U.S. Stocks Are Trading at a Rarely Seen Discount

Even with the market's bounce, the selloff provides a chance to invest in significantly undervalued stocks.

U.S. stocks may have rebounded after a brush with a bear market, but by our calculations, the broad equity market remains well in undervalued territory.

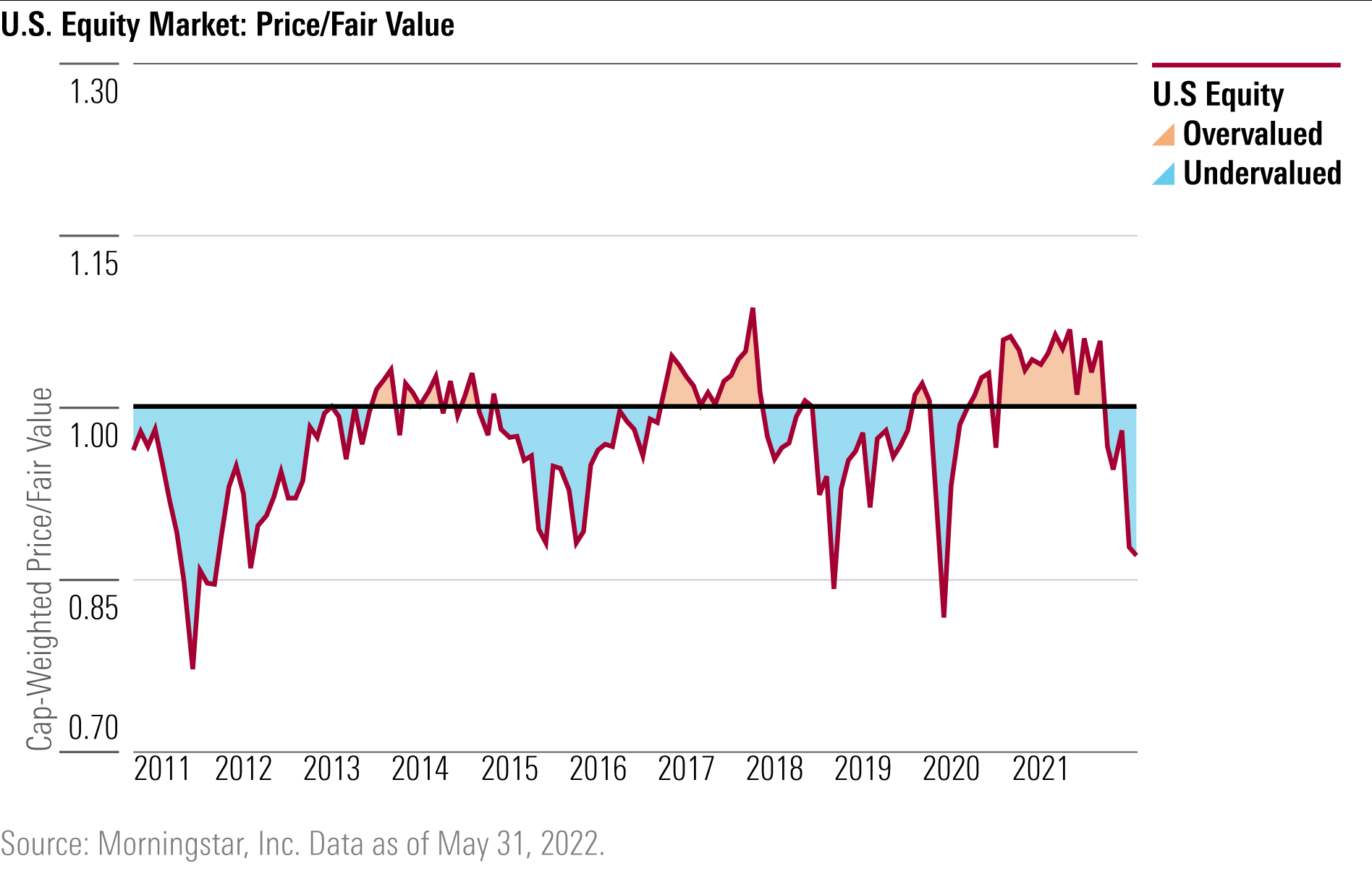

As of May 31, 2022, the price/fair value of a composite of the stocks covered by our equity analyst team was 0.87 times. Since 2011, on a monthly basis, there have only been a few other instances in which the markets have traded at such a large discount to our intrinsic valuation.

The current level of undervaluation is the greatest discount to fair value since the emergence of the pandemic in March 2020 and the growth scare that sent stocks lower in December 2018.

