Markets Brief: What's Happening With Inflation Expectations?

May CPI data ahead; software stocks rally.

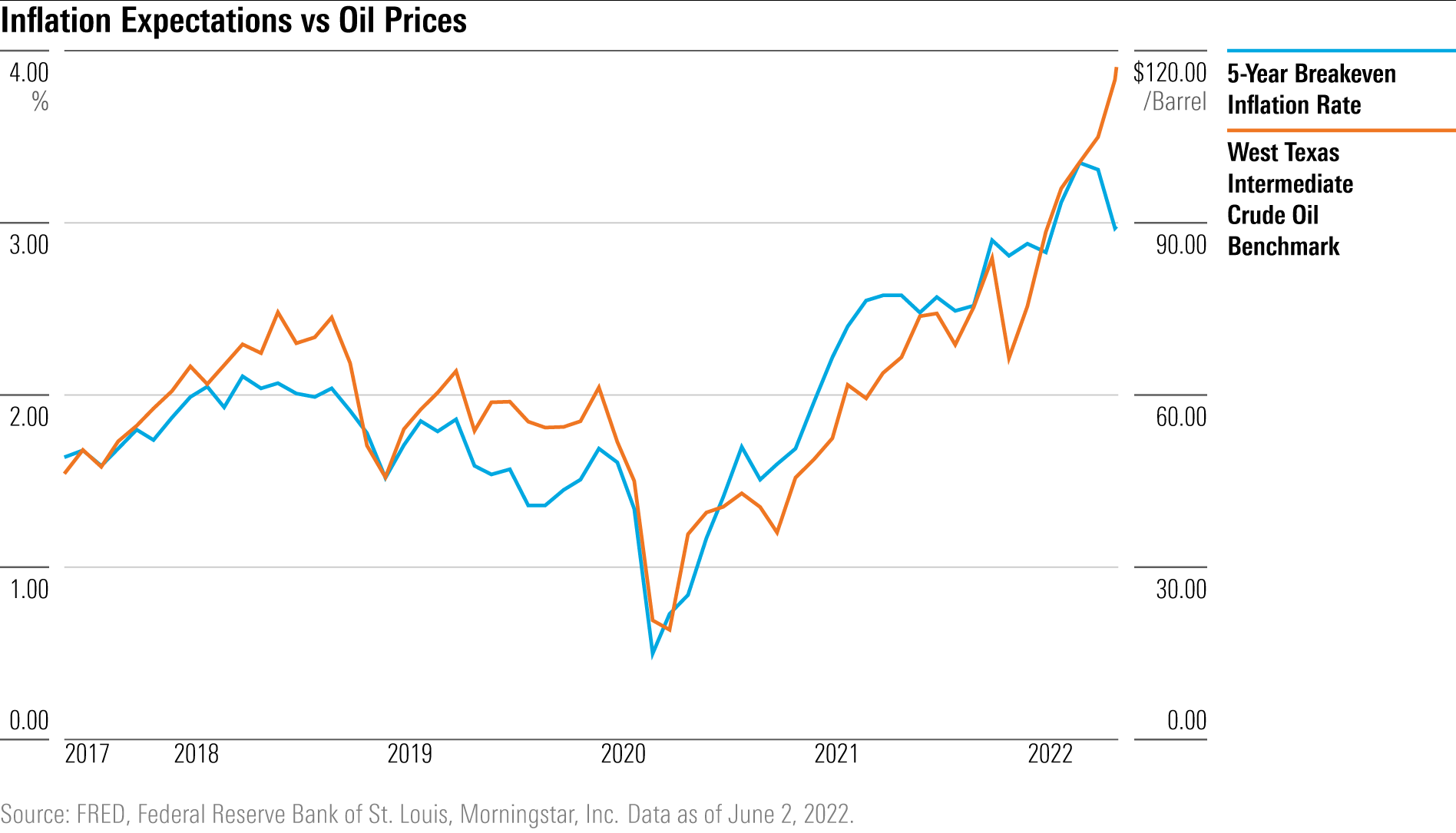

While high inflation continues to take a bite out of consumers’ wallets, an important corner of the bond market is signaling a little more comfort with the idea that price pressures won’t continue to spiral higher.

