Food and Ag Stocks Are Having Their Time in the Sun

Mosaic and ADM are among those with solid gains in 2022, but valuations are rich.

Amid a bad year for stocks, some of the biggest names in food and agriculture are producing a bumper crop of returns.

Two primary factors are at work: a so-called peak super cycle in agriculture coupled with the impact of Russia’s attack on Ukraine. The result is higher prices on fertilizer, benefiting companies such as Mosaic MOS and Nutrien NTR, along with strong demand for farm equipment from Deere DE and Agco AGCO.

Many food and agriculture stocks also land in the value stock Morningstar Category, which is generally seeing more interest from investors as technology and other fast-growing company stocks have taken a big hit in 2022.

“When crop prices are strong, the farmer wins. And when the farmer wins, companies that support them do, too,” says Dawit Woldemariam, equity analyst for industrials at Morningstar.

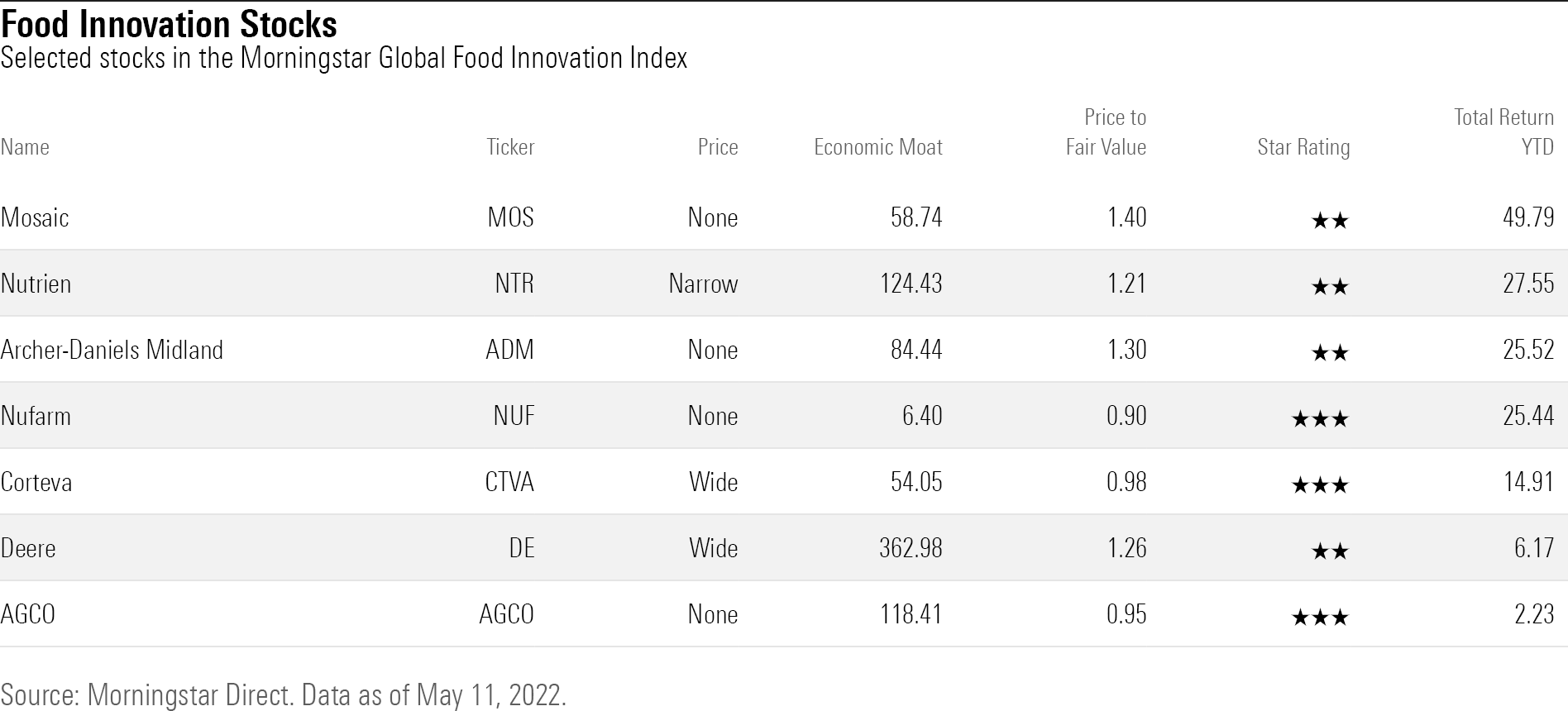

However, at this stage, shares of many industry leaders are now overvalued, or at best fairly valued, according to Morningstar’s equity analysts. Mosaic, Nutrien, and ADM, for example, are all in overpriced territory after double-digit gains in 2022 and 2021.

