Which Funds Have the Biggest Target Stock Exposure?

These growth funds and value-tilting dividend strategies had the largest weights in the stock.

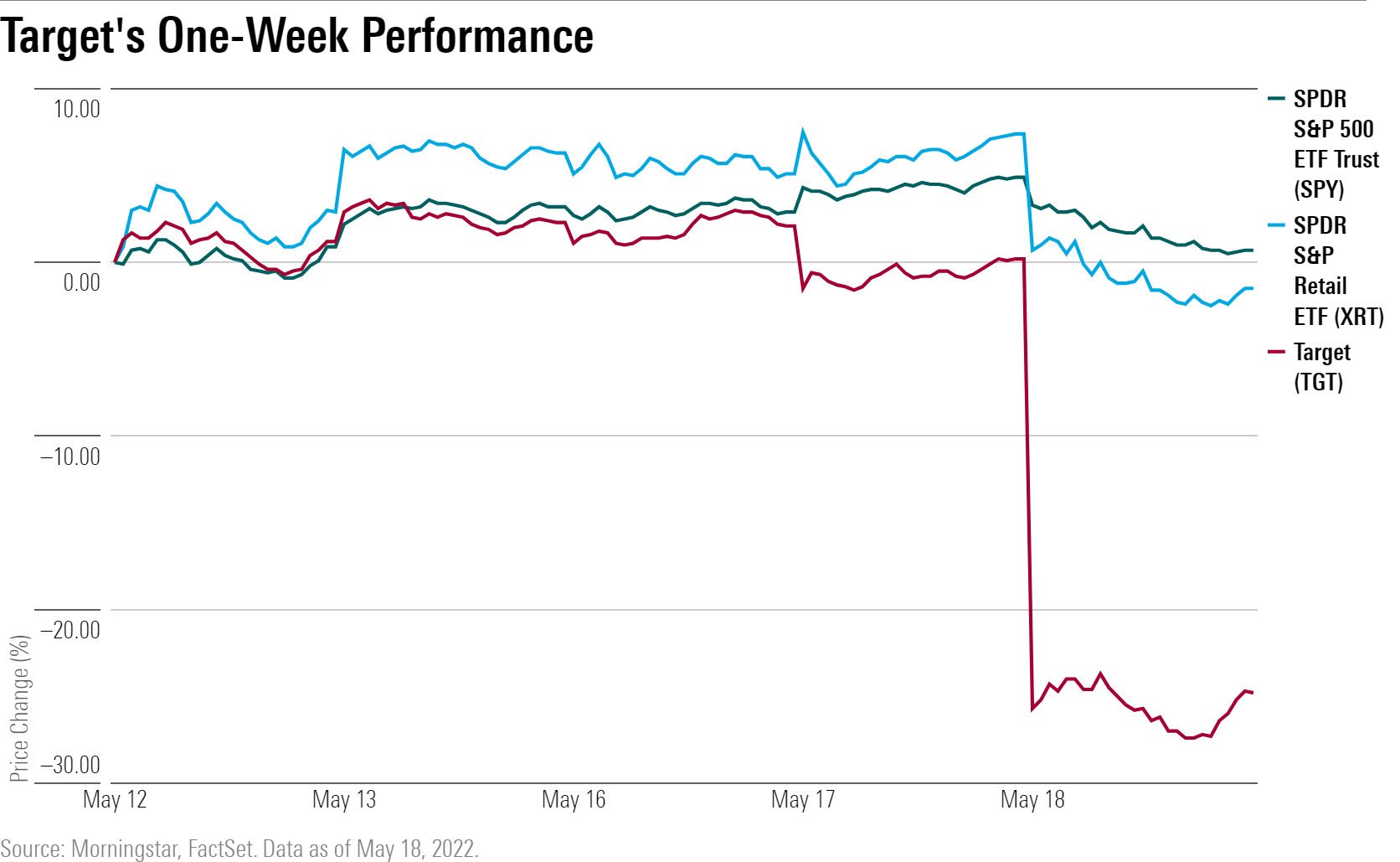

Target TGT reported lower-than-expected earnings on Wednesday, and the news sent shares spiraling. The 24.9% drop was the second-worst day for the stock in its 55-year history.

But for investors in diversified U.S. mutual funds and exchange-traded funds, the impact of the stock's sharp decline was minimal. Target represents only a 0.30% weight in the $367 billion SPDR S&P 500 ETF SPY and a 0.26% weight in the $295 billion Vanguard Total Stock Market Index VTSAX. Among narrower sector indexes, Target plays a larger part. In the SPDR S&P Retail ETF XRT, Target takes up a 1.1% weight. The fund fell 8.3% today, while SPY dropped 4.0%.

