4 Undervalued High-Dividend Stocks

Even as investors chase income, these high-quality dividend payers look attractive.

Dividend stocks have far outshined the broader U.S. market this year, but even some of the best-in-class and highest-paying dividend companies—including Comcast and BlackRock—are still trading below their fair value estimates.

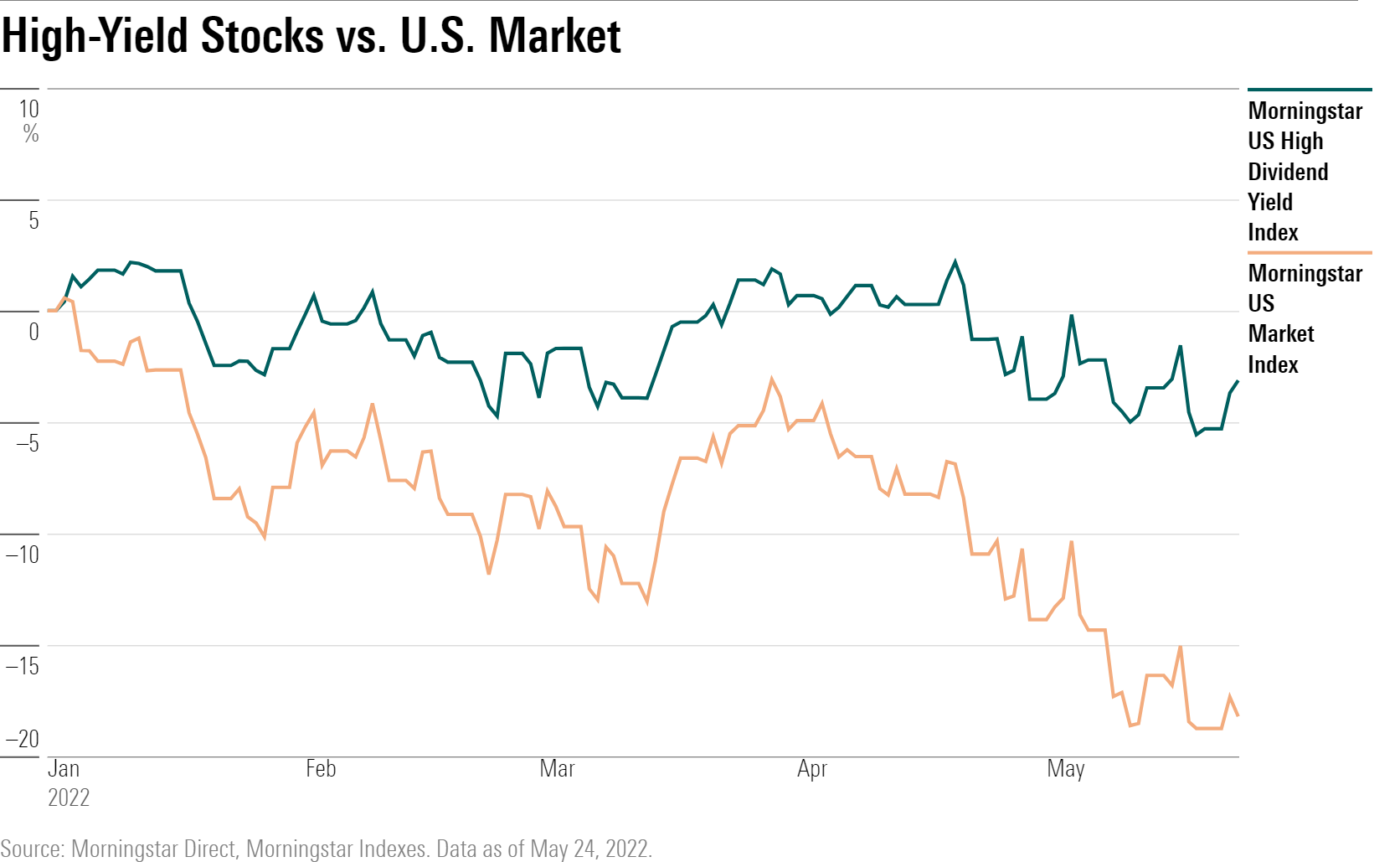

The Morningstar US High Dividend Yield Index—a collection of high-dividend paying stocks with the highest yields from the Morningstar US Market Index—is ahead of the Morningstar US Market Index by 14.4 percentage points this year. That’s the largest margin ever on record for the index on an annual basis (performance history dates back to 2007). The second largest was 2011, when the high dividend yield index outperformed the U.S. market by 9.8 percentage points.