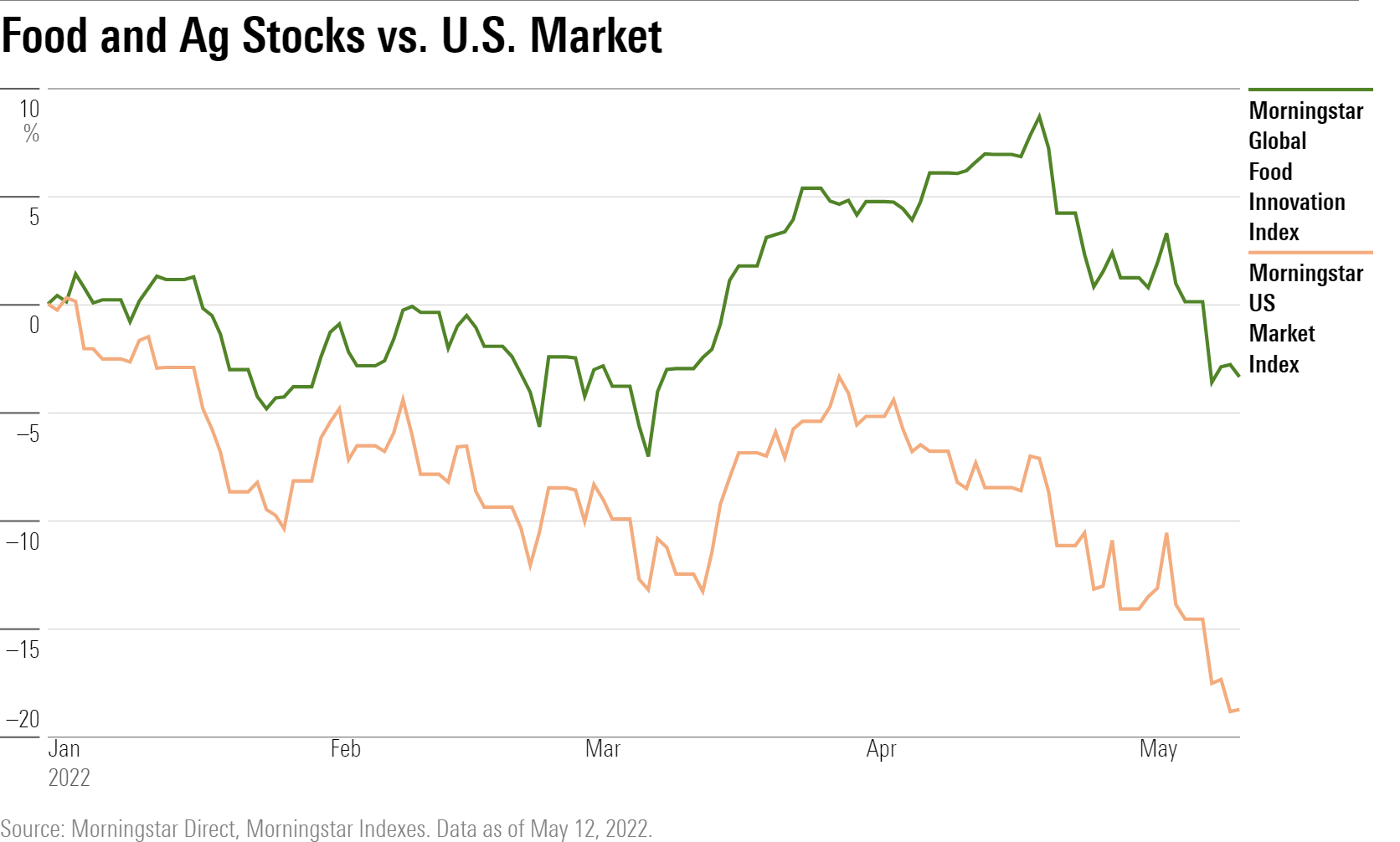

The strong performance of food and agriculture stocks can be seen in the Morningstar Global Food Innovation Index, a group of companies deemed by Morningstar analysts to be well positioned to benefit from improvements in food production practices, food safety measures, sustainable packaging, and nutrition. U.S.-based companies make up about two thirds of the index, and the vast majority of the rest comes from global chemical and fertilizer companies.