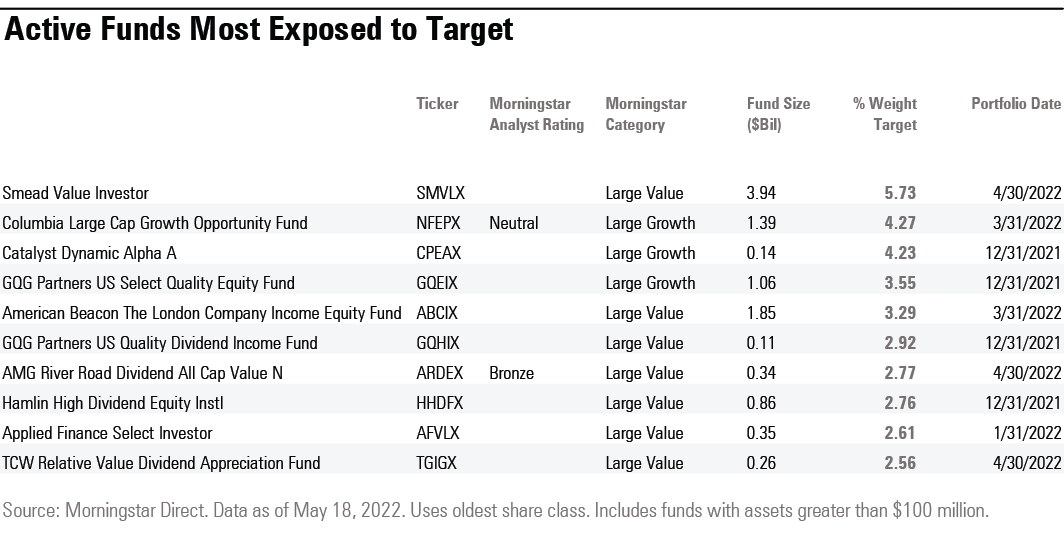

Funds that hold larger positions in Target include both growth-stock strategies and value funds, especially dividend strategies. "Target has been considered both a growth and a value stock by different investors," says Dan Lefkovitz, a strategist for Morningstar Indexes. "In recent years, the stock has displayed both growth and value characteristics on metrics like price/earnings, price/cash, sales growth, and cash flow growth."

Smead Value SMVLX registers the largest Target stake with 5.73% of its portfolio allocated to the company as of April 30.

Columbia Large Cap Growth Opportunity NFEPX, which runs a relatively concentrated portfolio of 54 names, held 4.27% in Target as of the end of March. This fund carries a Morningstar Analyst Rating of Neutral.

With a dividend yield of 1.7% and a history of growing its payout to shareholders, Target is a holding among many dividend funds. That includes AMG River Road Dividend All Cap Value ARDEX, which had a 2.8% weighting at the end of April. This fund is a "mostly defensive, dividend-oriented strategy," writes Morningstar associate director Tony Thomas.

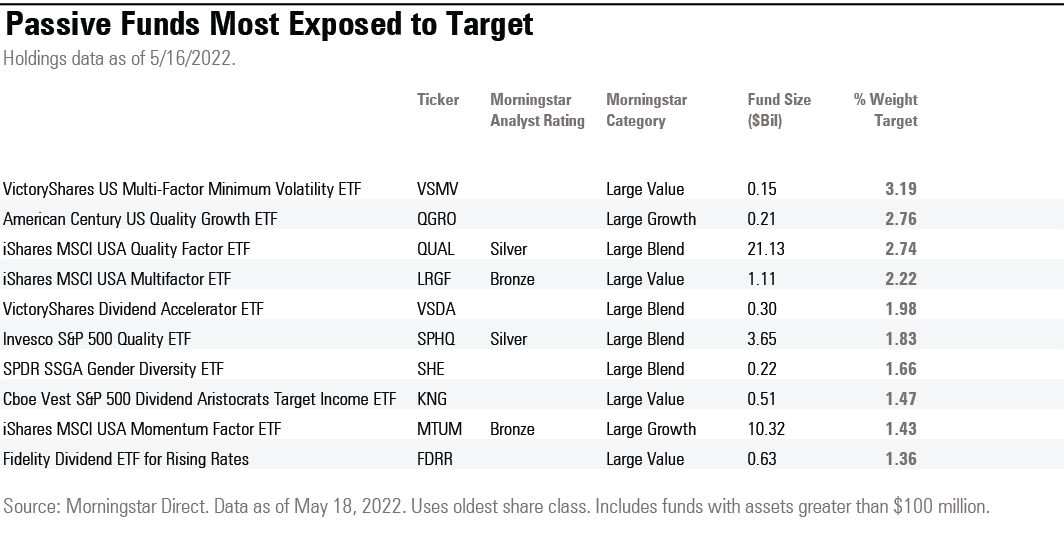

Among passive funds, VictoryShares US Multi-Factor Minimum Volatility ETF VSMV was the most exposed with Target making up 3.2% of the portfolio. The fund follows an index that screens for earnings quality, momentum, profitability, and valuation and is rebalanced semiannually.

Target's historically strong balance sheet and earnings growth also made it a popular holding in ETFs that focus on quality stocks. American Century U.S. Quality Growth ETF QGRO held 2.8% in the company, and Invesco S&P 500 Quality ETF SPHQ held slightly less at 1.8%. Morningstar associate analyst Lan Anh Tran writes that the companies featured in SPHQ's lineup tend to be established business with strong and stable cash flows.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)