Markets Brief: Stocks on a 4-Week Winning Streak

Inflation Reduction Act lifts clean energy; Fed minutes ahead.

With help from an inflation report that investors saw as showing clear signs that price pressures may have peaked, stocks continued their rally from bear-market lows set in June.

The Morningstar US Market Index finished the most recent week up 3.40% from the prior week notching a four-week winning streak.

While inflation remains extremely elevated by historical levels, data released from the Labor Department on Wednesday showed the Consumer Price Index was unchanged in July from June. Energy prices, airline fares, and used car prices all declined in July from June.

Cyclical sectors, which are more sensitive to economic conditions, rallied. Basic materials ended the week up 5.16% and financial services advanced 4.62%. The looming passage of the Inflation Reduction Act, which will allow Medicare to negotiate prices for certain drugs and cap drug costs, likely dented healthcare stocks.

The inflation data along with a strong jobs report sets the stage for future actions from the Federal Reserve. FOMC minutes from their July meeting will be released next week and will give better insight into the committee’s position for future rate hikes.

Events scheduled for the coming week include:

- Tuesday: Walmart WMT releases earnings.

- Wednesday: FOMC Minutes are released, Cisco Systems CSCO releases earnings.

For the trading week ending Aug. 12:

- The Morningstar US Market Index rose 3.40%.

- All sectors were up with the best-performing being energy, up 6.73%, and basic materials, up 5.16%.

- The worst-performing sectors were consumer defensive, up 1.24%, and healthcare, up 1.67%.

- Yields on the U.S. 10-year Treasury rose to 2.85% from 2.84%.

- WTI crude-oil prices rose 3.73% to $91.88 per barrel.

- Of the 854 U.S.-listed companies covered by Morningstar, 738, or 86%, were up, and 116, or 14%, declined.

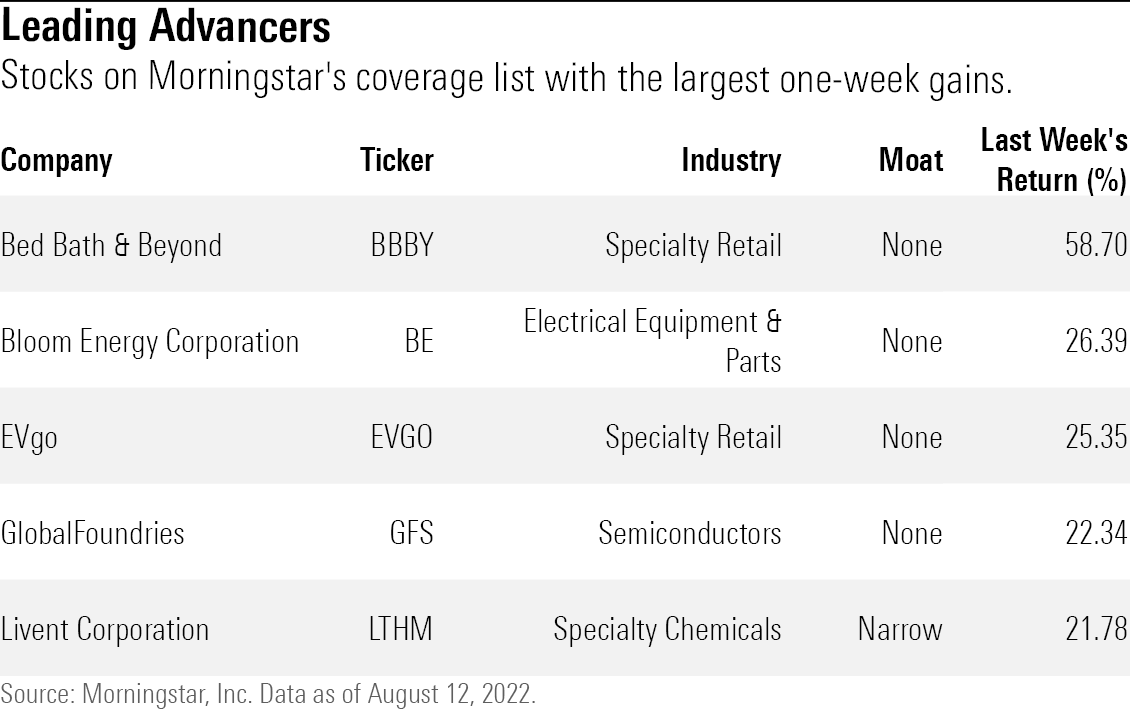

What Stocks Are Up?