That marks a change from March and April, when there were widespread concerns that the Federal Reserve was so far behind the curve in fighting inflation that it might not be able to get inflation under control.

That’s not to say that inflation doesn’t present a real risk to the economy and that inflation will come down to prepandemic levels anytime soon. Case in point: Oil prices closed north of $120 per barrel Friday, driven higher in the wake of the European Union moving forward with plans for a partial ban on Russian oil imports.

But the U.S. government bond market, which sends important signals on investor expectations for inflation, is telling a somewhat reassuring story.

This can be seen in Treasury Inflation-Protected Securities. To see what the market's expectation is for inflation over the next five years, investors look at the difference between the five-year nominal Treasury yield and the five-year TIPS. This is known as the breakeven rate. On June 2, the five-year breakeven rate was 2.97%, meaning investors expect inflation to average around 3% for the next five years.

On the one hand, a roughly 3% breakeven rate is still up from the 2.5% or so rate registered before the pandemic. But it’s also down meaningfully from March, when the breakeven rate topped out above 3.5%. Plus, inflation expectations have at least for now broken free of a tight connection to oil prices. As oil prices surged in the past week, the five-year breakeven rate only rose slightly.

What’s happened? The Fed has convinced the markets it is now on the ball.

"The bond market is telling us that they now believe the Fed is serious about curbing inflation," says Tim Murray, capital markets strategist at T. Rowe Price Associates. "They have been clear that they’re willing to take economic pain in order to get inflation under control and there was a lot of skepticism that they would do that until recently."

Murray notes that in public comments Fed officials have put the message out that fighting inflation is their current focus.

Part of that has included an unusually high level of communication about their plans for raising rates. In the past, Fed officials have generally avoided making predictions about coming changes in interest rates. In recent weeks, however, policymakers, including Fed Chair Jerome Powell, have explicitly said they expect to raise the federal-funds rate by a half of a percentage point in at least the next two meetings. The fed-funds rate is currently at 0.75% after a half-point increase in May.

That messaging "has helped longer-term inflation expectations stabilize," says John Briggs, global head of desk strategy at NatWest Markets.

