Retailers' Earnings Results Send Warning Signs About the Consumer

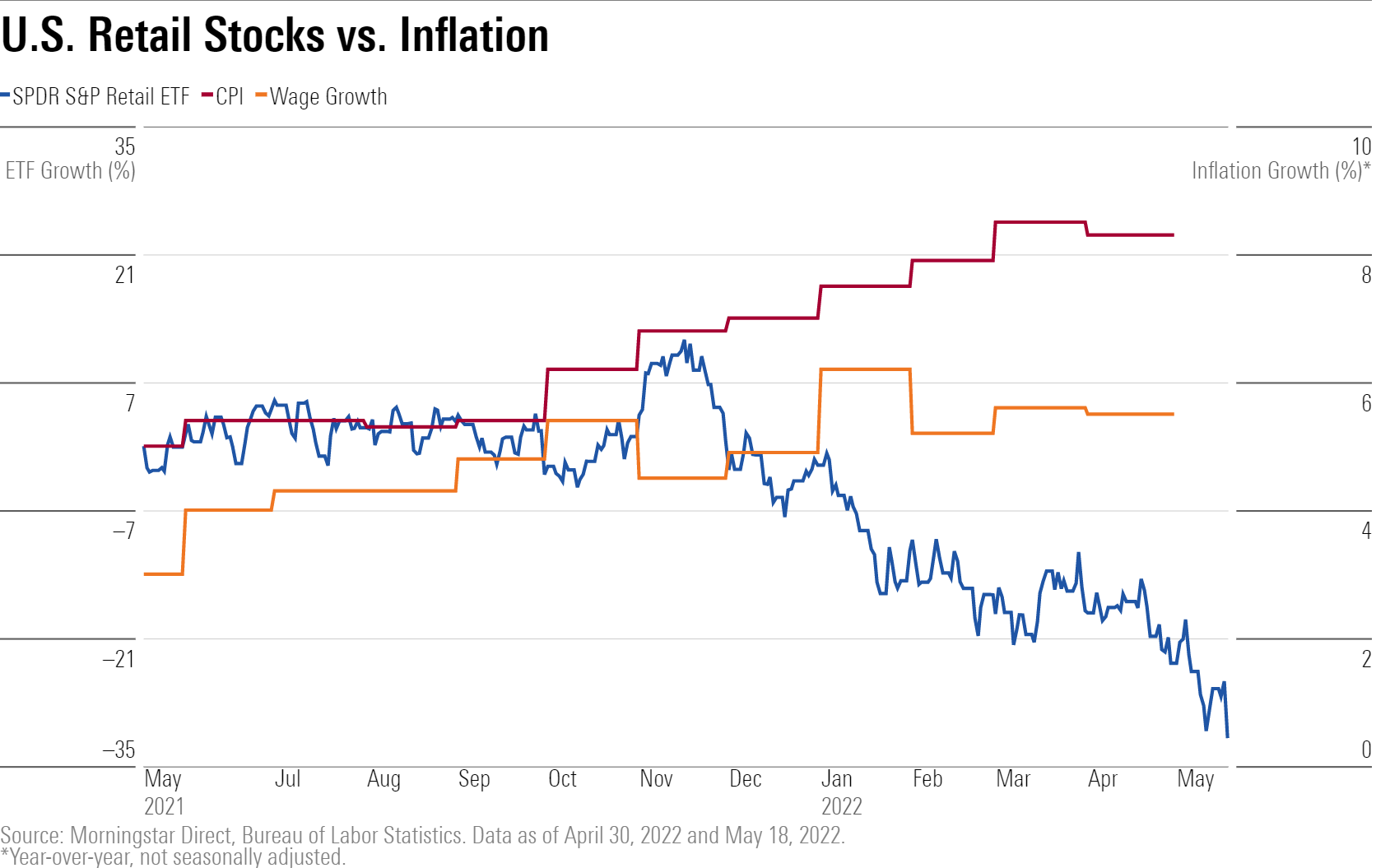

Inflation is having an impact on spending patterns, threatening profit margins.

When the some of the nation's largest retailers reported earnings last week they sent a clear signal: Consumers are struggling with inflation. That's raising concerns about profit margins and the strength of the economy.

Household names like Target TGT and Walmart WMT said inflation took a toll on their bottom lines, sending the S&P 500 into a nosedive Wednesday for its biggest one-day loss in two years.

