11 Undervalued Stocks That Crushed Earnings

Citigroup and Sabre are among those left undervalued despite strong first-quarter results.

Against a backdrop of a battered stock market, corporate earnings results among the U.S.-listed stocks covered by Morningstar for the first quarter were on par with 2021’s fourth quarter.

Of the 868 U.S.-listed companies on Morningstar’s coverage list, 37% beat Wall Street’s earnings per share estimates by 10% or more. That’s nearly equal to the fourth quarter but well below the 56% that beat earnings by that much a year ago. Meanwhile, the number of companies missing by that same amount was essentially flat from the final quarter of 2021 at 14%.

While Morningstar stock analysts pay close attention to quarterly earnings on the companies they cover, the focus is on long-term results and valuations. A single quarter’s results usually don’t lead to a change in the long-term assumptions behind our assessment of a stock’s fair value, unless a company also comes out with new, material information that those long-term assumptions are based on. For example, new data on a drug that raises the probability of approval or pricing gains in a key product line could affect an analyst’s long-run thinking.

Still, looking at quarterly earnings against the valuation backdrop can help investors identify opportunities.

We screened for stocks that beat expectations but remained undervalued to help investors capitalize on the new investment opportunities that arose during earnings season.

To keep the focus on those that had truly strong results—not, for example, beating earnings through accounting gimmicks or one-time factors—companies were also screened for revenue beats of 5% or more. Of those, stocks were filtered for a Morningstar Rating of 5 stars to highlight the most undervalued opportunities.

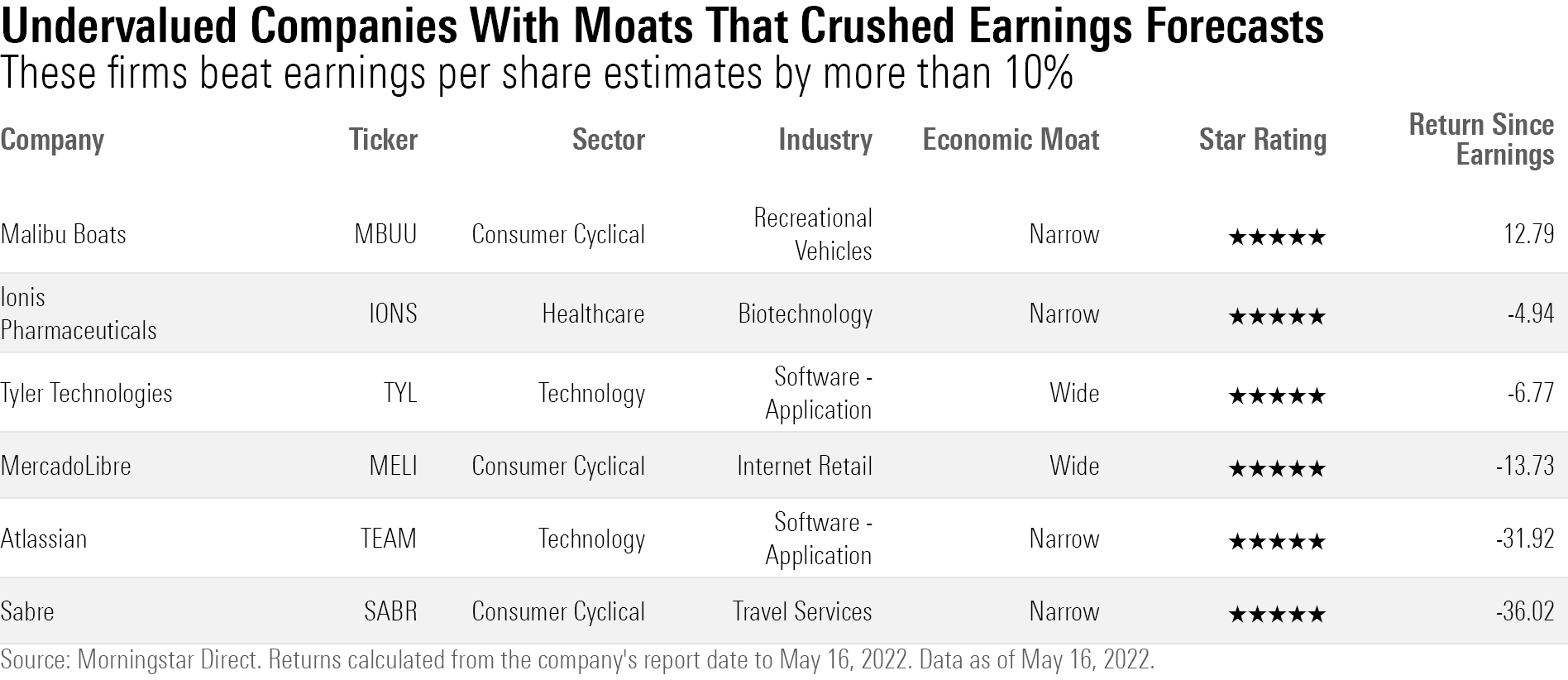

The result? The screen turned up 11 undervalued stocks that beat expectations in the first quarter. Highlighted below are six of those stocks that also hold a Morningstar Economic Moat Rating of either wide or narrow—meaning that Morningstar analysts believe they hold competitive advantage over their peers. A full list of the screen’s results can be found at the end of the article.