The food innovation index is down 2.1% for the year to date as of May 13. While that’s off from its best levels of the year—in late April it had been up nearly 9%—its returns have been far better than the broader market, where the Morningstar US Market Index is down 16.4%.

Soaring Food and Commodity Prices

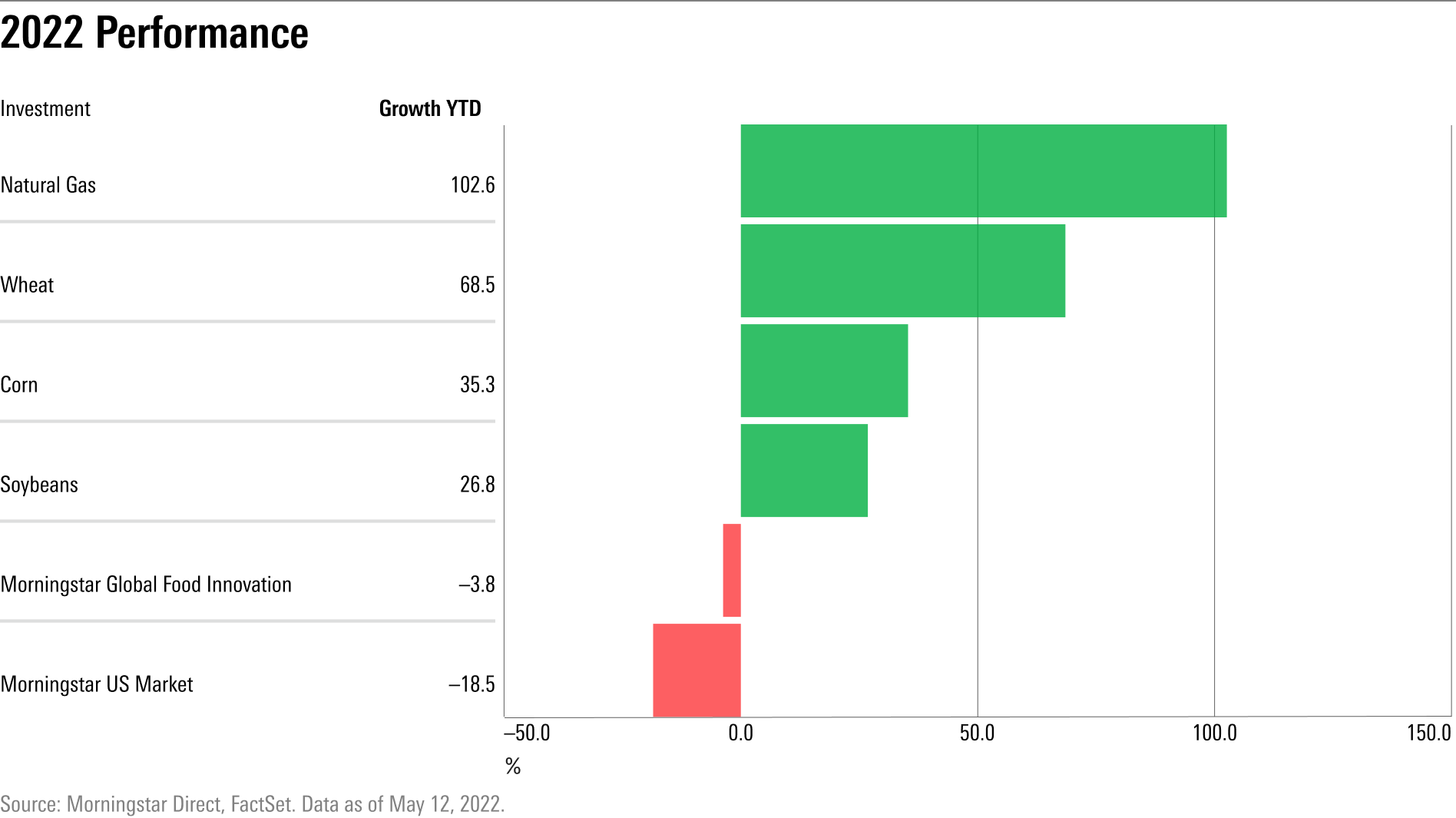

“The prices of crops like corn and soybeans have gone up over the past two years. They haven't been this high since 2012 when we had constrained supply in the U.S. that bid up crop prices,” Woldemariam says. Corn futures are at a decadelong high and wheat futures prices hit an all-time high in March. While wheat prices have fallen back, they remain up roughly 68% since the start of the year.

