Are Bonds Back?

It may still be a little early to start arguing that bond yields have stabilized.

"Are bonds back?" might sound like a stupid question given the popularity of phrases like, “It’s the end of the bond market’s 30-year bull run.” Admittedly, that has a ring of logic. The 10-year U.S. Treasury note’s yield started from its lowest point ever in August 2020, and has since soared further and more quickly than just about any time in the past couple of decades. By the end of April, Morningstar’s U.S. Treasury Bond Index had lost more than 14.5% since the end of July 2020 on a price basis. (Interest has helped cushion that a bit.) That does sound like the end of a bull market.

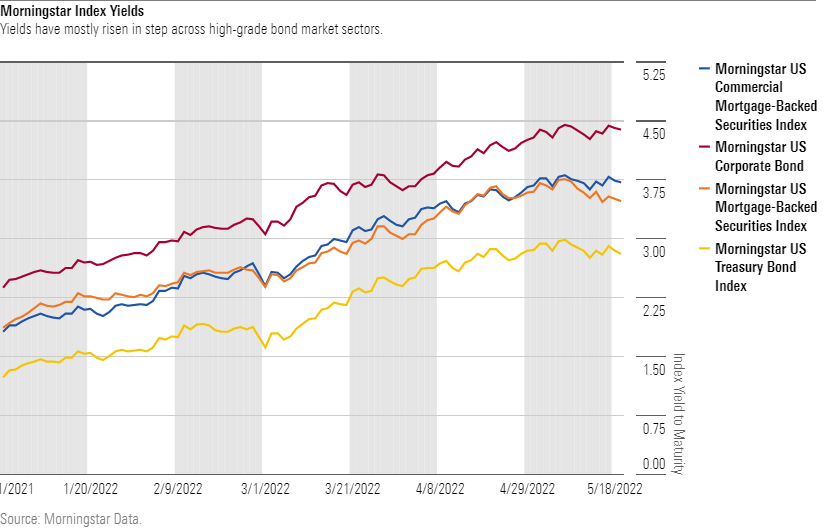

It's a little soon to know how much deeper that hole is going to get. There are too many shifting sands in the global economy right now. We’re seeing a nascent trend, though, of bond managers opining that some previously rich sectors are beginning to look attractive again, even though their valuations relative to Treasuries haven’t necessarily moved that much. Allspring Global Investments manager Janet Rilling sat on a panel at last week’s Morningstar Investment Conference. When asked about the appeal of core bond funds she was circumspect, but opined that a lot of the “hard work” has been done (referring to the distance market yields have risen) and that there’s more of a yield cushion than we’ve seen in some time to compensate investors for risk.

But that interest isn't only because yields have moved up. For many, it's also borne out of a sense that concerns they will continue to rise are misplaced. Among the most influential drivers of the outcome will be inflation, and accurately guessing when, how, and how much the Federal Reserve will do to combat it is a tricky business. Guessing what the Fed is likely to do in broad terms, however, is arguably less difficult. Whatever questions there were about how far the central bank would go to prop up the economy after the global financial crisis or following the onset of coronavirus, it's a reasonably safe bet that the Fed will do everything it can to keep inflation from spinning out of control. That usually means hiking the fed-funds rate, among other things, such as fostering a reduction in its own bond holdings (aka "quantitative tightening") to soak up excess cash from the economy.

