Demystifying Model Portfolios

Breaking down the X's and O's of these increasing popular investment vehicles.

The rise of model portfolios is undeniable. Based on the universe of model portfolios reported to Morningstar, nearly 800 individual model portfolios were launched since 2019. That’s almost one third of Morningstar’s current models database. Not only are providers looking to enter the fold with new offerings, but advisors are eager to leverage models for their clients and free up time to focus on other areas of their business. If you are unfamiliar with model portfolios, what should you be looking for? In this article we will hit on the basics of model portfolios and address common misconceptions.

What Is a Model Portfolio?

Model portfolios can be considered an investment playbook delivered to advisors to follow and implement on behalf of their clients. Typically, that comes in the form of asset-allocation positioning and fund selection within a multi-asset portfolio. Other model-delivered offerings, however, may focus on specific asset classes, recommending individual stock and bond picks. Model portfolios allow advisors to outsource some, or all, of their investment management responsibilities to investment professionals solely focused within this arena. This decoupling of responsibilities allows the advisor to dedicate more time to other areas of their client’s financial journey and place greater focus on growing their practice.

Opting for model portfolios allows an advisor’s client to directly own the securities in their portfolios rather than pool their assets with other investors like mutual funds. This important characteristic grants the advisor additional flexibility to customize the portfolio to their clients’ unique needs. For instance, this flexibility may allow the advisor to improve the client’s yearly tax hit through tax-loss harvesting. This approach involves the advisor opportunistically selling underperforming assets to offset gains of outperforming holdings, a tool available only when the client owns each individual holding in their portfolio.

Going Off Script

Model portfolios present advisors with the opportunity to use a blanket investment solution while maintaining the flexibility to make changes to meet their client’s individual needs. However, the level of flexibility and customization an advisor can deliver depends on how they access the model. For simplicity, we will focus on two general approaches: an advisor outsourcing their investment responsibilities like trading and rebalancing to an independent technology platform, and an advisor following a paper model. The latter option involves the advisor following the model by subscribing to email notifications from the provider or visiting the provider's website where updates may be posted. These differing approaches affect the level of customization available, with potentially good but also unintentionally bad outcomes.

Models can provide flexibility for an advisor to utilize their client’s existing holdings while still leveraging institutional-level asset-allocation research. For instance, an advisor’s client may hold a highly preferred growth strategy like ARK Innovation ETF ARKK, which they would like to incorporate into a model’s allocations. Utilizing a model portfolio may allow for such customization depending on the advisor’s chosen avenue for implementation. Following a paper model provides the most flexibility,as the advisor maintains full discretion and can adjust the underlying fund lineup as they choose. Through a platform, restrictions may be in place that hold an advisor closely to the lineup outlined by the model provider. Increased guardrails are not necessarily bad—greater involvement from an advisor to diverge from a model’s prescribed playbook can lead to unintended risks seeping into the portfolio. For example, ARKK’s highly concentrated portfolio with meaningful sector and industry tilts drive substantial volatility. That could lead to a riskier portfolio than intended.

Although the potential for tax-loss harvesting stands as a strong positive attribute for models, the avenue an advisor uses may limit their ability to make these opportunistic trades. Some platforms may limit these trades entirely, or they may offer their own or third-party services, like those offered by 55ip, to facilitate such trading, of course at an additional fee. Following a paper model would allow the advisor the leeway to make those buy and sell choices freely. That said, they should be experienced in this arena with a shrewd understanding of trade implications.

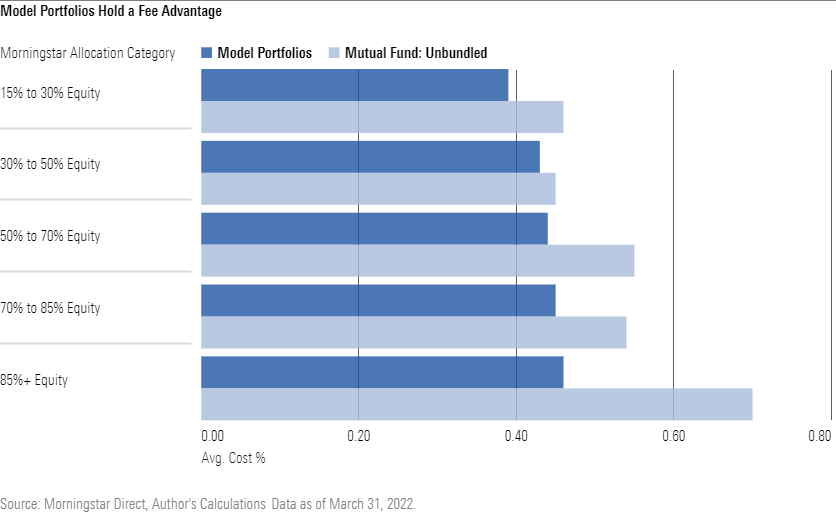

The Fee Advantage

Model portfolios come at a relatively cheap price. The below chart looks at the average cost of models and mutual funds across Morningstar’s equity allocation categories. Models hold a meaningful cost advantage even when comparing their asset-weighted fee directly against the expense ratios for lower-cost mutual fund share classes. Those offerings fall in the “unbundled” bucket of Morningstar’s clean share-service fee arrangement data point. These funds have the lowest built-in costs but still trail similarly allocated model portfolios by 11 basis points when comparing the average fee across the five categories. That said, additional fees can be overlaid onto a model portfolio like a strategist fee, which are not accounted for in the below analysis.