Retailers are scrambling to keep pace with shifting customer tastes in this less-restrictive period of the pandemic. Shoppers are spending more on travel and services instead of big-ticket items such as furniture and kitchen appliances as they had done for the past two years while working from home. Also, consumers have become more price sensitive since the withdrawal of government stimulus payments.

Investors also had to take into account comments from Federal Reserve Chair Jerome Powell, who said at a conference that "restoring price stability is an unconditional need." He noted that unemployment consistent with stable inflation "is probably well above 3.6%," the rate reported for April.

The developments unnerved Wall Street and Main Street, reinvigorating talk of a “growth scare.” There are two camps: those that see growing evidence of a recession and those that say it’s still too soon to call. What everyone agrees on is that the answer lies in how quickly supply chain snags can be unsnarled to rein in inflation.

What Is Causing Volatility in the Market?

“The supply side is the overarching problem,” says Paul Zhu, investment analyst for China and global consumer discretionary coverage at Morningstar Investment Management. He sees the current period as a return to “normalization on the top line” and notes that comparisons on the sales side are out of whack because of the enormous amount of stimulus delivered to consumers the past two years.

"If we can resolve the supply-side issues, we can achieve a soft landing and avoid recession. If we cannot, there’s likely to be a recession,” Zhu says.

However, based on what he’s seeing on the consumer side, Zhu doesn’t think a recession is coming.

“The market is trying to price in recession and inflation fears,” Zhu says. “I don’t see any recessionary signals. We’re still looking at positive retail sales numbers. There’s been four straight months of positive sales. Consumers are still willing to spend.”