Here’s a closer look at these stocks and Morningstar’s take on them.

Malibu Boats MBUU Power-boat maker Malibu Boats popped 12.79% since posting revenue and earnings results that beat the market's expectations. The company's revenue grew 26% to $344 million, beating consensus estimates by 13%. Gross margin also expanded to a record EBITDA margin of 23.2%, according to Morningstar senior analyst Jaime Katz; as a result, the firm posted an EPS of $2.61, ahead of the $1.96 that the market expected.

While new-boat buyer demand has slightly fallen to 56,000 consumers in 2021 from 63,000 in 2020, it remains elevated above the 10-year industry average of 44,000, says Katz. “First-time boat buyers for new and used units was also strong, at more than 415,000 units, a figure seen only once before in the last 15 years. In our opinion, this implies interest in the outdoor lifestyle has held firm despite a broad reopening of other experience parts of the economy,” she says.

Shares are 41% undervalued.

MercadoLibre MELI Wide-moat MercadoLibre, Latin America's largest e-commerce marketplace, beat both Wall Street's and Morningstar equity analyst Sean Dunlop's revenue and earnings expectations for the first quarter. The company brought in $2.2 billion in sales, beating Dunlop's forecast of $1.9 billion. EPS also came in at $1.30, above the $1.17 that the market anticipated.

“Platform sales growth remained steady on a three-year stacked basis, relative to prepandemic, suggesting that COVID-19-induced gains have remained sticky, an accomplishment we view as particularly impressive when juxtaposed against recent slowdowns seen by other e-commerce operators,” Dunlop says.

The firm operates an ecosystem of products ranging from fulfillment solutions, advertising, and payment processing that create meaningful switching costs for merchants on the platform.

“Over time, we expect Mercadolibre to monetize those services commensurate with their value added more closely, with our forecast for 17% equilibrium take rate, up from 13.5% in 2021, hinging on swelling revenue in the previously subsidized advertising and logistics businesses,” Dunlop says.

MercadoLibre is trading at a discount of about 50%.

Ionis Pharmaceuticals IONS Biotech firm Ionis' first-quarter results beat Wall Street estimates by a solid margin. Revenue came in at $142 million, beating the market estimate of $122 million, according to FactSet. While EPS still came in at negative $0.46, it was better than the negative $0.69 the market expected.

Despite those beats, Morningstar healthcare strategist Karen Andersen found the results to be in line with her personal expectations and continues to value the company at $62 per share, leaving shares 41% undervalued.

“Ionis has built a massive pipeline of promising new drugs that are rapidly moving toward the market, securing a narrow moat,” says Andersen.

Sabre SABR Air-travel booking servicer Sabre remains at a steep discount to its fair value estimate in spite of beating first-quarter expectations. Revenue came in at $585 million, 78% higher year-over-year, and beat estimates of $536 million. Although EPS posted a loss of $0.29, it was better than the market estimate of a $0.34 loss.

The company’s demand accelerated in the first quarter as air bookings rose to 52% of 2019 levels in March from 29% in January, says Morningstar senior equity analyst Dan Wasiolek. He sees air-travel recovery landing in the high-50% mark of 2019 levels during 2022 and forecasts it hitting in the low-90% mark in 2025.

Sabre shares dropped dramatically since it released results, which Wasiolek sees as misguided. Sabre’s long-term technology transformation plan, which stands to reduce costs, improve reliability, and speed innovation, remains on track, despite severe demand headwinds created by the pandemic the past two years, he says. Shares are currently 55% undervalued.

Tyler Technologies TYL Wide-moat Tyler Technologies, which provides a suite of software to address the organizational needs of several government institutions ranging from schools to courts, beat both revenue and EPS estimates for the first quarter. Total revenue grew 55% year over year to $456 million, compared with market estimates of $434 million. Organic revenue also grew 13% from 2021's first quarter, the company's fastest organic growth in the last 20 quarters, according to Morningstar senior equity analyst Dan Romanoff.

Romanoff sees business momentum continuing as the firm’s number of software subscriptions and transactional revenue grows. However, as the company starts to embrace cloud-based solutions more, he sees margins being pressured in the next few years. “We expect margins to bottom in 2023, with revenue growth not really impacted given that most new business already arrives via subscriptions,” he says.

Shares are 35% undervalued.

Atlassian TEAM Project management software provider Atlassian brought in $740 million in revenue, beating market estimates of $701 million. EPS came in at $0.47, ahead of the $0.32 expected by the market.

The company’s management provided a mixed outlook for the third quarter, says Morningstar's Romanoff. The firm expects revenue to come in higher than Romanoff’s expectations, but with weaker margins going forward. “We are impressed with Atlassian’s cloud migration progress and remain confident that, while the rapid transition is pressuring near-term margins, the company will benefit from its investments and drive long-term profitability and revenue growth,” he says.

Shares are 59% undervalued.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)