With stocks having flirted with a bear market, inflation still at a 40-year high and the Federal Reserve raising interest rates, dividend-paying stocks can help cushion the blow of rocky markets by offering a stream of income.

The Morningstar US High Dividend Yield Index has a trailing 12-month dividend yield of 2.8%—double the Morningstar US Market Index’s 1.4%. High-dividend yielding stocks as a group are down just 2.4% this year while the broader market is down 17.3%.

However, there are still discount buying opportunities for investors seeking high-quality company stocks with fat dividends.

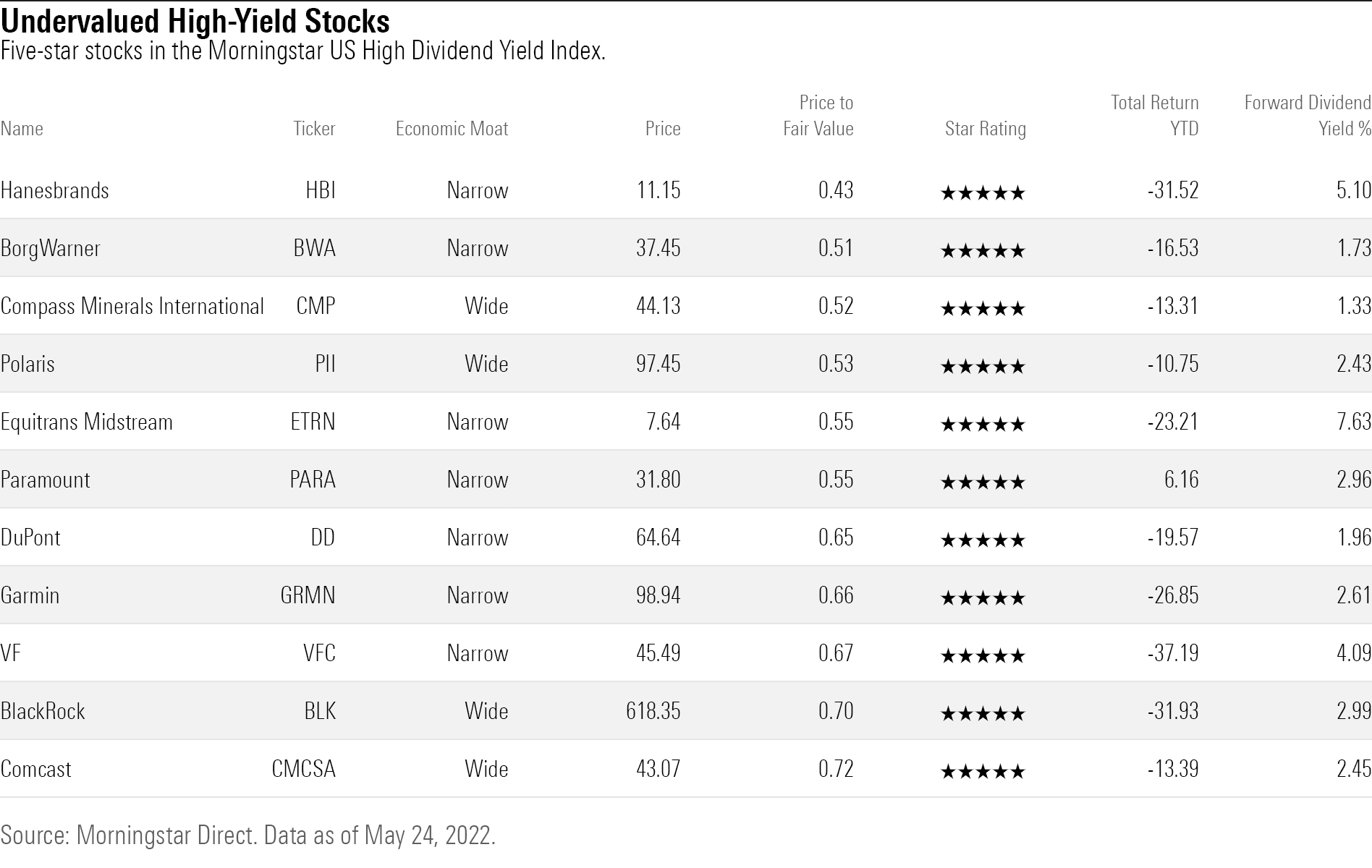

We screened the high-dividend yield index to find stocks trading at prices below their analyst-assessed fair value estimates. Four of them also have wide Morningstar Economic Moat Ratings for companies with competitive advantages expected to last at least 20 years. Wide-moat companies often have more pricing power than their no-moat counterparts, meaning they are better able to pass on the cost of rising prices to consumers when inflation is high.

Asset manager BlackRock BLK maintains the highest yield in the group with a forward dividend yield of 3.0%. Broadcasting and cable TV giant Comcast CMCSA holds a forward dividend yield of 2.5%, and off road vehicle manufacturer Polaris holds a yield of 2.4%.

Here is the full list of companies in the Morningstar US High Dividend Yield Index that are currently trading at discount prices.

Hanesbrands HBI

“Our narrow moat rating is due to the strength of Hanesbrands' intangible brand asset. Hanes’ key apparel brands have leading market share in their categories in the U.S. and a few other countries. The popularity of its brands allows it to maintain strong retail distribution and premium pricing. We believe the company can generate returns on invested capital above its weighted average cost of capital over the next 10 years.

“Hanesbrands serves the competitive but concentrated category of mass-market basic apparel. The COVID-19 crisis has had an adverse impact on Hanes’ results and may continue to do so but should not change its competitive position to any significant degree. Hanes’ brands have held up during many economic cycles and ownership changes. They have, in some cases, even survived years of mismanagement and neglect. Hanes’ brands have leading market share in multiple countries and multiple categories. For example, in men’s underwear in the North America market, Hanes’ 2021 share of about 32% was more than the combined shares of Fruit of the Loom and Jockey, the second- and third-largest manufacturers (Euromonitor). Similarly, in Australia, Hanes’ Bonds brand has more than double the share of the second-largest men’s underwear brand and Bonds has been gaining share (to 21.4% in 2021 from 13.9% in 2016, according to Euromonitor). A decline in consumer spending and store closures will hurt Hanes but, in most categories, not more so than peers.”

--David Swartz, equity analyst

BorgWarner BWA

“BorgWarner's economic moat rating is narrow. The sources of the company's moat include intangible assets, high customer switching costs, and cost advantages. BorgWarner benefits from a substantial global manufacturing presence, highly integrated and long-term customer ties, and a moderate level of pricing power from the regular commercialization of new technologies.

“BorgWarner's consistent technology innovation and ability to find alternative vehicular applications enable more favorable pricing relative to many automotive industry suppliers, increasing the company's dollar content per vehicle. Automakers are willing to pay for components and systems that provide substantial product differentiation, weight reduction, enhanced safety, or reduced cost, all while meeting fuel efficiency and emissions regulatory requirements, as is the case with BorgWarner.”

--Richard Hilgert, senior equity analyst

Compass Minerals International CMP

“We award Compass Minerals with a wide economic moat. It holds unique assets with geological advantages that are nearly impossible to replicate, which gives the firm a sustainable cost advantage over other producers of both salt and sulfate of potash.

“The company's rock salt mine in Goderich, Ontario, is the world's largest active salt mine. At Goderich, Compass mines deposits that are 100 feet thick, compared with many competing mines whose seams are only 25-30 feet thick. This allows Compass to use more efficient mining techniques and remove more salt for each foot advanced underground in the mine. Additionally, the thicker seams reduce the cost of transporting mined ore to the surface for processing.”