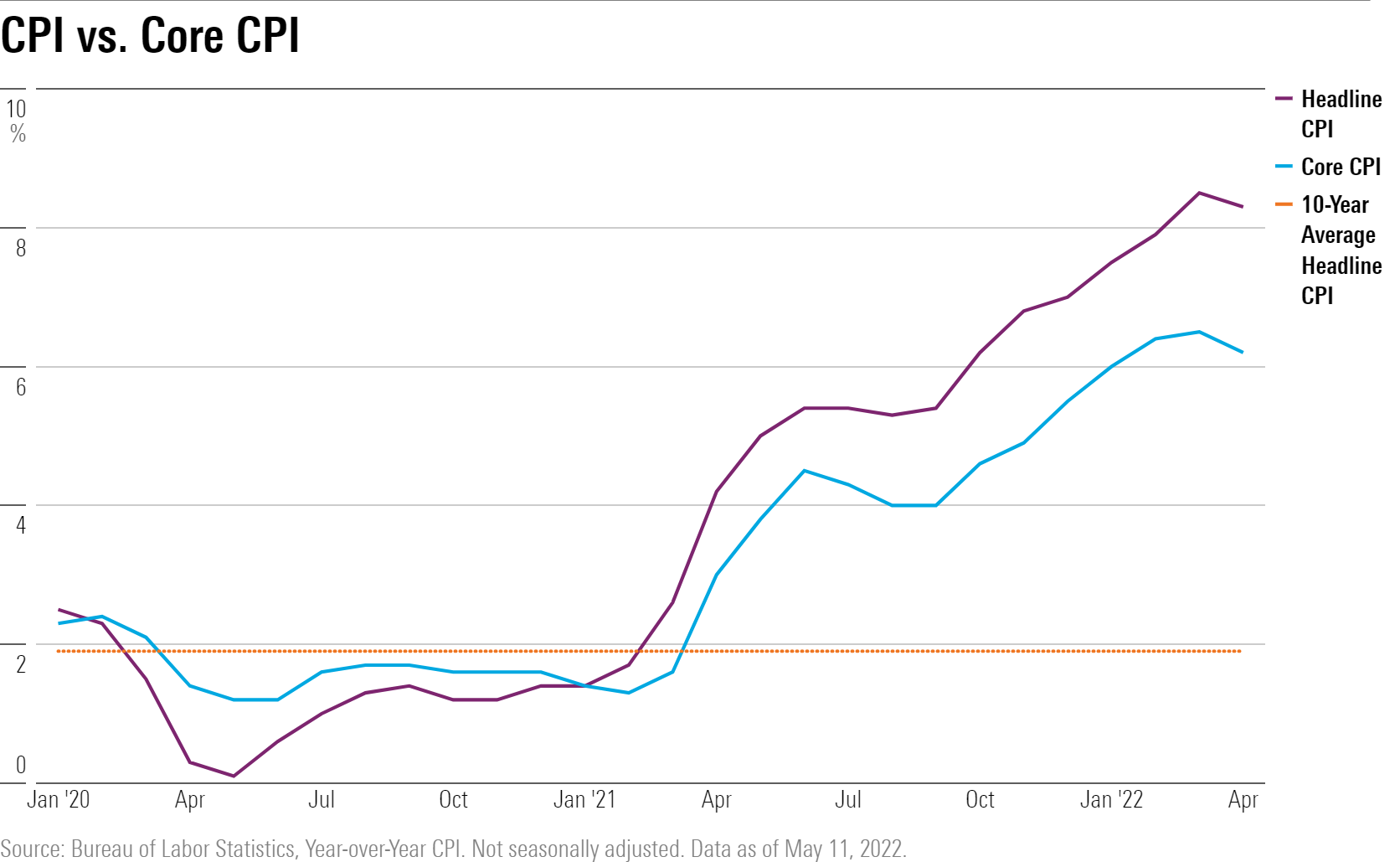

While the bond market is more convinced the Fed is committed to fighting inflation, Briggs says there's considerable uncertainty about just how much inflation will come down from 40-year highs running above 8% on an annual basis.

"Are we in a new inflation regime? Are supply chains going to stay more expensive? Is labor going to have more pricing power?" he asks. When it comes to longer-term trends, it's an "open question," Briggs says.

On the inflation front, investors will get a fresh reading on June 10 with the release of the May Consumer Price Index report. Economists expect the CPI to post an overall increase of 0.7% increase for the month, with a 0.4% increase excluding food and energy, according to FactSet. On an annual basis the CPI is expected to post an increase of 8.2%.

That would follow a 0.3% increase in the CPI for April from the month before and an 8.3% annual rise.

Events scheduled for the coming week include:

- Monday: Coupa Software COUP reports earnings.

- Tuesday: Guidewire Software GWRE reports earnings.

- Wednesday: Hasbro HAS Annual Meeting. Five Below FIVE reports earnings.

- Thursday: DocuSign DOCU reports earnings.

- Friday: Consumer Price Index update for May.

For the trading week ending June 3:

- The Morningstar US Market Index fell 1.14%.

- The best-performing sector was energy, up 1.23%.

- The worst-performing sectors were healthcare, down 2.94%, and real estate, down 1.98%.

- Yields on the U.S. 10-year Treasury rose to 2.96% from 2.74%.

- West Texas Intermediate oil futures rose $5.32 to $120.39 per barrel.

- Of the 867 U.S.-listed companies covered by Morningstar, 281, or 32%, were up, and 586, or 68%, declined.