The best-performing companies this past week were Bed Bath & Beyond BBBY, Bloom Energy BE, EVgo EVGO , GlobalFoundries GFS, and Livent LTHM.

Bed Bath & Beyond rallied for the second week in a row as day traders pushed the stock up 58.7%. Bloom Energy rallied as the Inflation Reduction Act will also offer subsidies to clean energy manufacturers. Lithium technology company Livent also benefited and EVgo rallied following strong Q2 results and the announcement of a partnership to expand its electric-vehicle charging network.

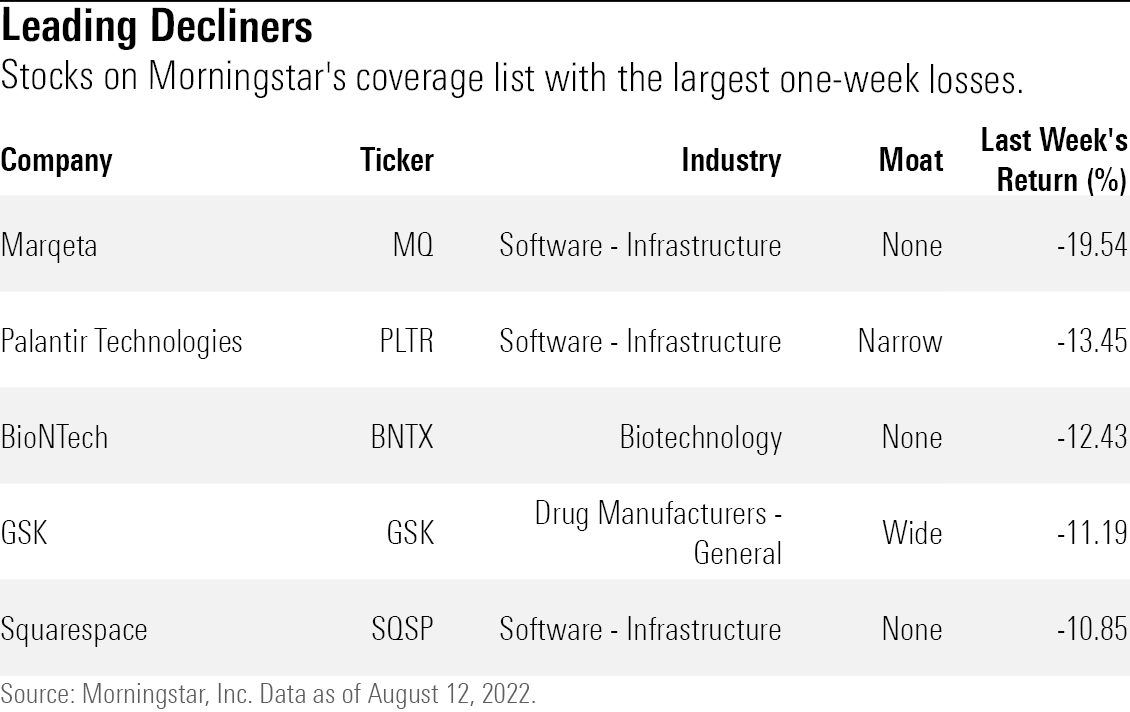

What Stocks Are Down?