Similar but Not Quite the Same

Models look to provide advisors with an easily digestible solution they can implement broadly across clients. As such, a model may be a more focused and simplified alternative to a firm’s mutual fund offering. That said, there are many instances where a model portfolio can be an identical replication of its mutual fund sibling as well.

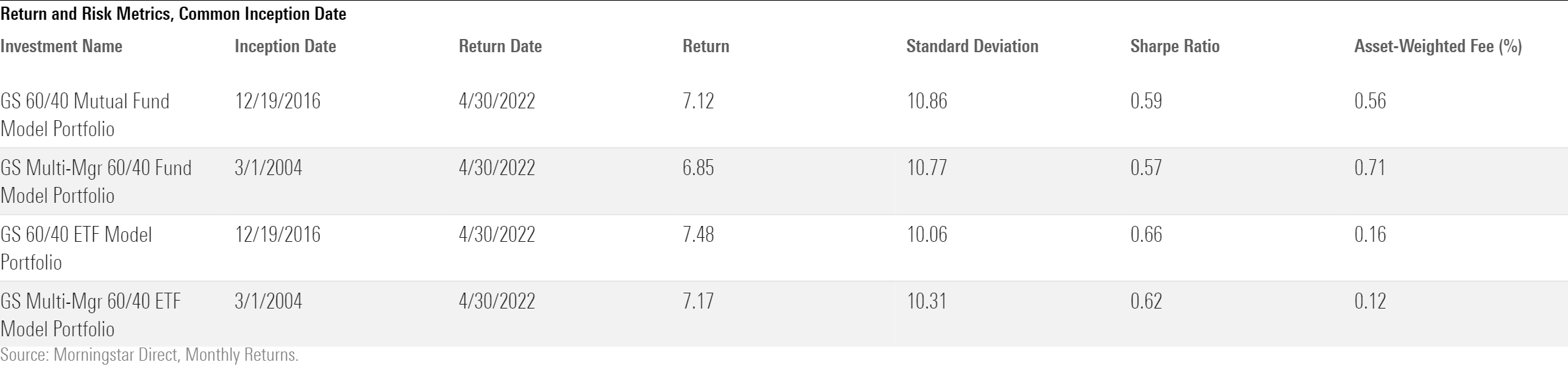

The exhibit below shows the absolute performance, volatility, and risk-adjusted returns for two model portfolios and their respective mutual fund equivalents.

BlackRock Global Allocation K MKLOX and BlackRock GA Selects Growth—one of five portfolios in the model series—are managed by the same team, led by portfolio manager Rick Rieder, and grounded by the same 60% stock/40% bond base allocation. The model portfolio currently holds a 6% position in the mutual fund. However, greater latitude to move allocations and scale up or down risk in the mutual fund offering underpins their different volatility profiles and subsequently returns. Oppositely, the American Funds Growth and Income series, available as both model portfolios and mutual funds, are essentially identical copies. As depicted, each series’ growth and income portfolios deliver extremely similar volatility and returns.

Open Architecture Versus Closed Architecture

The argument for open versus closed architecture stands as a hot topic for model portfolios. An open architecture construction consists of using either a broad mix of a firm’s proprietary offerings and third-party offerings or relying entirely on the latter. Alternatively, a closed architecture construction means a firm taps strategies run internally. Anecdotally, we have heard from model providers that open architecture has become increasingly more preferred from independent platforms. And, we’ve seen notable team-ups in the space between well-regarded firms that effectively complement their strongest areas of expertise. That said, does an open architecture construction always trump an all-proprietary approach? Not in all cases.

The table below shows four 60% stock/40% bond model portfolios offered by Goldman Sachs. The mutual fund and exchange-traded fund versions each deliver the same asset allocation mixes and use the same investment process. However, the multimanager offerings tap externally managed strategies versus Goldman Sachs managed funds.

Looking at performance dating back to the common inception of the models shows that both the proprietary-focused ETF and mutual fund portfolios performed better than their sibling open architecture offerings on an absolute basis and when adjusting for risk. In addition, the margin of outperformance could be even larger owing to an additional strategist fee overlaid onto the multimanager portfolios given the third-party-focused construction; for these two models, the firm tacks on a 0.15% strategist fee. These multimanager offerings can also come at a loftier cost driven by using third-party strategies. Based on February 2022 holdings, the multimanager mutual fund’s asset-weighted fee of 0.71% stands well above the 0.56% for its proprietary-only sibling. These fees can add up and eat away at an investor’s returns, something worth being aware of when analyzing model portfolios.

/s3.amazonaws.com/arc-authors/morningstar/a3ffb7d7-3689-49a2-bfde-9235ef1e06ad.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a3ffb7d7-3689-49a2-bfde-9235ef1e06ad.jpg)