So Far, Low-Volatility ETFs Are Doing Their Job in 2022

A look at how low-volatility ETFs have performed in recent adverse markets.

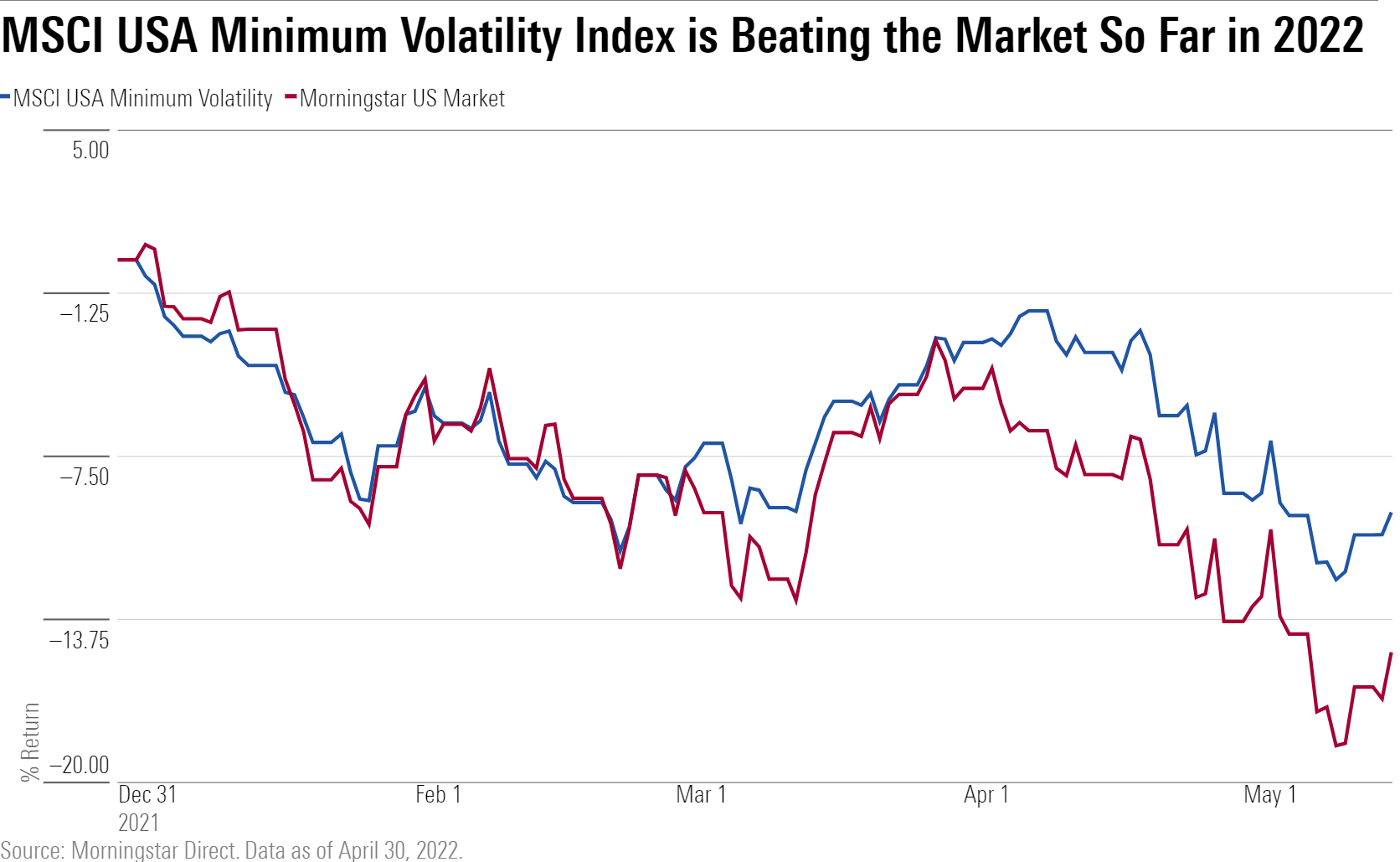

While markets have been falling across the board in 2022, low-volatility indexes and funds have generally held up better than their counterparts. For the year to date through May 17, 2022, the MSCI USA Minimum Volatility Index, which is designed to provide the lowest return variance, is down 9.7%, compared with a 15% loss for the Morningstar US Market Index.