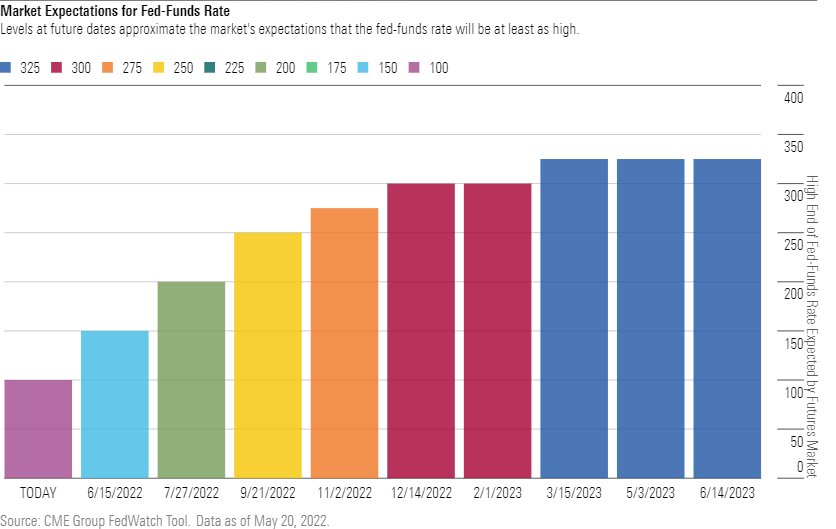

The bond market seems to be in agreement right now, and there are a couple of ways to tell. One is by observing the market's expectations for fed-funds levels at each of the next scheduled meetings to determine that rate. That typically involves examining fed-funds futures prices; the Chicago Mercantile Exchange crunches those numbers to arrive at the implied probability of future rate hikes, and puts the data on its website. Right now, the data are signaling expectations for roughly nine or 10 rate hikes of 0.25% each over the next year, though the Fed recently made a single 0.5% hike at the start of May. By way of comparison, it took the Fed three years to execute the equivalent of 10 rate hikes of 0.25% from 2016 through 2018. And until recently, the notion of 10 hikes in a year sounded implausible. The Fed has shifted its public statements sharply, though, driving up those expectations. The chart below shows data taken from the CME approximating the probable high end of the Fed's target range for the rate at the time of each meeting on its schedule through mid-2023.

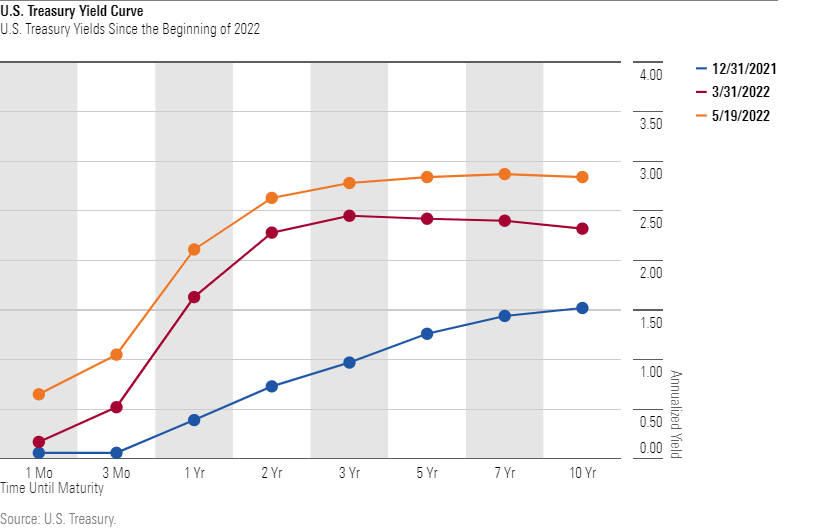

If fed-funds probabilities tell us what the market thinks the Fed will do, yields for Treasury notes with several years to maturity give a sense of how successful the market expects those efforts to be. Put another way, the lower those yields, the more confident the market is that the Fed’s rate hikes will work in taming inflation.

There are different ways to interpret the meaning behind Treasury yields. The 10-year U.S. Treasury yield, for example, recently hovered around 3%. That suggests for now that investors are comfortable in the belief that, on average, inflation will stay somewhere under that level over the next 10 years. The assumption is that few would be willing to buy a bond whose interest payments wouldn’t be enough to offset the impact of inflation on their principal repayment.

On the surface, the speed and distance that the 10-year note’s yield has already traveled would seem to suggest the market’s fears have been widespread. Putting together that information with shorter-term rates, however—in other words, a yield curve—tells a more-nuanced story.

Based on how the Treasury yield curve has shifted since the beginning of the year, expectations have clearly been in flux. Yields have risen across the spectrum, but not equally. Market-watchers often examine the data behind these curves and describe them in terms of whether they signal a recession. Implied in that data as well, though, is a market assessment of how well the Fed is going to manage inflation. If the curve moves up across the board, and longer-term yields remain significantly higher than short-term rates, it may signal that investors expect the Fed to act, but haven’t yet developed conviction that those efforts will work, or when. By contrast, a so-called flatter curve—in which shorter-maturity yields are close to those of longer-maturity bonds—can signal that investors expect the Fed to push up higher short-term rates enough to slow the economy and successfully tamp down inflation. The implication is that successfully controlling inflation can mitigate the need for investors to continue demanding higher yields further out the curve. The spread between two- and 10-year Treasuries is a popular tool for tracking the curve’s flatness (lower is flatter), and the data certainly show flattening over the past year, inclusive of recent hiccups as the market has reacted to choppy messaging from the Fed over the pace of its actions.

It may still be a little early to start arguing that bond yields have stabilized. And inflation won’t be the only concern for bonds with credit risk. If the process of taming inflation winds up including a recession, the debt of economically sensitive businesses will stop acting in concert with Treasury bonds in the way they have of late. But after a few years of Treasury yields that have looked at times like they might get close to zero, buying high-quality bonds with more generous payouts may start to look a little more attractive.

/s3.amazonaws.com/arc-authors/morningstar/1b991ddd-b85f-490e-8687-e60e3f136800.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1b991ddd-b85f-490e-8687-e60e3f136800.jpg)