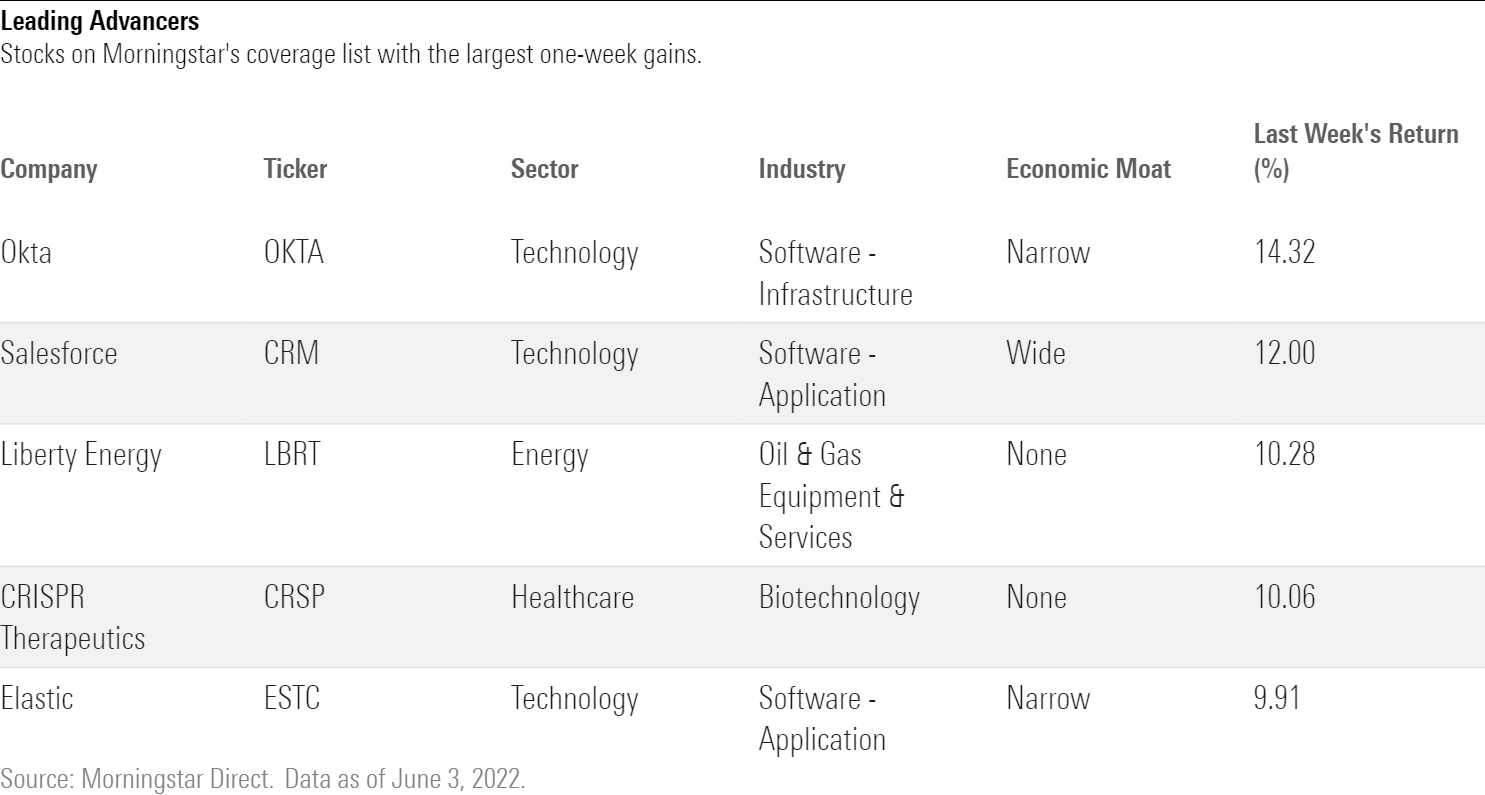

What Stocks Are Up?