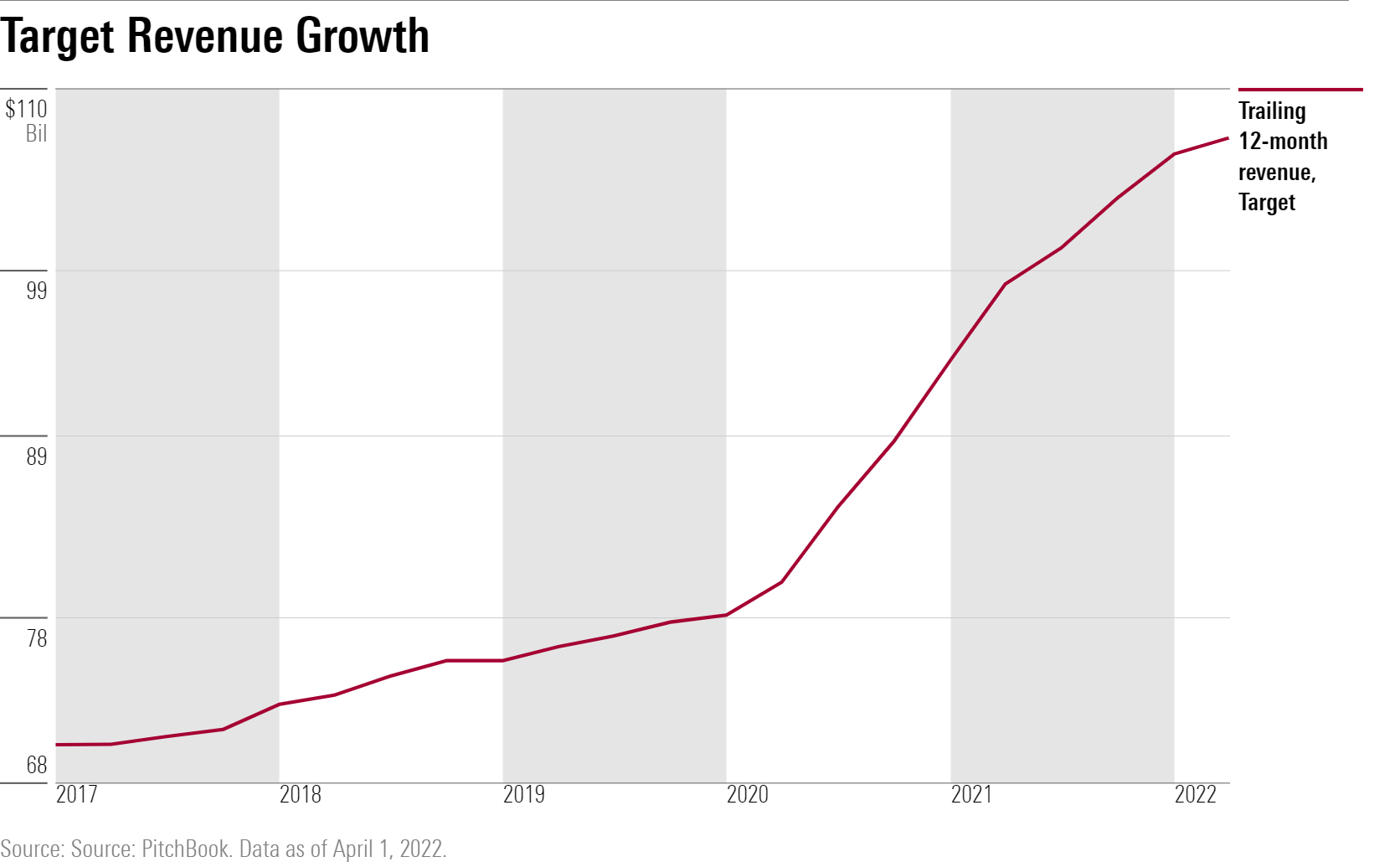

How Bad Were Target's Earnings?

Target triggered the selloff Wednesday when it said profits came up short in the first quarter despite positive sales growth. The company failed to anticipate the magnitude of a rapidly shifting macroeconomic backdrop, as well as dramatic changes in customers' behavior. Target's stock plummeted nearly 25% for its worst one-day performance since Black Monday in 1987. It also reported operating margins and earnings well below expectations.

Target executives were also caught off guard by unexpectedly high freight and shipping costs that squeezed margins as it tried to maintain pricing levels. The company found itself forced to mark down merchandise to shed excess inventories, as consumers switched their preferences from kitchen appliances and TVs to items related to travel, parties, and outdoor activities.

Stock market investors, already deeply pessimistic, ran for the exits and drove the broader averages down by 4%.

The S&P 500, down 18.2% from its record high on Jan. 3, is approaching the 20% level that would place it officially in a bear-market territory. The technology-heavy Nasdaq Composite index, already in a bear market, deepened its decline and is now down nearly 30% this year.

Target wasn’t alone.

