Vanguard Maintains Its Lead in 529 Plans

Capital Group and Fidelity round out the top three.

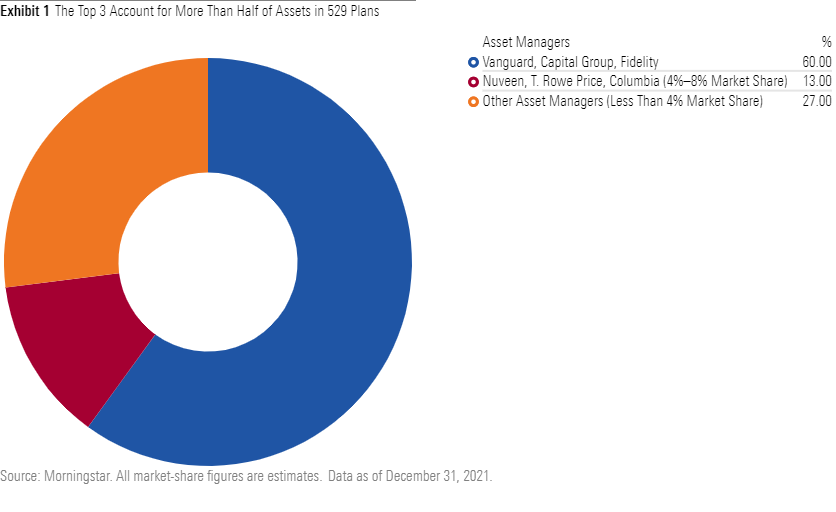

Assets in 529 savings accounts grew over the course of 2021, to $461 billion from $394 billion, reflecting both investor inflows and healthy market appreciation. Overall, the firms most frequently trusted to manage those assets—Vanguard, Capital Group, and Fidelity—remained the same over the past three years. 529 plans are sponsored by individual states, which partner with asset managers, record keepers, or banks to select the investments and to design and manage the plan. Vanguard, Capital Group, and Fidelity are attractive partners, offering strong and broad lineups of mutual funds and well-resourced multi-asset investment teams with established track records.

Individually, Vanguard is synonymous with diversification and low fees, Capital Group is renowned for its compelling actively managed offerings, and Fidelity brings together its strength in both active and passive investing to offer more choices to investors. Together, these three firms are responsible for over half of 529 assets under management and their proclivities provide an interesting snapshot of the industry.