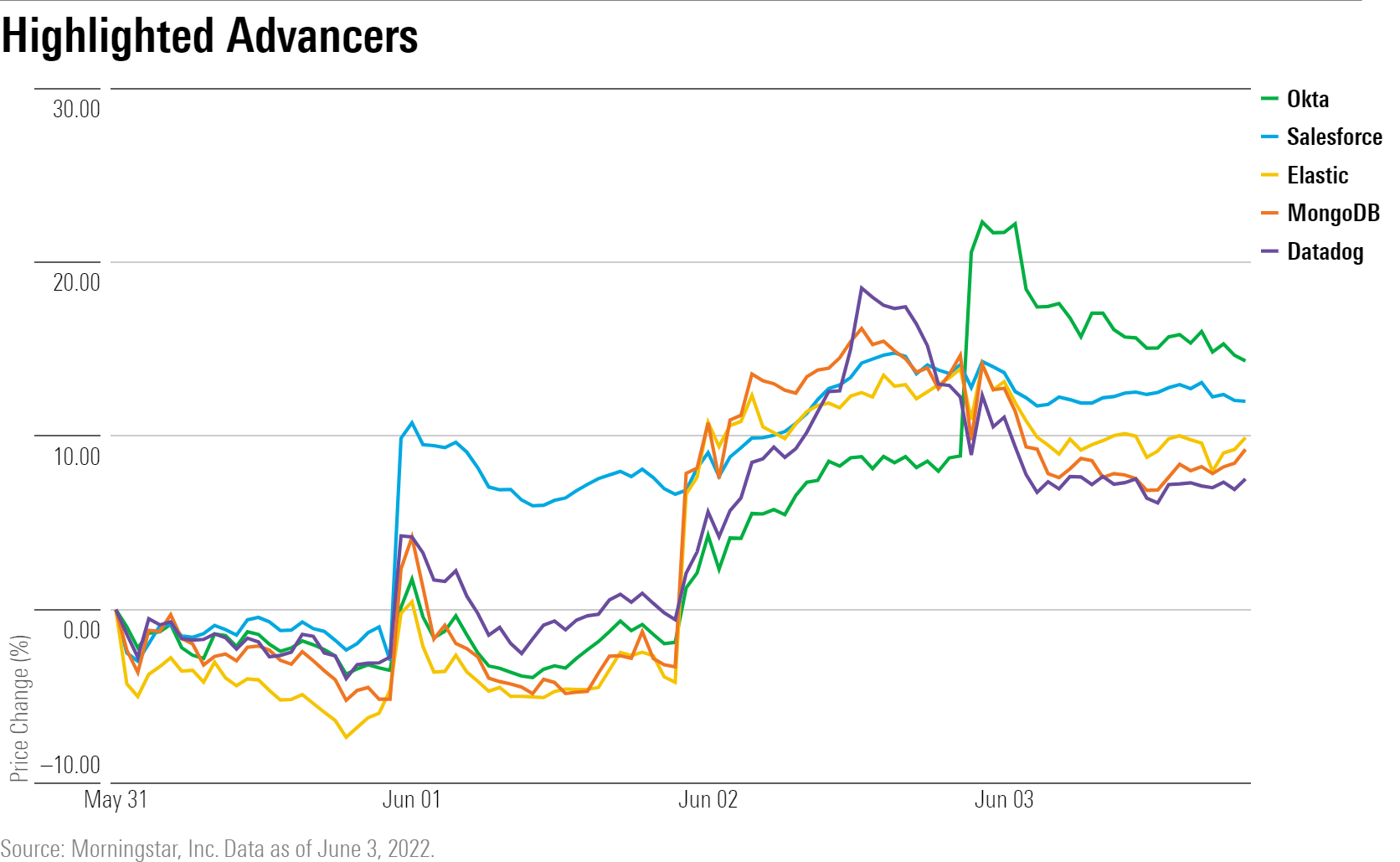

The best-performing companies in the past week were Okta OKTA, Salesforce CRM, Liberty Energy LBRT, CRISPR Therapeutics CRSP, and Elastic ESTC.

A wave of above-expectation earnings reports lifted shares of enterprise software companies, including Okta, Salesforce, Elastic, and Veeva Systems.

Shares of database management companies Mongo DB MDB and Datadog DDOG also closed the week up.