Low-volatility strategies look best when markets are at their worst. In an article on low-volatility funds, Ben Johnson dove into the history of low-volatility strategies in the largest bear markets. In short, the minimum-volatility index outperformed during the bursting of the dot-com bubble, the global financial crisis, and the coronavirus pandemic.

Analyst-Covered Low-Volatility Funds

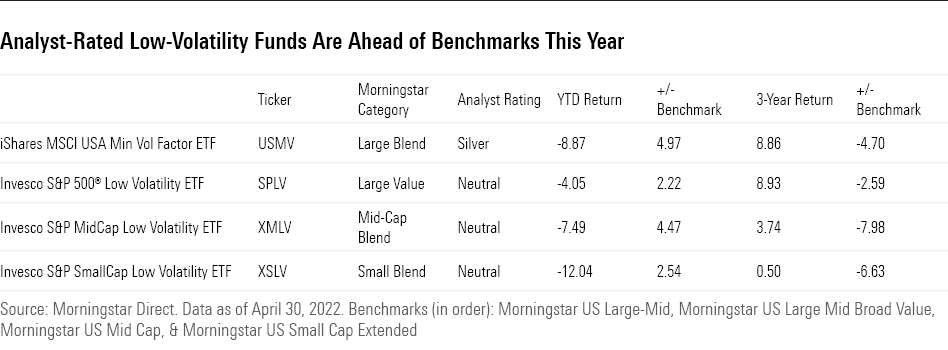

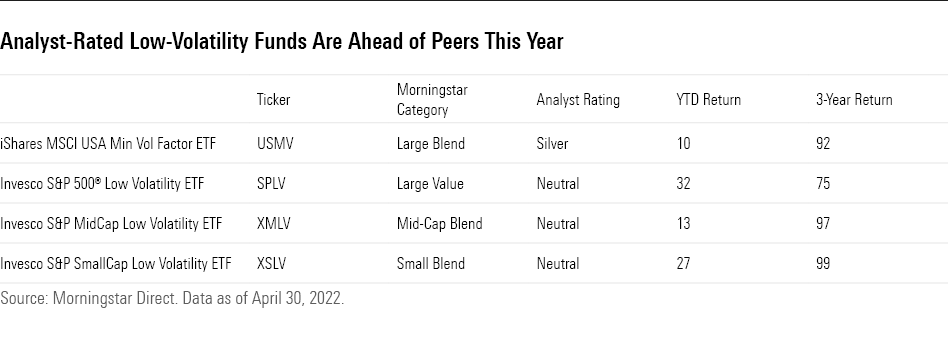

Our Morningstar Analysts cover four index-tracking U.S. low-volatility funds, all of which have outperformed their Morningstar benchmark for the year to date.

These funds are also showing strong returns relative to their respective Morningstar Category peers for the year to date. Over the past year, all funds finished in the top 10% of their categories. Longer-term performance demonstrates the downside of these strategies: In strong markets, low-volatility funds will lag.