Vanguard

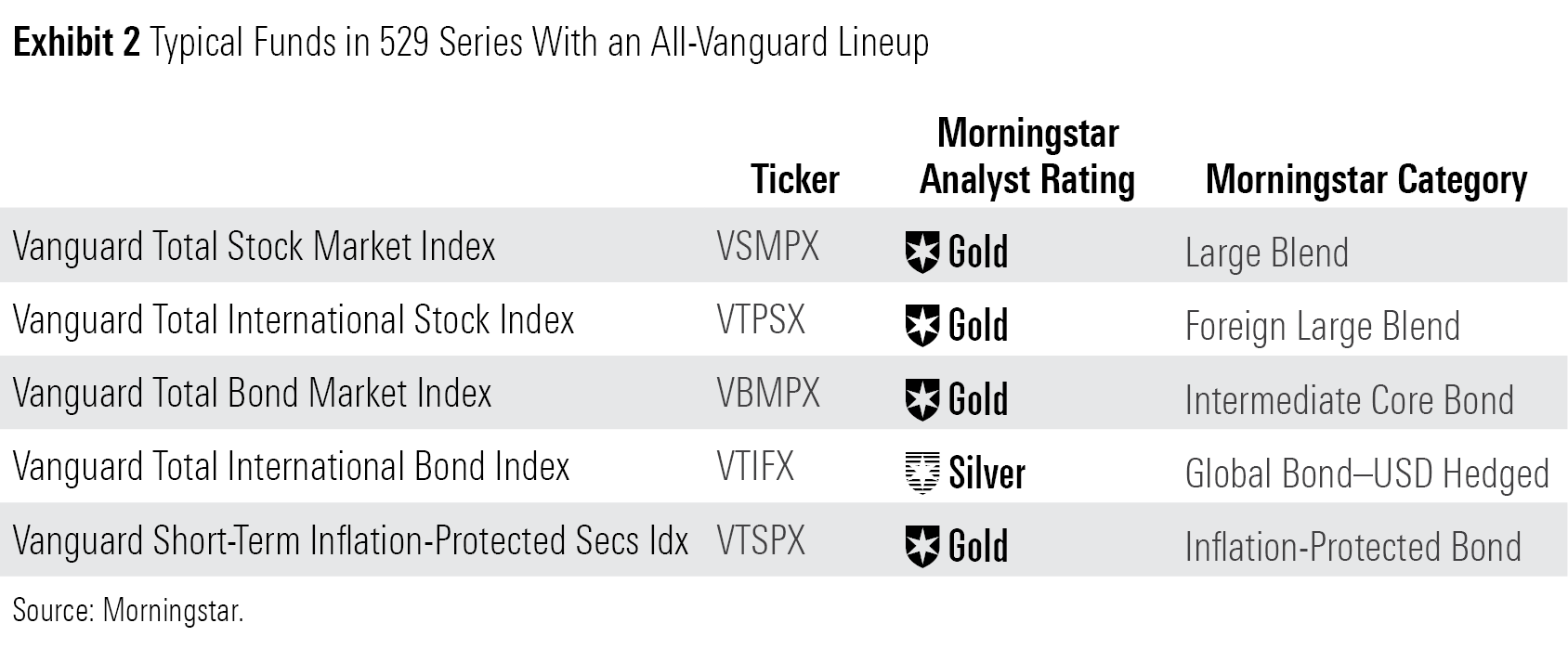

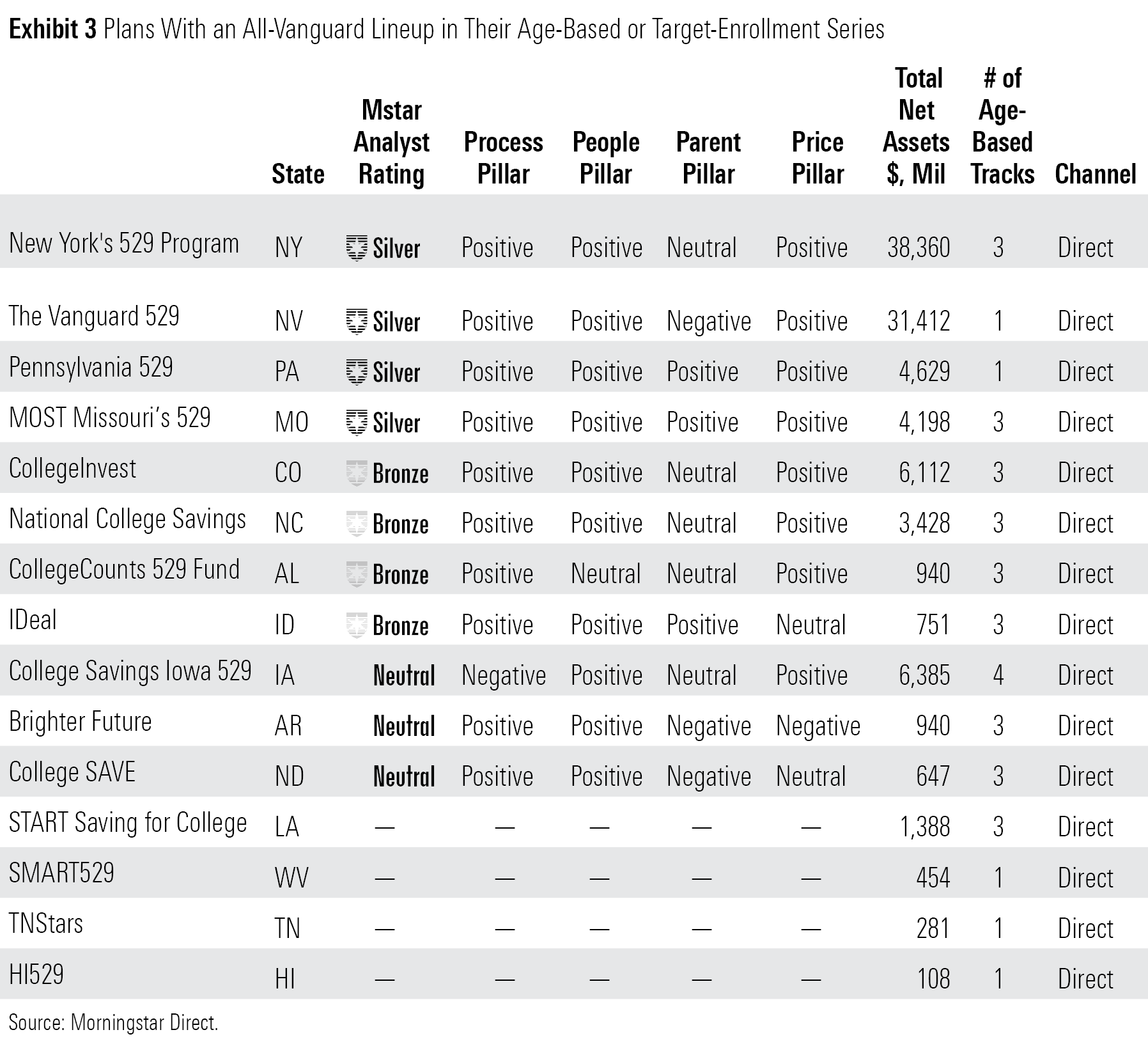

Vanguard has more 529 assets than any other firm, with an estimated 30% market share of assets under management. Out of 86 education savings plans, 15 hold all-Vanguard lineups for the equity and bond exposures in their age-based or target-enrollment series. About 10 other plans have offerings where a majority of assets are in Vanguard funds but also include funds from other families. Across all these plans, the most common holdings are Vanguard Total Stock Market Index VSMPX, Vanguard Total International Stock Index VTPSX, and Vanguard Total Bond Market Index VBMPX. Most also hold Vanguard Total International Bond Index VTIFX, and some hold Vanguard Short-Term Inflation-Protected Securities Index VTSPX. These funds are diversified and attractively priced, a combination of characteristics that continues to support each of their medalist Morningstar Analyst Ratings.

While these plans benefit from this straightforward fund lineup, we have different ratings across plans that hold Vanguard funds in their age-based or target-enrollment series. States that choose Vanguard funds do so because of low fees, simplicity, and broad diversification. But some states do not follow Vanguard's recommendations on how to combine and employ these holdings in an age-based or target-enrollment series. For example, Neutral-rated College Savings Iowa 529 Plan offers four risk tracks, instead of Vanguard's recommended three. The Iowa plan also deviates from Vanguard's glide path of 12.5% equity step-downs, with its Aggressive Growth and Growth options exhibiting large single-day 20% and 30% cuts in equities at the end of the glide path. This exposes investors to market-timing risk and drives our Negative Process rating in this instance. The other two Neutral-rated plans, Arkansas' Brighter Future Direct and North Dakota's College SAVE Plan, are weighed by relatively high fees and weak state oversight.