What Stocks Are Down?

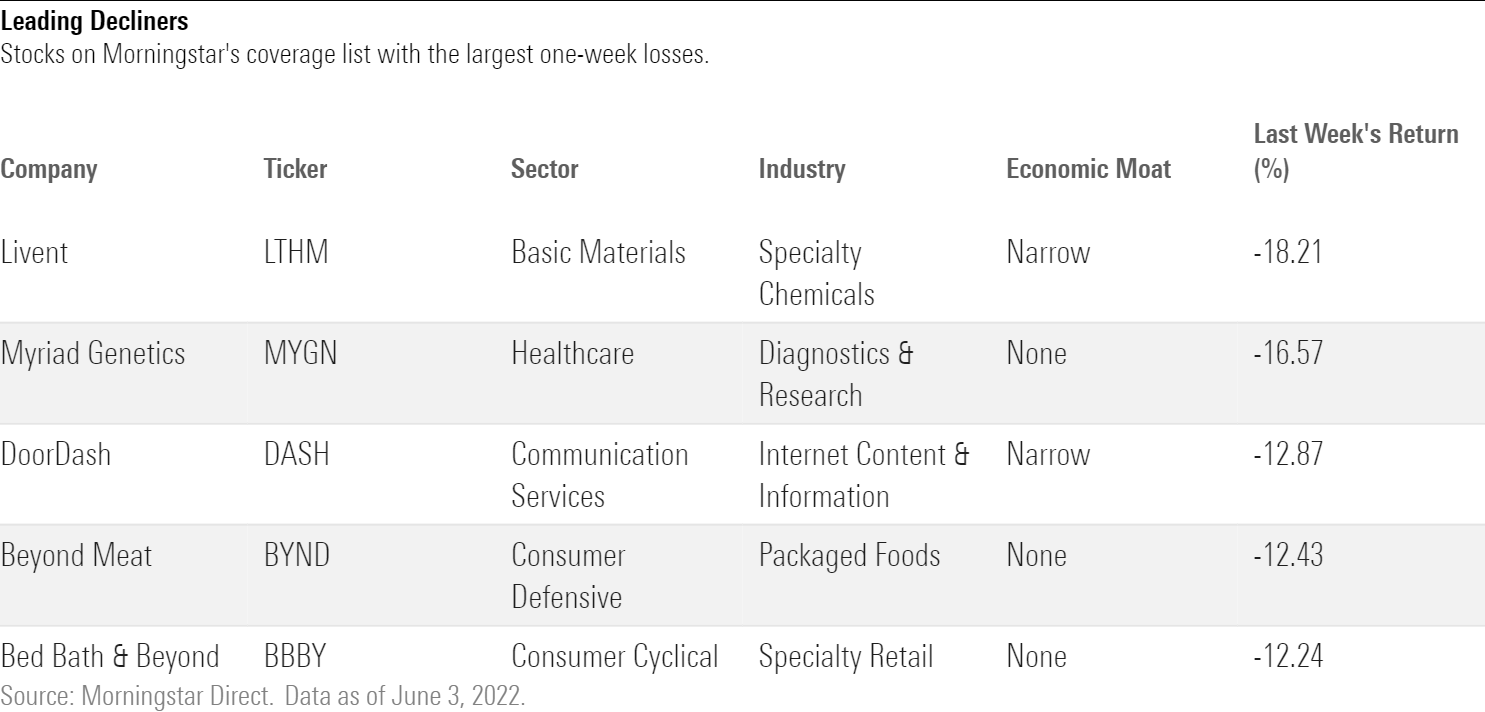

The worst-performing companies were Livent LTHM, Myriad Genetics MYGN, DoorDash DASH, Beyond Meat BYND, and Bed Bath & Beyond BBBY.

