New 5-Star Stocks

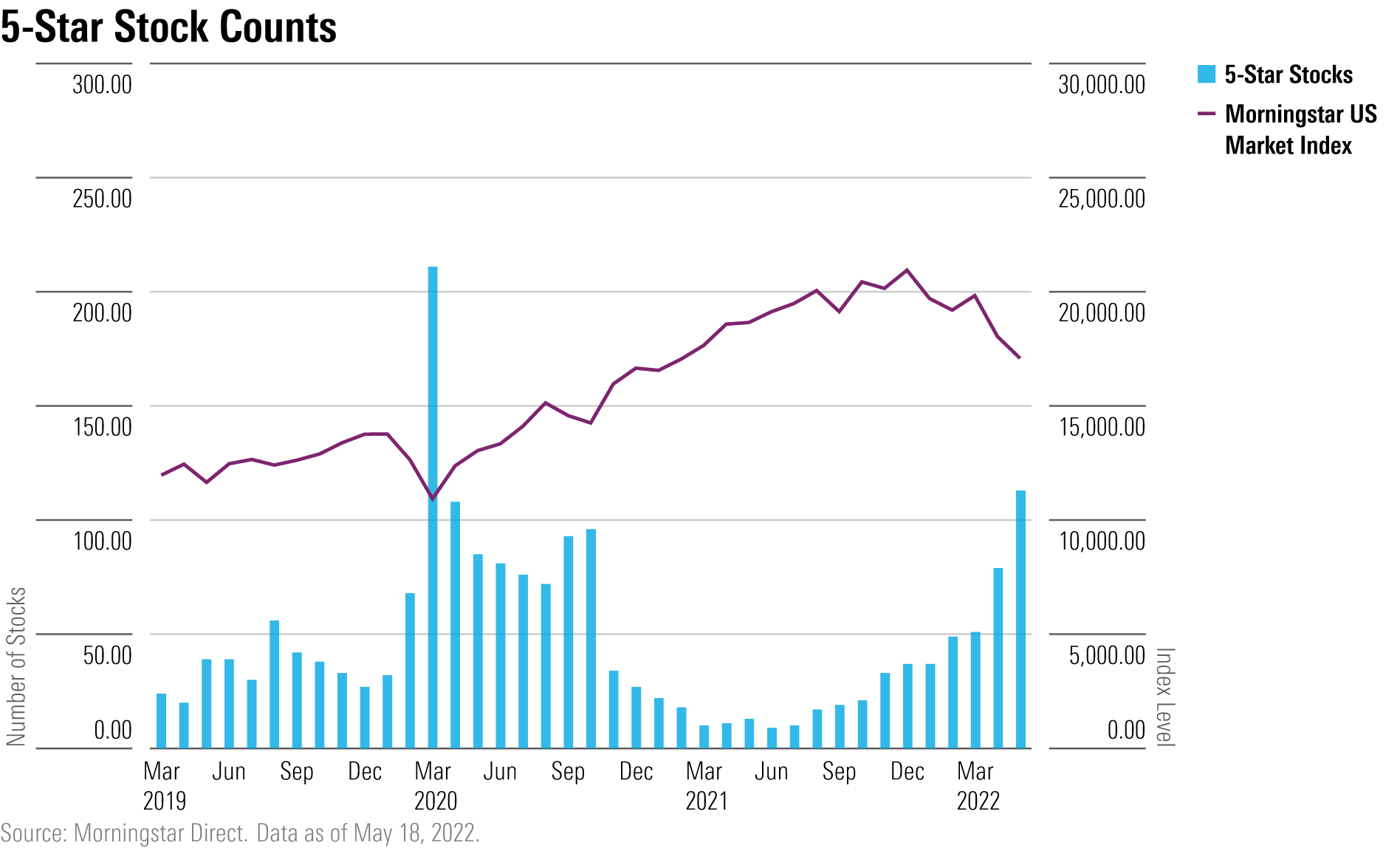

Opportunities in the stock market haven't been this abundant since the pandemic selloff.

As stocks slide into bear market territory, the number of companies whose stock valuations are dropping into the undervalued 5-star Morningstar Rating territory have reached levels not seen since the coronavirus pandemic selloff back in March 2020.

As of May 18, the number of 5-star-rated stocks hit 113, nearly 13% of 871 U.S.-listed stocks covered by Morningstar analysts. That is a little more than half of the 211 U.S. 5-star stocks that were in the market at the end of March 2020.

U.S. stocks now trade at an average discount of 15%, relative to their Morningstar fair value estimate, compared with an average 6% premium during the Morningstar US Market Index’s peak on Jan. 3. Since then, a total of 82 stocks became new 5-star-rated stocks and are trading at significant discounts—at 25% or more—creating an abundance of opportunities for eager long-term investors.

Below, we’ve listed all the stocks that became newly rated as 5-star stocks between Jan. 3 and May 18 and organized them by their Morningstar Economic Moat Rating. First up are the stocks of high-quality companies that Morningstar analysts believe to hold lasting competitive advantages over their peers for at least the next two decades, as denoted by their wide Morningstar economic moat rating.

These include Latin American marketplace MercadoLibre MELI and software company Tyler Technologies TYL, which we recently highlighted for beating first-quarter earnings expectations. Others among our screen include e-commerce giant Amazon.com AMZN, and the world’s largest asset manager, BlackRock BLK.

Next up are narrow-moat stocks. Like their wide-moat counterparts, Morningstar analysts believe these hold competitive advantages over their peers. Unlike wide-moat companies, companies with narrow moats are only expected to fend off competition for about 10 years. Among those that are new 5-star stocks are Lyft LYFT and Okta OKTA, which both trade at a discount of 72% to their fair value estimates.

Lastly are new 5-star companies that Morningstar analysts view as facing intense competition and are unable to carve out moats. Nonetheless, these stocks trade at even more significant discounts to their fair value, including biotech firm I-Mab IMAB, which is at an 80% discount to its fair value.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)