On a longer historical time frame, the only other instance when our price/fair value metric had dropped lower was in the fall of 2011, when there were concerns that possible contagion from the Greek debt crisis was spreading to other countries (Portugal, Italy, and Spain) and that the systemic risk from the European sovereign debt crisis was spreading to the European banking system. The markets were close to this level in mid-2015/early 2016 when U.S. equity markets fell as declining economic growth in China and plunging oil prices took their toll on market sentiment.

Markets were very volatile during May, as stocks fell for most of the month and even hit bear-market territory during intraday trading on May 20. However, almost immediately after breaking through the "official" bear-market marker of a 20% decline from their peak, stocks rallied as bargain-hunters emerged.

While we were not surprised by the market pullback earlier in the year, as the markets were overvalued coming into the year, we think the pendulum has swung too far the other direction and view the U.S. equity market as being significantly undervalued for long-term investors.

Where Are Stocks Undervalued?

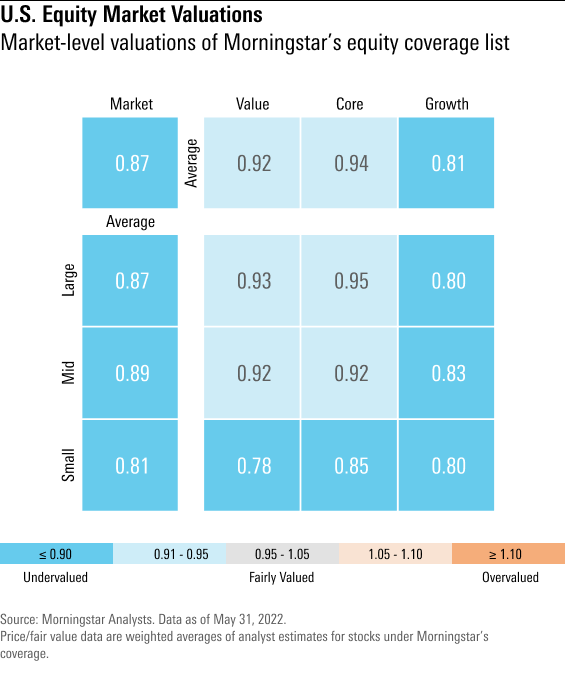

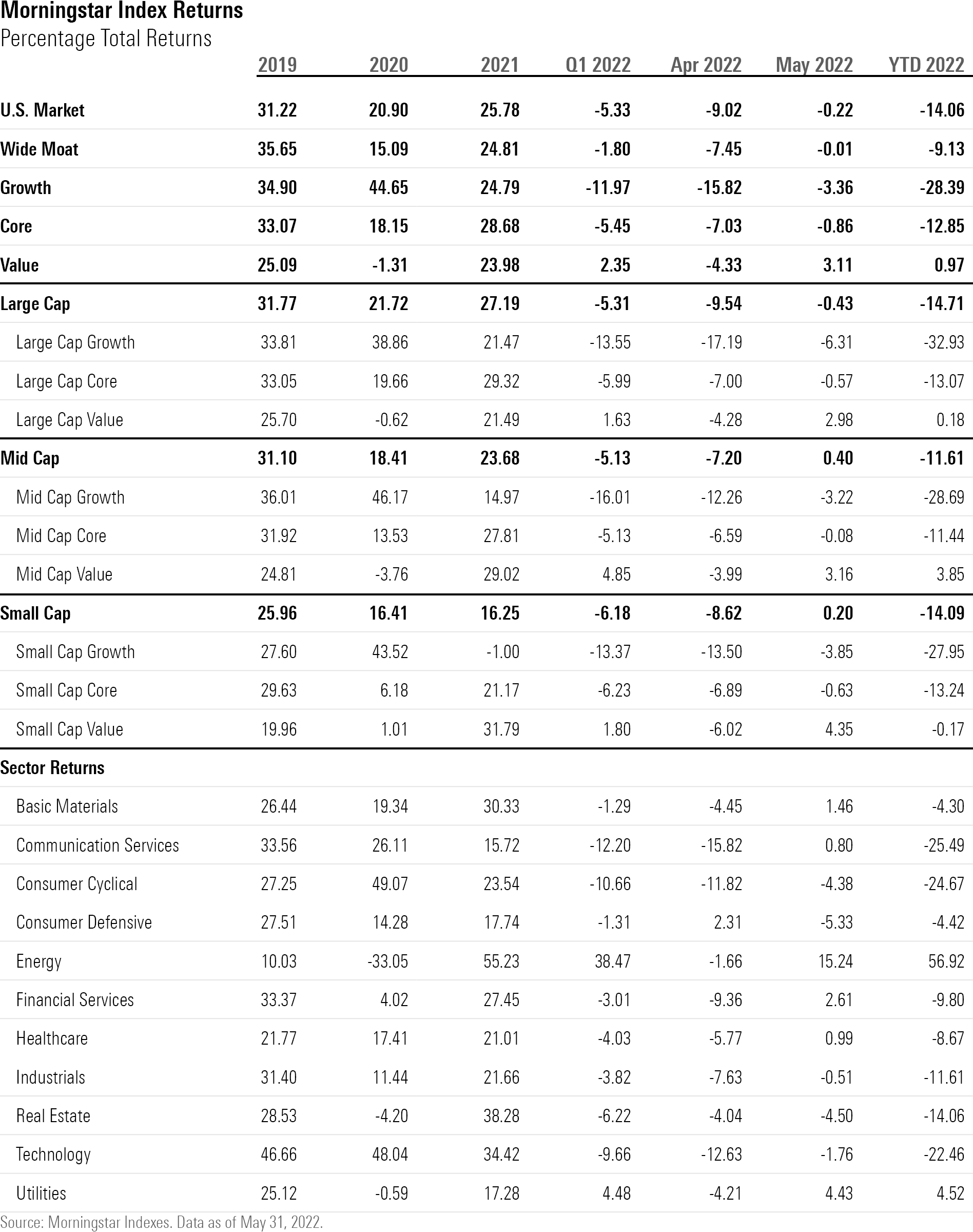

At the beginning of the year, we noted that the value category was the most attractive and that both core and growth stocks were overvalued. Value stocks have held up the best during the selloff as the Morningstar US Value Index increased 0.97% year to date through May. Most of the selloff occurred within the growth category; the Morningstar US Growth Index plummeted 28.39%.

Losses across the core stock category split the difference as the Morningstar US Core Index dropped 12.85%.

According to our valuations, the growth category is now the most undervalued, trading at a 19% discount to our fair value, followed by the value category at an 8% discount and then core at a 6% discount. Across capitalization levels, we continue to see the best opportunities among small-cap stocks (19% discount), followed by large-cap (13% discount) and mid-cap (11% discount) stocks.

What Will the Summer Months Bring?