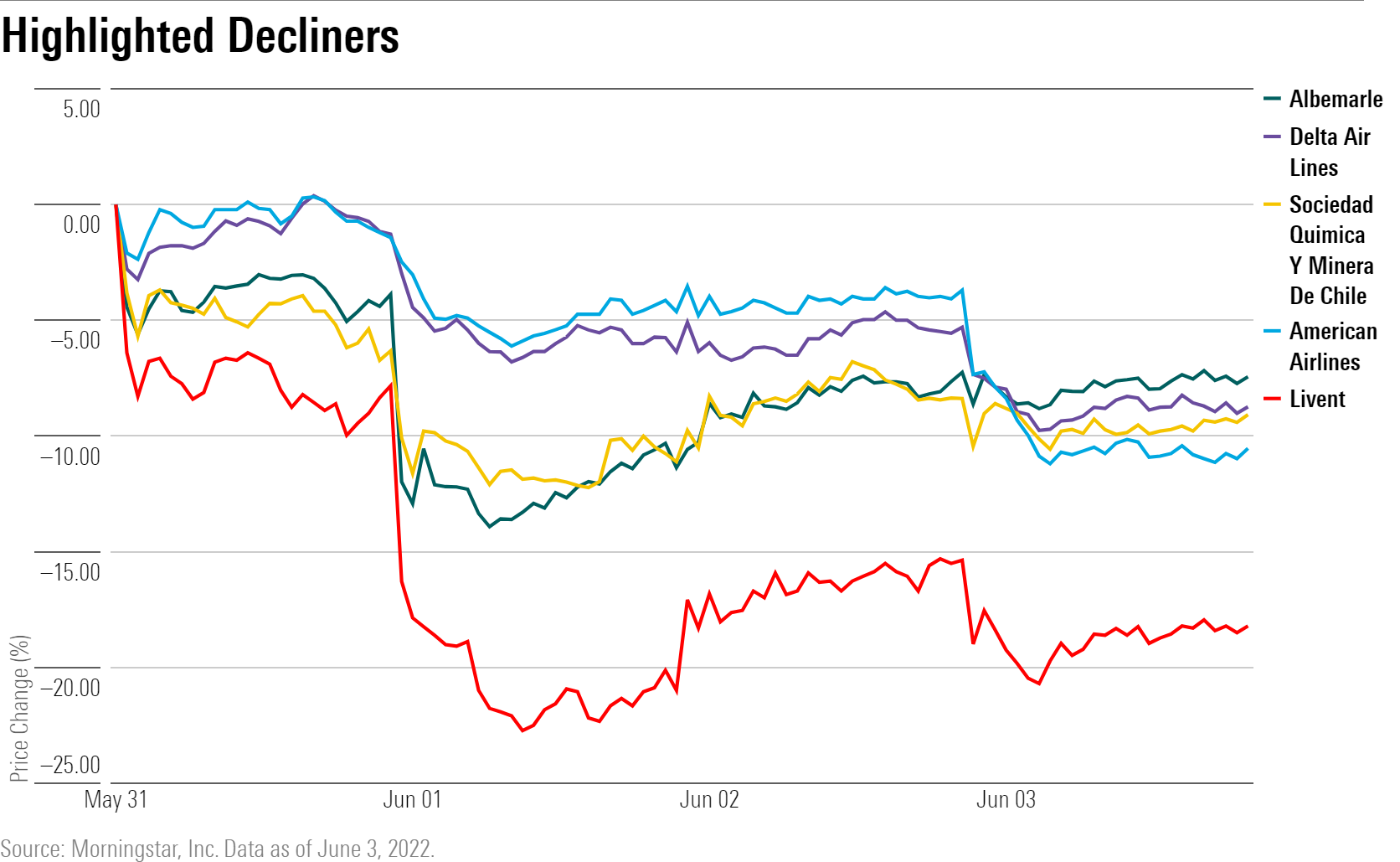

Shares of lithium producers Livent, Sociedad Quimica y Minera de Chile SQM, and Albemarle ALB fell over concerns of oversupply reducing prices.

Airline stocks American Airlines AAL, United Airlines UAL, and Delta Air Lines DAL fell as oil prices, one of airlines' largest cost inputs, rose. The WTI benchmark edged below $120 per barrel in the last week.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)