Fertilizer prices have also reached record levels. Natural gas, a key ingredient in nitrogen-based fertilizers, is up 102.6% from year-ago levels. “It is purely a good thing for these companies,” says Seth Goldstein, equity strategist at Morningstar. “Nutrien and Mosaic are commodities companies.” Fertilizer and crop prices are the largest driver of their profits, he says.

“Given market conditions, it’s not surprising that fertilizer companies’ profits are reaching multiyear and all-time highs,” says Goldstein. “The surprising part is that stock prices have really run up: The market is assuming that these peak conditions will remain in place longer than we’re forecasting.”

What’s Driving the Food and Ag Cycle?

The headlines about crop shortages and surging food prices have primarily pointed to Russia’s attack on Ukraine, which produces nearly one fifth of the world’s high-quality wheat.

But, says Goldstein, “We were near peak in the agriculture supercycle prior to the conflict.” Russia’s attack on Ukraine has accelerated the cycle and led to record-high fertilizer prices, and multiyear crop prices for corn, wheat, and soybeans

Part of the dynamic involves what’s known as the agriculture supercycle. A "peak" period in the supercycle means heavy demand for agricultural commodities. During a peak, producers have a tough time meeting demand, resulting in an extended period of rising prices. Supercycles can last for years, and the boom times are followed with a corresponding bust where supplies begin to overwhelm demand, and prices collapse.

Goldstein starts the history of the current cycle during the last decade, when crop prices fell because farms in America and Eastern Europe were able to grow massive amounts of crops year after year. Thanks to this flood of crops, prices fell.

“Now we’re seeing the opposite of that,” Goldstein says. “Crop prices have risen and fertilizer prices are at all-time highs.”

Goldstein notes that the forces driving the supercycle rise in crop prices were in place even before Russia attacked Ukraine, which is one of the world’s largest producers of wheat and sunflower oil. “To me, it looks like we're at the peak of the cycle,” he says. “But it's hard to say when the peak actually is. When you’re nearing the peak/trough of the cycle… it's impossible to know exactly what point we are in.”

Room to Spend on Improvements

“When crop prices are high, farmers have more money in their pockets,” Woldemariam says. “That allows them to spend more on improving their operations.”

Woldemariam points to agricultural equipment companies such as Deere and its competitors Agco and CNH Industrials CNHI, which have been developing tools for so-called precision agriculture, which aims to increase crop yields while lowering costs. “They’re using data and tech to allow the farmers to be more efficient at every step,” Woldemariam says.

Deere’s stock reached an all-time high price of $436.45 in April, up from $342.89 at the start of 2022. Agco has also stayed in positive territory as the rest of the market fell, up 5.6% for the year. CNH Industrial has not fared as well, down 12.4% so far in 2022.

Value Tailwinds

One of the major market trends in 2022 has been the collapse of growth stocks and the relative buoyancy of value stocks.

Morningstar assigns each stock a Style Score. These stock scores are relative, with companies landing in value, core, and growth Morningstar Categories. The Style Score is based on metrics such as growth rates for earnings, sales, book value, and cash flow. In addition, it factors in dividend yields and relative valuations such as the price/projected earnings ratio, price/book, price/sales, and price/cash flow. Lower scores indicate a value tilt; higher scores indicate growth orientation

The Morningstar Global Food Innovation Index has a value-growth score of 75.8, placing it firmly in the value side of the Morningstar Style Box. It scores much lower than the Morningstar US Market Index’s score of 190.2 and the Morningstar US Technology Sector Index’s score of 251.8.

Leading industries in the Morningstar Global Food Innovation Index in 2022 include the agricultural inputs industry, which are companies that produce seeds, crop chemicals and fertilizer. Agricultural inputs was up 29.9% as of May 13, and the farm products industry was up 12.1%.

Which Food and Agriculture Stocks Are Overvalued?

Goldstein writes that the market is overly optimistic in valuing the growth rate of new agricultural technologies. And with crop prices already at multiyear highs, the market is likely overestimating how long the strong demand for agriculture inputs and equipment will remain in place. “As a result, most of the ag stocks under our coverage are overvalued,” he writes.

Fertilizer company Mosaic rallied 58.7% for the year to date as of May 13 and 72% for calendar 2021. Both are the biggest annual gains in its stock since 2009. Nutrien, the world’s largest fertilizer company and the largest agricultural retailer in North America, has rallied 27.6% so far in 2022 after a 60% gain in 2021. Last year’s rally was the biggest in Nutrien's stock since 2007.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)