--Seth Goldstein, senior equity analyst

Polaris PII

“We believe Polaris has established a wide economic moat, delivering healthy adjusted returns on invested capital (averaging 21%, including goodwill, during the past five years). We believe innovative product offerings and growth of adjacent categories through acquisitions (and organically) have positioned the business to continue to capture increasing volume and profits as it reaches new end users. However, nonexistent switching costs could weigh on pricing power intermittently. Our concern in previous periods has been that hiccups in the quality of innovation along with an increasingly competitive environment could have put the company's wide moat at risk. We perpetually consider the company's ability to protect (and gain) market share and maintain brand goodwill in the key ORV and snowmobile segments to determine whether or not the brand equity remains at risk from prior recalls and the competitive landscape. In our opinion, Polaris has taken the right steps to protect its wide moat rating, with disciplined quality assurance protocols and well-developed manufacturing processes to prevent pervasive product recalls.”

--Jaime M. Katz, senior equity analyst

Equitrans Midstream ETRN

“We award Equitrans a narrow moat rating based on efficient scale. We think Equitrans has one of the higher-quality revenue mixes in our coverage, as over 50% of its revenue comes from firm fixed-fee contracts that are take or pay with average lengths of about 13-14 years. The eventual completion of the Mountain Valley Pipeline and related efforts (Hammerhead, MVP Southgate, MVP Expansions) should boost EBITDA by 30% and increase the revenue associated with firm reservation contracts to over 70%.

“The gathering and processing operations are some of the highest-quality G&P assets in our coverage, given efficient scale advantages for assets located in the Appalachian Basin, leading to highly lucrative contracts with EQT. There are some higher-quality minimum volume commitment contracts associated with the newly acquired Eureka assets, and we think the geographic location in the Marcellus region is exposed to some of the cheapest gas in the United States, providing a high level of confidence around future drilling activity. Overall ROICs should be about 9%-10% going forward at midcycle, in excess of our weighted average cost of capital.”

--Stephen Ellis, equity sector strategist

Paramount PARA

“We assign Paramount a narrow moat rating. Our guiding premise in media is that the value of video content continues to increase even as the distribution markets mutate. Despite changes in distribution, pay-TV penetration remains at above 60% of U.S. households. Even without a pay-TV subscription, most cord-cutters still consume video content and many use antennas to capture signals, providing content creators with an additional avenue to generate revenue from these viewers. Given the ongoing demand for content, we believe content creation is not a zero-sum game, as high-quality content will always find an outlet.

“Paramount’s competitive advantage lies in the CBS broadcast network, a valuable portfolio of cable networks with worldwide carriage, production studios, and a now deeper content library. The company owns one of four major national broadcast networks and affiliated TV stations in 16 markets. While network ratings have declined over the past two decades, the broadcast networks are the only outlet to reach almost all 120 million households in the U.S. Network ratings still outpace cable ratings and provide advertisers with one of the only remaining methods for reaching a large number of consumers. The network also provides an outlet for CBS Studios, which has generated multiple hit programs on an annual basis. CBS Studios currently produces or coproduces 80% of the prime-time slate on CBS, with 40% fully produced in house.”

--Neil Macker, senior equity analyst

DuPont DD

“We award DuPont a narrow economic moat rating from intangible assets based on the company’s patented portfolio of specialty products. The company’s success developing innovative materials has created a group of patented products that enjoy a premium position in the market.

“For example, in the water and protection business, Kevlar, a proprietary product, has become the material of choice for military and law enforcement safety and protection. Similarly, Nomex is the material of choice for firefighters due to its heat resistant properties. Tyvek is the market-leading housewrap material. For these products and others, DuPont develops multiple versions for end markets, with products such as Kevlar and Nomex being used in both consumer and industrial applications. Even when a product goes off patent, the company creates new applications for that product that allow premium prices to be maintained. Although Kevlar started as a material used for safety and protection, the material is now used in aerospace and automotive vehicles, consumer products, fiber optics, and in adhesives, sealants, and coatings.

“All in all, we think DuPont has proved its ability to continually generate new products. This keeps profit margins elevated as patents expire and competitors develop generic substitutes. The company's specialty chemicals portfolio, which demands elevated margins, enjoys higher barriers to entry and has stickier customer relationships. We are confident that DuPont will outearn its cost of capital over at least the next 10 years.”