Although we calculate that the market remains undervalued for long-term investors, we also expect that volatility will remain high over next few months. In our 2022 Outlook, we noted that there were four main headwinds that the market would need to contend with this year. Any one of these headwinds is difficult enough for the markets to traverse—and right now we are in the midst of the convergence of all four playing out at the same time. It is unlikely that volatility will meaningfully subside until the market gets better clarity over the next few months.

- Slowing rate of economic growth We recently lowered our projection for economic growth in 2022 to a 3.0% increase in gross domestic product growth from 3.5% and lowered our 2023 projection to 2.2% from 3.0%. However, while the economic growth rate may be slower, we continue to think that the probability of a near-term recession is relatively low.

- Tightening monetary policy Following the release of the minutes for the May 2022 Federal Reserve meeting, stocks rebounded sharply as investors perceived the minutes to be less hawkish than expected. The market continues to project that the Fed will increase the federal-funds rate by a half percent at each of the next two meetings. However, at that point, the Fed will be able re-evaluate its outlook for inflation and economic growth and determine its path for future rate hikes. If inflation subsides or the economy softens, the Fed could either slow or pause additional rate hikes. If inflation remains stubbornly high, then the Fed could maintain its 50-basis-point hikes.

- Inflation running hot In addition to lowering our forecast for economic growth, we also bumped up our forecast for inflation to a 5.2% increase in the personal consumption expenditure index from 4.5% this year. While the current rate of inflation remains high, we continue to project that inflation will begin to moderate in the second half of this year as supply chain disruptions ease and inflation runs up against high year-over-year comparisons. We forecast that inflation will moderate further in 2023 and drop below 2%.

- Rising interest rates Since the start of the year, the yield on the 10-year U.S. Treasury rose 1.42 percentage points to 2.93% as of May 31. While long-term interest rates are expected to rise further over the course of the year, the preponderance of the increase has already likely occurred. The next test for the bond market begins this month as the Fed begins to shrink its bond holdings. With the Fed no longer reinvesting the proceeds from bonds that mature, the bond market will have to absorb this additional amount of supply.