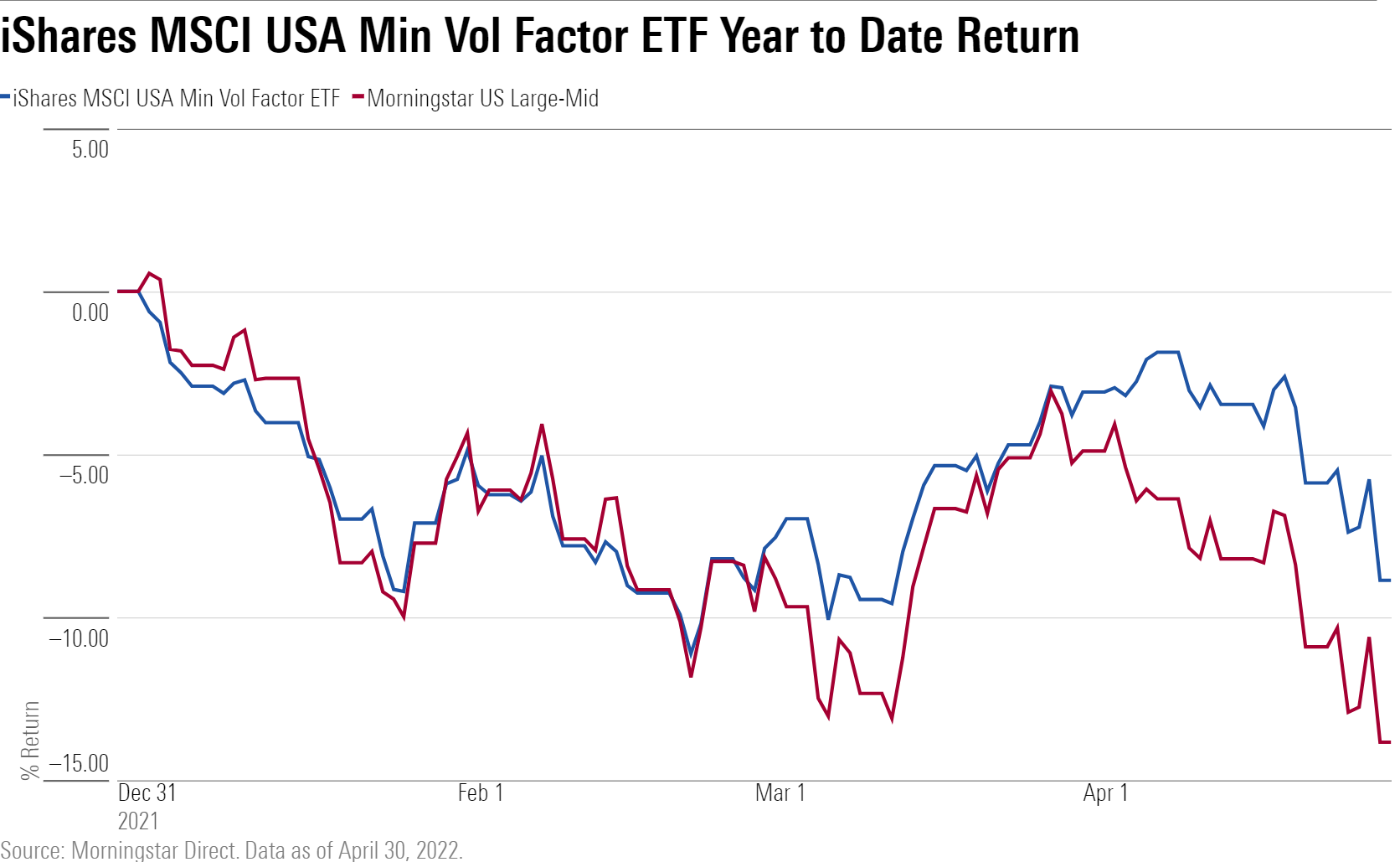

IShares MSCI USA Min Vol Factor ETF USMV is the lone Morningstar Medalist in the group. The Silver-rated ETF finished 4.97 percentage points better than the Morningstar US Large-Mid Index for the year to date through April 2022.

IShares MSCI USA Min Vol Factor ETF fully tracks the MSCI USA Minimum Volatility Index, which is designed to craft the least-volatile portfolio out of the MSCI USA Index, a broad, cap-weighted benchmark of large- and mid-cap stocks. “This portfolio is constructed with an optimizer that considers stocks' individual volatility as well as how their performance interrelates with other holdings,” says analyst Ryan Jackson in his report on the fund.

This fund also keeps weights similar to the index, preventing overexposure to less-volatile sectors such as utilities and consumer staples.