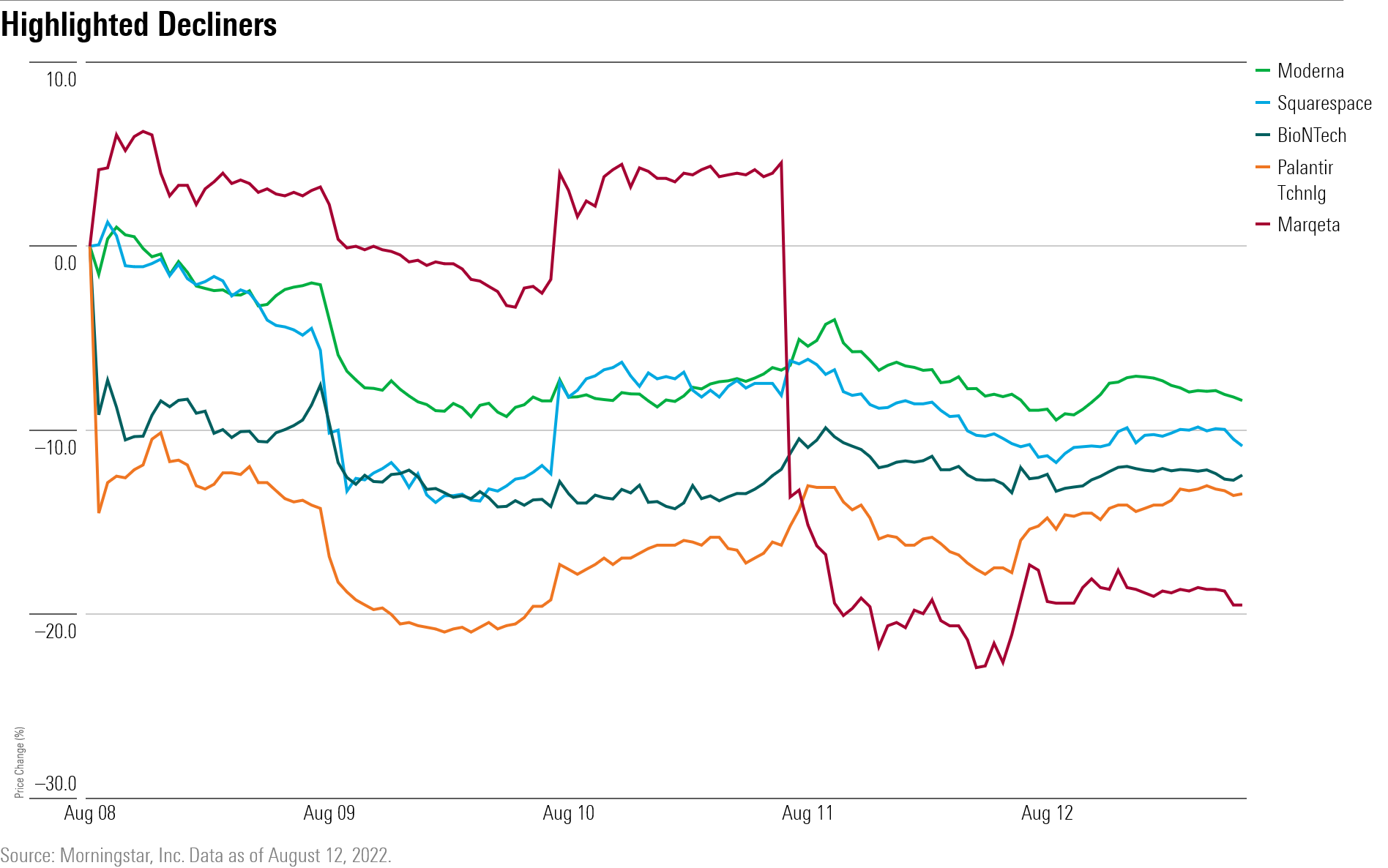

The worst-performing companies the past week were Marqeta MQ, Palantir Technologies PLTR, BioNTech BNTX, GSK GSK, and Squarespace SQSP.

Amid a leadership change and a cautious outlook, fintech company Marqeta shares declined 19.54%. Palantir shares also slid following disappointing Q2 results and a cloudy second-half outlook. Morningstar recently downgraded the fair-value estimate on Palantir. BioNTech shares fell after announcing its earnings and revenue results for Q2 were below analysts’ expectations.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)