--Seth Goldstein, senior equity analyst

Garmin GRMN

“We believe Garmin’s aviation segment is a moaty business, given the mission-critical functions the company’s avionics products serve in small to midsize jets as well as helicopters. We think that switching costs result from this critical nature, which is further demonstrated by the fact that governments require avionics products to hold various certifications. These certifications are limited, and for these reasons, we think Garmin’s aviation segment also merits intangible assets as a moat source.

“While Garmin’s aviation segment has seen a recent surge in growth, this is a result of the Federal Aviation Administration’s new mandate requiring ADS-B out units. There are a limited number of FAA-approved ADS-B out models, of which Garmin has the second most approved models, after Honeywell. While the ADS-B mandate has been enforced since January 2020, we think Garmin will continue to benefit from the mandate in years to come with installations in new aircraft or aftermarket deals in aircrafts grounded after January 2020. We think this is a good example of how Garmin’s aviation segment benefits from its intangible assets via regulation.”

--Julie Bhusal Sharma, equity analyst

VF VFC

“We rate VF as a narrow-moat firm based on its intangible brand asset. Our moat rating is mainly based on the company's three largest brands, Vans, The North Face, and Timberland, which exhibit good growth and profitability characteristics and provide the intangible asset that supports our narrow-moat view. As evidence of the strength of its competitive position, VF’s adjusted returns on invested capital, including goodwill, have averaged nearly 17% over the past 10 years. We are confident that the firm can generate ROICs above its weighted average cost of capital for 10 years, supporting our moat rating. We estimate VF’s WACC at 8% and expect its adjusted ROICs, including goodwill, to average 20% over the next decade. Although the pandemic continues to affect both supply and orders, we forecast VF’s fiscal 2022 gross and adjusted operating margins at about 55% and 13%, respectively, which compare favorably with those of other activewear and fashion brands.”

--David Swartz, equity analyst

BlackRock

“In our view, the asset-management business is conducive to economic moats, with switching costs and intangible assets being the most durable sources of competitive advantage for the industry. Although the switching costs might not be explicitly large, inertia and the uncertainty of achieving better results by moving from one asset manager to another tends to keep many investors invested with the same funds for extended periods of time. As a result, money that flows into asset-management firms tends to stay there. For the industry as a whole, the average narrow redemption (retention) rate, which does not include exchange redemptions, has been 25% or less (75% or greater) annually during the past 5-, 10-, 15-, 20-, 25-, and 30-year time frames. Including exchange redemptions, the rate has been less than 30% (greater than 70%).

Because BlackRock does not break out its net flows (which are gross sales less investor redemptions) we assume that, based on its historical track record of positive organic growth, the company's average annual redemption rate has been at its worst no worse than the industrywide rate (especially given the tailwinds that have been provided by the secular shift into low-cost passive products the past couple of decades). During 2017-21 (2012-21), BlackRock's organic growth rate averaged 4.9% (4.0%) with a standard deviation of 2.0% (2.0%), which meant the firm was in most years compensating for investor redemptions with new flows into its products. Our current forecast has the firm generating 5.1% average annual organic growth during 2022-26, with a standard deviation of 1.1%. Driven by ongoing investments in retail distribution, enhanced product/vehicles and technology, BlackRock should continue to have a better-than-average switching cost profile compared with its peers.”

--Greggory Warren, equity sector strategist

Comcast

“We believe Comcast possesses a wide moat, resulting from the strength of its core cable business. The majority of U.S. homes today can receive fixed-line internet access service from only two providers: the traditional cable or phone company. Across nearly half of the U.S., that cable company is Comcast. The cost to enter this market is enormous. While technological developments have made it possible to build more efficient and reliable networks than legacy providers possess, deploying these technologies still requires heavy construction spending, while also overcoming the regulatory hurdles that municipalities often impose. Assuming successful network construction, entrants then face steep customer acquisition costs and startup losses as they attempt to gain share, typically with a modestly differentiated product in a rapidly maturing market. Several firms have attempted to enter the fixed-line market over the years, but failures far outnumber successes. Most notably, Alphabet sharply curtailed its Google Fiber plans in 2016 after six years of effort ended with likely less than 1% of the U.S connected, despite the firm’s deep pockets.”

--Michael Hodel, equity sector director

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2UWGQD7LCJCYNF3WQ5HHLP7UBE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)