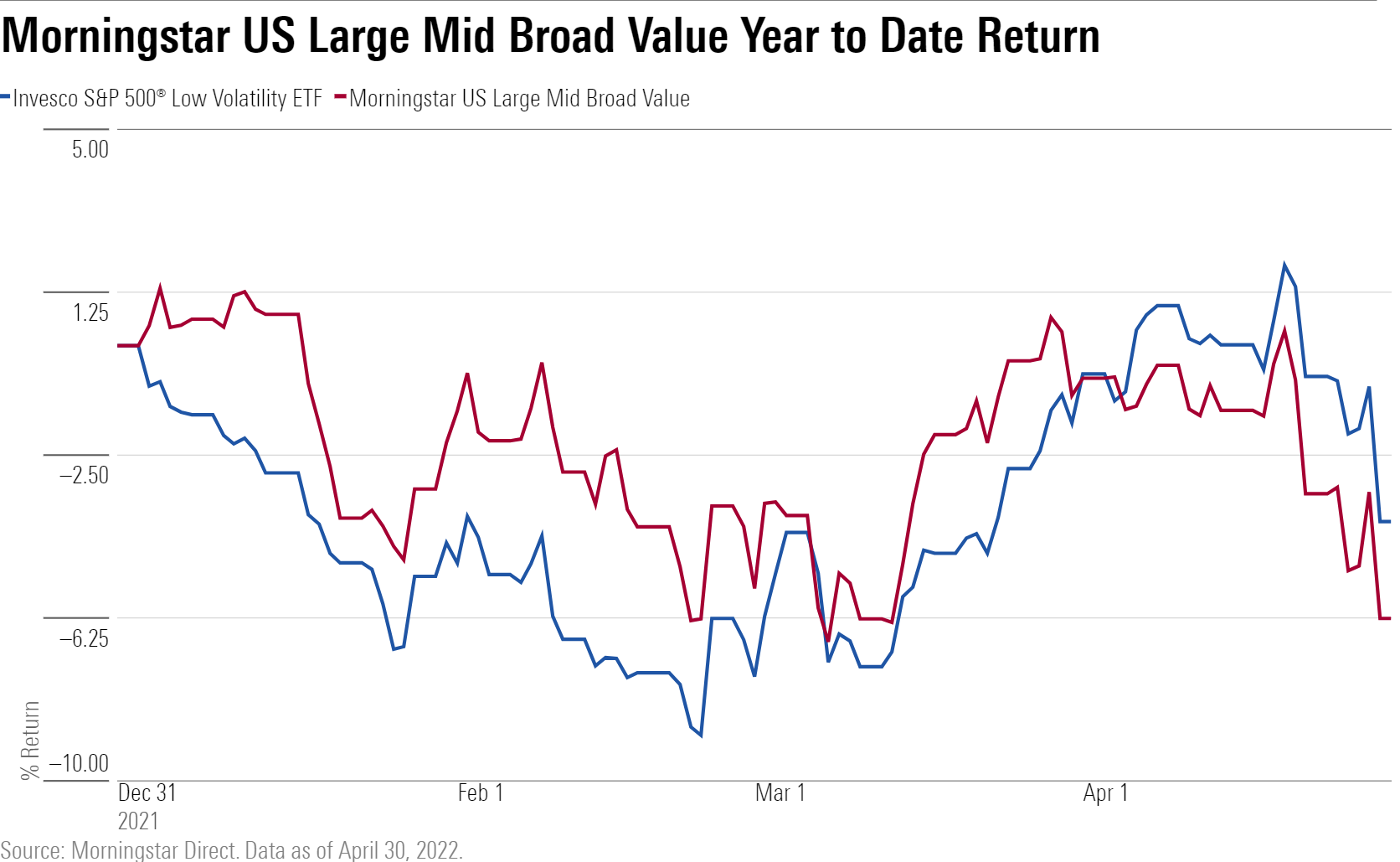

In the large-value Morningstar Category, Invesco S&P 500 Low Volatility ETF SPLV has outperformed its Morningstar index by 2.22 percentage points over the last year. This was aided by strong performance in April, when the fund finished in the third percentile of the large-value category.

The fund fully replicates the S&P 500 Low Volatility Index, which ranks the S&P 500 constituents by trailing 12-month volatility and invests in the 100 least volatile, weighted by volatility. However, the fund has its flaws, according to Jackson.

“Its lack of constraints exposes it to several unintended risks, most notably in the form of distinct sector biases relative to the broad market. The fund tends to load up on utilities, real estate, and consumer staples stocks at the expense of tech and communications firms,” he writes in his report.