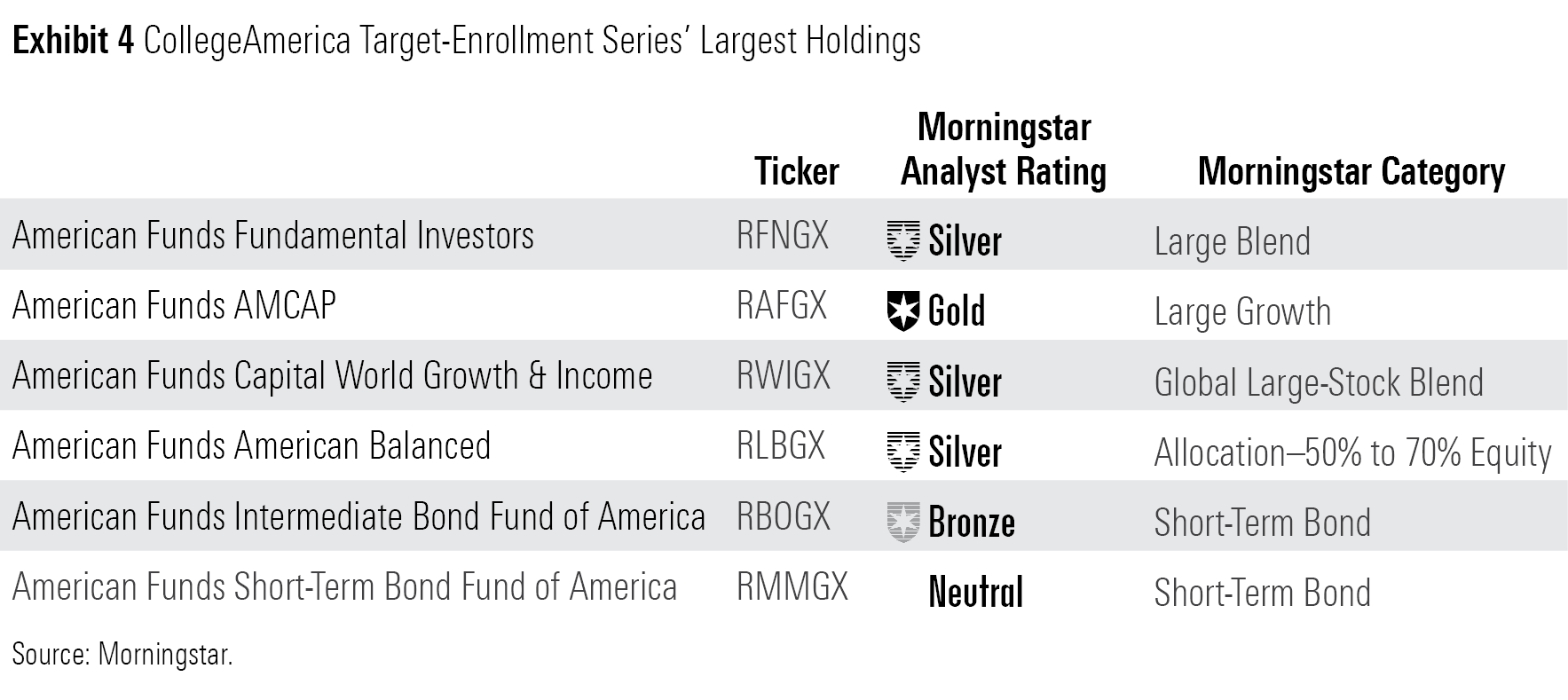

Capital Group

Capital Group (the parent company of American Funds) has the second-largest market share at 20%, or $93 billion in assets. This is accomplished with one plan, CollegeAmerica, which Capital Group manages with minimal interference from its state partner Virginia. This Bronze-rated plan benefits from Capital Group's dedicated multi-asset specialists and seasoned equity and fixed-income investors. CollegeAmerica offers a target-enrollment series with a relatively smooth glide path, and features well-regarded actively managed funds, 87% of which received a Morningstar Medalist rating as of May 2022. While CollegeAmerica earns praise for its investment team and underlying processes, this advisor-sold plan is pricey.

