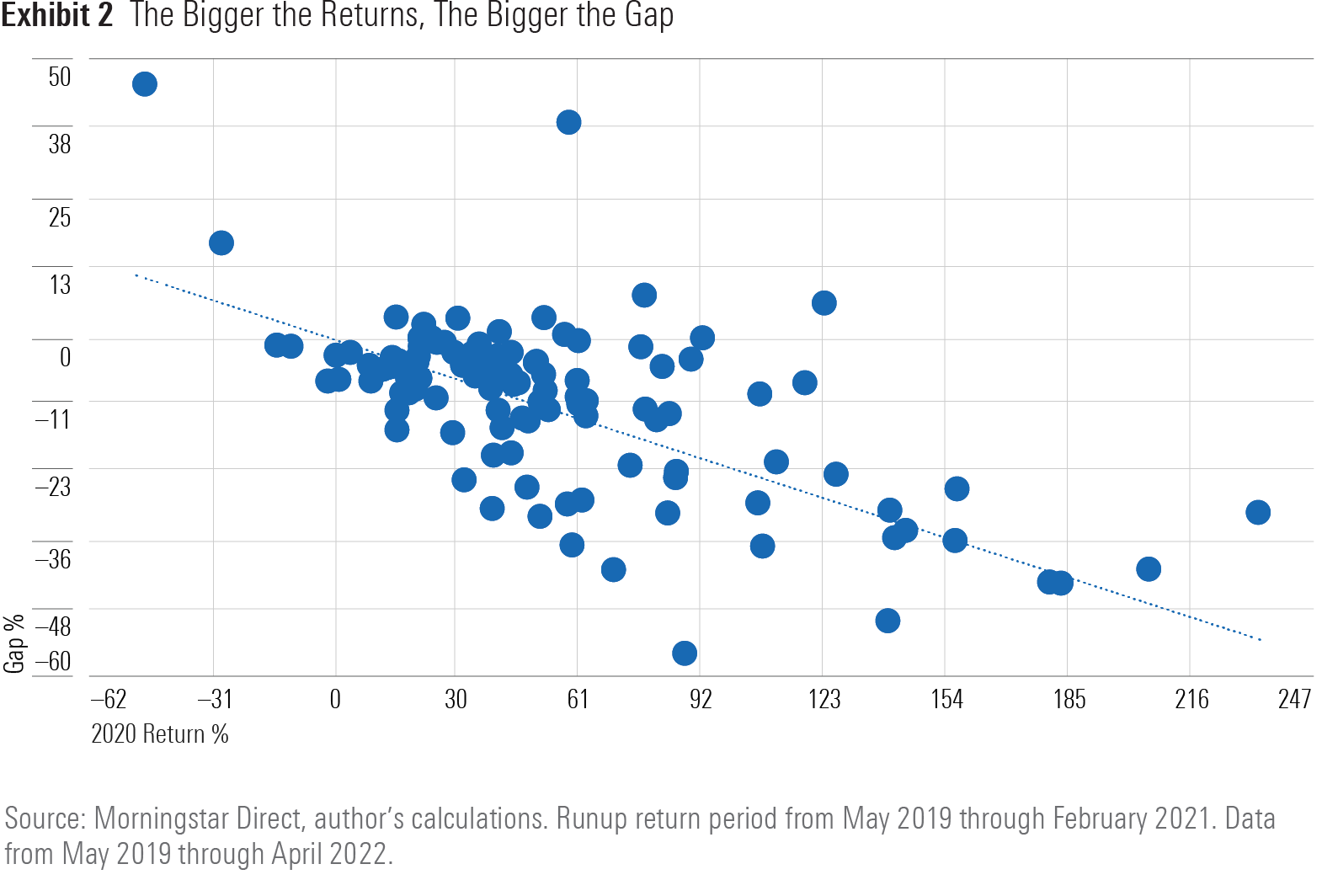

Exhibit 2 highlights the relationship between each sampled fund's gap in investor and total returns and its 2020 return during the runup to peak inflows. It paints a clear picture of the potential pitfalls of chasing performance. From May 2019 through April 2022, investors in 2020's top-performing thematic funds experienced the largest (negative) gap between the returns they realized and the returns delivered by the funds they owned. Indeed, several of 2020's top-performing thematic ETFs experienced three-year investor returns that were more than 40 percentage points below their three-year total returns.

Among the 10 best-performing thematic ETFs of 2020, all but one had a negative investor return from May 2019 through April 2022. The smallest gap between time-weighted and dollar-weighted returns among these 10 ETFs was 26.6 percentage points.

Unsurprisingly, three of the ETFs in this group hail from ARK Invest. The remaining seven ETFs are all pinned to clean energy themes and gained anywhere from 140% to 233% in 2020. Unlike the ARK Invest funds, these funds have held on to a decent portion of their gains. Each of these seven clean energy ETFs logged an annualized total return of at least 20% between May 2019 and April 2022, roughly double VTI's return over the same period. Yet the average dollar-weighted return among these top-performing clean energy ETFs was negative 9.8%, translating to an average gap of 37.9% between these funds' total returns and investor returns.

On the flip side, the 10 worst-performing thematic ETFs of 2020 saw a positive gap between their total returns and investor returns. This positive investor experience was driven entirely by the two worst-performing thematic ETFs of 2020: Breakwave Dry Bulk Shipping ETF BDRY and U.S. Global Jets ETF JETS. BDRY dropped by more than 48% in 2020, and JETS lost 29%, as the pandemic brought the global economy to a halt.

But contrarian investors bought the dip, betting on a reversion to the mean for these funds and a reversal of the restrictions imposed by the global pandemic. Between the end of 2019 and June 2021, BDRY's net assets grew 48-fold and JETS' multiplied by a factor of 69. Investors timed their investments in BDRY and JETS well. From April 2020 through March 2021, BDRY gained 159% and JETS 83%. The result was a positive gap of 45.5% between BDRY's time- and dollar-weighted returns and 17.2% for JETS. Investors clearly had more success buying this pair of beaten-down thematic ETFs at depressed prices than those with sky-high valuations.

Chasing Returns Comes With a High Cost

A look at the performance of thematic funds over the past three years is a damning indictment of investors' tendency to chase performance. It's easy to be swept up in narratives and envious of others' success, but investors must consider what is currently priced into the theme they are buying. Buying opportunities are often long gone once investors recognize the trend—and even further gone by the time there are thematic ETFs looking to capitalize on it. This rings especially true for the top-performing thematic funds.

In my analysis, top performers tended to be used worst by investors. This cautionary tale is a good reminder that low-cost, diversified portfolios are tough to beat in the long run.

/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-25-2023/t_f3a19a3382db4855b642d8e3207aba10_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)