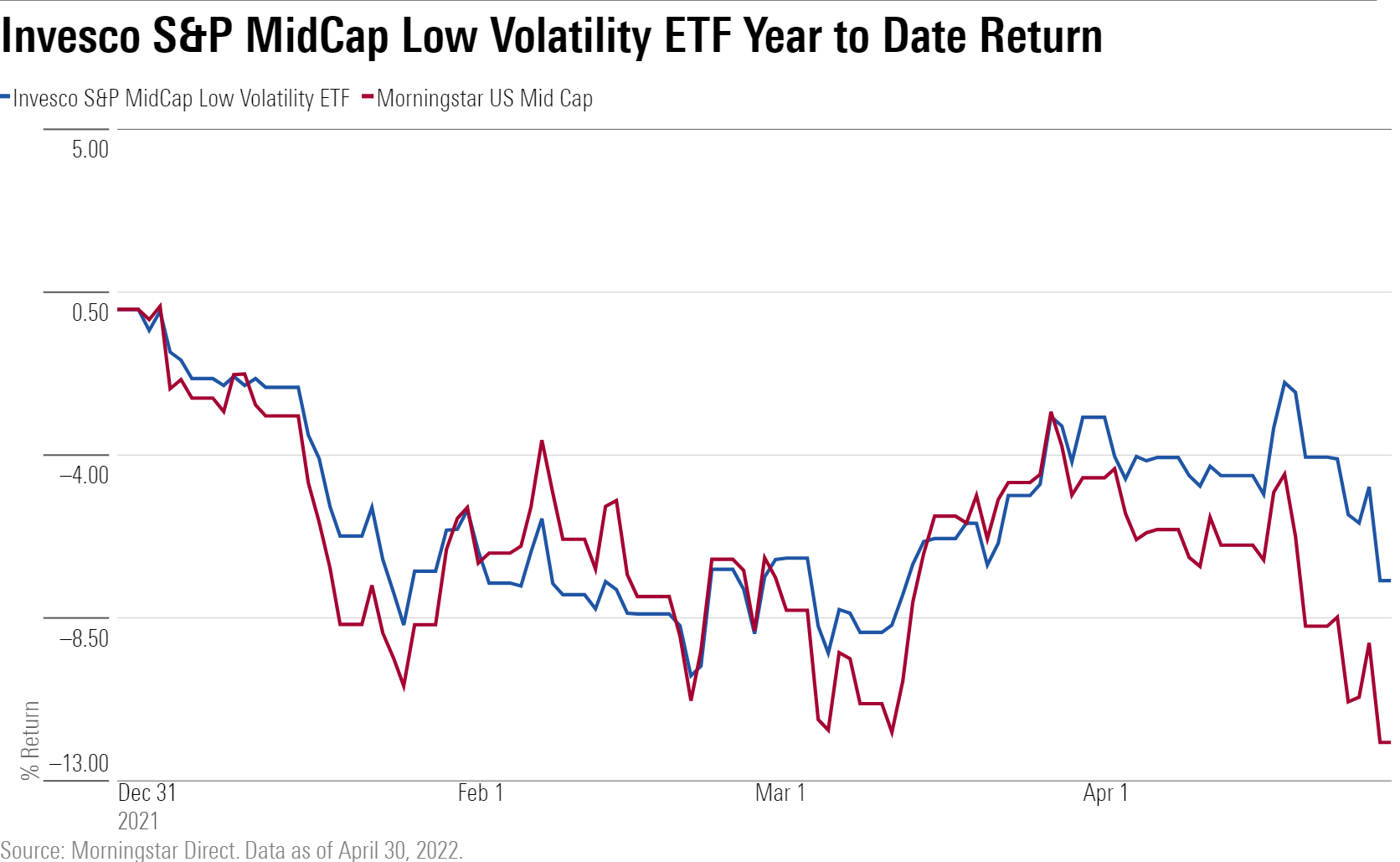

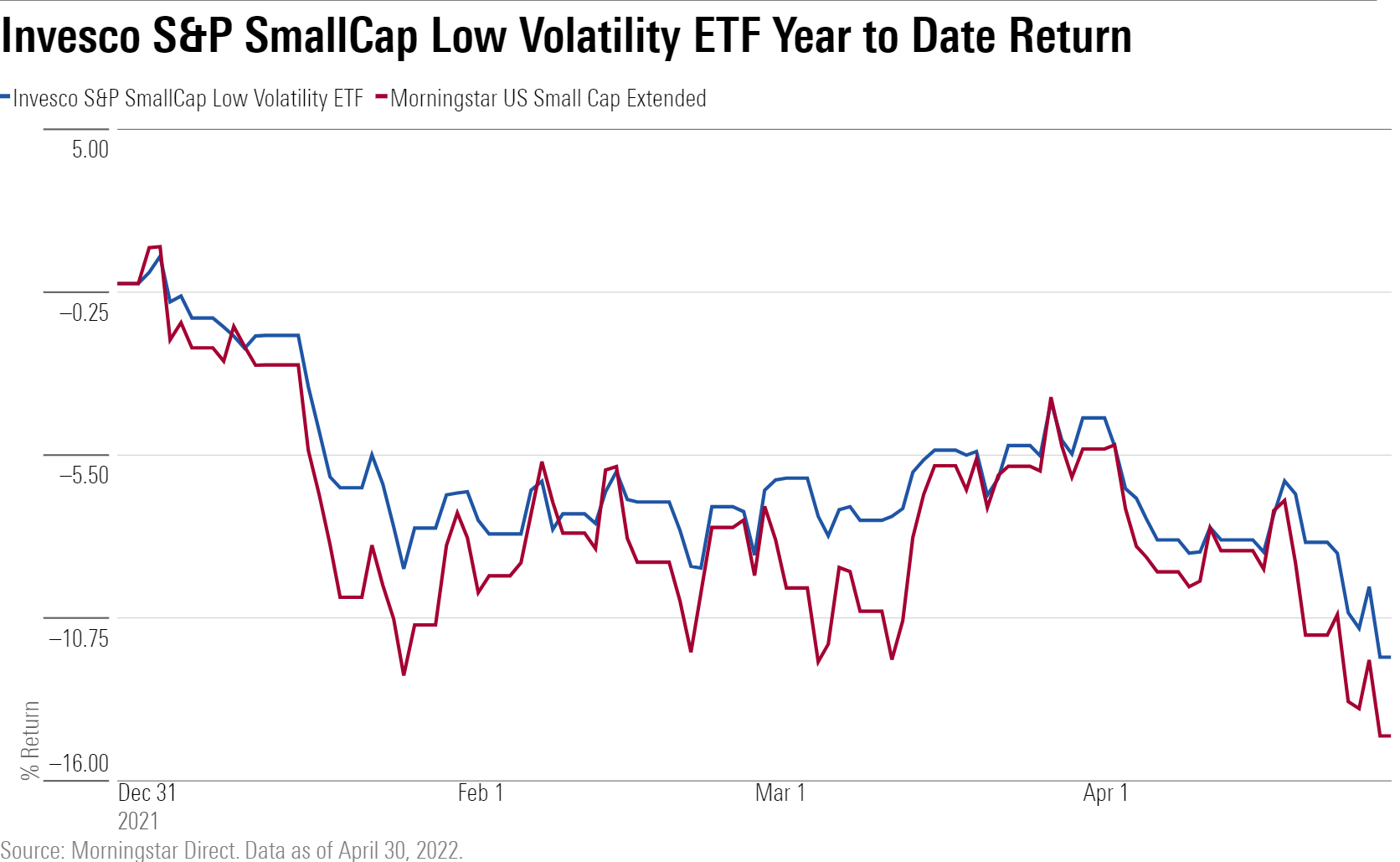

Invesco S&P MidCap Low Volatility ETF XMLV tracks the S&P Mid Cap 400 Low Volatility Index, and Invesco S&P SmallCap Low Volatility ETF XSLV tracks the S&P SmallCap 600 Low Volatility Index. Similar to their large counterpart, both funds invest in the least volatile 20% of the larger index. This comes with similar risks, write analyst Lan Anh Tran and director Bryan Armour. “The lack of sector constraints allows it to make outsize bets that may overwhelm its risk-reducing properties and hurt its performance,” Tran writes.

Neutral-rated Invesco S&P MidCap Low Volatility is in the mid-cap blend category and outperformed its Morningstar Index by 4.47 percentage points. This puts the ETF in the 13th percentile this year when compared with its peers in its category. Invesco S&P SmallCap Low Volatility is in the small-blend category and outperformed by 2.54 percentage points.

/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)