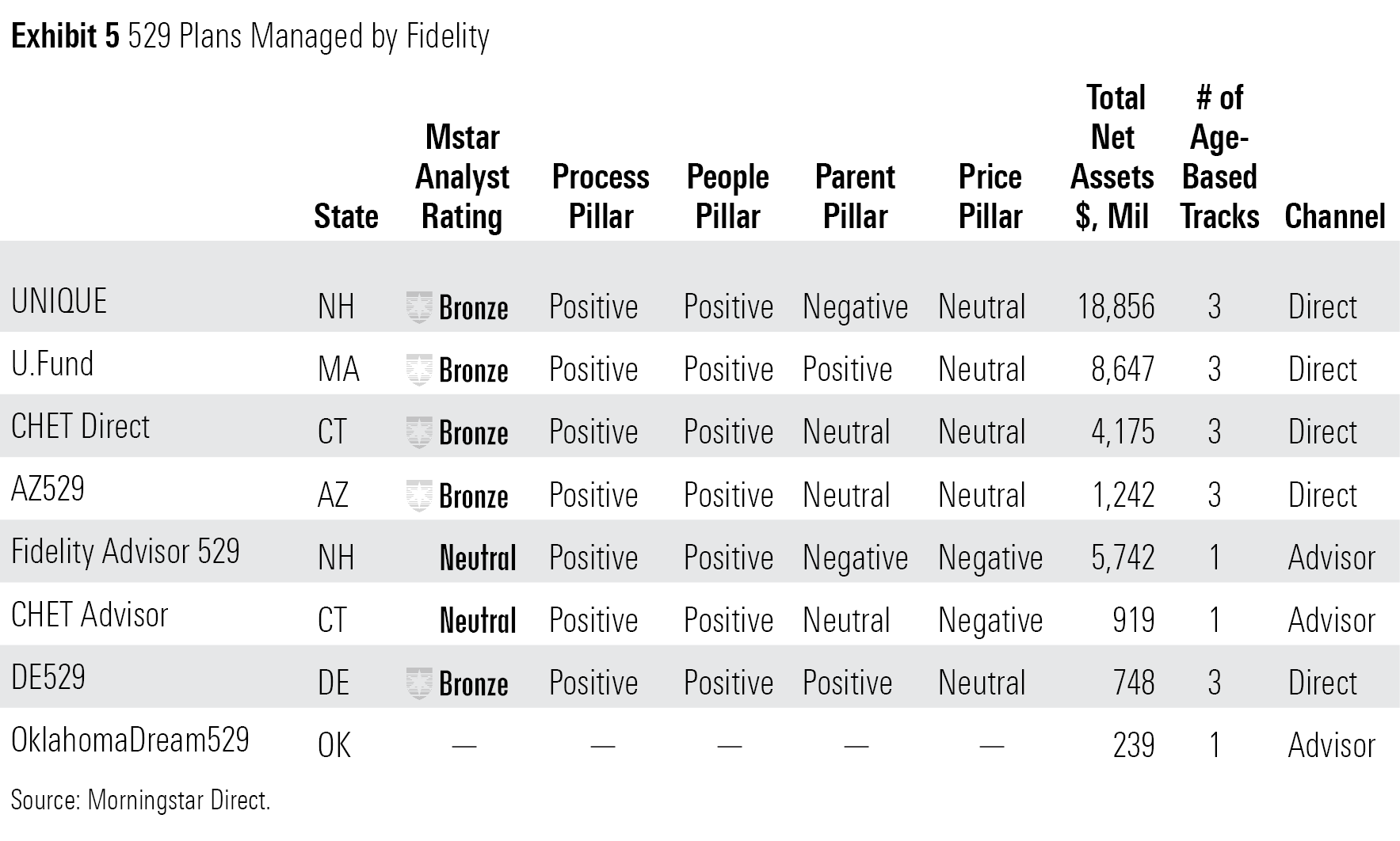

Fidelity

The firm with the third-largest market share, at about 9%, is Fidelity. Unlike Capital Group's single plan, Fidelity runs a number of plans and has had long, 20-plus-year partnerships with states such as Massachusetts, New Hampshire, and Delaware. In 2021, the firm won two new mandates and now serves as the program manager for Connecticut's direct- and advisor-sold plans. This brings the total number of plans under Fidelity's purview to eight.

Across these plans, Fidelity offers the same glide path designed by the firm's experienced and well-resourced asset-allocation team. The direct-sold plans provide the option of three tracks (one that uses all actively managed Fidelity funds, one that uses all index funds, and one that uses a mix) and the advisor-sold offers one active track. The underlying holdings are all Fidelity Series funds, many of which are clones of Morningstar Medalists or are managed by Fidelity's top managers such as Jed Weiss for Fidelity Series International Growth FIGSX, Ford O'Neill for Fidelity Series Investment Grade Bond FSIGX, and Matthew Fruhan for Fidelity Series Large Cap Stock FGLGX. Though it manages less 529 assets than either Vanguard or Capital Group, Fidelity provides choice (active, passive, or a blend), and that contributes to its ongoing appeal.

Asset managers trailing behind these three market share leaders in 529 assets are firms such as Columbia, T. Rowe Price, BlackRock, J.P. Morgan, Nuveen, Franklin Templeton, Invesco, and Voya, which each hold market shares of 1% to 8%.

This is the fourth in a five-article series on 529 college savings plans. The first installment explains our ratings methodology for 529 plans and our top picks. The second article discusses the tax benefits of 529 plans, and the third article addresses common concerns about using 529 plans.

Subscribers to Morningstar.com can access our 529 plan reports and ratings from the 529 Plan Center map. (After clicking on a state, please allow a few seconds for the plan options to download into your browser.)

Correction: An earlier version of this article stated that Capital Group managed $93 million in 529 assets. The correct AUM figure is $93 billion (May 18, 2022).

/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BC7NL2STP5HBHOC7VRD3P64GTU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)