High-Quality Companies Trading at Significantly Undervalued Levels

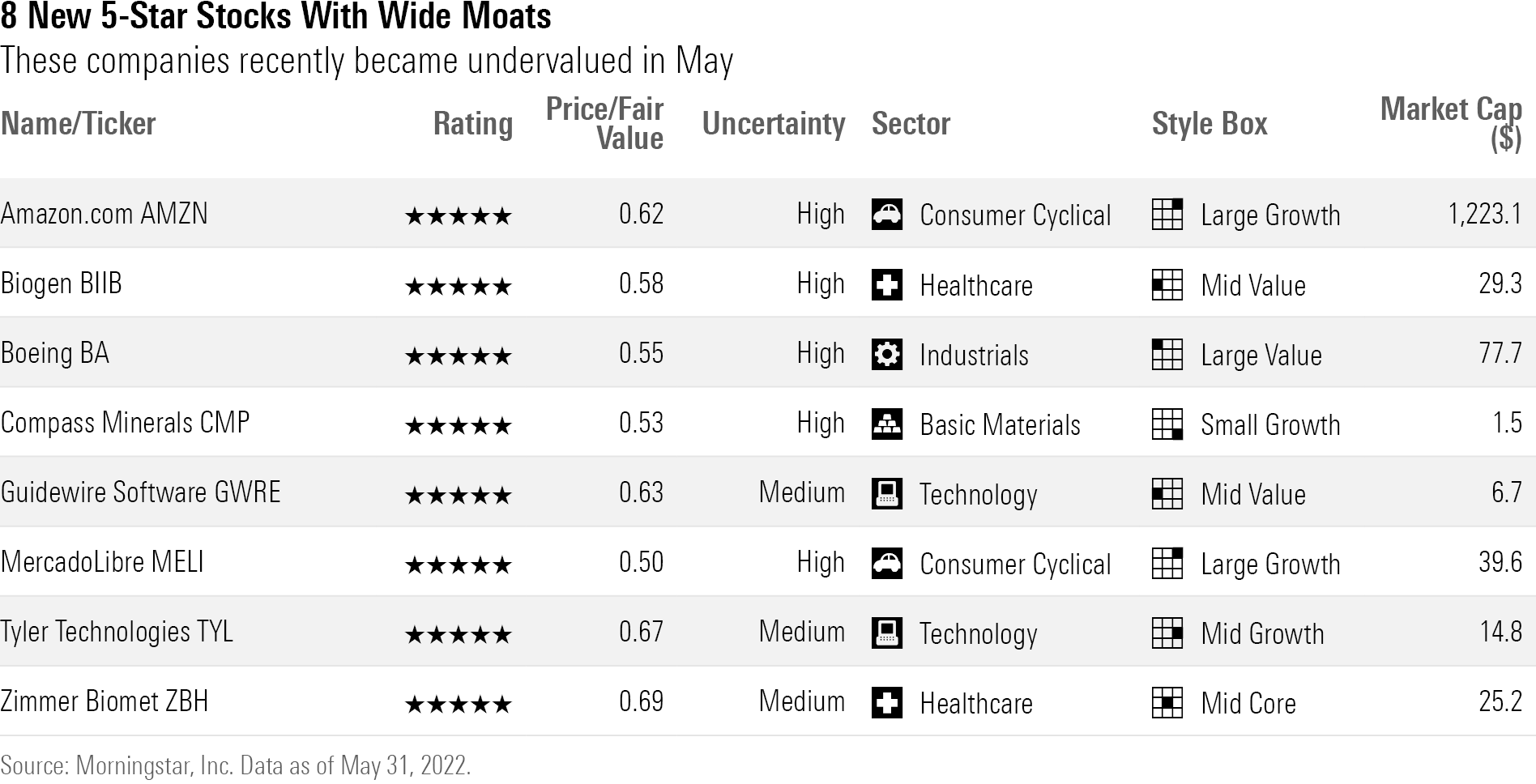

Much of the selloff this year has been relatively indiscriminate in that even high-quality companies, such as those with Morningstar Economic Moat Ratings of wide, have declined. Companies rated with wide economic moats are those with long-term durable competitive advantages that will allow them to generate excess returns over their cost of capital. These companies are best positioned to weather any potential economic disruptions and typically have the strongest pricing power.

There were eight wide-moat stocks whose Morningstar Ratings moved into 5-star territory. Of the 238 companies that we rate with a wide moat that trade on U.S. exchanges, there are now 27 with a 5-star rating; at the end of 2021, there were only nine.

What to Do Now?

In these types of market environments, it is especially important for investors to have a plan that balances their long-term investment goals with their risk tolerances. This plan should also allow for periodic rebalancing to increase equity allocations when valuations decline but also reduce exposure when valuations become overextended. Based on our view that the U.S. equity market is undervalued, we think that now is not the time to be reducing exposures but to be adding judiciously—especially in high-quality companies—based on your investment plan and goals.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)