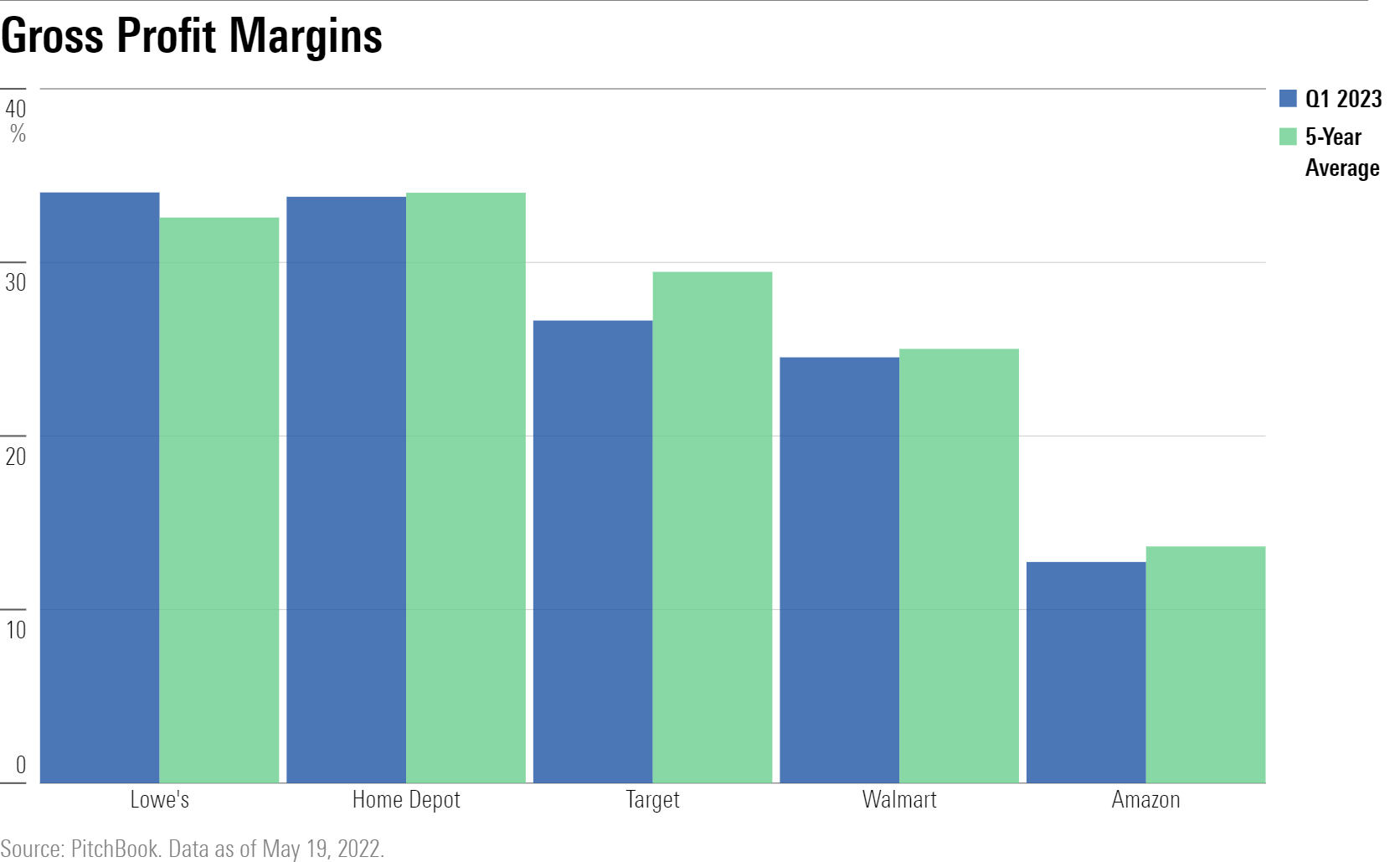

Walmart reported disappointing results on Tuesday and saw its shares plummet the most in 35 years. Despite sales growth, net income dropped by 25% year over year as profits were eroded by higher food and fuel costs, as well as higher wages in addition to more-selective consumers who traded down to less-expensive private-label goods. The same problems surfaced at Lowe's LOW.

Amazon.com AMZN provided clues to trouble ahead when it reported a first-quarter loss in late April and noted it had overbuilt warehouses and hired too many people. The company said it would likely report another loss in the second quarter.

Only Home Depot HD bucked the trend by posting record sales results and higher-than- expected earnings that were 6% were up from the same period last year, as demand exceeded expectations. While inflation lowered its average ticket price, that was offset by consumers trading up to premium products.

“The home improvement consumer remains engaged,’’ president and chief executive Ted Decker says. "Customers continue to tell us that their homes have never been more important, and project backlogs are very healthy. We believe that the medium- to longer-term underpinnings of demand for home improvement have never been stronger.''

What Happened to Retail Earnings?

The picture painted by the major retailers “is one of the first real warning signs that consumers are starting to capitulate,” says Tim Murray, capital markets strategist for the multi-asset division at T. Rowe Price.

“Supply is at the root of all of this,” Murray says. “We’ve had numerous unforeseen supply shocks, and it’s hard to see when that ends. Demand may have to fall to the level of supply.”

Consumer spending is a closely watched barometer of economic health in the U.S. because it represents two thirds of gross domestic product. A slowdown in spending is closely aligned with faltering consumer confidence and raises the specter of a potential recession.

