The Role of Family and Friends in Investing Decisions

Consider involving clients' families in financial planning.

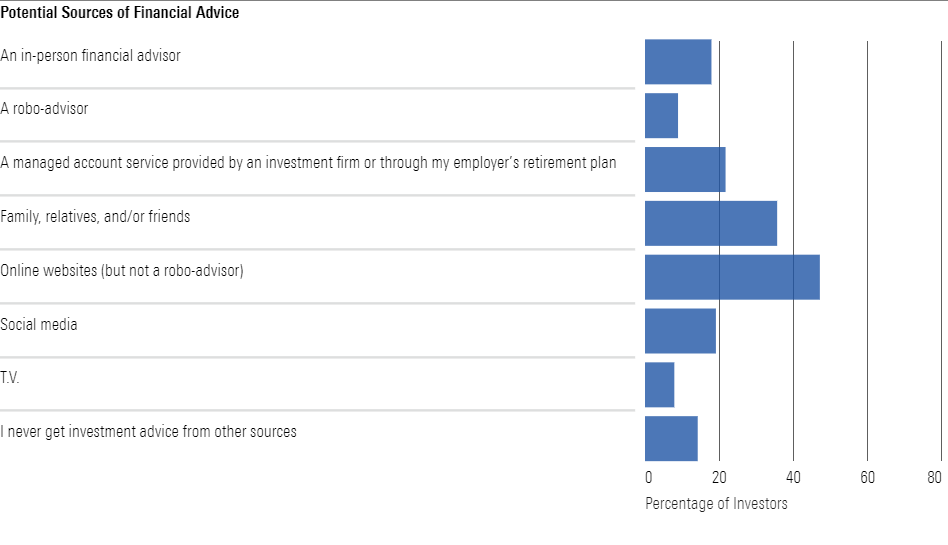

Nowadays, there are myriad sources of financial advice, some more credible than others. We wanted to understand where people looked for advice most often.

Overall, we found that websites were their most common source; about 47% of individuals reporting them as a source of financial advice.

As we were reviewing the data, we also stumbled upon a recurring theme: the importance of family and friends when making investment decisions. According to our data, family and friends play an influential role in investment decisions—in some cases, even rivaling the influence of financial advisors and robo-advisors.

Where Do People Seek Financial Advice?

We asked a nationally representative sample a few questions regarding financial advice-seeking tendencies. We started by asking individuals to select all the sources they received financial advice from on a provided list. As evident in Exhibit 1, although websites reign supreme as a source, family and friends aren’t far behind.

When we separate our data by age group, the role of family and friends seems to exceed that of websites for younger investors. For the 18-29 age group, 58% of investors reported going to family and friends for investment advice, 48% reported using using websites.

- source: Morningstar Analysts

Even when looking at investors' primary source of advice, the role of family and friends continues to be prominent. In our research, 16% of investors reported family and friends and their primary source of advice, compared with 12% of investors who reported a financial advisor as their primary source.

Influencing for Good

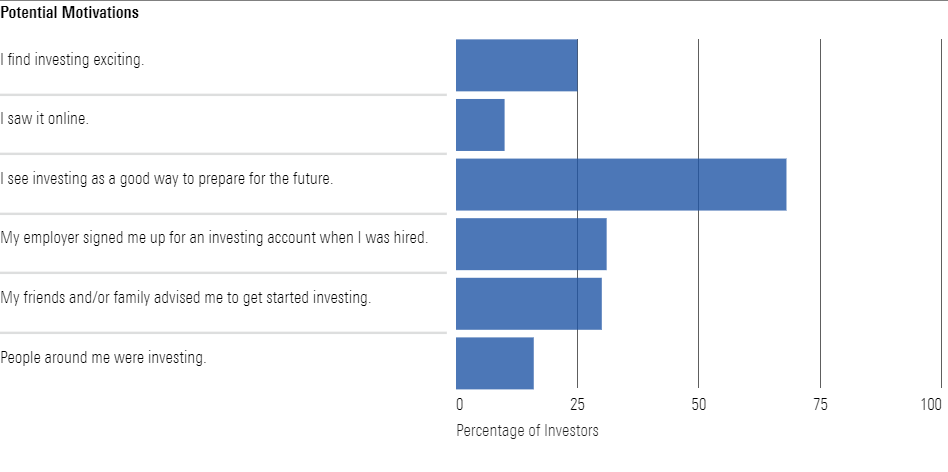

We also asked people what factors influenced their decision to get started in investing.

Although we see other factors playing a role, we also see the positive impact that friends and family can have on a person’s decision to start investing. Again, we see this trend more prominently by age: 48% of investors in the 18-29 age range reported family and friends as a group who influenced their decision to get started.

- source: Morningstar Analysts

From Research to Practice

Our findings mean a few things for the financial industry. For professionals, our results emphasize the importance of including the whole family (when possible) when working with a client, as previous research has noted. This ensures that everyone is on the same page and that clients responsibly considers advice from a relative.

For individual investors, it may be time to consider the positive influence you can have for your family and friends. Personally, since I don’t consider myself an absolute expert in all things finance, I lean on other experts when trying to be that positive influence on my family and friends. Sometimes that may mean referring them to a financial advisor I trust. Other times, that may mean sending them articles from sources I trust. Luckily, there are plenty of articles on Morningstar.com to help any investor get started, here are a few of my favorites:

- Should You Be Using a Robo-Advisor?

- A Retirement Readiness Checklist

- Morningstar's Guide to Life-Stage Investing

- Morningstar's Money Guide for New Graduates

/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5N6PBZJLMJEIXBH6EHTKPDK6NE.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FIN36RNGOFABFDS2NCP2RCCG3I.png)