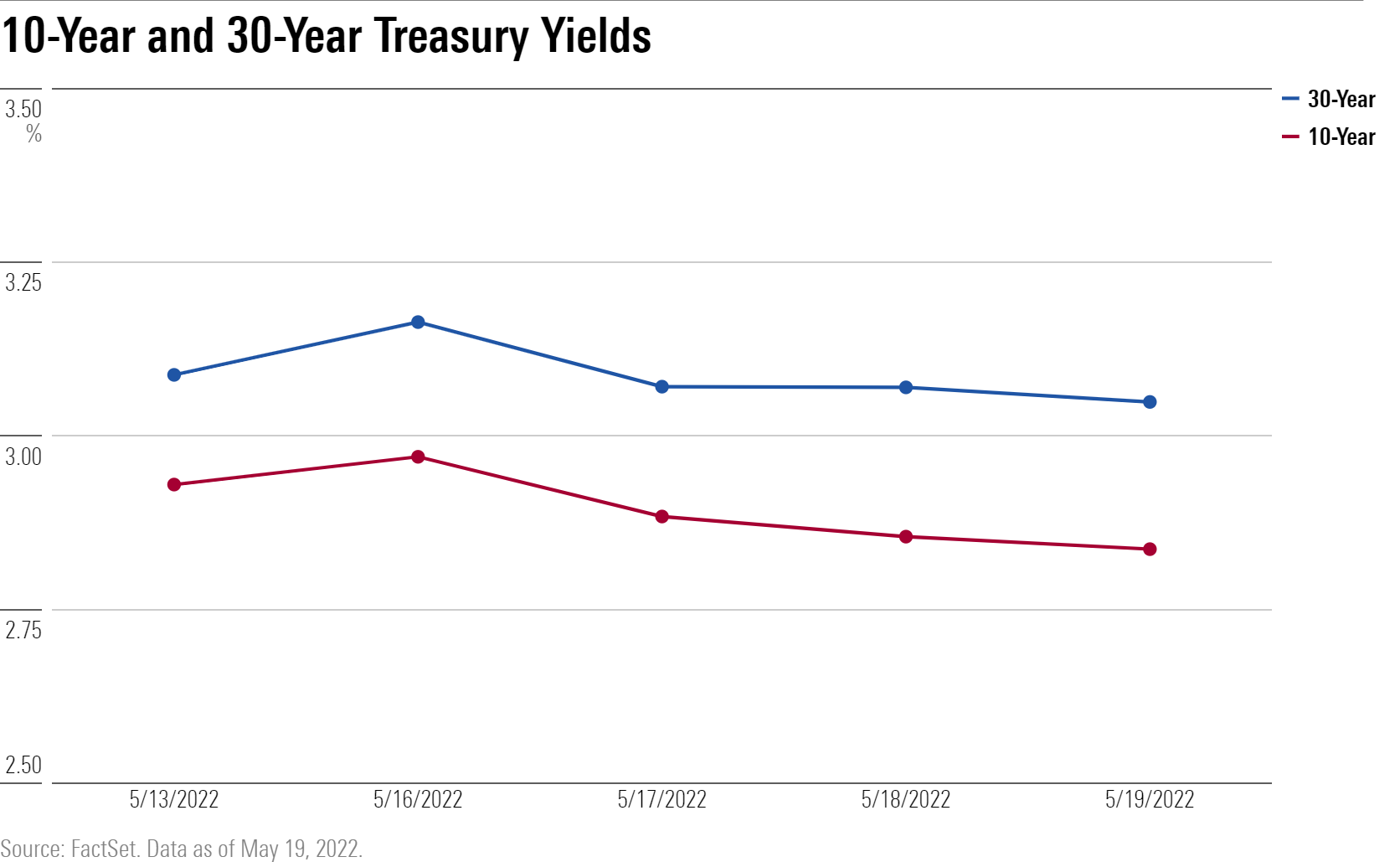

“Everybody has to be concerned that we are headed for recession. Earlier selloffs were more about rates rising and growth sold off more than value,'' Murray says. "Now growth is holding up better than value and yields are coming down on the 10-year Treasury, developments consistent with a slowing economy.”

In the past two years, the economy has been roiled by the pandemic, labor shortages, and, more recently, COVID lockdowns in China and the Russian invasion of Ukraine.

Investors have turned to U.S. Treasuries for safety, despite the Federal Reserve’s intention to fight inflation by raising rates. The yield on the 10-year Treasury has fallen to 2.83% from close to 3% since Wednesday.

T. Rowe’s Murray says the firm’s multi-asset portfolios have adopted a more defensive posture by reducing equity exposure and adding longer-dated Treasuries to their holdings.

Despite the deep pessimism surrounding the stock market, all agree that corporate balance sheets and consumers are in good enough shape to weather any storm. Savings are high, debt/income is low, rates are still relatively low, home equity is high, and personal incomes are strong.

Wage inflation at 5.5% has trended sideways for the past seven months, below the 8% annual rate of the Consumer Price Index.

“That hardly seems like the making of a wage-price spiral,” says James Paulsen, chief investment strategist at the Leuthold Group.

“We haven’t seen evidence of big imbalances that would result in a deep recession,” says Murray of T. Rowe Price. “If we do have a recession, consumers will be better able to withstand it.”

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)